Multi-Indicator Comprehensive Analysis Quantitative Trading Strategy: Trend Momentum and Volatility Collaborative Prediction Model

SMA EMA ADX RSI MACD STOCHASTIC CCI BOLLINGER BANDS ATR OBV MFI VWAP supertrend Williams %R FIBONACCI

Overview

The Multi-Indicator Comprehensive Analysis Quantitative Trading Strategy is a quantitative trading method based on the integrated analysis of multiple technical indicators. This strategy incorporates 30 different technical indicators, including trend indicators, momentum indicators, volatility indicators, volume indicators, and other specialized indicators, forming a complete trading signal system through the collaborative analysis of these indicators. The strategy primarily utilizes mutual verification and filtering mechanisms between multiple indicators to identify market trends while combining momentum and volatility analysis to find high-probability trading opportunities. The strategy employs strict entry conditions and ATR-based dynamic stop-loss and take-profit settings, aiming to balance returns and risks.

Strategy Principles

The core principle of this strategy lies in creating a mutually verifying trading decision system through multi-dimensional market analysis. The strategy first defines five major categories of indicator systems:

Trend Indicators: Including SMA50, SMA200, EMA20, EMA50, and ADX. These indicators are used to confirm the primary market direction, with rising or falling ADX used to identify strengthening or weakening trends.

Momentum Indicators: Including RSI, MACD, Stochastic, CCI, and Momentum. These indicators primarily measure the speed and strength of price movements, identifying potential overbought or oversold areas.

Volatility Indicators: Including Bollinger Bands, Average True Range (ATR), and Keltner Channel. These indicators assess market volatility and determine potential price breakouts.

Volume Indicators: Including OBV, Money Flow Index (MFI), VWAP, and Chaikin indicator. These indicators confirm the authenticity of price trends by analyzing volume changes.

Other Specialized Indicators: Including Parabolic SAR, Supertrend, Williams %R, Fibonacci Retracement, and some modified indicators based on moving averages.

The strategy’s trading logic is based on the comprehensive analysis of these indicators, with specific trading signal conditions as follows:

Long Conditions: Requires ADX trend rising, RSI not exceeding 70, MACD line above signal line, Stochastic K greater than 20, CCI greater than -100, price breaking through the upper Bollinger Band, OBV greater than its 20-day moving average, sudden volume increase, golden cross formation, and price above the 200-day moving average.

Short Conditions: Requires ADX trend falling, RSI greater than 30, MACD line below signal line, Stochastic D less than 80, CCI less than 100, price falling below the lower Bollinger Band, OBV less than its 20-day moving average, sudden volume increase, death cross formation, and price below the 200-day moving average.

Once a trading signal is triggered, the strategy uses ATR-based dynamic stop-loss and take-profit settings, specifically setting the stop-loss at the current price minus 2 times ATR and take-profit at the current price plus 4 times ATR (for long positions), or vice versa (for short positions).

Strategy Advantages

Multi-dimensional Market Analysis: By integrating 30 different types of technical indicators, the strategy can analyze the market from multiple dimensions, reducing misleading signals from a single indicator and improving the reliability of trading decisions.

Strict Signal Filtering Mechanism: The strategy sets multiple conditions for trading signals, only opening positions when most indicators point in the same direction, effectively filtering out false signals.

Dynamic Risk Management: Using ATR-based dynamic stop-loss and take-profit settings, adjusting risk parameters according to actual market volatility, avoiding the limitations of fixed-point stop-loss and take-profit under different market conditions.

Combination of Trend and Volatility: The strategy focuses on both medium-to-long-term trends and short-term volatility, capturing trading opportunities within major trends while optimizing entry timing through volatility indicators.

Integration of Price and Volume Analysis: By integrating multiple volume indicators, the strategy verifies the authenticity of price movements, improving the accuracy of trend determination.

Comprehensive Technical Schools: The strategy integrates ideas from various technical analysis schools such as trend following, breakout trading, and swing trading, making it more adaptable.

Strategy Risks

Indicator Overcrowding Risk: Using 30 indicators may lead to conflicting signals, especially in oscillating markets, where multiple indicators may give contradictory signals, resulting in lost trading opportunities or incorrect decisions.

Parameter Optimization Challenges: So many indicators mean a large number of parameters that need optimization, easily leading to overfitting historical data and poor performance in live trading.

System Computation Burden: Calculating numerous indicators increases system resource consumption, potentially causing slow strategy operation, especially in high-frequency trading or when running multiple instruments simultaneously.

Signal Scarcity Issue: Due to extremely strict entry conditions, it may result in long periods without trading signals, reducing capital efficiency.

Market Condition Dependency: Despite integrating multiple indicators, the strategy may still fail under certain specific market conditions (such as extreme volatility or liquidity drought).

Solutions: - Group indicators and prioritize them according to market conditions, avoiding equal weighting of all indicators - Conduct specialized optimization tests for key parameters such as Williams %R period - Consider using more efficient calculation methods or simplifying the calculation logic of some indicators - Dynamically adjust the strictness of entry conditions for different market phases - Add liquidity and market state detection mechanisms, reducing or suspending trading under extreme market conditions

Strategy Optimization Directions

Indicator Weight Optimization: Assign weights to different indicators rather than simple “AND” logic, using machine learning methods such as random forests or neural networks to evaluate the importance of various indicators and dynamically adjust weights.

Parameter Adaptive Mechanism: For key parameters such as Williams %R, automatically adjust cycle parameters according to market volatility or trading cycles, for example, using longer cycles when volatility increases.

Signal Hierarchical Processing: Divide indicators into confirmation indicators and filter indicators, using confirmation indicators to generate basic signals and filter indicators to improve signal quality, thus increasing signal quantity while maintaining high quality.

Market Environment Recognition: Add a market state classification module to identify whether the current market is a trend market or an oscillating market, and dynamically adjust strategy parameters and trading rules accordingly.

Optimize Calculation Efficiency: Streamline some highly correlated indicators or use more efficient calculation methods, such as using exponential smoothing techniques instead of simple moving averages, reducing computational burden.

Improve Stop-Loss Strategy: Consider adding trailing stop-loss or volatility-based dynamic stop-loss, giving prices sufficient room to fluctuate while protecting profits.

Capital Management Optimization: Add position management based on the Kelly criterion or fixed fraction model, adjusting the proportion of funds for each trade according to signal strength and market volatility.

The reason for optimizing these directions is that although the current strategy integrates multi-dimensional analysis, the rigid signal generation logic and equal-weight indicator processing method limit the strategy’s adaptability and efficiency. By introducing adaptive mechanisms, hierarchical processing, and intelligent weight allocation, the strategy’s flexibility and market adaptability can be improved while maintaining the advantages of multi-indicator analysis.

Summary

The Multi-Indicator Comprehensive Analysis Quantitative Trading Strategy constructs a comprehensive trading decision system by integrating market information from multiple dimensions such as trend, momentum, volatility, and volume. The main advantages of the strategy lie in high signal reliability and dynamic risk management, but it also faces challenges such as signal scarcity and computational burden.

From an implementation perspective, the strategy’s code structure on the TradingView platform is clear and logical, divided into three major modules: indicator definition, signal generation, and strategy execution. The code optimization space is mainly in parameter adaptation and indicator weighting.

Overall, this is a comprehensive quantitative strategy with complete ideas and rigorous logic, particularly suitable for medium-to-long-term trend trading and highly volatile market environments. Through the proposed optimization directions, especially indicator hierarchical processing and market environment recognition, the strategy can further enhance its adaptability and stability under different market conditions, becoming a more comprehensive and robust quantitative trading system.

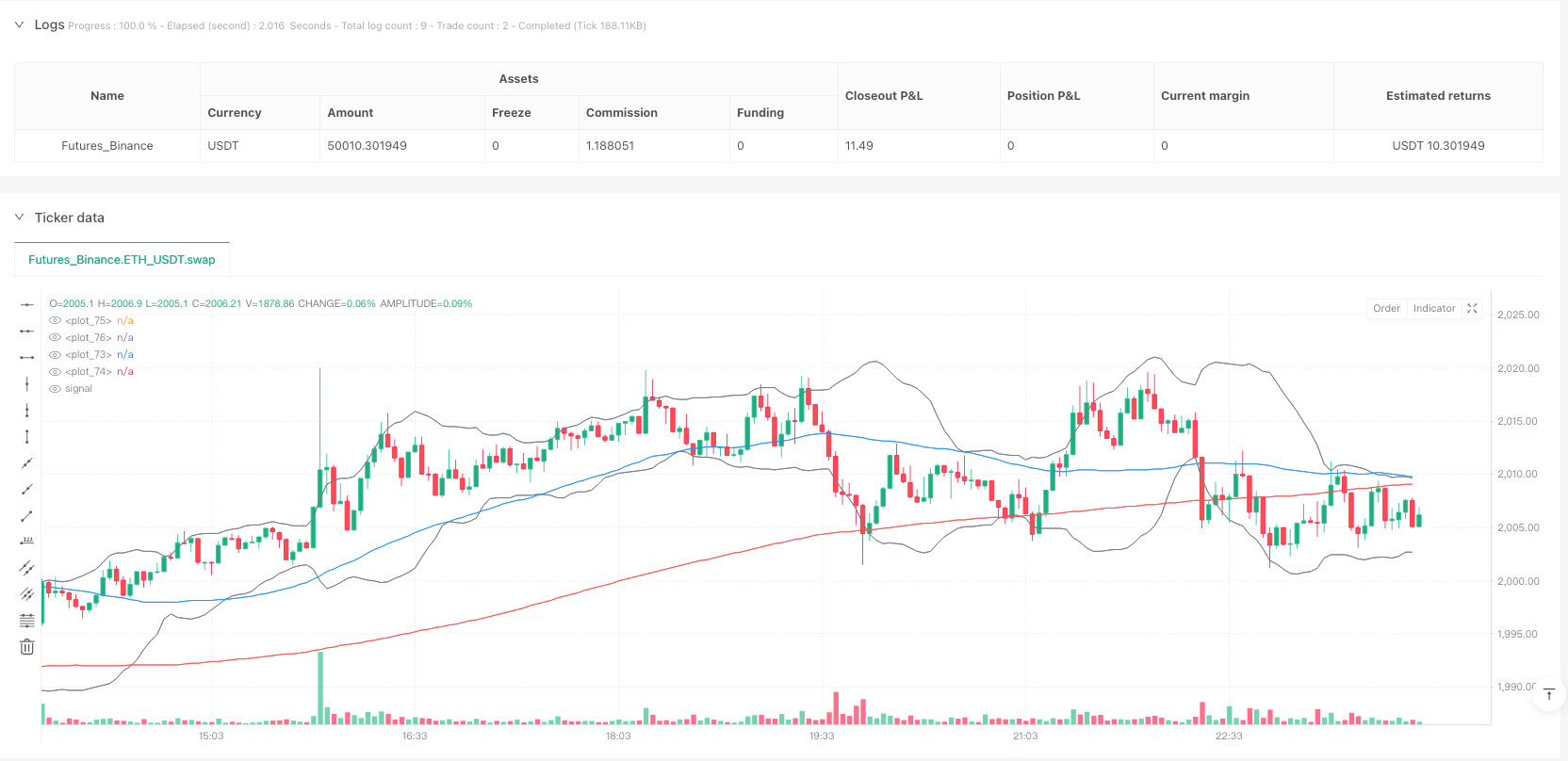

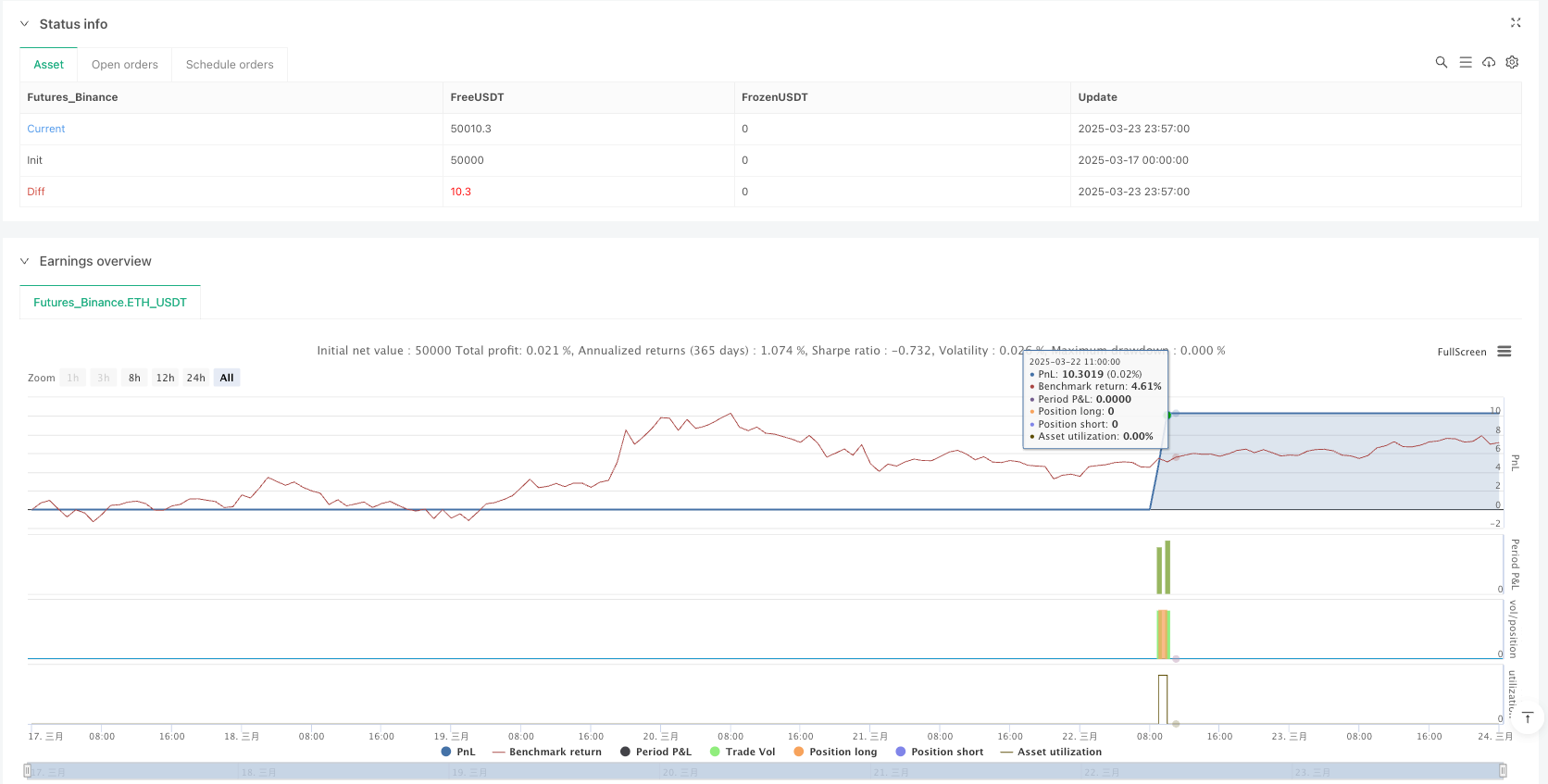

/*backtest

start: 2025-03-17 00:00:00

end: 2025-03-24 00:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("30 Göstergeli Strateji (BAKİ REİS)", overlay=true)

// 1. Trend Göstergeleri

// ------------------------------

sma50 = ta.sma(close, 50)

sma200 = ta.sma(close, 200)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

[diPlus, diMinus, adx] = ta.dmi(14, 14)

trendUp = ta.rising(adx, 3)

trendDown = ta.falling(adx, 3)

// 2. Momentum Göstergeleri

// ------------------------------

rsi = ta.rsi(close, 14)

macdLine = ta.ema(close, 12) - ta.ema(close, 26)

macdSignal = ta.ema(macdLine, 9)

stochK = ta.sma(ta.stoch(close, high, low, 14), 3)

stochD = ta.sma(stochK, 3)

cci = ta.cci(close, 20)

mom = ta.mom(close, 10)

// 3. Volatilite Göstergeleri

// ------------------------------

bbUpper = ta.sma(close, 20) + 2 * ta.stdev(close, 20)

bbLower = ta.sma(close, 20) - 2 * ta.stdev(close, 20)

atr = ta.atr(14)

kcUpper = ta.ema(close, 20) + 2 * ta.atr(20)

kcLower = ta.ema(close, 20) - 2 * ta.atr(20)

// 4. Hacim Göstergeleri

// ------------------------------

obv = ta.obv

mfi = ta.mfi(close, 14)

vwap = ta.vwap(close)

chaikin = ta.ema((close - low) - (high - close), 3) / (high - low) * volume

// 5. Diğer Göstergeler

// ------------------------------

sar = ta.sar(0.02, 0.2, 0.2)

[supertrendLine, supertrendDir] = ta.supertrend(3, 10)

williamsR = ta.wpr(14) // DÜZELTME BURADA!

fibRetrace = close > ta.highest(close, 50) * 0.618

ichimokuTenkan = ta.ema(close, 9)

ichimokuKijun = ta.ema(close, 26)

// 6. Özel Koşullar

// ------------------------------

goldenCross = ta.crossover(ema20, ema50)

deathCross = ta.crossunder(ema20, ema50)

volumeSpike = volume > 2 * ta.sma(volume, 20)

priceAboveSMA200 = close > sma200

// Sinyal Mantığı (Aynı)

// ------------------------------

longCondition = trendUp and rsi < 70 and macdLine > macdSignal and stochK > 20 and cci > -100 and close > bbUpper and obv > ta.ema(obv, 20) and volumeSpike and goldenCross and priceAboveSMA200

shortCondition = trendDown and rsi > 30 and macdLine < macdSignal and stochD < 80 and cci < 100 and close < bbLower and obv < ta.ema(obv, 20) and volumeSpike and deathCross and close < sma200

// Strateji Kuralları

// ------------------------------

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", stop=close - 2 * atr, limit=close + 4 * atr)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", stop=close + 2 * atr, limit=close - 4 * atr)

// Grafik Çizimleri

// ------------------------------

plot(sma50, color=color.blue)

plot(sma200, color=color.red)

plot(bbUpper, color=color.gray)

plot(bbLower, color=color.gray)