# Multi-Timeframe Trend Momentum and VWAP Rebound Crossover Quantitative Strategy

Overview

This strategy is a comprehensive intraday trading system that combines multi-timeframe analysis, trend confirmation, and price momentum indicators to generate trading decisions through EMA crossovers and VWAP rebound signals. The core of the strategy is to confirm the overall trend direction on a 1-hour timeframe, then look for entry signals on a 15-minute chart that align with the trend direction, while using the RSI indicator to filter out overbought or oversold conditions, and controlling volatility risk through the ATR indicator. The strategy also implements daily signal limitations, trading session management, and dynamic trailing stop-loss mechanisms, aiming to capture intraday trend movements and effectively manage risk.

Strategy Principles

The operation of this strategy is based on a combination of several key technical indicators and conditions:

Multi-Timeframe Trend Identification: The strategy first uses 9 and 21-period EMAs on a 1-hour timeframe to determine the overall trend direction. When the short-term EMA is above the long-term EMA, it identifies a bullish trend; otherwise, it’s a bearish trend.

Entry Signals on 15-Minute Timeframe:

- EMA Crossover: Generates trading signals when the short-term EMA crosses the long-term EMA in the confirmed trend direction

- VWAP Rebound: Generates signals when price rebounds from near the Volume Weighted Average Price and crosses through the VWAP line

Indicator Filtering:

- RSI Filter: Long signals require RSI between 50-70, short signals require RSI between 30-50

- Volatility Filter: Uses the ATR indicator to ensure current market volatility is within a normal range

Trade Management:

- Trading Time Window Restriction: Only executes trades within specified trading sessions

- Daily Signal Limitation: Controls the number of trades per day

- Noon Signal Supplement: If no signals are triggered in the morning, generates additional signals at 12 noon based on trend and VWAP relationship

Risk Management:

- Dynamic Trailing Stop-Loss: Sets initial stop-loss based on entry price and volatility, and dynamically adjusts stop-loss position based on price movements

The strategy improves trading success rate by ensuring that the trading direction aligns with the larger timeframe trend, while utilizing medium and short-term price momentum and support/resistance confirmation. The trailing stop-loss mechanism helps lock in profits and reduces single trade risk.

Strategy Advantages

Through deep analysis of the strategy code, we can summarize the following clear advantages:

Multi-Level Confirmation Mechanism: Combines multi-timeframe analysis, trend direction, and momentum indicators to reduce false signal risk through multiple confirmations.

Strong Adaptability: The strategy has multiple adjustable parameters, including EMA periods, RSI levels, ATR range, and trading times, allowing it to adapt to different market conditions and trading instruments.

Comprehensive Risk Management:

- Uses the ATR indicator to assess market volatility, only trading within normal volatility ranges

- Implements dynamic trailing stop-loss, which can maximize profits while protecting capital

- Sets trading time windows, avoiding high-volatility opening and closing sessions

Trading Frequency Control: Limits the number of daily signals, avoiding overtrading and reducing transaction costs.

Flexible Entry Strategies: Provides two different types of entry signals (EMA crossover and VWAP rebound), increasing the ways to capture market opportunities.

Visual Operation Guidance: Through arrows on the chart and indicator lines, traders can intuitively understand trading signals and market conditions.

Intelligent Signal Supplementation: On days when main signals aren’t triggered, the strategy generates alternative signals at a specific time (12 noon) based on trend and price position, improving the rate of capturing trading opportunities.

Strategy Risks

Despite its many advantages, the strategy still faces some potential risks and challenges:

Sudden Trend Reversal Risk: Although using multi-timeframe analysis, markets can still experience rapid reversals, especially during major news or event releases, which may trigger stop-losses.

- Solution: Pause trading before important economic data or company announcements; consider adding filters to exclude abnormal volatility.

Parameter Optimization Overfitting: The multiple parameters in the strategy (such as EMA periods, RSI thresholds, etc.) may perform well on historical data but may not maintain the same effect in the future.

- Solution: Use robust parameter settings; conduct thorough backtesting across different market conditions and time periods; periodically revalidate parameter effectiveness.

Insufficient Liquidity Risk: In low-liquidity instruments, slippage and price gaps may cause actual entry prices or stop-loss prices to be far from expected levels.

- Solution: Prioritize high-liquidity trading instruments; avoid low-volume trading sessions; consider adding liquidity filtering conditions.

Transaction Cost Impact: High-frequency intraday strategies may generate substantial transaction costs, eroding actual returns.

- Solution: Optimize signal quality to reduce the number of trades; increase minimum profit target requirements; consider converting some intraday signals to overnight positions.

Time Window Restrictions Causing Missed Opportunities: Strict trading time windows may miss quality signals outside the window.

- Solution: Flexibly adjust trading windows based on market characteristics; consider setting window exceptions for important breakout signals.

Single Indicator Dependency Risk: Over-reliance on EMAs and VWAP may fail in certain market environments, especially in ranging markets.

- Solution: Add market structure recognition logic; apply different signal generation mechanisms in different market states.

Strategy Optimization Directions

Based on deep analysis of the strategy code, here are several possible optimization directions:

Market Environment Classification & Adaptive Parameters:

- Add market type recognition logic (trending, ranging, or volatile) and automatically adjust parameters based on different market states

- Reason for implementation: Different market environments require different trading strategies; adaptive parameters can improve performance across various environments

Enhanced Signal Filtering Mechanism:

- Integrate volume confirmation, only executing signals when supported by volume

- Add price patterns (such as support/resistance breakouts, reversal patterns) as additional confirmation

- Reason for implementation: Volume and price structure are important indicators of trend strength and sustainability, can significantly improve signal quality

Dynamic Risk Management:

- Dynamically adjust position size based on volatility and trend strength

- Implement intelligent take-profit targets, set based on key resistance/support levels or ATR multiples

- Reason for implementation: Dynamic risk management can increase returns on high-confidence signals while reducing risk exposure in uncertain environments

Add Market Breadth Indicators:

- Introduce industry or broader market trend analysis, ensuring trade direction aligns with the overall market

- Reason for implementation: Individual stock movements are often influenced by market and industry trends; staying consistent with the larger trend can improve success rates

Optimize Noon Alternative Signals:

- Add stricter confirmation conditions for alternative signals, such as support/resistance tests or key price level breakouts

- Reason for implementation: Current alternative signal conditions are relatively simple and may be lower quality than primary signals

Machine Learning Model Integration:

- Use historical data to train models to predict signal success probability, only executing high-probability signals

- Reason for implementation: Machine learning can identify complex patterns and correlations difficult for humans to detect, improving prediction accuracy

Introduce Pullback Entry Logic:

- After confirming trend direction, wait for price to pull back to key support/resistance levels before entering

- Reason for implementation: Pullback entries typically provide better risk-reward ratios, reducing unnecessary losing trades

Summary

The “Multi-Timeframe Trend Momentum and VWAP Rebound Crossover Quantitative Strategy” is a comprehensively designed intraday trading system that provides a systematic trading approach through combining multi-timeframe analysis, technical indicator confirmation, and strict risk management. The strategy particularly emphasizes maintaining consistency with larger timeframe trends while utilizing short-term indicators to capture optimal entry points, reducing false signals through multi-layer filtering mechanisms.

The core advantages of the strategy lie in its comprehensive confirmation mechanism and well-established risk management framework, including dynamic trailing stop-losses, volatility filtering, and trading session control. Meanwhile, the strategy also faces challenges such as trend reversals, parameter optimization, and market environment changes.

By implementing the suggested optimization measures, especially market environment classification with adaptive parameters, enhanced signal filtering mechanisms, and dynamic risk management, the strategy has the potential to further improve its stability and profitability. Ultimately, this strategy provides traders with a reliable framework that can be adjusted and refined according to individual risk preferences and market views.

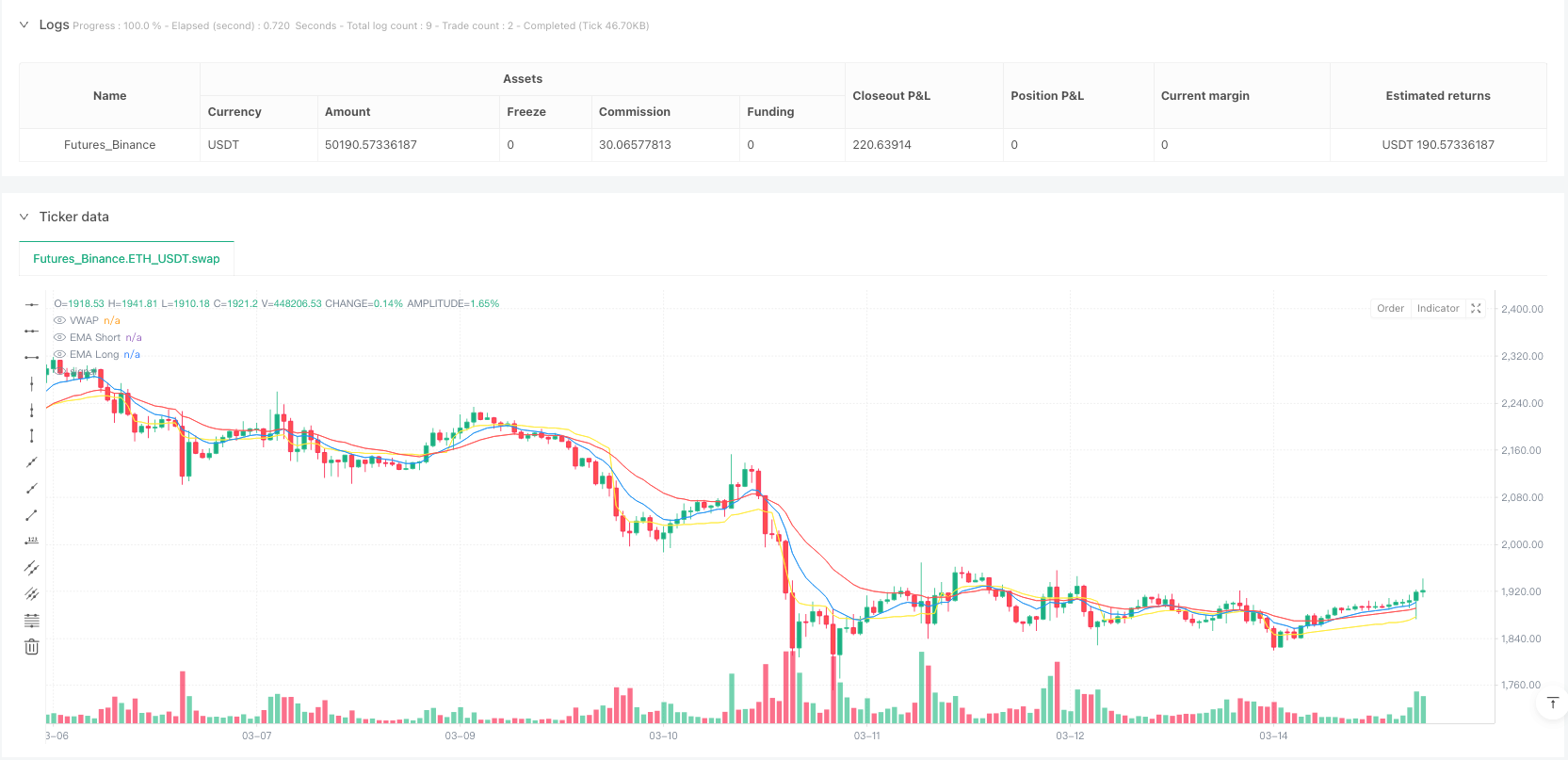

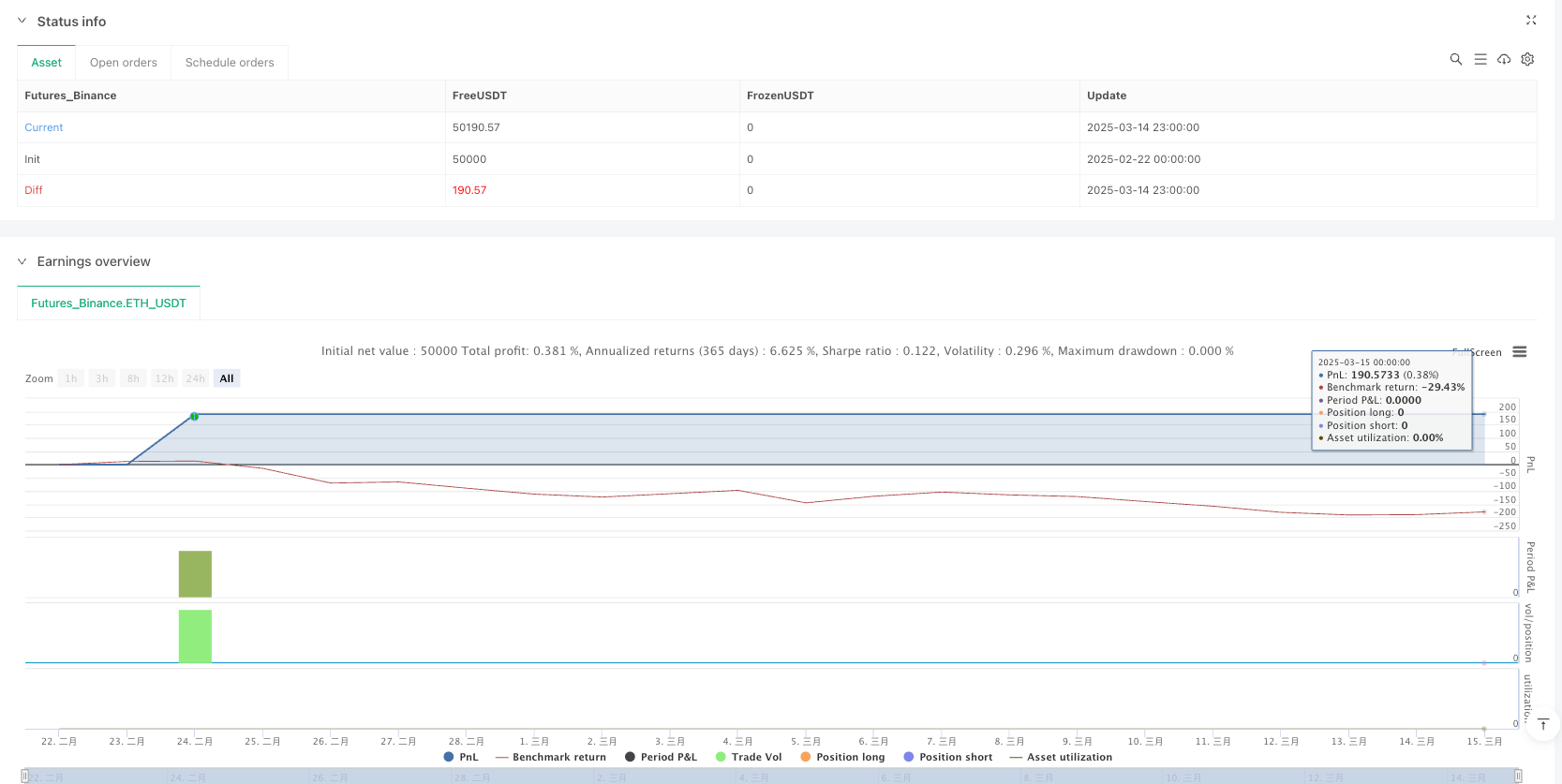

/*backtest

start: 2025-02-22 00:00:00

end: 2025-03-15 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("HDFC Bank 95% Accuracy Intraday Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// --- Inputs ---

emaShortPeriod = input(9, "Short EMA Period")

emaLongPeriod = input(21, "Long EMA Period")

rsiPeriod = input(14, "RSI Period")

atrPeriod = input(14, "ATR Period")

atrNormalRange = input.float(1.0, "ATR Normal Range %", minval=0.5, maxval=2.0, step=0.1)

trailPercent = input.float(0.5, "Trailing Stop %", minval=0.1, maxval=1.0, step=0.1)

tradeStartHour = input(10, "Trade Start Hour")

tradeStartMin = input(0, "Trade Start Minute")

tradeEndHour = input(14, "Trade End Hour")

tradeEndMin = input(0, "Trade End Minute")

// --- Time and Session Management ---

inTradeWindow = (hour >= tradeStartHour and hour <= tradeEndHour) and (minute >= tradeStartMin and minute <= tradeEndMin) and (hour != tradeEndHour or minute < tradeEndMin)

isNewDay = ta.change(time("D"))

var int signalsToday = 0

if isNewDay

signalsToday := 0

// --- Multi-Timeframe Trend (1-Hour) ---

emaShort1H = request.security(syminfo.tickerid, "60", ta.ema(close, emaShortPeriod))

emaLong1H = request.security(syminfo.tickerid, "60", ta.ema(close, emaLongPeriod))

bullTrend1H = emaShort1H > emaLong1H

bearTrend1H = emaShort1H < emaLong1H

// --- Indicators (15-Minute) ---

emaShort = ta.ema(close, emaShortPeriod)

emaLong = ta.ema(close, emaLongPeriod)

vwap = ta.vwap(hlc3)

rsi = ta.rsi(close, rsiPeriod)

atr = ta.atr(atrPeriod)

priceRange = atr / close * 100

normalVolatility = priceRange <= atrNormalRange

// --- Entry Conditions ---

emaCrossoverUp = ta.crossover(emaShort, emaLong) and bullTrend1H

emaCrossoverDown = ta.crossunder(emaShort, emaLong) and bearTrend1H

vwapBounceUp = ta.crossover(close, vwap) and ta.lowest(low, 2) < vwap and bullTrend1H and rsi > 50

vwapBounceDown = ta.crossunder(close, vwap) and ta.highest(high, 2) > vwap and bearTrend1H and rsi < 50

longCondition = (emaCrossoverUp or vwapBounceUp) and normalVolatility and rsi > 50 and rsi < 70 and inTradeWindow

shortCondition = (emaCrossoverDown or vwapBounceDown) and normalVolatility and rsi < 50 and rsi > 30 and inTradeWindow

// --- Ensure One Signal Per Day ---

if longCondition or shortCondition

signalsToday := signalsToday + 1

if signalsToday == 0 and hour == 12 and minute == 0 and inTradeWindow

longCondition = close > vwap and bullTrend1H and rsi > 50 and normalVolatility

shortCondition = close < vwap and bearTrend1H and rsi < 50 and normalVolatility

// --- Dynamic Stop-Loss and Trailing Take-Profit ---

var float entryPrice = 0.0

var float trailStop = 0.0

if longCondition

entryPrice := close

trailStop := entryPrice - (entryPrice * trailPercent / 100)

if shortCondition

entryPrice := close

trailStop := entryPrice + (entryPrice * trailPercent / 100)

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

if strategy.position_size > 0

trailStop := math.max(trailStop, entryPrice - (high - entryPrice) * trailPercent / 100)

strategy.exit("Trail Long", "Long", trail_points=(entryPrice - trailStop) / syminfo.mintick, trail_offset=(entryPrice - trailStop) / syminfo.mintick)

if strategy.position_size < 0

trailStop := math.min(trailStop, entryPrice + (entryPrice - low) * trailPercent / 100)

strategy.exit("Trail Short", "Short", trail_points=(trailStop - entryPrice) / syminfo.mintick, trail_offset=(trailStop - entryPrice) / syminfo.mintick)

// --- Plot Arrows and Indicators ---

plotshape(longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.normal)

plotshape(shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.normal)

plot(emaShort, color=color.blue, title="EMA Short")

plot(emaLong, color=color.red, title="EMA Long")

plot(vwap, color=color.yellow, title="VWAP")