Overview

The Dual Moving Average Crossover Trading System is a trend-following strategy based on technical analysis. Its core mechanism utilizes the crossover relationship between short-term moving average (MA7) and medium-term moving average (MA10) to generate buy and sell signals. The strategy also incorporates long-term moving averages (MA100 and MA200) as reference indicators for market trends, although the primary trading signals rely on the crossover behavior of the short and medium-term moving averages. A buy signal is generated when the short-term MA crosses above the medium-term MA, while a sell signal occurs when the short-term MA crosses below the medium-term MA. This trading approach is simple, intuitive, easy to implement, and suitable for capturing medium to short-term price trend changes.

Strategy Principles

The core principle of this strategy is based on moving average crossover signals, with the following implementation logic:

Calculate four moving averages: 7-day simple moving average (MA7), 10-day simple moving average (MA10), 100-day simple moving average (MA100), and 200-day simple moving average (MA200).

Generate trading signals:

- Buy signal (buySignal): When MA7 crosses above MA10 (ta.crossover function).

- Sell signal (sellSignal): When MA7 crosses below MA10 (ta.crossunder function).

Trading execution logic:

- When a buy signal appears, the system enters a long position (strategy.entry).

- When a sell signal appears, the system closes the long position (strategy.close).

Mark trading signals on the chart: Buy signals are displayed below the candles, and sell signals are displayed above the candles for visual confirmation.

The strategy relies on moving average crossovers to capture price momentum changes. In an uptrend, the short-term MA is positioned above the medium-term MA, indicating strengthened buying pressure in the short term; in a downtrend, the short-term MA is positioned below the medium-term MA, indicating strengthened selling pressure. When the two moving averages cross, it suggests a change in market momentum, potentially signaling a trend reversal.

Strategy Advantages

Simplicity: The strategy is based on classic technical analysis concepts, with clear logic that is easy to understand and implement, making it suitable for beginners entering quantitative trading.

Trend-capturing ability: The dual moving average crossover system effectively captures medium to short-term price trend changes, avoiding frequent trading during sideways markets.

High degree of automation: The strategy can be fully automated, requiring no subjective judgment, thus reducing emotional interference.

Adaptability: By adjusting the moving average periods, the strategy can adapt to different market environments and trading instruments.

Visual intuitiveness: Trading signals are clearly marked on the chart, facilitating backtesting analysis and real-time monitoring.

Clear risk management: With well-defined entry and exit rules, it supports effective capital management and risk control.

Computational efficiency: Using simple moving averages (SMA) for calculations reduces computational burden, making it suitable for real-time trading systems.

Strategy Risks

Lag issues: Moving averages are inherently lagging indicators, and signals may be generated after missing the optimal entry point, potentially leading to losses in rapidly changing markets.

False signals in oscillating markets: In sideways, oscillating markets, frequent moving average crossovers can generate numerous false signals, resulting in frequent trading and commission erosion.

Lack of stop-loss mechanism: The code does not include a clear stop-loss strategy, which could lead to significant losses during strong trend reversals.

Fixed parameter risk: The fixed moving average periods (7, 10, 100, 200) may not be suitable for all market environments, lacking adaptability.

Single indicator dependence: Relying solely on moving average crossovers may lack a comprehensive market perspective, ignoring information from fundamentals and other technical indicators.

No volume confirmation: The strategy does not incorporate volume analysis, potentially leading to false breakout signals in low-volume situations.

Lack of dynamic position sizing: The strategy uses fixed position sizing for entry, without adjusting position size based on market volatility.

Strategy Optimization Directions

Introduce stop-loss mechanisms: Add fixed stop-loss or ATR-based dynamic stop-loss to protect capital, such as

strategy.exit("StopLoss", "Buy", stop=close * 0.95).Add trend filtering conditions: Utilize MA100 and MA200 as trend filters, trading only in the direction of the main trend indicated by the long-term moving averages, such as only going long when price is above MA200.

Incorporate volume confirmation: Combine volume indicators to verify signal validity, avoiding false breakouts during low-volume periods.

Optimize moving average parameters: Backtest different combinations of moving average periods to find optimal parameters for specific market environments, or consider using adaptive moving averages.

Add additional technical indicators: Combine RSI, MACD, or other indicators to form a multi-confirmation system, improving signal quality.

Implement dynamic position sizing: Adjust position size dynamically based on volatility (such as ATR), reducing position size during high volatility and increasing it during low volatility.

Add market environment assessment: Differentiate between trending and oscillating markets, applying different trading strategies or parameters in different environments.

Improve exit logic: Design more sophisticated exit conditions, such as partial profit-taking or trailing stops, to optimize profit structure.

Summary

The Dual Moving Average Crossover Trading System is a classic trend-following system based on technical analysis that captures market momentum changes and executes trades through the crossover relationship between MA7 and MA10. The strategy’s advantages lie in its simple logic, ease of understanding and implementation, and effective capture of medium to short-term trend changes. However, it also faces risks such as moving average lag, multiple false signals in oscillating markets, and lack of stop-loss mechanisms.

To enhance strategy performance, we can make improvements by adding stop-loss mechanisms, trend filtering, volume confirmation, parameter optimization, and combining other technical indicators. Additionally, implementing dynamic position sizing and market environment-specific trading logic are potential optimization directions.

In conclusion, the dual moving average crossover strategy provides traders with a good starting point for quantitative trading. Through reasonable optimization and risk management, it can be developed into a more robust and efficient trading system. It is suitable as a first strategy for beginners entering quantitative trading, and can also serve as part of an experienced trader’s strategy portfolio.

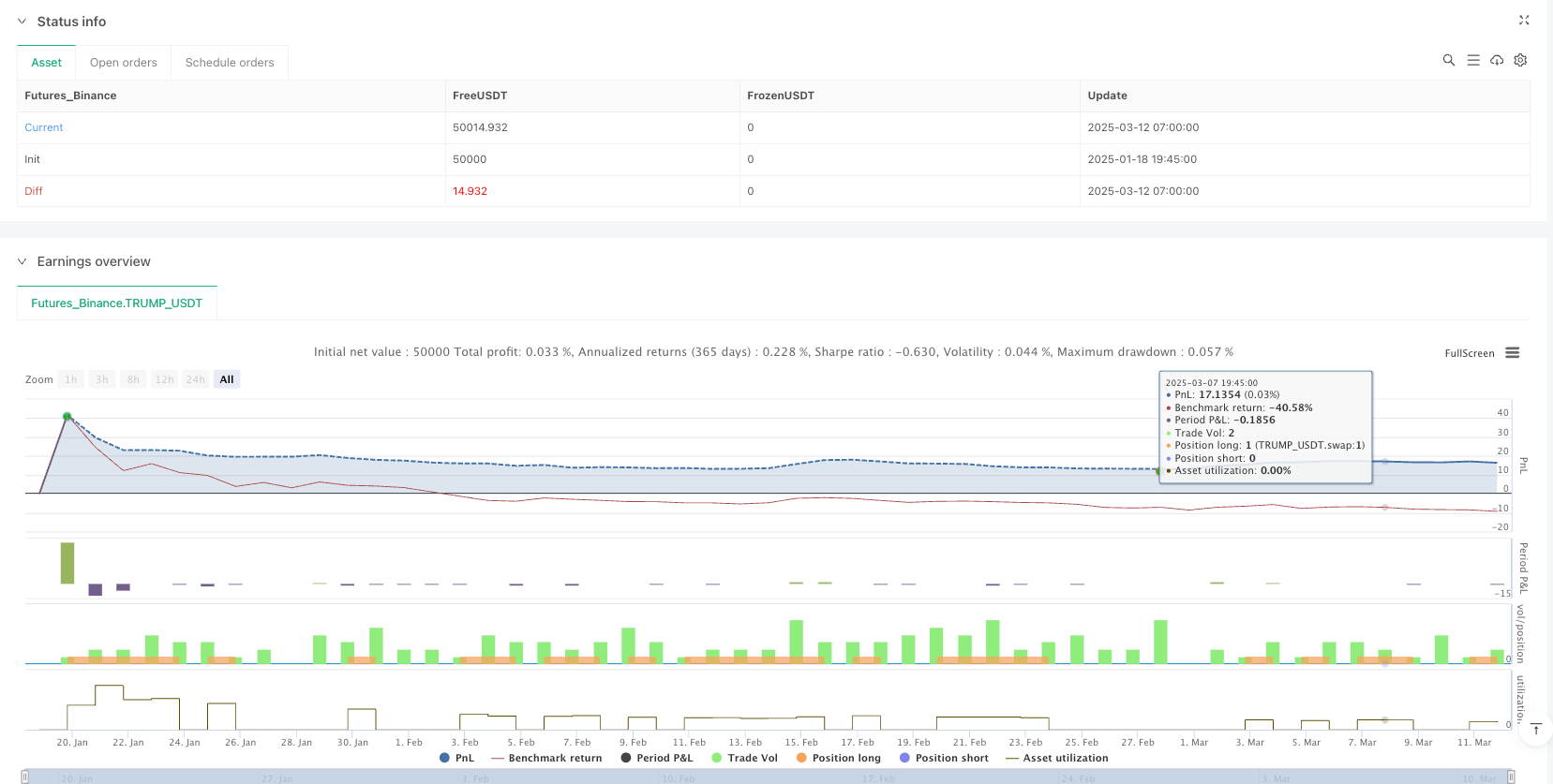

/*backtest

start: 2025-01-18 19:45:00

end: 2025-03-12 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"TRUMP_USDT"}]

*/

//@version=5

strategy("Backtest Buy and Sell Signals with MA 7 and MA 10", overlay=true)

// Calculate Moving Averages

ma7 = ta.sma(close, 7)

ma10 = ta.sma(close, 10)

ma100 = ta.sma(close, 100)

ma200 = ta.sma(close, 200)

// Plot MAs

plot(ma7, color=color.blue, title="MA 7")

plot(ma10, color=color.red, title="MA 10")

plot(ma100, color=#512ca8, title="MA 100")

plot(ma200, color=color.rgb(152, 139, 20), title="MA 200")

// Buy and Sell Signals

buySignal = ta.crossover(ma7, ma10)

sellSignal = ta.crossunder(ma7, ma10)

// Display signals on the chart

plotshape(buySignal, style=shape.labelup, location=location.belowbar, color=color.rgb(231, 241, 232), size=size.small, title="Buy Signal", text="buy")

plotshape(sellSignal, style=shape.labeldown, location=location.abovebar, color=color.rgb(237, 221, 221), size=size.small, title="Sell Signal", text="sell")

// Entry and Exit Logic

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Buy")