Overview

The Multi-Indicator Dynamic Trend Following Trading System is a comprehensive strategy that combines Exponential Moving Average (EMA) crossovers, Moving Average Convergence Divergence (MACD) momentum filtering, and Average True Range (ATR) risk management. The core design philosophy of this strategy is to accurately capture market trends through the synergistic effect of multiple technical indicators while dynamically adjusting risk parameters based on market volatility. The strategy uses the crossover of a short-period EMA (6 periods) and a long-period EMA (2 periods) to identify initial trend signals, then employs MACD (18,19,24) as a momentum confirmation filter, and finally sets stop-loss and take-profit levels dynamically through the ATR (13 periods) indicator, achieving adaptive risk management.

Strategy Principles

The trading logic of this strategy is based on a three-layer filtering mechanism: 1. Trend Identification Layer: Uses the crossover point of the short-period EMA (6 periods) and the long-period EMA (2 periods) as the basic signal for trend direction. When the short-period EMA crosses above the long-period EMA, it identifies a potential uptrend; when the short-period EMA crosses below the long-period EMA, it identifies a potential downtrend.

Momentum Confirmation Layer: Uses the MACD indicator (fast line period 18, slow line period 19, signal line period 24) for signal filtering. A long entry signal is only confirmed when the MACD line is greater than the signal line and the MACD line is positive; a short entry signal is only confirmed when the MACD line is less than the signal line and the MACD line is negative. This design effectively filters out false signals before trend reversals.

Risk Management Layer: Uses the ATR (13 periods) indicator multiplied by a factor (7 times) to dynamically determine stop-loss and take-profit levels. For long trades, the stop-loss is set at a distance of the ATR multiplier below the entry price, and the take-profit is set at a distance of the ATR multiplier above the entry price; for short trades, it’s the opposite. This method allows risk management to automatically adjust according to market volatility, providing wider stop-loss space during high volatility periods and compressing risk exposure during low volatility periods.

The system triggers a long entry when the following conditions are met: the short-term EMA crosses above the long-term EMA, and the MACD line is greater than the signal line and is positive. The system triggers a short entry when the following conditions are met: the short-term EMA crosses below the long-term EMA, and the MACD line is less than the signal line and is negative. After entry, the system immediately sets ATR-based stop-loss and take-profit levels.

Strategy Advantages

Multi-Layer Filtering Reduces False Signals: By combining EMA crossovers and MACD momentum filtering, the strategy significantly reduces the risk of false signals that might come from a single indicator, improving the quality and reliability of trading signals.

Adaptive Risk Management: ATR-based stop-loss and take-profit settings can dynamically adjust according to actual market volatility conditions, avoiding the problem of fixed-point stop-losses triggering too early in high-volatility markets, while not over-exposing risk in low-volatility markets.

Parameter Optimization Space: The strategy provides multiple adjustable parameters, including EMA periods, MACD parameters, and ATR multiplier, allowing traders to make detailed adjustments according to different market environments and personal risk preferences.

Fully Automated Execution: The strategy is completely systematized, eliminating emotional factors in trading, and can monitor the market around the clock and automatically execute trading decisions.

Strong Adaptability: The strategy design concept is applicable to various market conditions, particularly excelling in markets with obvious trends. By adjusting parameters, it can adapt to different trading cycles from intraday to long-term.

Strategy Risks

Trend Reversal Risk: Despite using a multi-layer filtering mechanism, the strategy may still face significant losses when market volatility is severe or sudden events cause sharp trend reversals. An improvement method is to add trend strength confirmation indicators, such as ADX, and only execute trades when the trend strength reaches a certain threshold.

Parameter Sensitivity: Strategy performance is highly dependent on parameter settings, especially the selection of short-term and long-term EMA periods. Different market environments may require different optimal parameter settings, and there is a high risk of overfitting historical data. It is recommended to verify parameter stability through forward testing and robustness analysis.

Consecutive Loss Risk: In oscillating markets or sideways markets with unclear trends, the strategy may generate consecutive false breakout signals, leading to multiple stop-loss triggers. This can be addressed by adding market environment filters, such as volatility indicators or trend strength indicators, to pause trading in non-trending markets.

ATR Multiplier Setting Risk: A 7x ATR multiplier may be too large or too small in certain market environments. If too large, it will lead to wide stop-losses and large single losses; if too small, it may lead to premature stop-losses. It is recommended to adjust the ATR multiplier according to specific market characteristics and capital management requirements.

MACD Parameter Setting Risk: The MACD fast line (18) and slow line (19) periods are close, which may lead to unclear signals. It is recommended to adjust the gap between the two to obtain clearer momentum signals.

Strategy Optimization Directions

Parameter Adaptive Mechanism: Develop mechanisms to automatically adjust EMA and MACD parameters based on market environment, such as using longer periods in high-volatility markets and shorter periods in low-volatility markets. This can be achieved by introducing volatility monitoring indicators such as the Volatility Index (VIX) or historical volatility.

Add Market State Filters: Introduce market state recognition mechanisms to distinguish between trending and oscillating markets, and only enable the strategy in trending market environments. ADX > 25 can be used as a trend confirmation condition, or the slope of long-term moving averages can be used to judge the overall trend direction.

Optimize Take-Profit Mechanism: The current strategy using a fixed ATR multiplier for take-profit may lock in profits too early. Consider implementing trailing stop-loss or segmented take-profit strategies to allow capturing more profits in strong trends. For example, after achieving 1x ATR profit, move the stop-loss to the entry point, followed by using a trailing stop-loss.

Introduce Volume Confirmation: Add volume confirmation elements to signal trigger conditions to ensure that price breakouts are supported by sufficient trading volume. This can be implemented by requiring volume to be greater than a specific percentage of the N-day average volume.

Refine Risk Management: Implement more complex capital management schemes to dynamically adjust risk exposure for each trade based on strategy win rate, risk-reward ratio, and account size. Introduce position sizing formulas based on historical volatility, reducing position size when volatility rises.

Improve MACD Filtering Conditions: The current MACD filtering conditions may be too strict, causing missed opportunities for early trends. Consider using the change trend of the MACD histogram rather than absolute values as filtering conditions, which may yield more sensitive signals.

Summary

The Multi-Indicator Dynamic Trend Following Trading System is a systematic trading strategy that organically combines trend identification, momentum confirmation, and risk management. By capturing trend turning points through EMA crossovers, reducing false signals with MACD momentum filtering, and adapting to market volatility changes with ATR dynamic risk management mechanisms, it achieves a relatively complete trend-following trading framework. This strategy is particularly suitable for application in markets with obvious trend characteristics and is more effective for medium to long-term trading cycles.

Although this strategy provides a comprehensive trading decision process, parameter optimization is still needed in practical applications according to specific market environments and personal risk tolerance. There is still great room for improvement in the strategy through adding market state recognition, improving take-profit strategies, and optimizing risk management. Ultimately, the key to successfully applying this strategy lies in deeply understanding its design principles while maintaining keen insight into market changes, continuously adjusting and optimizing trading parameters.

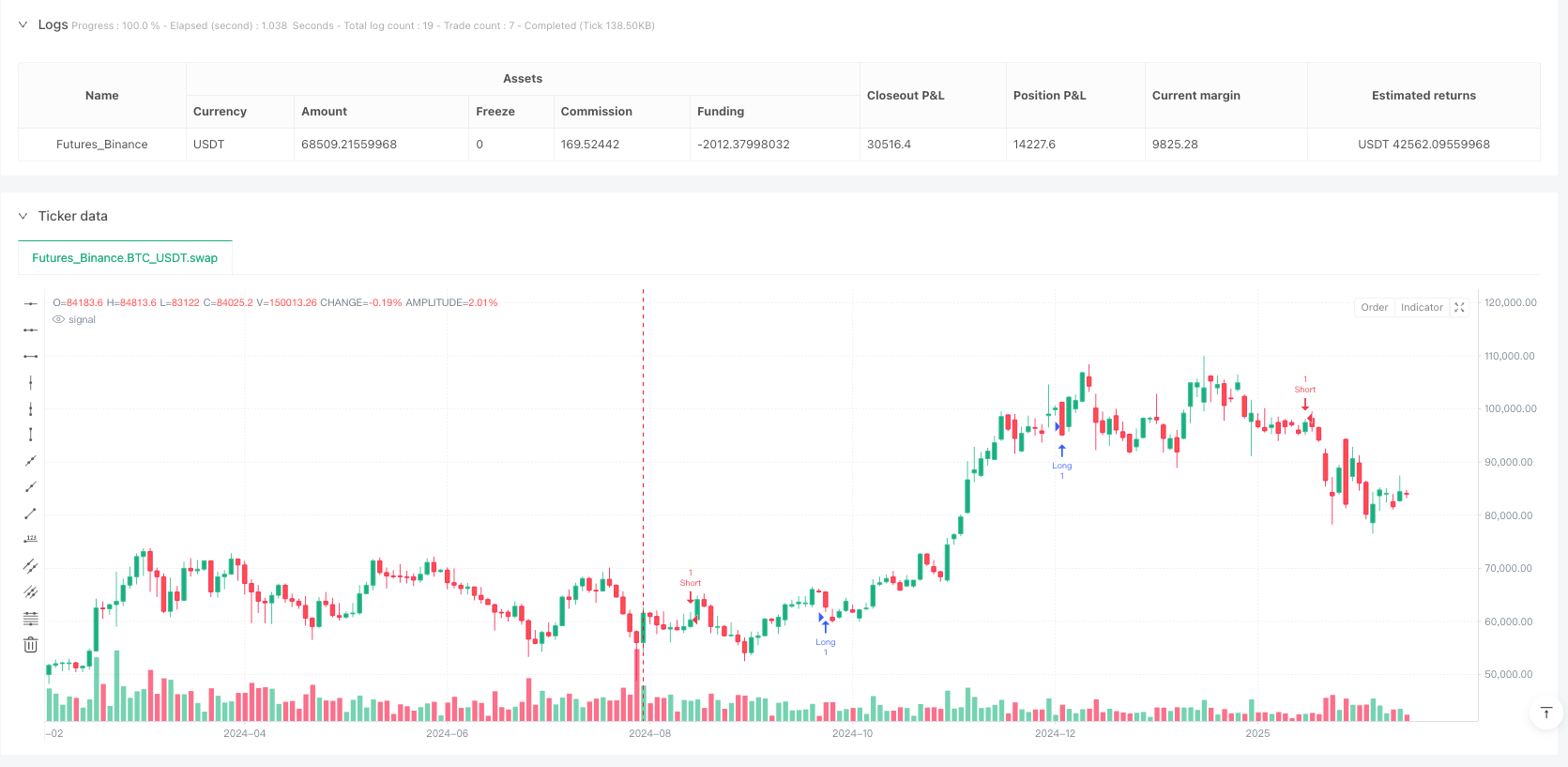

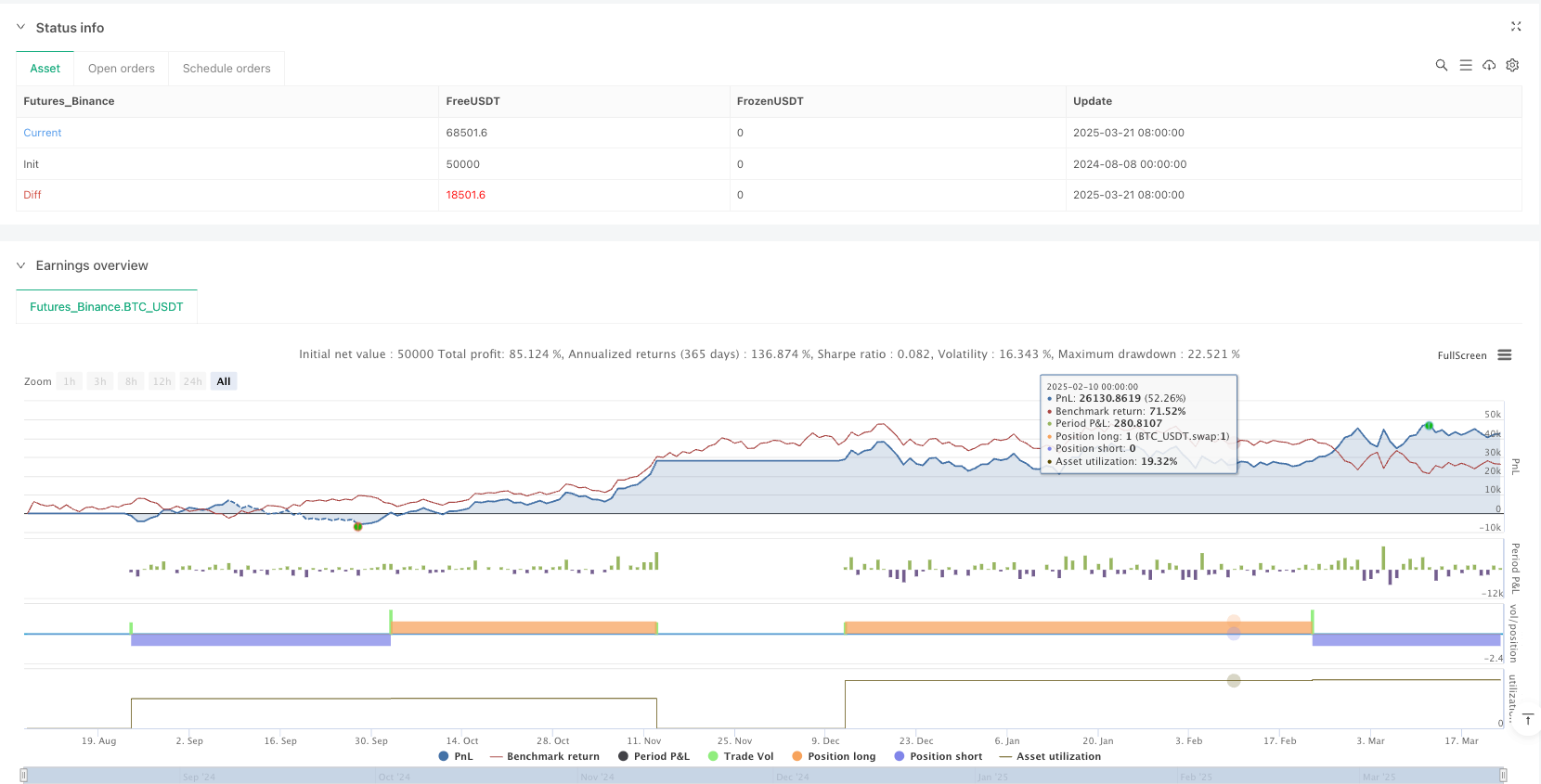

/*backtest

start: 2024-08-08 00:00:00

end: 2025-03-23 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("3-7 Program EMA + MACD + ATR", overlay=true)

// === User Parameter Settings ===

shortEmaLength = input.int(6, title="Short EMA Period", minval=1)

longEmaLength = input.int(2, title="Long EMA Period", minval=1)

atrLength = input.int(13, title="ATR Period", minval=1)

atrMultiplier = input.float(7, title="ATR Stop Loss/Take Profit Multiplier", minval=0.1)

macdFast = input.int(18, title="MACD Fast Line Period", minval=1)

macdSlow = input.int(19, title="MACD Slow Line Period", minval=1)

macdSignal = input.int(24, title="MACD Signal Line Period", minval=1)

// === Indicator Calculations ===

// Moving Averages

shortEma = ta.ema(close, shortEmaLength)

longEma = ta.ema(close, longEmaLength)

// MACD Momentum Filter

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

macdFilterLong = (macdLine > signalLine) and (macdLine > 0)

macdFilterShort = (macdLine < signalLine) and (macdLine < 0)

// ATR Stop Loss / Take Profit Calculation

atr = ta.atr(atrLength)

longStopLoss = close - (atr * atrMultiplier)

longTakeProfit = close + (atr * atrMultiplier)

shortStopLoss = close + (atr * atrMultiplier)

shortTakeProfit = close - (atr * atrMultiplier)

// === Trend Entry Conditions ===

longCondition = ta.crossover(shortEma, longEma) and macdFilterLong

shortCondition = ta.crossunder(shortEma, longEma) and macdFilterShort

// === Entry Logic ===

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit Long", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit Short", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)