Overview

This strategy is a dynamic breakout trading system based on Bollinger Bands, primarily utilizing price breakouts above the upper band for long entries, combined with trend persistence and mean reversion principles for exits. The strategy operates on a 5-minute timeframe, capturing breakout opportunities in short-term market fluctuations by setting Bollinger Bands parameters and trend tolerance to achieve quick entries and risk control. The core logic of the strategy is: enter long positions when price breaks above the upper Bollinger Band, and exit when the price fails to maintain above the upper band for a preset tolerance period, or when it touches the middle band (moving average).

Strategy Principles

The strategy is based on the Bollinger Bands indicator, which consists of three lines: the middle band (20-period simple moving average), the upper band (middle band + 1.9 standard deviations), and the lower band (middle band - 1.9 standard deviations). The trading logic is as follows:

- Entry Signal: A long signal is generated when the closing price breaks above the upper Bollinger Band (ta.crossover(close, upper)).

- Exit Conditions: There are two exit conditions:

- The price fails to maintain above the upper band for longer than the preset tolerance (default 4 periods)

- The price touches the middle band (low is less than or equal to the middle band)

The strategy uses the variable barsNotAboveUpper to count the consecutive periods when the price does not remain above the upper band. Whenever the price is above the upper band, the counter resets to 0; otherwise, the counter increments by 1. When the count reaches the tolerance threshold, or the price touches the middle band, the strategy closes the long position.

Although the code includes a framework for short strategies, the short trading portion is commented out in the actual execution, making the strategy only execute long trades. This may be an optimization decision based on market characteristics or backtesting results.

Strategy Advantages

Trend Following and Volatility Adaptation: Bollinger Bands adapt to market volatility, automatically adjusting the channel width in different volatility environments, making the strategy effective under varying market conditions.

Clear Entry and Exit Rules: The strategy provides clear entry signals (breakout above the upper band) and two objective exit conditions (insufficient trend persistence or touching the moving average), reducing subjective judgment.

Risk Control Mechanism: By setting the trend tolerance parameter, the strategy can quickly respond to trend changes and cut losses in a timely manner. This dual exit mechanism based on time and price effectively controls risk exposure per trade.

Parameter Optimization Space: The strategy provides three adjustable parameters: Bollinger Band length, multiplier, and trend tolerance, allowing traders to optimize according to different market conditions and trading styles.

Application of Mean Reversion Principle: The strategy uses price touching the moving average (middle band) as an exit condition, conforming to the mean reversion characteristics of financial markets, improving the rationality of exits.

Alert System Integration: The strategy integrates trade signal alert functionality, providing real-time notifications of entry and exit signals to traders, improving trade execution efficiency.

Strategy Risks

False Breakout Risk: Prices may temporarily break above the upper band and then quickly retreat, leading to false signals and unnecessary trades, increasing transaction costs.

Parameter Sensitivity: Bollinger Band length and multiplier parameters significantly impact strategy performance; inappropriate parameter settings may lead to excessive false signals or missed important trading opportunities.

Unidirectional Trading Limitation: The current strategy only executes long trades, potentially lacking profit opportunities in downtrend markets, leading to unstable long-term performance.

Time-Dependent Stop Loss Mechanism: The trend tolerance is based on period counting rather than price fluctuation magnitude, which may not stop losses in a timely manner in extreme market conditions, increasing downside risk.

Insufficient Drawdown Control: The strategy lacks a stop-loss mechanism based on overall fund management, which may lead to significant account drawdowns when consecutive false signals occur.

Timeframe Limitation: The strategy is specifically designed for 5-minute charts and may not be suitable for other timeframes, limiting the strategy’s application range.

To mitigate these risks, it is recommended to: (1) add additional filtering conditions to reduce false breakout signals; (2) implement risk control based on overall position size; (3) add trend confirmation indicators; (4) consider adding stop-loss mechanisms based on price magnitude.

Strategy Optimization Directions

Add Trend Confirmation Filter: Additional trend indicators (such as ADX, moving average systems) can be introduced to confirm market direction, executing trades only in confirmed trends, reducing false breakout signals. Implementation method:

adxLength = input.int(14, "ADX Length") adxThreshold = input.int(25, "ADX Threshold") dI = ta.dmi(adxLength, adxLength) adx = ta.adx(adxLength) trendFilter = adx > adxThreshold and dI+"DI" > dI+"DI-" longCondition := longCondition and trendFilterImplement Complete Long-Short Strategy: Activate the commented short trading logic in the code to allow the strategy to profit in downtrend markets as well. This will improve the strategy’s adaptability and comprehensiveness across different market environments.

Optimize Fund Management: Add position size control and overall risk management, such as ATR-based stop-loss settings, maximum drawdown limits, etc. For example:

atrPeriod = input.int(14, "ATR Period") atrMultiplier = input.float(3.0, "ATR Multiplier") atr = ta.atr(atrPeriod) stopLossPrice = strategy.position_avg_price - (atrMultiplier * atr)Add Time Filtering: Trading session filtering can be added to avoid low liquidity or high volatility market sessions:

timeFilter = (hour >= 9 and hour < 16) or (hour >= 18 and hour < 22) longCondition := longCondition and timeFilterParameter Adaptive Mechanism: Develop a dynamic adjustment mechanism for Bollinger Band parameters, allowing the strategy to automatically adjust parameters based on current market volatility states, improving adaptability:

volatilityRatio = ta.atr(14) / ta.atr(56) dynamicMult = volatilityRatio < 0.8 ? mult * 0.8 : mult * 1.2Introduce Trailing Stop Loss: Implement high-point based trailing stops to lock in more profits:

var float trailingStop = na if strategy.position_size > 0 trailingStop := math.max(trailingStop, close - atrMultiplier * atr) if close < trailingStop strategy.close("Long")

Summary

The Bollinger Bands Dynamic Breakout Momentum Trading Strategy is a short-term trading system based on technical analysis, combining trend following and mean reversion principles. The strategy enters long positions by monitoring price breakouts above the upper Bollinger Band and exits when price persistence is insufficient or touches the moving average, forming a complete trading loop.

The strategy’s advantages lie in its ability to adapt to market volatility and clear trading rules, but it also faces challenges such as false breakout risks and parameter sensitivity. By adding trend filters, perfecting the long-short trading system, optimizing fund management, and introducing adaptive parameters, the strategy’s robustness and profitability can be significantly enhanced.

For traders, this strategy is suitable as a short-term trading system, especially in markets with high volatility and obvious breakout characteristics. With further optimization, it has the potential to become a comprehensive trading solution capable of maintaining relatively stable performance across various market environments.

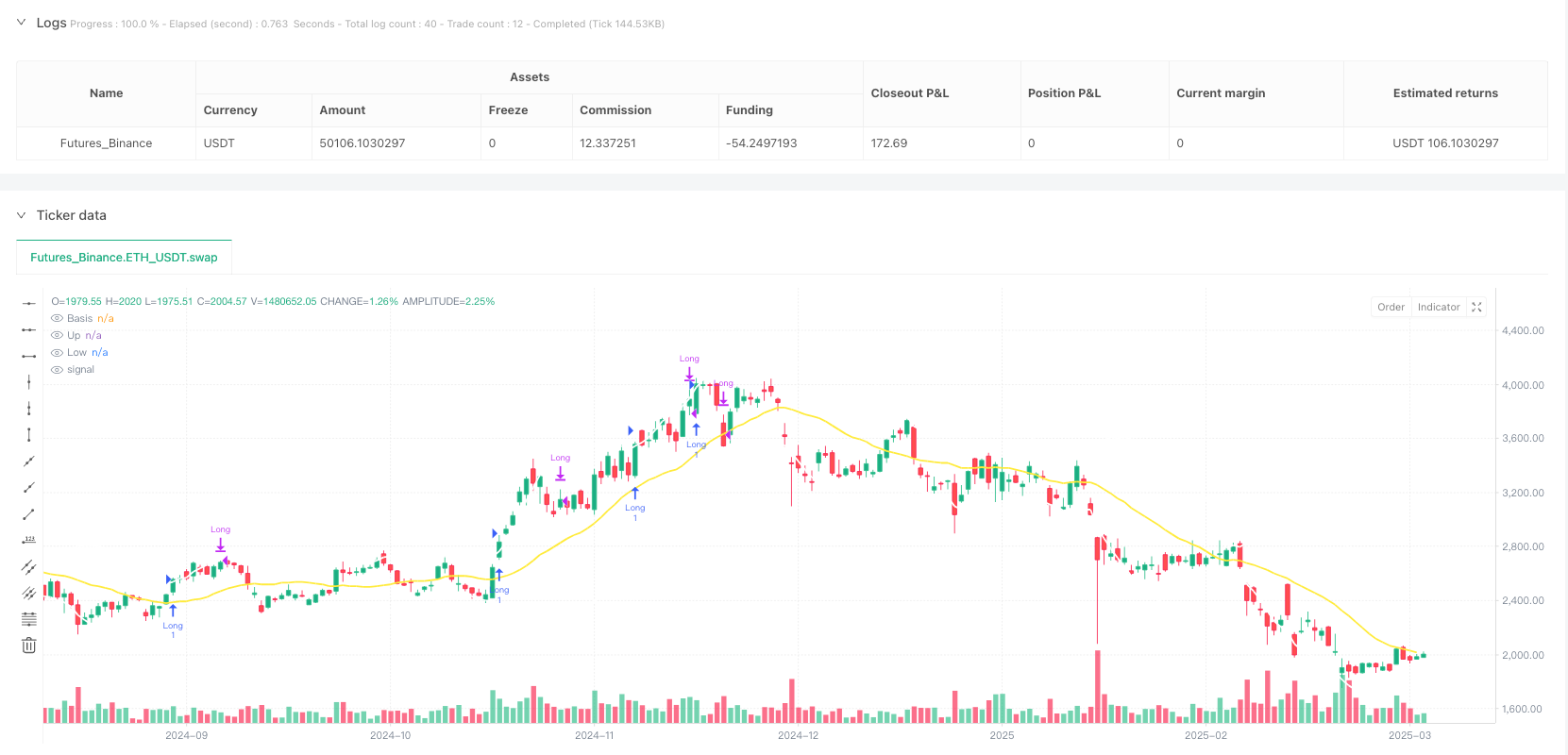

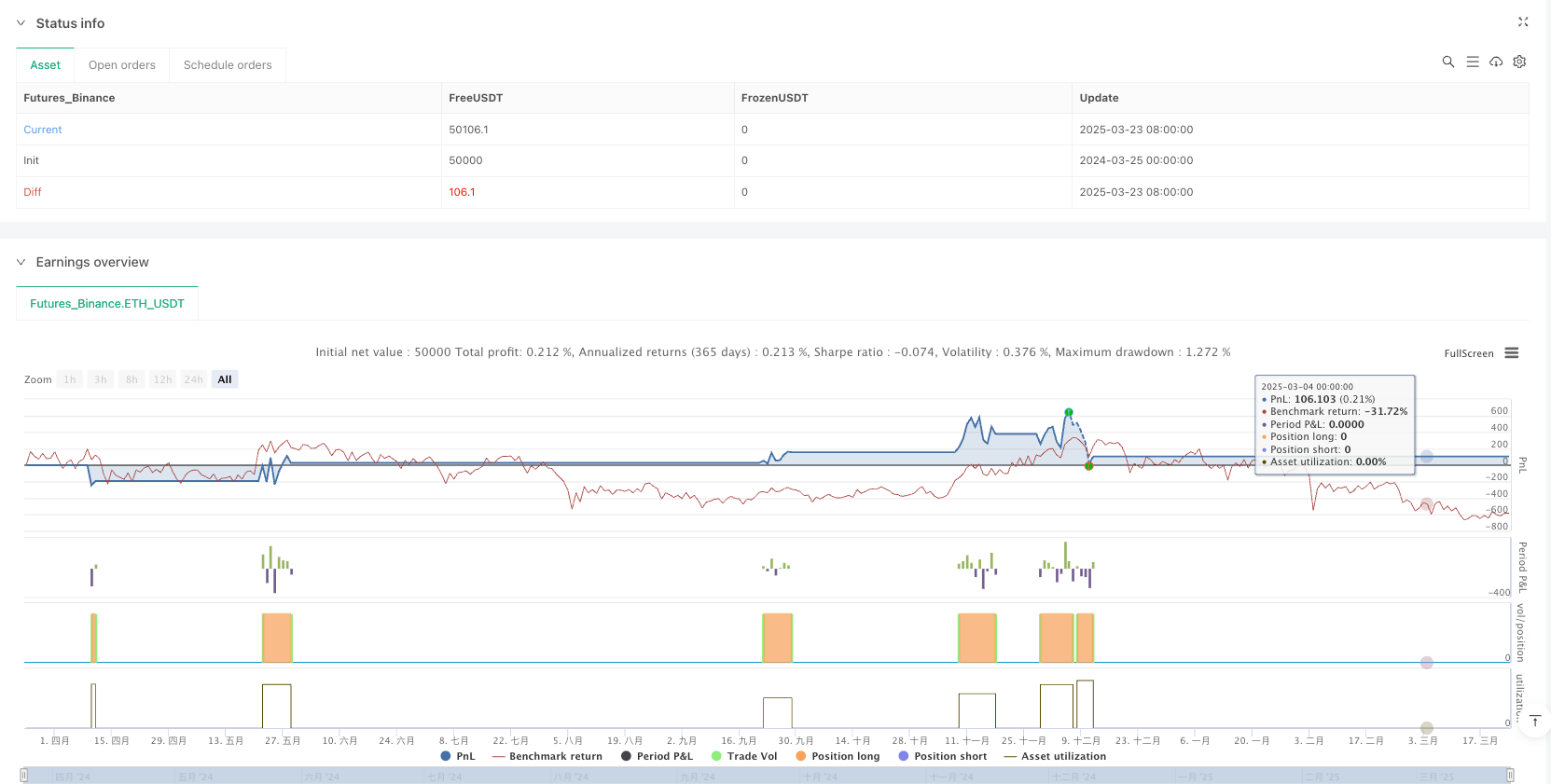

/*backtest

start: 2024-03-25 00:00:00

end: 2025-03-24 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GoodDayss

//@version=6

strategy("Bollinger Bands Strategy 5m", overlay=true)

length = input.int(20, "Bollinger Length", minval=1)

mult = input.float(1.9, "Bollinger Mult", minval=0.001, maxval=50)

tolerance = input.int(4, "Trend Tolerance", minval=1)

source = close

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

plot(basis, color=color.yellow, linewidth=2, title="Basis")

plot(upper, color=color.white, linewidth=2, title="Up")

plot(lower, color=color.white, linewidth=2, title="Low")

var int barsNotAboveUpper = 0

var int barsNotBelowLower = 0

bool longCondition = ta.crossover(close, upper)

bool shortCondition = ta.crossunder(close, lower)

if longCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

// Alert

alertcondition(longCondition and strategy.position_size <= 0, title = "幹你媽買進", message = "{{{ticker}} 的價格是 {{close}},\n買進!!!.}")

// if shortCondition and strategy.position_size >= 0

// strategy.entry("Short", strategy.short)

if strategy.position_size > 0

if close > upper

barsNotAboveUpper := 0

else

barsNotAboveUpper += 1

bool touchedBasisLong = (low <= basis)

if barsNotAboveUpper >= tolerance or touchedBasisLong

// Alert

alert(message = "{{{ticker}} 的價格是 {{close}},\n塊陶啊,賣出!!!.}")

strategy.close("Long", comment="Exit Long")

barsNotAboveUpper := 0

if strategy.position_size < 0

if close < lower

barsNotBelowLower := 0

else

barsNotBelowLower += 1

bool touchedBasisShort = (high >= basis)

// if barsNotBelowLower >= tolerance or touchedBasisShort

// strategy.close("Short", comment="Exit Short")

// barsNotBelowLower := 0