Overview

This is a trend-following trading strategy that combines multiple moving averages with the Average True Range (ATR) indicator. The core concept involves identifying entry signals through crossovers between fast and slow moving averages, while using a long-term moving average as a trend filter to ensure trade direction aligns with the overall market trend. Additionally, the strategy employs the ATR indicator to dynamically set stop-loss and take-profit levels, allowing it to automatically adjust risk management parameters based on market volatility, while also implementing functionality to operate within a preset time period, focusing on specific trading sessions.

Strategy Principles

The core principles of this strategy include several key components:

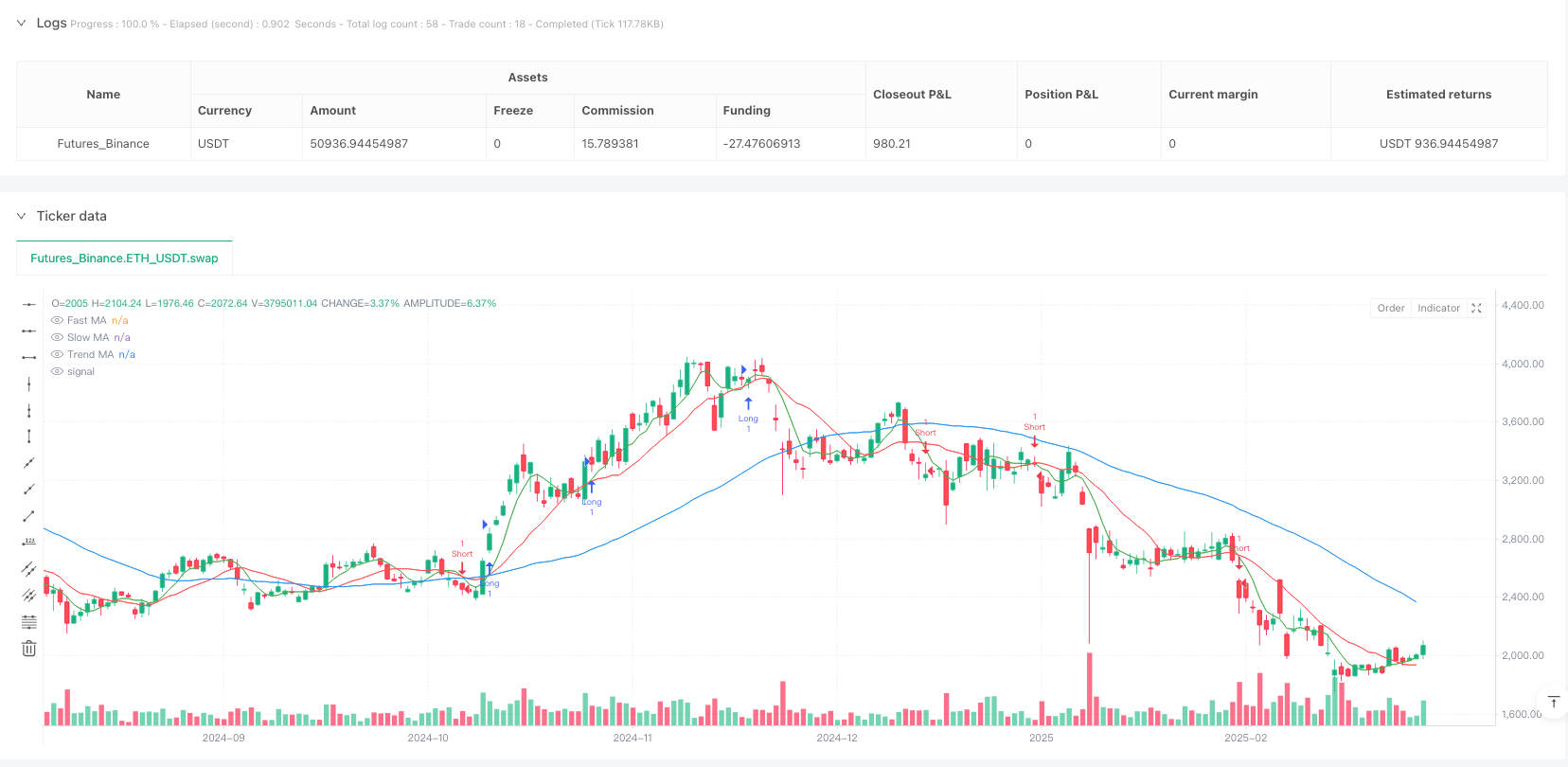

Multiple Moving Average System: The strategy simultaneously utilizes three moving averages: a fast MA (5-period), a slow MA (13-period), and a trend MA (50-period). The fast and slow MA crossovers provide trading signals, while the trend MA determines the overall market direction.

Trend Confirmation Mechanism: The strategy requires price to be above the trend MA for long trades and below the trend MA for short trades, effectively filtering out counter-trend trading signals.

ATR-Based Risk Management: The strategy uses a 14-period ATR to calculate market volatility and sets stop-loss positions through a multiplier (1.5). This approach allows stop-loss levels to automatically adjust based on actual market volatility, avoiding the limitations of fixed-point stops.

Dynamic Profit Targets: The strategy adopts the product of ATR and a profit target multiplier (2.0) to set take-profit levels, enabling it to adjust expected profits in different volatility environments.

Time Filtering: The strategy executes trading signals only within a set trading period (January 1, 2023, to December 31, 2025), helping to avoid adverse market conditions during specific periods.

Trailing Stop Mechanism: The strategy implements an ATR-based trailing stop that can lock in partial profits as price moves favorably while giving price sufficient room to breathe.

Strategy Advantages

Through deep analysis of the strategy code, the following significant advantages can be summarized:

Combination of Trend and Momentum: The strategy cleverly combines trend following (via trend MA) and momentum trading (via fast/slow MA crossovers), helping to capture favorable entry points within strong trends.

Adaptive Risk Management: ATR-based stop-loss and take-profit settings allow the strategy to automatically adjust risk parameters based on market volatility, which is more intelligent than fixed-point settings and can adapt to different market environments.

Complete Trading System: The strategy includes clear entry and exit conditions and risk management rules, forming a complete trading system that doesn’t require subjective judgment from traders.

Parameter Adjustability: The strategy provides multiple adjustable parameters, such as MA periods, ATR multiplier, and profit target multiplier, making it customizable based on different market characteristics or personal risk preferences.

Time Filtering Function: By setting specific trading periods, the strategy can avoid trading during historically poor-performing times, which is an effective risk control measure.

Visual Support: The strategy plots all key moving averages on the chart, allowing traders to intuitively understand current market structure and potential signals.

Strategy Risks

Despite being well-designed, the strategy still has the following risks and limitations:

Moving Average Lag: All strategies based on moving averages suffer from signal lag issues, which can lead to significant drawdowns or missed initial movements in rapid reversal scenarios.

False Breakout Risk: Fast/slow MA crossovers may produce false breakout signals, particularly in low-volatility, ranging markets.

Parameter Sensitivity: Strategy performance may be highly sensitive to chosen parameter values, as small changes in MA periods or ATR multipliers can lead to significantly different results.

Potential Over-Optimization: Parameters optimized for specific historical data may not perform equally well in future markets, posing the risk of overfitting.

Market Environment Dependency: The strategy may perform excellently in strong trending markets but could frequently generate losing trades in oscillating markets or low-volatility environments.

Single Timeframe Limitation: The strategy is based on data from a single timeframe, lacking multi-timeframe confirmation, which may miss important market structures from larger cycles.

For these risks, the following solutions can be adopted: - Add additional filtering conditions, such as volatility thresholds or momentum confirmation indicators - Implement graduated position management instead of all-in trading - Periodically re-optimize parameters to adapt to changing market environments - Add multi-timeframe analysis as a confirmation mechanism

Strategy Optimization Directions

Based on deep analysis of the code, the strategy can be optimized in the following directions:

Multi-Timeframe Analysis: Integrating trend confirmation signals from higher timeframes can improve trade quality. For example, executing trades only when the daily trend direction aligns with the current trading timeframe.

Volatility Filtering: Adding volatility filtering conditions, such as executing trades only when the ATR value exceeds a specific threshold, can avoid false signals in low-volatility environments.

Dynamic Parameter Adjustment: Automatically adjusting ATR multipliers and profit target multipliers based on market conditions, such as increasing ATR multipliers in high-volatility environments to avoid premature stop-outs.

Adding Volume Confirmation: Integrating volume indicators into entry conditions and executing trading signals only when supported by volume can reduce false breakout risks.

Smart Position Management: Implementing an ATR-based dynamic position management system, reducing position size in high-volatility environments and appropriately increasing it in low-volatility environments.

Optimizing Exit Mechanisms: Consider adding exit conditions based on market structure or indicator reversals, rather than relying solely on stop-loss and take-profit levels.

Seasonality Analysis: Studying seasonal patterns in specific markets can further optimize trading period settings.

These optimizations can enhance strategy robustness, reduce drawdowns, and improve overall risk-adjusted returns.

Summary

The Multi-Moving Average & ATR Dynamic Volatility Strategy is a well-structured quantitative trading system that cleverly combines trend-following and momentum trading principles with adaptive risk management mechanisms. By using moving averages of different periods to identify trends and generate trading signals, while utilizing the ATR indicator to dynamically set stop-loss and take-profit levels, the strategy can adapt to volatility changes in different market environments.

Although the strategy faces inherent risks such as moving average lag and false breakouts, its comprehensive trading rules and risk management framework provide traders with an operational and scalable system. By adding multi-timeframe analysis, volatility filtering, and smart position management optimizations, the robustness and long-term profitability of the strategy can be further enhanced.

Overall, this is a strategy that balances signal generation and risk control, particularly suitable for traders who wish to follow clear trading rules while maintaining flexibility to adapt to market changes. The strategy not only embodies core principles of technical analysis but also demonstrates the systematic nature of quantitative trading, providing a solid foundation for long-term consistent trading. Most importantly, by using ATR to dynamically adjust risk parameters, the strategy maintains relatively consistent risk exposure across different market volatility environments, which is one of the key elements for long-term trading success.

This strategy can serve as a foundational framework that traders can personalize according to their trading style and risk tolerance. Whether for intraday trading or long-term holding, this method combining moving average systems with volatility measurement provides a reliable starting point. Through continuous monitoring and parameter optimization, its performance in real trading environments can be further enhanced.

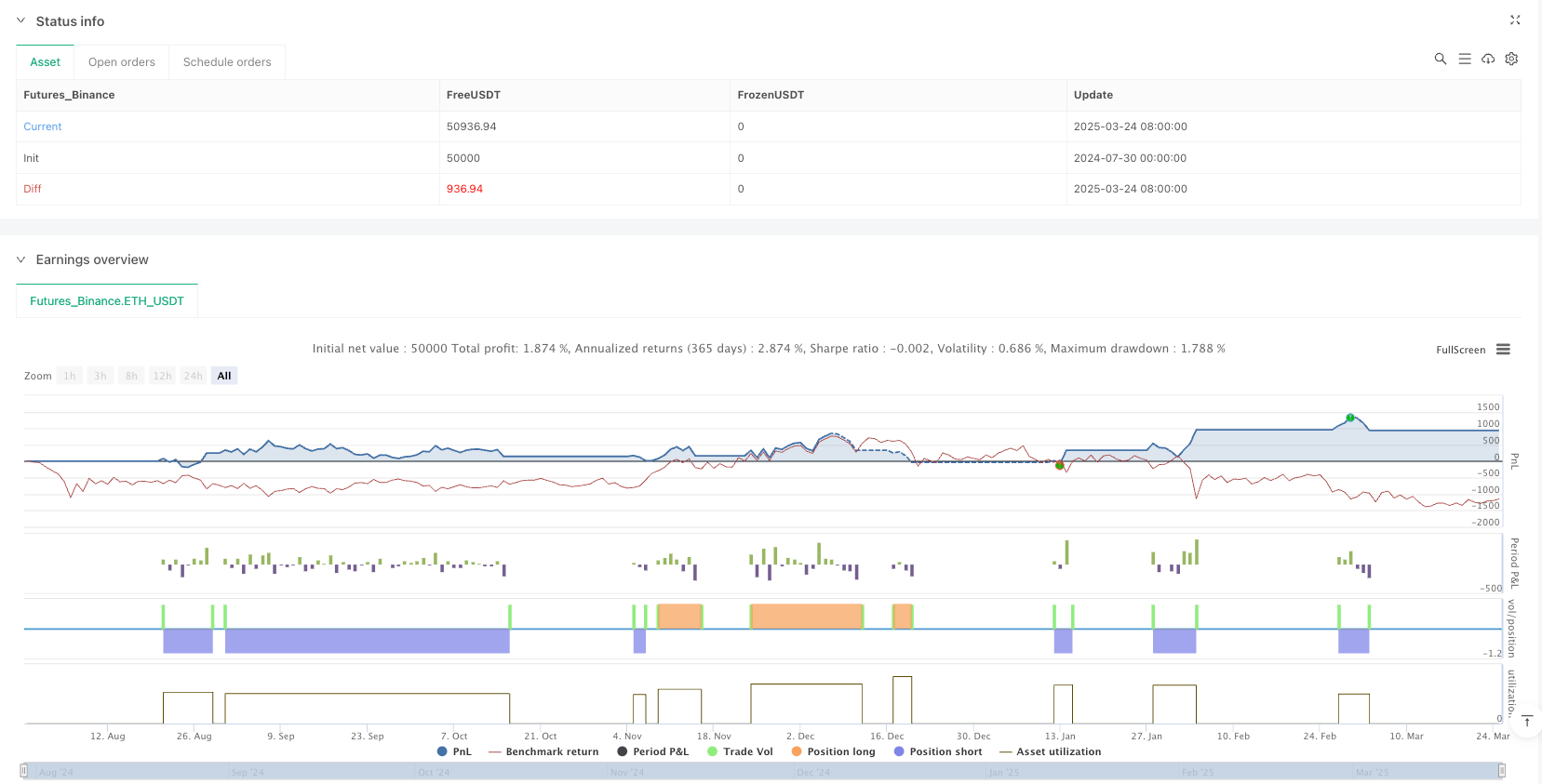

/*backtest

start: 2024-07-30 00:00:00

end: 2025-03-25 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

// Copyright 2025 Rouvonn Wales

strategy("Bitcoin King V1", overlay=true)

// Input parameters

fast_length = input(5, title="Fast MA Length")

slow_length = input(13, title="Slow MA Length")

atr_length = input(14, title="ATR Length")

atr_multiplier = input(1.5, title="ATR Multiplier")

trend_length = input(50, title="Trend MA Length")

profit_target_multiplier = input(2.0, title="Profit Target Multiplier")

// Calculate moving averages

fast_ma = ta.sma(close, fast_length)

slow_ma = ta.sma(close, slow_length)

trend_ma = ta.sma(close, trend_length)

// Calculate ATR for stop loss and take profit levels

atr = ta.atr(atr_length)

// Plot moving averages

plot(fast_ma, color=color.green, title="Fast MA")

plot(slow_ma, color=color.red, title="Slow MA")

plot(trend_ma, color=color.blue, title="Trend MA")

// Entry conditions with trend filter

long_condition = ta.crossover(fast_ma, slow_ma) and close > trend_ma

short_condition = ta.crossunder(fast_ma, slow_ma) and close < trend_ma

// Execute trades with stop loss and take profit

if (long_condition)

strategy.entry("Long", strategy.long, stop=close - atr * atr_multiplier, limit=close + atr * profit_target_multiplier)

if (short_condition)

strategy.entry("Short", strategy.short, stop=close + atr * atr_multiplier, limit=close - atr * profit_target_multiplier)

// Exit conditions with trailing stop and additional criteria

if (strategy.position_size > 0)

strategy.exit("Exit Long", "Long", stop=close - atr * atr_multiplier, limit=close + atr * profit_target_multiplier, trail_offset=atr * atr_multiplier)

if (strategy.position_size < 0)

strategy.exit("Exit Short", "Short", stop=close + atr * atr_multiplier, limit=close - atr * profit_target_multiplier, trail_offset=atr * atr_multiplier)