Overview

This strategy is a trend following system based on the crossover of dual moving averages, utilizing the intersection of short-term and long-term simple moving averages (SMA) to generate clear long and short trading signals. The design is concise and easy to understand and implement, particularly suitable for traders seeking to master the basic principles of moving average crossovers. The core idea is that when the short-term moving average crosses above the long-term moving average, the system generates a long signal; when the short-term moving average crosses below the long-term moving average, the system generates a short signal. This trading method automatically reverses positions at the closing price when signals appear, ensuring traders can adjust market direction in a timely manner.

Strategy Principles

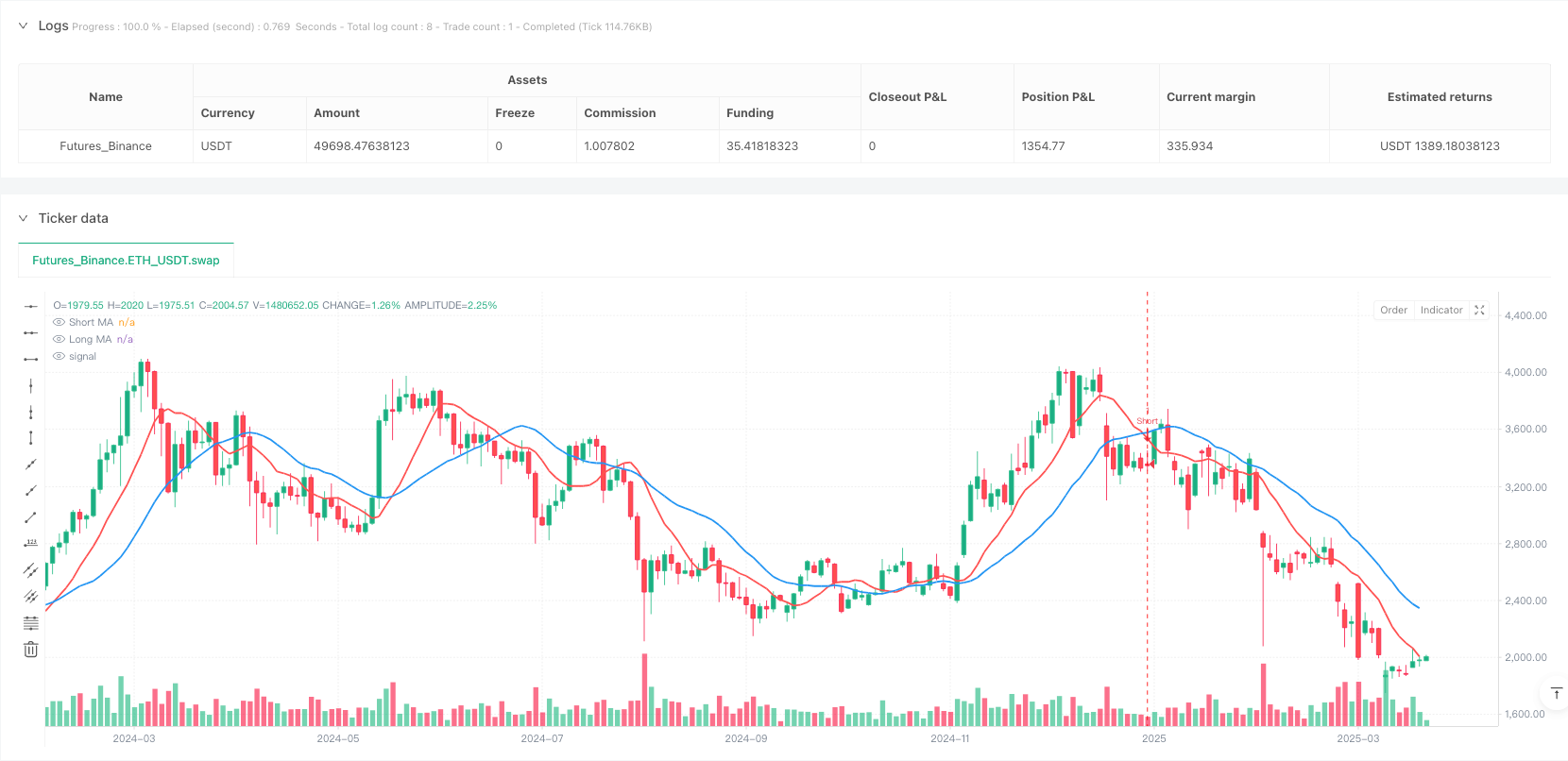

The core of the strategy is based on the interaction of two simple moving averages (SMA): 1. Short-term moving average: Default setting is 9 periods, reflecting more recent price movements 2. Long-term moving average: Default setting is 21 periods, reflecting longer-term price trends

Trade signal generation logic: - Long condition: When the short-term MA crosses above the long-term MA (ta.crossover function), the system generates a long signal - Short condition: When the short-term MA crosses below the long-term MA (ta.crossunder function), the system generates a short signal

Trading execution process: - When a long signal is triggered, the system first immediately closes any existing short positions, then opens a new long position - When a short signal is triggered, the system first immediately closes any existing long positions, then opens a new short position - The system clearly labels entry prices on the chart, with long labels displayed above the candlesticks and short labels below

The strategy also allows users to customize the price source (default is opening price) and moving average period lengths to adapt to different market environments or trading styles.

Strategy Advantages

Through in-depth analysis of the strategy code, we can summarize the following distinct advantages:

- Simplicity and clarity: The strategy logic is clear, without complex indicator combinations or conditional judgments, making it easy for traders to understand and apply

- Visual intuitiveness: The system draws two moving averages on the chart, distinguished by color (short-term MA in red, long-term MA in blue), while visually displaying entry points and prices in label form

- Automatic reversal mechanism: When a new signal appears, the strategy automatically closes opposite positions and establishes new positions, ensuring traders always follow the current trend direction

- Strong customizability: Users can adjust the price source and moving average periods according to their preferences to adapt to different market environments or trading timeframes

- Real-time calculation: The strategy is set with calc_on_every_tick=true parameter, ensuring calculations are performed at each price movement, providing the most timely signals

- No parameter overfitting: The strategy uses only two moving average parameters, reducing the risk of overfitting and enhancing strategy robustness under different market conditions

- Clear label prompts: By pre-placing labels at the next candlestick position, traders can clearly see entry prices, facilitating risk management

Strategy Risks

Despite the strategy’s concise and effective design, there are still the following potential risks:

Frequent trading in oscillating markets: In sideways consolidation or oscillating markets, short-term and long-term moving averages may frequently cross, leading to excessive trading signals and unnecessary trading costs

- Solution: Add additional filtering conditions, such as ADX indicator to confirm trend strength, or set a minimum holding time

Lag issues: Moving averages are inherently lagging indicators, signals may be generated only after trends have developed or are about to end

- Solution: Combine with other leading indicators, such as RSI or MACD, or use shorter moving average periods to reduce lag

False breakout risk: Prices may briefly cross the moving average and then return to the original trend, causing false signals

- Solution: Add confirmation mechanisms, such as requiring prices to maintain a certain time or amplitude after crossing before triggering a trade

Lack of stop-loss mechanism: The current strategy has no explicit stop-loss settings, which may lead to significant losses in strong reversal markets

- Solution: Implement fixed stop-loss or volatility-based dynamic stop-loss strategies

Parameter sensitivity: Strategy performance is relatively sensitive to the choice of moving average period lengths, inappropriate parameters may cause significant changes in strategy effectiveness

- Solution: Conduct backtest optimization to find parameter combinations that perform stably under various market conditions

Strategy Optimization Directions

Based on an in-depth analysis of the code, I propose the following optimization directions:

Add trend filters: Introduce ADX, trend strength indicators, or relative position judgments of price and moving averages, generating signals only in confirmed trend environments to avoid frequent trading in oscillating markets

- Explanation: This will reduce false signals, improving trade success rates and capital efficiency

Implement dynamic stop-loss mechanisms: Set dynamic stop-loss levels based on ATR or other volatility indicators to protect profits and limit maximum risk per trade

- Explanation: Effective risk management is key to long-term trading success

Optimize entry timing: Consider using smaller timeframes for confirmation after signal generation or waiting for pullbacks before entering, to obtain better execution prices

- Explanation: Optimizing entry prices can significantly improve long-term returns

Add volume filtering: Add volume confirmation on top of crossover signals, executing trades only when volume also supports directional changes

- Explanation: Volume is an important confirming factor for the validity of price movements

Implement adaptive moving average periods: Automatically adjust moving average period lengths based on market volatility, using longer periods in high-volatility environments and shorter periods in low-volatility environments

- Explanation: This can make the strategy better adapt to different market states and cycles

Add phased position building and closing mechanisms: Instead of establishing full positions at once, build and close positions in steps to reduce timing risk

- Explanation: This approach can smooth trading results and reduce luck factors brought by single entry point selection

Summary

The Dual Moving Average Crossover Trend Following Strategy is a concise yet powerful quantitative trading system that generates clear trading signals through the crossover of short-term and long-term moving averages. Its main advantages lie in simple operation, visual intuitiveness, and automatic reversal mechanisms, allowing traders to objectively follow market trends. However, the strategy also has inherent risks such as frequent trading in oscillating markets and signal lag.

This basic strategy can be significantly enhanced by adding trend filters, implementing dynamic stop-loss mechanisms, optimizing entry timing, and adding volume confirmation. Particularly, combining other technical indicators to filter signals and optimize risk management will help improve strategy performance across various market environments.

For beginners hoping to start quantitative trading, this is an ideal starting point; for experienced traders, it provides a solid foundation that can be further customized and optimized. Importantly, whatever improvements are adopted should be evaluated through rigorous backtesting and forward validation to ensure strategy improvements truly add long-term value.

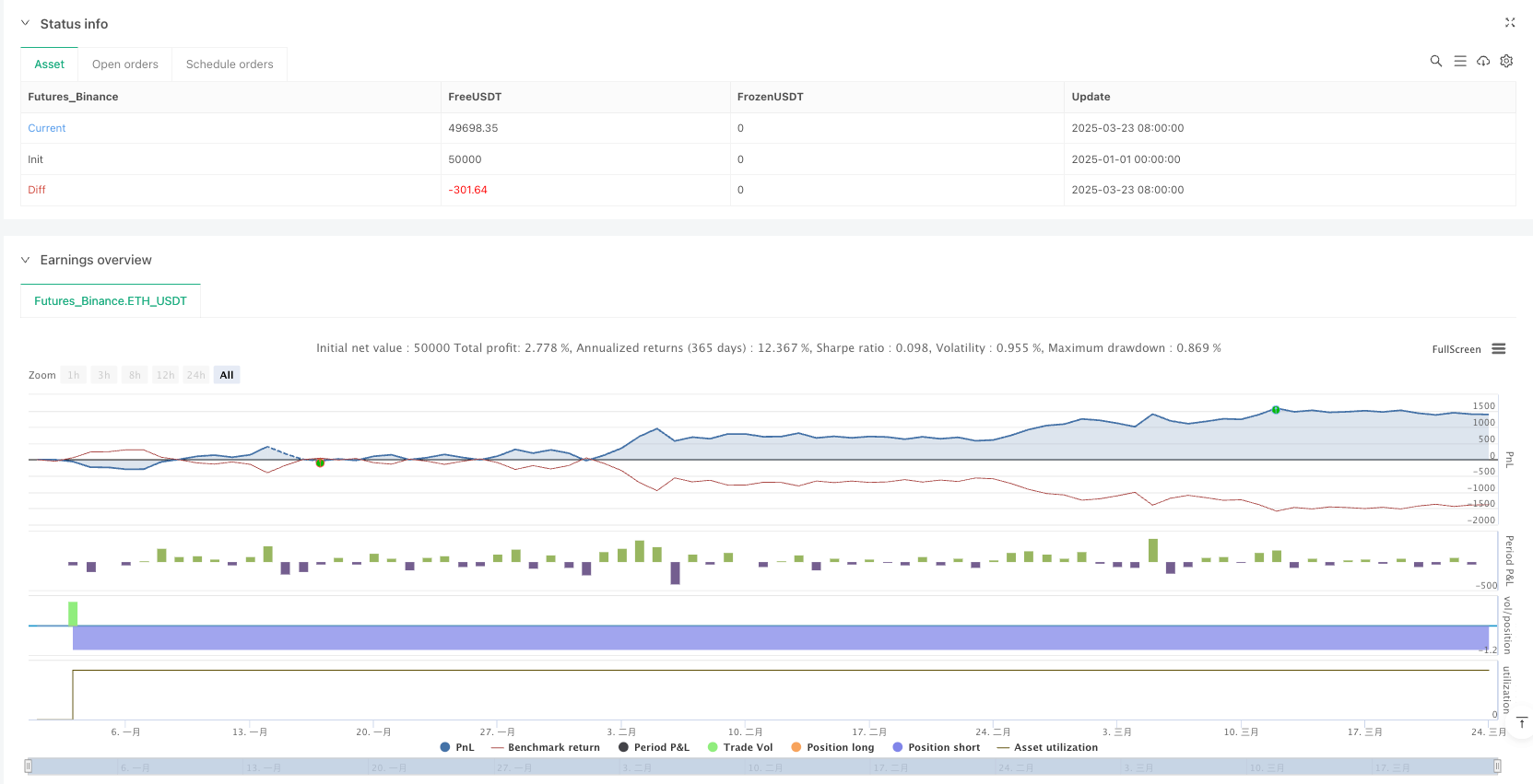

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-24 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////

//

//@version=6

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @author = Da_mENIZ

// © denis_zvegelj

// last change 20.Mar.2025

//

// Simple MA Crossover strategy that shows on the chart with Long/Short indicators. Feel free to use it to suit

// your needs

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////

strategy("DZ Simple MA Crossover Strategy", shorttitle="DZ_MACross", overlay=true, calc_on_every_tick=true)

// Define the moving average lengths

i_src_price = input.source (open, "Price source", group="Main Settings")

i_shMA_len = input.int (9, "Short MA Length", minval=1, group="Main Settings")

i_loMA_len = input.int (21, "Long MA Length", minval=6, group="Main Settings")

// Calculate the moving averages

short_MA = ta.sma(i_src_price, i_shMA_len)

long_MA = ta.sma(i_src_price, i_loMA_len)

// Plot the moving averages on the chart

plot(short_MA, color=color.red, linewidth=2, title="Short MA")

plot(long_MA, color=color.blue, linewidth=2, title="Long MA")

// Generate the buy and sell signals

long_Cond = ta.crossover(short_MA, long_MA)

short_Cond = ta.crossunder(short_MA, long_MA)

// Place the orders based on conditions

if (long_Cond)

strategy.close("Short", immediately = true, comment = "Close")

strategy.entry("Long", strategy.long, comment = "Enter")

label.new(bar_index+1, open, "Long\n" + str.tostring(open), style=label.style_label_down, color=color.blue, textcolor=color.white, yloc=yloc.abovebar)

if (short_Cond)

strategy.close("Long", immediately = true, comment = "Close")

// strategy.entry("Short", strategy.short, comment = "Short\n" + str.tostring(open))

strategy.entry("Short", strategy.short, comment = "Enter")

label.new(bar_index+1, open, "Short\n" + str.tostring(open), style=label.style_label_up, color=color.red, textcolor=color.white, yloc=yloc.belowbar)