Overview

The Dynamic Crossover Moving Average Trend Capture Strategy is a quantitative trading system based on technical analysis that combines short-term and long-term moving average crossover signals with a long-term trend confirmation mechanism, while integrating a precise risk management module. This strategy operates on a 5-minute timeframe and primarily relies on three core indicators: Fast Simple Moving Average (SMA), Slow Simple Moving Average, and Long-term Exponential Moving Average (EMA) to capture market trends and execute trades. The strategy adopts a trend-following approach and controls risk exposure for each trade through fixed risk amounts and dynamic stop-loss placements, while using trailing stops to secure profits.

Strategy Principles

The core principles of this strategy are based on a multi-timeframe moving average system combined with precise risk management mechanisms:

Signal Generation System:

- Uses crossovers between Fast SMA (10 periods) and Slow SMA (25 periods) to identify short-term trend changes

- Employs a 250-period EMA as a long-term trend filter

- Multiple confirmation mechanism: entry signals are triggered only when price is above/below the long-term EMA and the Fast SMA forms golden/death crosses with the Slow SMA

Entry Logic:

- Long entry: Fast SMA crosses above Slow SMA and price is above long-term EMA

- Short entry: Fast SMA crosses below Slow SMA and price is below long-term EMA

- To avoid duplicate signals, the strategy includes a position check mechanism, opening positions only when no current position exists

Risk Management System:

- Dynamically calculates stop-loss distance based on a fixed risk amount ($7)

- Adjustable leverage (up to 125x), defaulting to 100x

- Minimum position size set at 0.001 to ensure trades can be executed under any market conditions

Exit Strategy:

- Primary exit mechanism: close position when price touches the long-term EMA, following long-term trend reversals

- Protective exit: fixed stop-loss placed at a set risk distance above/below entry price

- Profit securing: trailing stop set at 3x the risk distance, activated when price moves beyond this distance

Strategy Advantages

After deep analysis, this strategy demonstrates the following significant advantages:

Multi-level Trend Confirmation: By combining moving averages of different periods, the strategy effectively filters out market noise, capturing only directional trend movements, greatly reducing false breakout risks.

Precise Risk Control: Using a fixed risk amount rather than a fixed percentage ensures consistent actual risk for each trade, avoiding excessive exposure in highly volatile markets.

Dynamic Position Sizing: Calculates position size dynamically based on current price level and preset risk, allowing the strategy to maintain consistent risk exposure across different price ranges.

Intelligent Profit-Taking Mechanism: Uses trailing stops instead of fixed take-profit levels, enabling the strategy to maximize returns in trending markets while securing already-gained profits.

Dual Exit Mechanism: Combines EMA touch exits with trailing stops, allowing both quick response to trend reversals and position maintenance when trends continue.

Visualized Trading Signals: The strategy provides a clear graphical interface, including entry signal markers and risk management lines, allowing traders to intuitively understand the trading logic.

High Adaptability: Through parameterized design, the strategy can be adjusted for different market conditions and personal risk preferences without modifying the core logic.

Strategy Risks

Despite its rational design, the strategy still has the following potential risks and limitations:

Rapid Volatility Risk: On a 5-minute timeframe, the market may experience extreme fluctuations, causing prices to quickly reverse after triggering signals, potentially bypassing stop-loss levels and resulting in losses exceeding expectations. The solution is to reduce leverage or widen stop-loss distances.

High-Frequency Trading Costs: The strategy may generate numerous trading signals in volatile markets, leading to frequent trading and accumulated transaction costs that could erode profits. It’s advisable to add additional signal filtering mechanisms or extend the timeframe.

Trend Mutation Risk: The market may suddenly experience major events causing dramatic trend changes, making moving average systems based on historical data react with a lag. Consider adding volatility filters or other auxiliary indicators to enhance risk control.

Parameter Sensitivity: Strategy performance highly depends on selected parameters, especially moving average periods and risk settings. Sufficient parameter optimization and backtesting should be conducted for different market environments.

Leverage Risk: The strategy’s use of high leverage (default 100x) may amplify losses in unfavorable market conditions. It’s recommended to set leverage levels carefully according to individual risk tolerance, with beginners considering lower leverage.

Technical Limitations: The fixed risk calculation method used in the code may not be precise enough in extreme market conditions, especially when price volatility is exceptionally high. Consider introducing dynamic adjustment mechanisms based on historical volatility to adjust risk parameters.

Strategy Optimization Directions

Through in-depth analysis of the code, here are several possible optimization directions:

Add Volatility Filter: Integrate ATR (Average True Range) indicator to dynamically adjust risk amount and stop-loss distance, allowing the strategy to adaptively adjust based on current market volatility. This can automatically increase stop-loss distance in high-volatility environments and tighten stops in low-volatility environments, improving risk-adjusted returns.

Introduce Volume Confirmation: Add volume indicators as additional confirmation for trading signals, executing trades only when volume increases, to reduce false breakout risks. Volume is a powerful confirming factor for price movements and can significantly improve signal quality.

Time Filter: Implement trading session filtering to avoid low liquidity or high volatility periods, such as certain news release times or market opening/closing sessions. This can reduce unnecessary trades caused by market noise.

Dynamic Parameter Optimization: Develop adaptive mechanisms to dynamically adjust moving average period parameters based on market states (such as trend strength, volatility cycles), enabling the strategy to adapt to changing market environments. Static parameters perform very differently across various market phases.

Enhanced Profit-Locking Mechanism: Improve the current trailing stop design by considering a stepped trailing stop approach, gradually tightening the stop-loss distance as price moves favorably, more effectively securing profits.

Integrate Market Sentiment Indicators: Add indicators such as RSI and Stochastic as auxiliary filtering conditions to avoid opening positions in overbought/oversold areas, reducing counter-trend trading risks. Extreme market sentiment is often a precursor to short-term reversals.

Multi-Timeframe Analysis: Introduce trend confirmation from higher timeframes (such as 1-hour, 4-hour) to ensure trading direction aligns with larger cycle trends, increasing trade success rates. This “top-down” analysis approach can significantly reduce counter-trend trading.

Summary

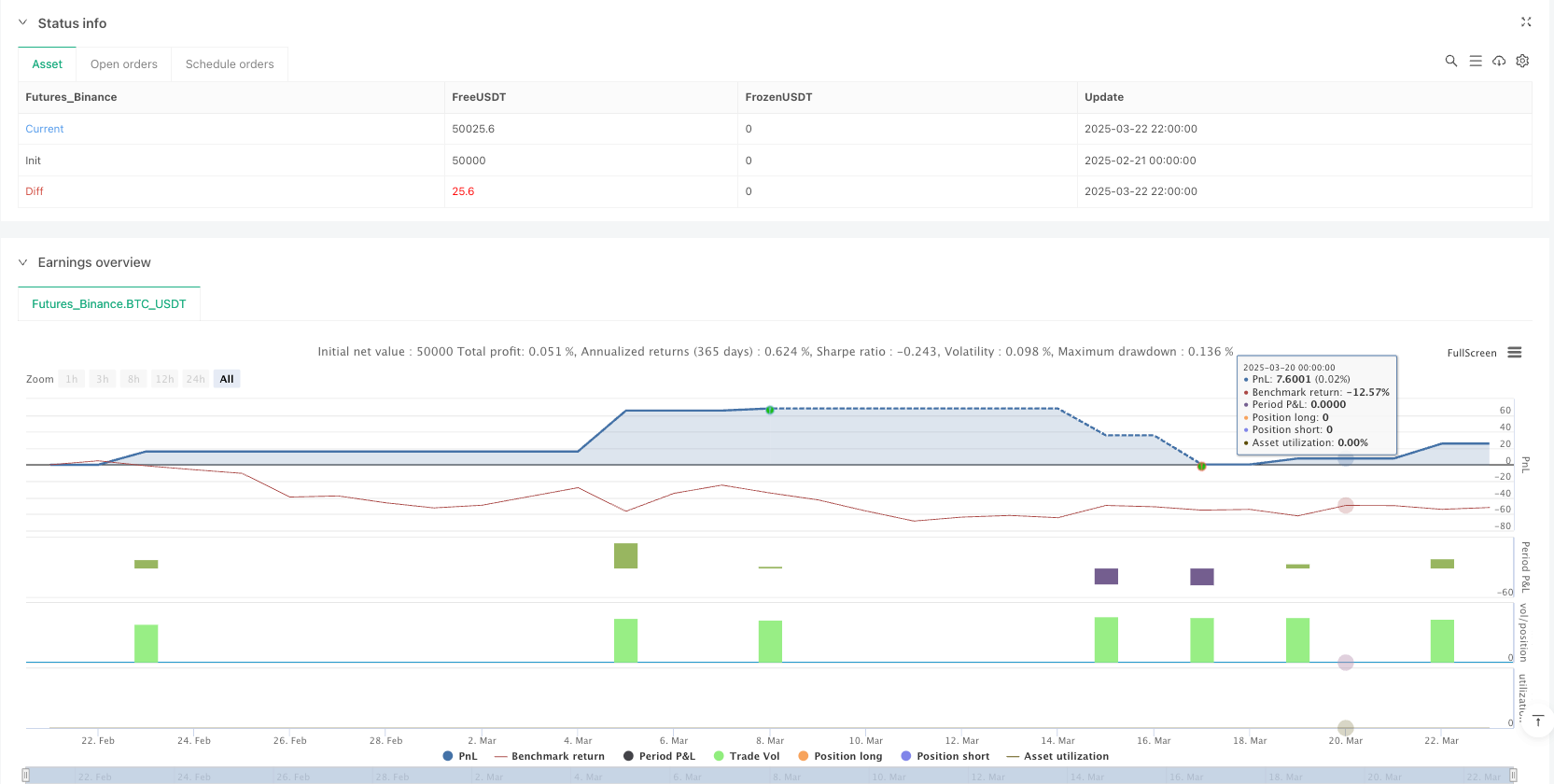

The Dynamic Crossover Moving Average Trend Capture Strategy is a well-structured quantitative trading system that aims to capture medium to short-term price trends and control trading risk through multi-level technical indicator combinations and refined risk management mechanisms. The strategy’s core lies in combining crossover signals from Fast and Slow SMAs with EMA trend filtering, while managing the risk-reward ratio of each trade through fixed risk amounts and trailing stops.

The strategy’s greatest advantage is its comprehensive risk control system and clear trading logic, making the trading decision process highly systematic and objective. However, it also faces challenges such as rapid market fluctuations, parameter sensitivity, and leverage use. Through adding volatility filters, volume confirmation, multi-timeframe analysis, and other optimization measures, strategy performance can be further improved.

For quantitative traders seeking medium to short-term trend trading opportunities, this strategy provides a reliable framework, particularly suitable for those emphasizing risk management. With reasonable parameter adjustments and optimization improvements, the strategy has the potential to maintain stable performance across various market environments.

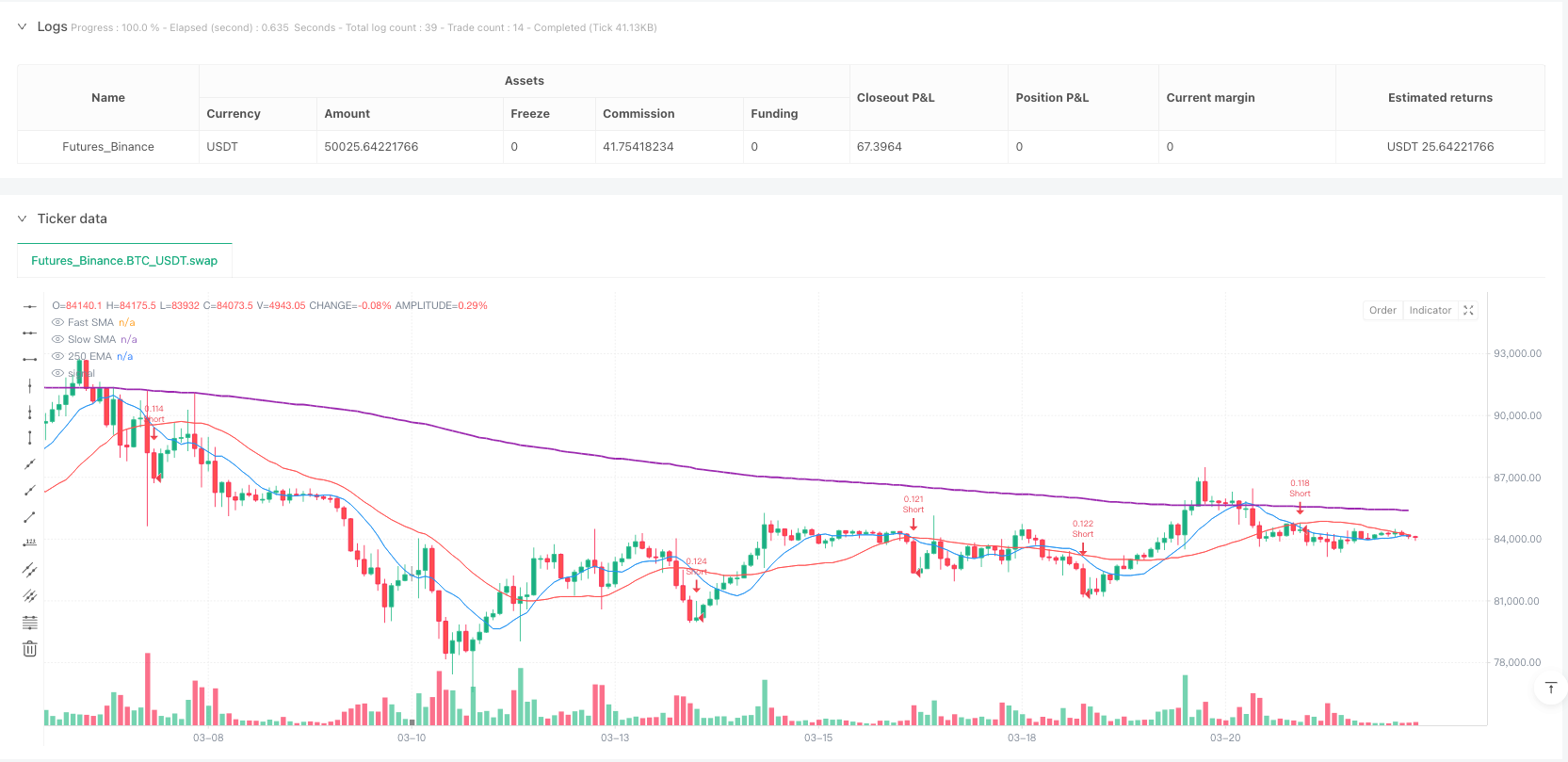

/*backtest

start: 2025-02-21 00:00:00

end: 2025-03-23 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("crypto strat", overlay=true, initial_capital=100, default_qty_type=strategy.cash, default_qty_value=100)

// Input parameters

fastSMA = input.int(10, "Fast SMA Period", minval=1)

slowSMA = input.int(25, "Slow SMA Period", minval=1)

emaLength = input.int(250, "EMA Length", minval=1)

riskAmount = input.float(7, "Risk Amount in USD", minval=1)

leverage = input.int(100, "Leverage", minval=1, maxval=125)

// Calculate indicators

fastMA = ta.sma(close, fastSMA)

slowMA = ta.sma(close, slowSMA)

longEMA = ta.ema(close, emaLength)

// Plot indicators

plot(fastMA, "Fast SMA", color=color.blue)

plot(slowMA, "Slow SMA", color=color.red)

plot(longEMA, "250 EMA", color=color.purple, linewidth=2)

// Entry conditions

longCondition = ta.crossover(fastMA, slowMA) and close > longEMA and strategy.position_size == 0

shortCondition = ta.crossunder(fastMA, slowMA) and close < longEMA and strategy.position_size == 0

// Exit conditions - close when price touches 250 EMA

exitLongCondition = low <= longEMA and strategy.position_size > 0

exitShortCondition = high >= longEMA and strategy.position_size < 0

// Position sizing based on risk

positionSize = math.max((100 * leverage) / close, 0.001) // Minimum 0.001 BTC

stopLossDistance = riskAmount / positionSize // $7 risk in price terms

// Entry logic

if (longCondition)

entryPrice = close

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("Long Exit", "Long",

stop=entryPrice - stopLossDistance,

trail_points=stopLossDistance * 3,

trail_offset=stopLossDistance)

if (shortCondition)

entryPrice = close

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("Short Exit", "Short",

stop=entryPrice + stopLossDistance,

trail_points=stopLossDistance * 3,

trail_offset=stopLossDistance)

// Exit logic - close when price touches 250 EMA

if (exitLongCondition)

strategy.close("Long", comment="EMA Exit")

if (exitShortCondition)

strategy.close("Short", comment="EMA Exit")

// Visualize entry signals

plotshape(longCondition, "Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, "Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)