Overview

The Multi-Timeframe Momentum Convergence Trading System is a quantitative trading strategy that combines technical indicators with multi-timeframe analysis. The core concept revolves around simultaneously monitoring market trends across short-term (15-minute) and long-term (4-hour) timeframes, using the convergence of EMA (Exponential Moving Average), MA (Moving Average), and RSI (Relative Strength Index) to filter out false signals. The strategy only executes trades when multiple timeframes align in the same direction. It employs EMA crossovers, price breakouts, and RSI momentum confirmation, supplemented by volume verification, to generate high-quality entry signals. Additionally, the system incorporates comprehensive risk management features including ATR-based dynamic stop-losses, fixed percentage take-profit/stop-loss levels, and trailing stops to form a complete trading framework.

Strategy Principles

The core principles of this strategy are based on the synthesis of multiple technical indicators across different timeframes, divided into the following components:

Multi-Timeframe Analysis: The strategy simultaneously analyzes 15-minute (entry) and 4-hour (trend confirmation) timeframes to ensure trade direction aligns with the broader market trend.

Entry Conditions (15-minute timeframe):

- Long Entry: EMA13 > EMA62 (short-term bullish momentum), close price > MA200 (price above major trend indicator), Fast RSI(7) > Slow RSI(28) (increasing momentum), Fast RSI > 50 (bullish momentum bias), and volume greater than 20-period average.

- Short Entry: Opposite of long conditions, requiring EMA13 < EMA62, close price < MA200, Fast RSI(7) < Slow RSI(28), Fast RSI < 50, with increased volume.

Trend Confirmation (4-hour timeframe):

- Long Confirmation: Similar to 15-minute conditions but with slightly different RSI requirements, requiring Slow RSI > 40.

- Short Confirmation: Similarly opposite to long conditions, with Slow RSI < 60.

Precise Entry Requirements: The strategy requires either a fresh EMA13 crossover of EMA62 or a price crossing of MA200, providing more precise entry points and avoiding blind entries into trends that have been established for extended periods.

Exit Mechanisms: Multiple exit options including technical indicator reversals (EMA relationship changes or RSI reaching overbought/oversold), ATR-based dynamic stops, fixed percentage stop-loss/take-profit, and trailing stops.

Strategy Advantages

Systematic Multi-Timeframe Analysis: By analyzing market conditions across different timeframes, the strategy filters out short-term market noise and only enters when trends are clear and consistent, significantly reducing the probability of false signals.

Multiple Confirmation Mechanisms: The synergy of EMA, MA, and RSI confirmations increases the reliability of trading signals. Particularly, requiring EMA crossovers or price breakouts as trigger conditions enhances entry timing precision.

Flexible Risk Management: The strategy offers various risk control options, including ATR-based dynamic stops, fixed percentage stop-loss/take-profit, and trailing stops, allowing traders to adjust risk parameters according to personal risk preferences and market conditions.

Volume Confirmation: The addition of increased volume as a condition further filters potential false breakouts, as genuine price movements are typically accompanied by increased trading volume.

Visual Interface: The strategy provides an intuitive visual dashboard displaying the status of various indicators and signals, enabling traders to clearly understand current market conditions and strategy assessments at a glance.

High Customizability: Almost all parameters of the strategy can be adjusted through input settings, including EMA lengths, MA type, RSI parameters, and risk control multipliers, allowing traders to optimize the strategy for different market environments.

Strategy Risks

Sideways Market Risk: In range-bound, consolidating markets, EMA and MA may frequently cross, leading to increased false signals and frequent trading, potentially resulting in consecutive losses. The solution is to add additional filtering conditions, such as volatility assessment or trend strength confirmation, pausing trading when markets are clearly identified as ranging.

Parameter Optimization Overfitting: Excessive optimization of indicator parameters may cause the strategy to perform excellently on historical data but fail in future markets. It is recommended to use walk-forward analysis to verify strategy robustness and test a fixed set of parameters across multiple trading instruments.

Large Gap Risk: Following major news or sudden events, markets may experience significant gaps, preventing stops from executing at preset levels. Consider using more conservative position sizing or implementing volatility-based position adjustment mechanisms.

Limitations of Reliance on Quantitative Indicators: The strategy completely relies on technical indicators, ignoring fundamental factors. Before major economic data releases or central bank policy changes, consider reducing position size or pausing trading to avoid risks from sudden news.

Signal Lag: EMA, MA, and other indicators are inherently lagging, potentially generating signals when trends are already nearing their end. This can be improved by adjusting EMA periods or incorporating other forward-looking indicators (such as price patterns or volatility changes).

Strategy Optimization Directions

Market Environment Filtering: Introduce adaptive indicators or market structure assessment to identify whether the current market is trending or ranging before strategy execution, adjusting trading parameters or pausing trading accordingly. For example, using ADX (Average Directional Index) to quantify trend strength and only trading when trends are clear.

Dynamic Parameter Adjustment: The current strategy uses fixed technical indicator parameters; consider automatically adjusting parameters based on market volatility. For example, using shorter-period EMAs to quickly capture movements in low-volatility environments and longer-period EMAs to reduce noise in high-volatility environments.

Position Sizing Optimization: The current strategy uses fixed percentage money management; this could be improved to dynamic position sizing based on volatility, expected win rate, or Kelly formula to maximize risk-adjusted returns.

Machine Learning Integration: Introduce machine learning algorithms, such as decision trees or random forests, to optimize weight allocation to various indicators or predict which market environments the strategy might perform better in.

Fundamental Filtering: Automatically adjust stop-loss ranges or pause trading before important economic data releases to address potential high-volatility events.

Multi-Timeframe Weight Optimization: The current strategy simply requires confirmation from two timeframes; consider introducing a more complex multi-timeframe weighting system, assigning different weights to different timeframes to form a comprehensive score for determining entry timing.

Seasonal Analysis Addition: Some trading instruments may exhibit temporal seasonal characteristics; analyze historical data to mine these patterns and adjust strategy parameters or trading periods accordingly.

Summary

The Multi-Timeframe Momentum Convergence Trading System is a structurally complete, logically clear quantitative trading system that effectively filters market noise and captures high-probability trading opportunities through multi-timeframe analysis and multi-indicator confirmation. The strategy integrates classic technical analysis indicators EMA, MA, and RSI, and enhances trading quality through precise entry requirements and a comprehensive risk management system.

The strategy’s greatest advantage lies in its multiple confirmation mechanisms and multi-timeframe collaborative analysis, which not only reduces false signals but also ensures trades align with the primary trend. Meanwhile, comprehensive risk management options allow traders to flexibly control risk exposure. However, the strategy also faces risks including poor performance in ranging markets, parameter optimization overfitting, and technical indicator lag.

Future optimization directions primarily focus on market environment classification, dynamic parameter adjustment, machine learning applications, and integration of additional temporal dimension analyses. Through these optimizations, the strategy has the potential to maintain stable performance across different market environments, further improving win rates and risk-adjusted returns.

For traders seeking systematic, disciplined trading methods, this strategy provides a solid framework that can be either directly applied or customized and extended as the foundation for a personalized trading system.

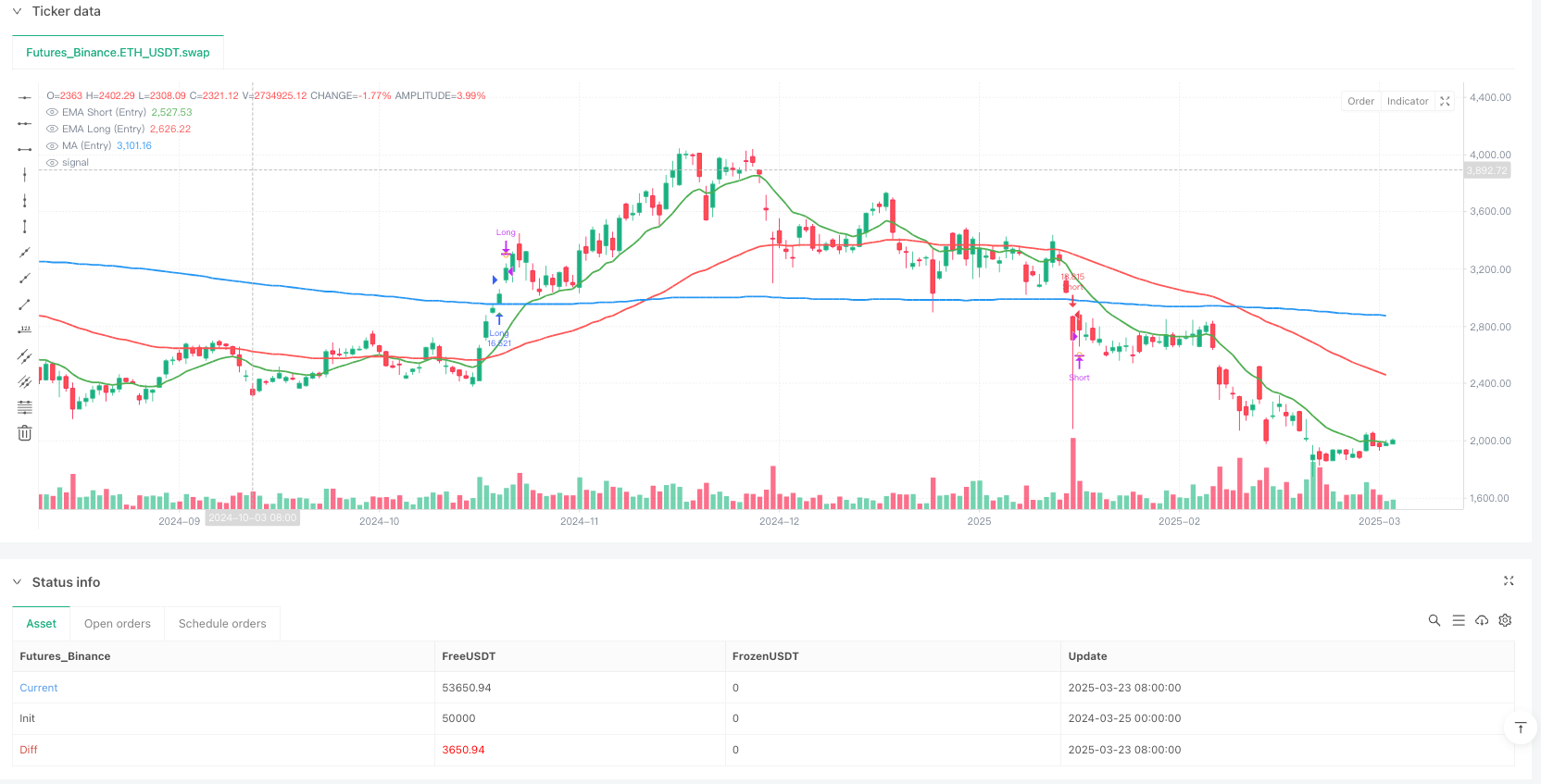

/*backtest

start: 2024-03-25 00:00:00

end: 2025-03-24 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// Advanced Multi-Timeframe EMA/MA/RSI Strategy

// Uses 4h for confluence and 15m for entry

// Version 6

//@version=6

strategy("Forex Fire EMA/MA/RSI Strategy", overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100,

initial_capital=10000, pyramiding=0, calc_on_every_tick=true)

// Input parameters with sections

// Timeframe inputs

tf_entry = input.string("15", title="Entry Timeframe", options=["1", "5", "15", "30", "60", "120"], group="Timeframes")

tf_confluence = input.string("240", title="Confluence Timeframe", options=["60", "240", "D", "W"], group="Timeframes")

// Indicator settings

ema_short_length = input.int(13, title="EMA Short Length", minval=5, maxval=50, group="EMAs")

ema_long_length = input.int(62, title="EMA Long Length", minval=20, maxval=200, group="EMAs")

ma_length = input.int(200, title="Moving Average Length", minval=50, maxval=500, group="Moving Average")

ma_type = input.string("SMA", title="MA Type", options=["SMA", "EMA", "WMA", "VWMA"], group="Moving Average")

// RSI settings

rsi_slow_length = input.int(28, title="RSI Slow Length", minval=14, maxval=50, group="RSI")

rsi_fast_length = input.int(7, title="RSI Fast Length", minval=3, maxval=14, group="RSI")

rsi_overbought = input.int(70, title="RSI Overbought Level", minval=60, maxval=90, group="RSI")

rsi_oversold = input.int(30, title="RSI Oversold Level", minval=10, maxval=40, group="RSI")

// Strategy parameters

use_atr_exits = input.bool(true, title="Use ATR for Exit Targets", group="Strategy Settings")

atr_multiplier = input.float(2.0, title="ATR Multiplier for Exits", minval=1.0, maxval=5.0, step=0.1, group="Strategy Settings")

atr_length = input.int(14, title="ATR Length", minval=5, maxval=30, group="Strategy Settings")

use_stop_loss = input.bool(true, title="Use Stop Loss", group="Risk Management")

stop_loss_percent = input.float(2.0, title="Stop Loss (%)", minval=0.5, maxval=10.0, step=0.5, group="Risk Management")

use_take_profit = input.bool(true, title="Use Take Profit", group="Risk Management")

take_profit_percent = input.float(4.0, title="Take Profit (%)", minval=1.0, maxval=20.0, step=1.0, group="Risk Management")

use_trailing_stop = input.bool(true, title="Use Trailing Stop", group="Risk Management")

trailing_percent = input.float(1.5, title="Trailing Stop (%)", minval=0.5, maxval=5.0, step=0.1, group="Risk Management")

// Visual settings

show_plot = input.bool(true, title="Show Indicator Plots", group="Visuals")

show_signals = input.bool(true, title="Show Entry/Exit Signals", group="Visuals")

show_table = input.bool(true, title="Show Info Table", group="Visuals")

// Helper function for MA type

f_ma(src, length, type) =>

switch type

"SMA" => ta.sma(src, length)

"EMA" => ta.ema(src, length)

"WMA" => ta.wma(src, length)

"VWMA" => ta.vwma(src, length)

=> ta.sma(src, length)

// ATR for dynamic exits

atr_value = ta.atr(atr_length)

// Indicators for Entry timeframe

ema_short_entry = ta.ema(close, ema_short_length)

ema_long_entry = ta.ema(close, ema_long_length)

ma_entry = f_ma(close, ma_length, ma_type)

rsi_slow_entry = ta.rsi(close, rsi_slow_length)

rsi_fast_entry = ta.rsi(close, rsi_fast_length)

// Indicators for Confluence timeframe

ema_short_conf = request.security(syminfo.tickerid, tf_confluence, ta.ema(close, ema_short_length), barmerge.gaps_off, barmerge.lookahead_off)

ema_long_conf = request.security(syminfo.tickerid, tf_confluence, ta.ema(close, ema_long_length), barmerge.gaps_off, barmerge.lookahead_off)

ma_conf = request.security(syminfo.tickerid, tf_confluence, f_ma(close, ma_length, ma_type), barmerge.gaps_off, barmerge.lookahead_off)

rsi_slow_conf = request.security(syminfo.tickerid, tf_confluence, ta.rsi(close, rsi_slow_length), barmerge.gaps_off, barmerge.lookahead_off)

rsi_fast_conf = request.security(syminfo.tickerid, tf_confluence, ta.rsi(close, rsi_fast_length), barmerge.gaps_off, barmerge.lookahead_off)

// Volume confirmation

volume_increasing = volume > ta.sma(volume, 20)

// Plotting indicators - completely outside of conditional blocks

// We'll use the show_plot variable directly in the color transparency

ema_short_plot_color = show_plot ? color.new(color.green, 0) : color.new(color.green, 100)

ema_long_plot_color = show_plot ? color.new(color.red, 0) : color.new(color.red, 100)

ma_plot_color = show_plot ? color.new(color.blue, 0) : color.new(color.blue, 100)

plot(ema_short_entry, title="EMA Short (Entry)", color=ema_short_plot_color, linewidth=2)

plot(ema_long_entry, title="EMA Long (Entry)", color=ema_long_plot_color, linewidth=2)

plot(ma_entry, title="MA (Entry)", color=ma_plot_color, linewidth=2)

// Define entry conditions for Entry timeframe

long_entry_condition = ema_short_entry > ema_long_entry and close > ma_entry and rsi_fast_entry > rsi_slow_entry and rsi_fast_entry > 50 and volume_increasing

short_entry_condition = ema_short_entry < ema_long_entry and close < ma_entry and rsi_fast_entry < rsi_slow_entry and rsi_fast_entry < 50 and volume_increasing

// Define confluence conditions from Confluence timeframe

long_confluence = ema_short_conf > ema_long_conf and close > ma_conf and rsi_slow_conf > 40 and rsi_fast_conf > rsi_slow_conf

short_confluence = ema_short_conf < ema_long_conf and close < ma_conf and rsi_slow_conf < 60 and rsi_fast_conf < rsi_slow_conf

// Advanced entry conditions

ema_crossover = ta.crossover(ema_short_entry, ema_long_entry)

ema_crossunder = ta.crossunder(ema_short_entry, ema_long_entry)

price_crossover_ma = ta.crossover(close, ma_entry)

price_crossunder_ma = ta.crossunder(close, ma_entry)

// Enhanced strategy conditions combining both timeframes with crossovers

long_condition = (long_entry_condition and long_confluence) and (ema_crossover or price_crossover_ma)

short_condition = (short_entry_condition and short_confluence) and (ema_crossunder or price_crossunder_ma)

// Exit conditions

long_exit_technical = ema_short_entry < ema_long_entry or rsi_fast_entry > rsi_overbought

short_exit_technical = ema_short_entry > ema_long_entry or rsi_fast_entry < rsi_oversold

// Strategy execution

var float entry_price = 0.0

var float stop_loss_level = 0.0

var float take_profit_level = 0.0

var float trailing_stop_level = 0.0

if (long_condition)

entry_price := close

stop_loss_level := use_stop_loss ? close * (1 - stop_loss_percent / 100) : 0.0

take_profit_level := use_take_profit ? close * (1 + take_profit_percent / 100) : 0.0

trailing_stop_level := use_trailing_stop ? close * (1 - trailing_percent / 100) : 0.0

strategy.entry("Long", strategy.long)

if (short_condition)

entry_price := close

stop_loss_level := use_stop_loss ? close * (1 + stop_loss_percent / 100) : 0.0

take_profit_level := use_take_profit ? close * (1 - take_profit_percent / 100) : 0.0

trailing_stop_level := use_trailing_stop ? close * (1 + trailing_percent / 100) : 0.0

strategy.entry("Short", strategy.short)

// Handle stops and exits

if strategy.position_size > 0

// Update trailing stop for longs

if use_trailing_stop and close > entry_price

trail_level = close * (1 - trailing_percent / 100)

trailing_stop_level := math.max(trailing_stop_level, trail_level)

// Exit conditions for longs

if (use_stop_loss and low < stop_loss_level and stop_loss_level > 0) or

(use_take_profit and high > take_profit_level and take_profit_level > 0) or

(use_trailing_stop and low < trailing_stop_level and trailing_stop_level > 0) or

(long_exit_technical)

strategy.close("Long")

if strategy.position_size < 0

// Update trailing stop for shorts

if use_trailing_stop and close < entry_price

trail_level = close * (1 + trailing_percent / 100)

trailing_stop_level := math.min(trailing_stop_level, trail_level)

// Exit conditions for shorts

if (use_stop_loss and high > stop_loss_level and stop_loss_level > 0) or

(use_take_profit and low < take_profit_level and take_profit_level > 0) or

(use_trailing_stop and high > trailing_stop_level and trailing_stop_level > 0) or

(short_exit_technical)

strategy.close("Short")

// ATR-based exits

if use_atr_exits and strategy.position_size != 0

atr_stop_long = strategy.position_size > 0 ? close - (atr_value * atr_multiplier) : 0.0

atr_stop_short = strategy.position_size < 0 ? close + (atr_value * atr_multiplier) : 0.0

if strategy.position_size > 0 and low <= atr_stop_long

strategy.close("Long", comment="ATR Exit")

if strategy.position_size < 0 and high >= atr_stop_short

strategy.close("Short", comment="ATR Exit")

// Visual signals on chart - completely outside conditional blocks

// Define plot conditions with show_signals incorporated

longEntryPlot = long_condition and show_signals

shortEntryPlot = short_condition and show_signals

longExitPlot = strategy.position_size > 0 and (long_exit_technical or

(use_stop_loss and low < stop_loss_level and stop_loss_level > 0) or

(use_take_profit and high > take_profit_level and take_profit_level > 0) or

(use_trailing_stop and low < trailing_stop_level and trailing_stop_level > 0)) and show_signals

shortExitPlot = strategy.position_size < 0 and (short_exit_technical or

(use_stop_loss and high > stop_loss_level and stop_loss_level > 0) or

(use_take_profit and low < take_profit_level and take_profit_level > 0) or

(use_trailing_stop and high > trailing_stop_level and trailing_stop_level > 0)) and show_signals

// Move plotshape outside of any conditional block

plotshape(series=longEntryPlot, title="Long Entry", style=shape.triangleup, location=location.belowbar,

color=color.new(color.green, 0), size=size.small)

plotshape(series=shortEntryPlot, title="Short Entry", style=shape.triangledown, location=location.abovebar,

color=color.new(color.red, 0), size=size.small)

plotshape(series=longExitPlot, title="Long Exit", style=shape.circle, location=location.abovebar,

color=color.new(color.orange, 0), size=size.small)

plotshape(series=shortExitPlot, title="Short Exit", style=shape.circle, location=location.belowbar,

color=color.new(color.orange, 0), size=size.small)

// Info table

if show_table

var table info = table.new(position.top_right, 3, 7, color.new(color.black, 0), color.new(color.white, 0), 2, color.new(color.gray, 0), 2)

table.cell(info, 0, 0, "INDICATOR", bgcolor=color.new(color.blue, 10), text_color=color.white)

table.cell(info, 1, 0, "ENTRY (" + tf_entry + ")", bgcolor=color.new(color.blue, 10), text_color=color.white)

table.cell(info, 2, 0, "CONF (" + tf_confluence + ")", bgcolor=color.new(color.blue, 10), text_color=color.white)

table.cell(info, 0, 1, "EMA Relation", bgcolor=color.new(color.gray, 10), text_color=color.white)

table.cell(info, 1, 1, ema_short_entry > ema_long_entry ? "Bullish" : "Bearish",

bgcolor=ema_short_entry > ema_long_entry ? color.new(color.green, 20) : color.new(color.red, 20),

text_color=color.white)

table.cell(info, 2, 1, ema_short_conf > ema_long_conf ? "Bullish" : "Bearish",

bgcolor=ema_short_conf > ema_long_conf ? color.new(color.green, 20) : color.new(color.red, 20),

text_color=color.white)

table.cell(info, 0, 2, "Price vs MA", bgcolor=color.new(color.gray, 10), text_color=color.white)

table.cell(info, 1, 2, close > ma_entry ? "Above" : "Below",

bgcolor=close > ma_entry ? color.new(color.green, 20) : color.new(color.red, 20),

text_color=color.white)

table.cell(info, 2, 2, close > ma_conf ? "Above" : "Below",

bgcolor=close > ma_conf ? color.new(color.green, 20) : color.new(color.red, 20),

text_color=color.white)

table.cell(info, 0, 3, "RSI Fast vs Slow", bgcolor=color.new(color.gray, 10), text_color=color.white)

table.cell(info, 1, 3, rsi_fast_entry > rsi_slow_entry ? "Bullish" : "Bearish",

bgcolor=rsi_fast_entry > rsi_slow_entry ? color.new(color.green, 20) : color.new(color.red, 20),

text_color=color.white)

table.cell(info, 2, 3, rsi_fast_conf > rsi_slow_conf ? "Bullish" : "Bearish",

bgcolor=rsi_fast_conf > rsi_slow_conf ? color.new(color.green, 20) : color.new(color.red, 20),

text_color=color.white)

table.cell(info, 0, 4, "Volume", bgcolor=color.new(color.gray, 10), text_color=color.white)

table.cell(info, 1, 4, volume_increasing ? "Increasing" : "Decreasing",

bgcolor=volume_increasing ? color.new(color.green, 20) : color.new(color.red, 20),

text_color=color.white)

table.cell(info, 2, 4, "n/a", bgcolor=color.new(color.gray, 40), text_color=color.white)

table.cell(info, 0, 5, "Entry Signal", bgcolor=color.new(color.gray, 10), text_color=color.white)

table.cell(info, 1, 5, long_entry_condition ? "Long" : (short_entry_condition ? "Short" : "None"),

bgcolor=long_entry_condition ? color.new(color.green, 20) : (short_entry_condition ? color.new(color.red, 20) : color.new(color.gray, 40)),

text_color=color.white)

table.cell(info, 2, 5, long_confluence ? "Long" : (short_confluence ? "Short" : "None"),

bgcolor=long_confluence ? color.new(color.green, 20) : (short_confluence ? color.new(color.red, 20) : color.new(color.gray, 40)),

text_color=color.white)

table.cell(info, 0, 6, "Final Signal", bgcolor=color.new(color.blue, 10), text_color=color.white)

table.cell(info, 1, 6, long_condition ? "LONG" : (short_condition ? "SHORT" : "NONE"),

bgcolor=long_condition ? color.new(color.green, 0) : (short_condition ? color.new(color.red, 0) : color.new(color.gray, 20)),

text_color=color.white)

table.cell(info, 2, 6, strategy.position_size > 0 ? "In LONG" : (strategy.position_size < 0 ? "In SHORT" : "No Position"),

bgcolor=strategy.position_size > 0 ? color.new(color.green, 20) : (strategy.position_size < 0 ? color.new(color.red, 20) : color.new(color.gray, 40)),

text_color=color.white)