Overview

The Adaptive Moving Average Crossover Quantitative Strategy is a technical analysis-based trading system that identifies market trend changes by monitoring crossovers between moving averages of different periods. The core concept involves comparing the relative positions of a fast moving average (default 9-period) and a slow moving average (default 21-period), generating buy signals when the fast line crosses above the slow line and sell signals when the fast line crosses below the slow line. The strategy’s flexibility is demonstrated through support for multiple moving average types, including Simple Moving Average (SMA), Exponential Moving Average (EMA), Weighted Moving Average (WMA), and Volume-Weighted Moving Average (VWMA), allowing traders to adjust according to different market environments and personal preferences.

Strategy Principles

The core principle of this strategy is based on the trend-indicating functionality of moving averages. Moving averages smooth price data, filter out short-term price fluctuation noise, and reflect the overall trend direction of the market. Key components of the strategy implementation include:

Moving Average Calculation: The strategy uses a custom function

f_mato calculate different types of moving averages, supporting SMA, EMA, WMA, and VWMA, allowing users to select the most suitable moving average type for the current market environment.Trading Signal Generation:

- Buy Signal: When the fast moving average (default 9-period) crosses above the slow moving average (default 21-period), detected by the

ta.crossoverfunction, indicating that short-term price momentum exceeds the long-term trend and the market might be entering an uptrend. - Sell Signal: When the fast moving average crosses below the slow moving average, detected by the

ta.crossunderfunction, indicating that short-term price momentum falls below the long-term trend and the market might be entering a downtrend.

- Buy Signal: When the fast moving average (default 9-period) crosses above the slow moving average (default 21-period), detected by the

Trade Execution: The strategy uses

strategy.entryandstrategy.closefunctions to execute buy and sell operations, implementing fully automated trading.Visualization: The strategy uses the

plotfunction to draw moving averages andlabel.newto mark buy and sell signal points on the chart, allowing traders to intuitively understand the strategy logic and trading timing.

Strategy Advantages

Trend Following Capability: Based on moving average crossovers, this strategy effectively captures market trend changes and is suitable for medium to long-term trend trading. While moving average crossover signals typically lag behind price turning points, they filter out numerous noise trades, improving trade quality.

Flexible Parameter Adjustment: The strategy allows users to customize the period lengths of fast and slow moving averages and choose different types of moving average calculation methods, which can be optimized based on different market cycles and volatility characteristics.

Multiple Moving Average Type Support: The strategy supports four different types of moving averages, each with its own characteristics:

- SMA: Assigns equal weight to all prices, strong smoothing effect but slower response

- EMA: Assigns higher weight to recent prices, more sensitive to price changes

- WMA: Enhances recent price influence through linear weighting, balancing sensitivity and stability

- VWMA: Incorporates volume information, providing more accurate support and resistance levels in high-volume areas

Clear Visual Feedback: The strategy intuitively marks buy and sell signals on the chart, helping traders quickly understand and validate trading decisions.

Concise and Efficient Code: The strategy code is concise and clear, adopting a functional programming approach with custom functions for flexible moving average calculation switching, improving code maintainability and extensibility.

Strategy Risks

False Signals in Ranging Markets: In sideways or oscillating markets, moving averages may frequently cross, generating numerous false signals, leading to overtrading and unnecessary transaction fees. Solutions may include adding additional filtering conditions, such as trend strength indicators or setting minimum crossover amplitude thresholds.

Lag Issues: Moving averages are inherently lagging indicators and may not capture turning points in time during rapidly changing markets, resulting in delayed entry or exit timing. Solutions may include combining more sensitive technical indicators, such as RSI or MACD, or optimizing moving average parameters to reduce lag.

Single Indicator Dependency: The strategy relies solely on moving average crossovers for decision making, lacking multi-dimensional analysis and susceptible to market noise. Solutions may include integrating other technical indicators such as volume, volatility indicators, or support and resistance levels to build a more comprehensive trading system.

Lack of Risk Management Mechanisms: The current strategy has no built-in stop-loss or take-profit mechanisms, potentially leading to significant drawdowns when trends reverse but no crossover signal has been triggered. Solutions may include adding dynamic stop-loss mechanisms, such as trailing stops or ATR-based stop-loss settings.

Parameter Sensitivity: Strategy performance is sensitive to moving average parameter selection, and different market environments may require different parameter combinations. Solutions may include conducting parameter optimization tests or implementing adaptive parameter adjustment mechanisms.

Strategy Optimization Directions

Multi-Indicator Integration:

- Add volume indicators to ensure trading signals are more reliable with significant volume support

- Combine RSI or stochastic indicators to identify overbought/oversold areas and avoid counter-trend trading in extreme situations

- Introduce trend strength indicators (like ADX) to execute trades only in clear trends

Enhanced Risk Management:

- Implement dynamic stop-loss mechanisms, such as ATR-based volatility stops or trailing stops

- Add money management functionality to dynamically adjust position size based on account size and market volatility

- Design scaled entry and exit mechanisms to reduce single-point risk

Signal Filtering Optimization:

- Introduce minimum crossover confirmation periods, requiring moving averages to maintain their position for a certain time before confirming signals

- Add crossover amplitude thresholds to filter weak signals from small-amplitude crossovers

- Incorporate market structure analysis, such as support/resistance levels or price channels, to improve signal quality

Parameter Adaptivity:

- Implement dynamic parameter adjustment based on market volatility, using longer period moving averages in high-volatility markets

- Develop adaptive parameter mechanisms based on market cycle identification, adapting to different market phases

- Introduce machine learning methods to automatically optimize parameter combinations based on historical data

Trading Logic Expansion:

- Add short trading logic to implement a bidirectional trading strategy

- Develop position management based on moving average bandwidth, reducing position size when moving averages are far apart to lower drawdown risk

- Combine price breakout confirmation to improve the accuracy of trading signals

Summary

The Adaptive Moving Average Crossover Quantitative Strategy builds an effective trend-following trading system by monitoring crossover relationships between moving averages of different periods. The core advantages of this strategy lie in its simple and understandable logic, flexible parameter adjustment capability, and adaptability to different market environments. However, as a strategy based on lagging indicators, it also faces risks such as numerous false signals in ranging markets, signal lag, and single indicator dependency.

To enhance the strategy’s robustness and profitability, optimizations can be made in the directions of multi-indicator integration, enhanced risk management, signal filtering mechanism optimization, parameter adaptivity implementation, and trading logic expansion. In particular, combining technical indicators with volume, market structure, and risk management principles can build a more comprehensive and robust trading system.

In summary, this moving average crossover-based strategy provides a good starting point for quantitative trading, suitable for beginners to understand and practice the basic principles of quantitative trading. Through continuous optimization and refinement, it can develop into a more mature and reliable trading system, providing stable trading signals and risk control mechanisms for investors.

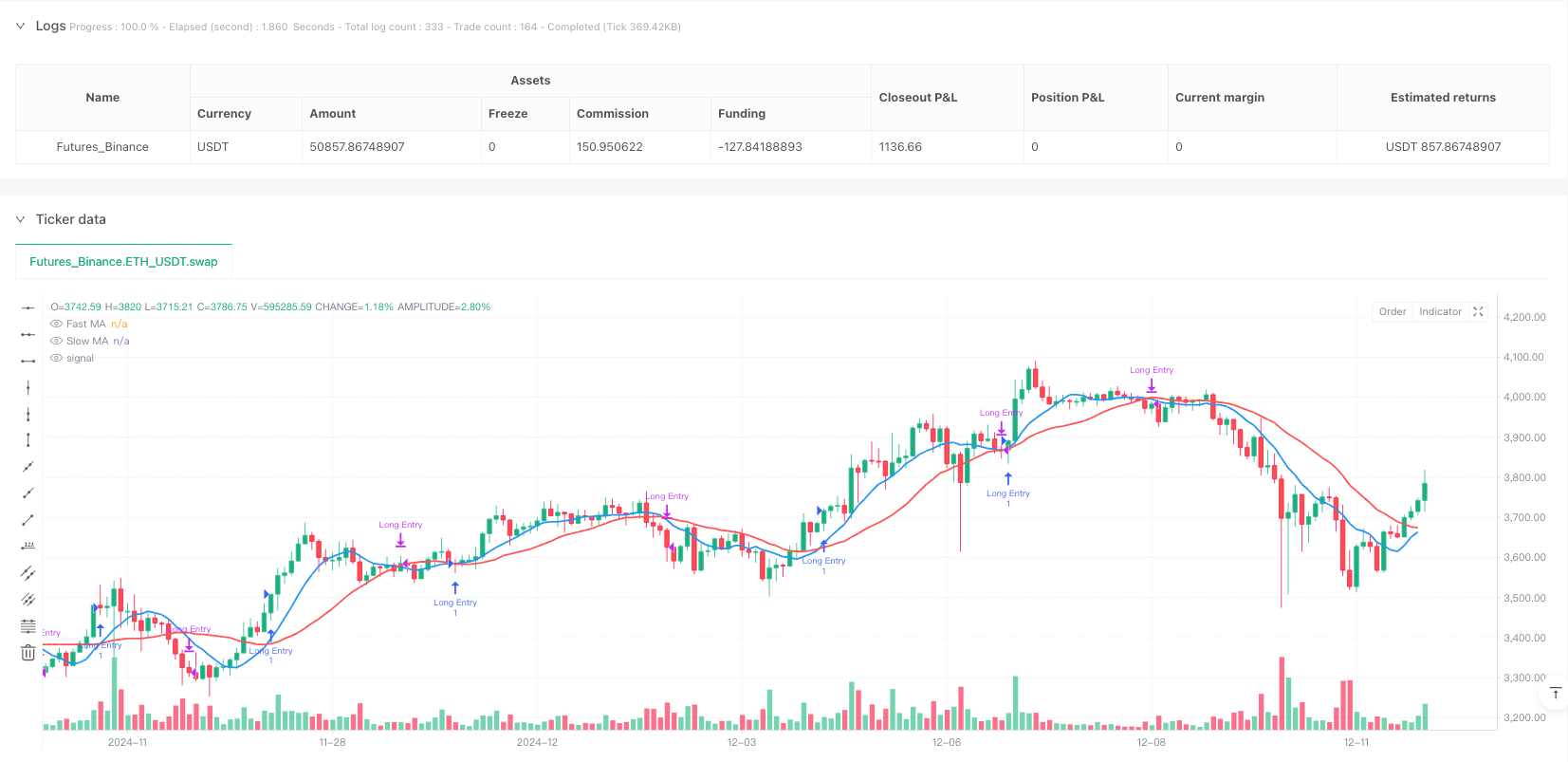

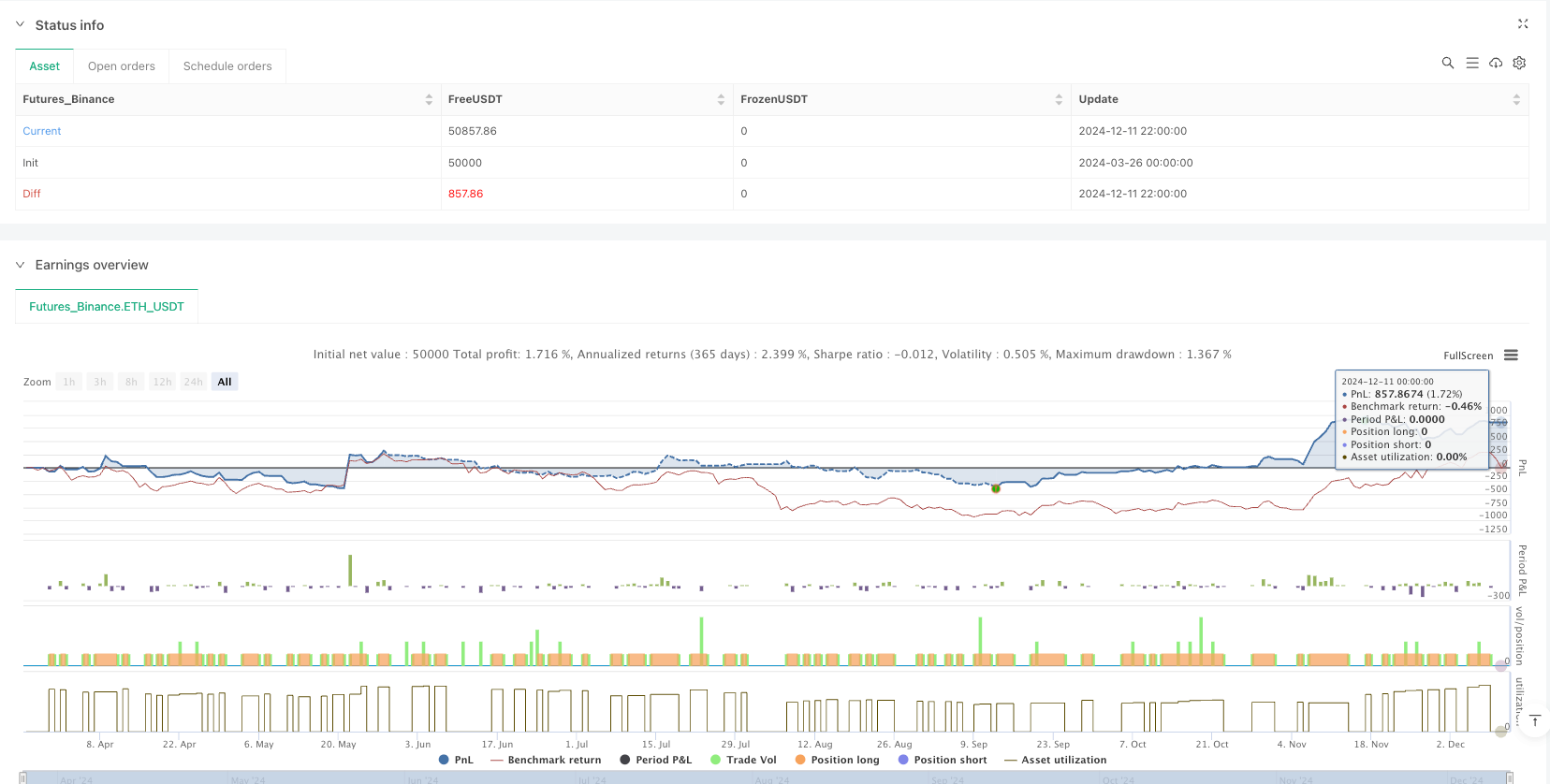

/*backtest

start: 2024-03-26 00:00:00

end: 2024-12-12 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// @version=5

strategy("Moving Average Crossover Strategy", shorttitle="MA Crossover", overlay=true)

// ——— INPUTS ———

fastLength = input.int(9, title="Fast MA Length", minval=1)

slowLength = input.int(21, title="Slow MA Length", minval=1)

maType = input.string(title="MA Type", defval="SMA", options=["SMA", "EMA", "WMA", "VWMA"])

// ——— FUNCTION TO RETURN SELECTED MA ———

f_ma(_source, _length, _type) => switch _type

"SMA" => ta.sma(_source, _length)

"EMA" => ta.ema(_source, _length)

"WMA" => ta.wma(_source, _length)

"VWMA" => ta.vwma(_source, _length)

// ——— CALCULATE FAST AND SLOW MAs ———

fastMA = f_ma(close, fastLength, maType)

slowMA = f_ma(close, slowLength, maType)

// ——— PLOT THE MOVING AVERAGES ———

plot(fastMA, color=color.blue, linewidth=2, title="Fast MA")

plot(slowMA, color=color.red, linewidth=2, title="Slow MA")

// ——— TRADING CONDITIONS ———

longCondition = ta.crossover(fastMA, slowMA)

exitCondition = ta.crossunder(fastMA, slowMA)

// ——— EXECUTE TRADES ———

if longCondition

strategy.entry("Long Entry", strategy.long)

if exitCondition

strategy.close("Long Entry")

// ——— PLOT BUY/SELL LABELS ———

if longCondition

label.new(bar_index, low, style=label.style_label_up, color=color.new(color.green, 0), textcolor=color.white, text="Buy")

if exitCondition

label.new(bar_index, high, style=label.style_label_down, color=color.new(color.red, 0), textcolor=color.white, text="Sell")