Overview

The Support and Resistance Enhanced Momentum Reversal Strategy is a technical analysis-based trading system designed to capture potential reversal opportunities near key support and resistance levels. This strategy combines multiple technical indicators, including support/resistance levels, candlestick pattern recognition, Relative Strength Index (RSI) divergence, volume confirmation, and moving average trend filters to form a comprehensive trading decision framework. The core concept is to identify potential reversal signals when price approaches significant support or resistance zones and execute trades under appropriate risk management conditions.

Strategy Principles

The core principles of this strategy involve filtering for high-probability reversal points through multiple conditions:

Support/Resistance Identification: The strategy uses the highest and lowest prices over a specified period (default 20 bars) to determine key resistance and support levels.

Proximity Assessment: When price is within a specific percentage range (default 0.5%) of support or resistance levels, the strategy begins looking for potential reversal signals.

Reversal Signal Identification:

- Candlestick patterns: The strategy identifies classic reversal formations such as hammers, shooting stars, bullish engulfing, and bearish engulfing patterns

- RSI Divergence: When price makes a new low but RSI doesn’t (bullish divergence), or price makes a new high but RSI doesn’t (bearish divergence)

Trend Confirmation: Using a Simple Moving Average (SMA) to determine the overall trend direction, looking for bullish signals in downtrends and bearish signals in uptrends.

Volume Confirmation: Requiring current volume to be at least 1.5 times the average volume over the past 14 periods, enhancing signal reliability.

Risk Management:

- Dynamic position sizing: Calculating risk factors based on ATR (Average True Range) to adjust trade quantity

- Stop-loss: Based on user-defined percentage (default 0.5%)

- Take-profit: Based on user-defined percentage (default 0.5%)

- Maximum holding period: Forced exit after 18 bars

When all conditions are met, the strategy generates either long or short signals and executes trades according to the preset risk management rules.

Strategy Advantages

Multiple Confirmation Mechanisms: The strategy combines price action, technical indicators, and volume confirmation, significantly reducing the risk of false signals and improving trading accuracy.

Adaptability to Market Volatility: Through ATR-based dynamic position sizing, the strategy can adapt to varying market conditions, reducing position size during high volatility and appropriately increasing it during low volatility.

Comprehensive Risk Control: The strategy incorporates multiple risk control measures, including fixed stop-loss, take-profit, trailing stops, and maximum holding period limits, effectively controlling potential losses for each trade.

Precise Entry Points: By identifying reversal signals near support and resistance levels, the strategy can execute trades at potentially favorable price points, improving the risk-to-reward ratio.

Flexible Parameter Settings: Users can adjust multiple key parameters according to personal risk preferences and instrument characteristics, including stop-loss percentage, support/resistance proximity, RSI parameters, etc., giving the strategy high adaptability.

Strategy Risks

False Breakout Risk: Near support and resistance levels, markets often exhibit false breakouts where prices temporarily break through before quickly reversing, which may lead to incorrect signals. Solutions include adding confirmation periods or adjusting proximity parameters.

Extreme Market Risk: During severe market volatility or major news events, normal technical patterns may fail, and the strategy may face significant losses. It’s advisable to pause the strategy or reduce position sizes during such periods.

Parameter Optimization Risk: Excessive optimization of parameters may lead to a strategy that performs excellently on historical data but poorly in live trading. Over-fitting should be avoided, maintaining reasonable and robust parameters.

Trend Change Lag: Using moving averages to determine trends has inherent lag, which may cause missed opportunities or false signals during the initial stages of trend changes. Consider incorporating more sensitive trend indicators.

Insufficient Volume Risk: In certain markets or time periods, volume may be generally low, making volume confirmation conditions difficult to meet. Volume confirmation multipliers can be adjusted based on specific market characteristics.

Strategy Optimization Directions

Support/Resistance Calculation Enhancement: The current strategy uses simple high/low prices to determine support/resistance levels. More complex methods could be considered, such as Fibonacci retracements, volume-price analysis, or structural peak-trough identification, to obtain more precise support and resistance levels.

Multi-Timeframe Analysis: Introducing multi-timeframe analysis can enhance strategy reliability, for example, confirming the overall trend direction in larger timeframes and then seeking precise entry points in smaller timeframes.

Machine Learning Optimization: Consider introducing machine learning algorithms to dynamically optimize strategy parameters or predict reversal probabilities, automatically adjusting parameters based on market states to improve strategy adaptability.

Market State Classification: Add classification of market states (e.g., distinguishing between ranging and trending markets) and use different trading logic and parameter settings for different market states.

Sentiment Indicator Integration: Consider integrating market sentiment indicators, such as VIX or relative volume change rates, to better capture market turning points and avoid trading under unfavorable conditions.

Stop-Loss Strategy Enhancement: Consider implementing more intelligent stop-loss strategies, such as volatility-based dynamic stops or structure-based stops, rather than just fixed percentage stops.

Summary

The Support and Resistance Enhanced Momentum Reversal Strategy is a complete trading system that emphasizes risk management and multiple confirmations. By combining support/resistance levels, candlestick patterns, RSI divergence, volume confirmation, and trend filtering, the strategy can effectively identify potential high-probability reversal points. Its built-in risk management mechanisms, including dynamic position sizing, multiple stop methods, and maximum holding period limits, make it a relatively robust trading approach.

Despite its many advantages, traders should be aware of potential risks such as false breakouts, extreme markets, and parameter optimization pitfalls. The strategy still has significant room for improvement through continuous optimization of support/resistance calculation methods, introduction of multi-timeframe analysis, application of machine learning techniques, addition of market state classification, and integration of sentiment indicators.

Overall, this is a trading strategy with clear concepts and complete structure, suitable for experienced traders to apply and further optimize under appropriate risk management.

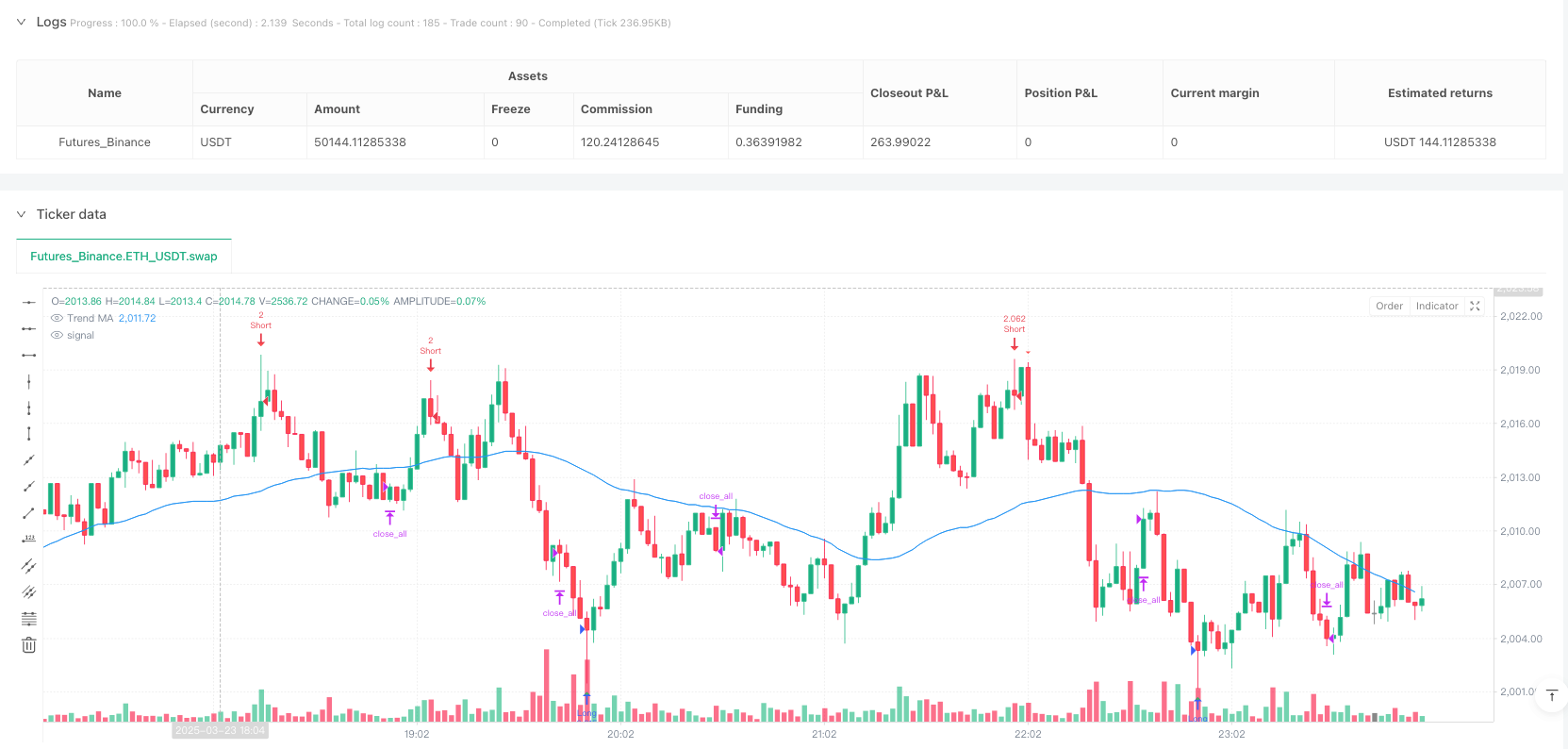

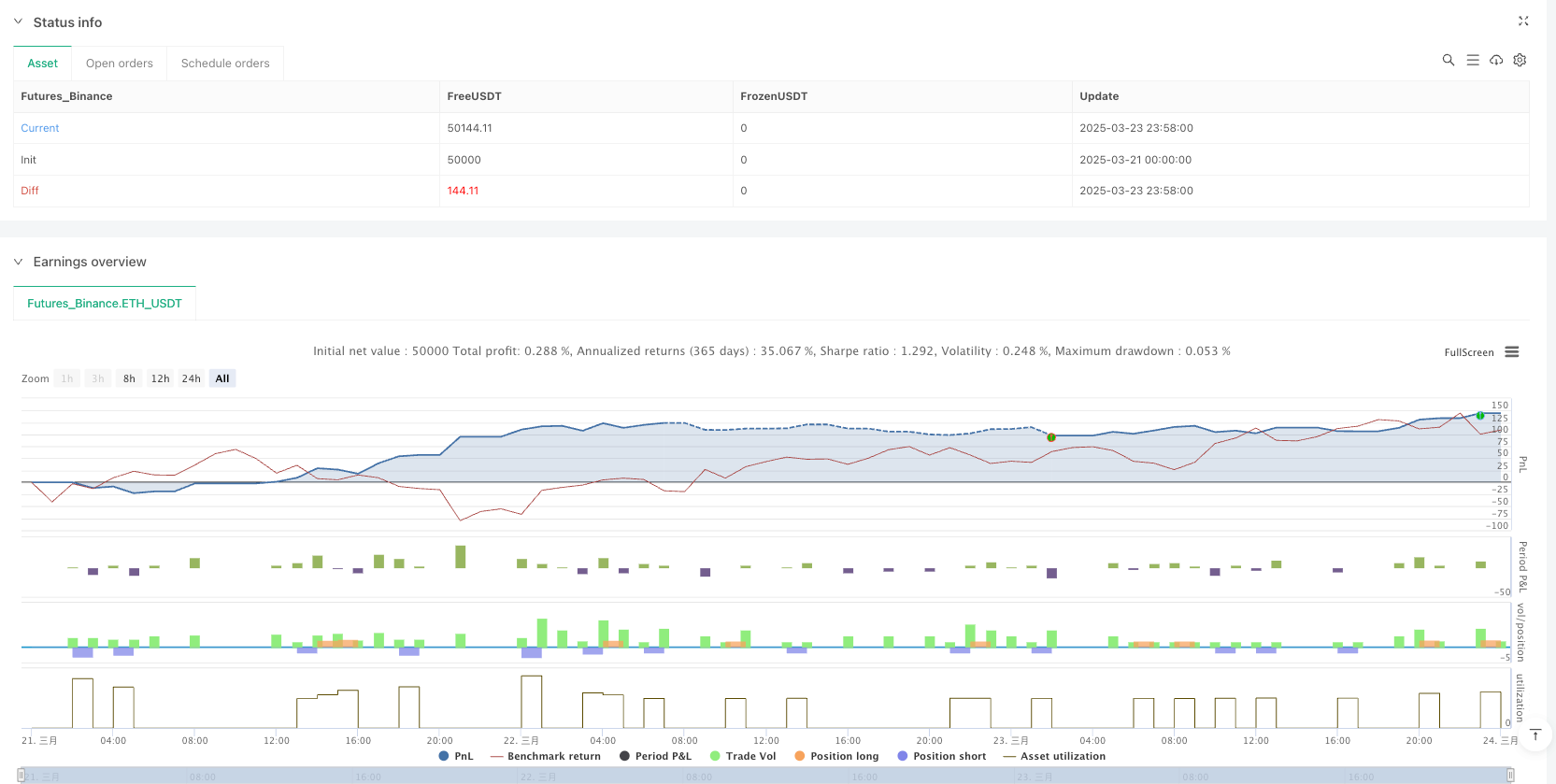

/*backtest

start: 2025-03-21 00:00:00

end: 2025-03-24 00:00:00

period: 2m

basePeriod: 2m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

// TradingView Strategy: Gold Reversal with S/R (Enhanced)

// Targets reversals near support/resistance with additional filters

strategy("Gold Reversal with S/R Enhanced", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// --- Inputs ---

stop_loss_percent = input.float(0.5, "Stop Loss (%)", minval=0.1, maxval=5.0)

take_profit_percent = input.float(0.5, "Take Profit (%)", minval=0.1, maxval=10.0)

rsi_period = input.int(14, "RSI Period", minval=2, maxval=50)

rsi_min = input.float(30, "RSI Minimum Threshold", minval=0, maxval=50)

pivot_lookback = input.int(20, "Pivot Lookback", minval=1, maxval=20)

proximity_percent = input.float(0.5, "S/R Proximity (%)", minval=0.1, maxval=2.0, step=0.1)

ma_period = input.int(50, "Trend MA Period", minval=10, maxval=200)

max_hold_bars = input.int(18, "Max Hold Period (bars)", minval=5, maxval=100) // Reduced from 20 to 18

volume_lookback = input.int(14, "Volume Lookback", minval=5, maxval=50)

// --- Trend Filter --- (unchanged)

ma = ta.sma(close, ma_period)

in_uptrend = close > ma

in_downtrend = close < ma

// --- Volatility Calculation --- (unchanged)

atr = ta.atr(14)

base_risk = atr / close * 100

risk_factor = stop_loss_percent / base_risk

adjusted_qty = math.min(25, math.max(2, 10 / risk_factor))

// --- Candlestick Patterns --- (unchanged)

hammer = (high - low) > 0 and (close - open) / (high - low) <= 0.3 and (open - low) >= 2 * (high - close) and close[1] < open[1]

shooting_star = (high - low) > 0 and (close - open) / (high - low) <= 0.3 and (high - open) >= 2 * (close - low) and close[1] > open[1]

bullish_engulfing = close[1] < open[1] and close > open and close > open[1] and open < close[1]

bearish_engulfing = close[1] > open[1] and close < open and close < open[1] and open > close[1]

// --- RSI Divergence --- (unchanged)

rsi = ta.rsi(close, rsi_period)

bullish_rsi_div = close < close[1] and rsi > rsi[1] and rsi > rsi_min

bearish_rsi_div = close > close[1] and rsi < rsi[1]

// --- Volume Confirmation --- (unchanged)

avg_volume = ta.sma(volume, volume_lookback)

volume_confirmed = volume > avg_volume * 1.5

// --- Support/Resistance --- (unchanged)

support = ta.lowest(low, pivot_lookback)

resistance = ta.highest(high, pivot_lookback)

// --- Proximity to S/R --- (unchanged)

proximity_factor = proximity_percent / 100

near_support = close >= support * (1 - proximity_factor) and close <= support * (1 + proximity_factor)

near_resistance = close >= resistance * (1 - proximity_factor) and close <= resistance * (1 + proximity_factor)

// --- Combined Conditions --- (unchanged)

long_condition = near_support and in_downtrend and volume_confirmed and (hammer or bullish_engulfing or bullish_rsi_div)

short_condition = near_resistance and in_uptrend and volume_confirmed and (shooting_star or bearish_engulfing or bearish_rsi_div)

// --- Execute Trades --- (unchanged)

if (long_condition)

strategy.entry("Long", strategy.long, qty=adjusted_qty)

strategy.exit("Long Exit", "Long", stop=strategy.position_avg_price * (1 - stop_loss_percent / 100),

profit=strategy.position_avg_price * (1 + take_profit_percent / 100),

trail_offset=atr*100)

if (short_condition)

strategy.entry("Short", strategy.short, qty=adjusted_qty)

strategy.exit("Short Exit", "Short", stop=strategy.position_avg_price * (1 + stop_loss_percent / 100),

profit=strategy.position_avg_price * (1 - take_profit_percent / 100),

trail_offset=atr*100)

// --- Time-based Exit ---

if (strategy.position_size != 0)

bars_held = ta.barssince(strategy.position_size[1] == 0)

if (bars_held >= max_hold_bars)

strategy.close_all("Time Exit")

// --- Plot Signals --- (unchanged)

plotshape(long_condition, title="Buy", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(short_condition, title="Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

plot(ma, "Trend MA", color=color.blue)

// --- Debug Outputs --- (unchanged)

plotchar(rsi, "RSI", "", location.bottom)

plotchar(adjusted_qty, "Position Size", "", location.bottom)