Overview

The SuperTrend Dynamic Take-Profit with Time Filter Strategy is a volatility-adaptive quantitative trading system that relies on the SuperTrend indicator as a dynamic trailing stop tool. This strategy captures market trends by identifying moments when price breaks through the SuperTrend indicator line, combined with multiple filtering mechanisms including Moscow time (MSK) filter, price level filtering, and fixed percentage take-profit functionality. The system is designed as a multi-functional mode that can trade long positions only, short positions only, or enable bidirectional trading. The strategy visually displays trading direction on the chart through color changes: green areas indicate uptrends (long), while red areas indicate downtrends (short), greatly enhancing strategy visualization and operational decision-making convenience.

Strategy Principles

The core operation of this strategy is based on the following key mechanisms:

SuperTrend Indicator Calculation: The strategy uses the ATR indicator (default period 23) and a multiplier factor (default 1.8) to calculate the SuperTrend line, which automatically adjusts its position according to market volatility, forming dynamic support and resistance.

Trade Signal Generation:

- Long entry signal: Triggered when the closing price breaks above the SuperTrend line (dir value changes from positive to negative) and meets time and price filtering conditions.

- Short entry signal: Triggered when the closing price falls below the SuperTrend line (dir value changes from negative to positive) and meets filtering conditions.

Trade Mode Selection: The strategy offers three trading modes:

- Long Only: Only executes long trades, closes positions on short signals.

- Short Only: Only executes short trades, closes positions on long signals.

- Both: Allows bidirectional trading.

Multiple Filtering Systems:

- Moscow time filter (MSK, UTC+3): Allows users to set specific trading sessions, executing trades only within those periods.

- Price level filtering: Sets a price threshold, executing long positions only when price is above the threshold and short positions when below.

Dynamic Take-Profit Mechanism: The strategy implements a fixed percentage take-profit (default 1.5%) based on entry price. Once price reaches the take-profit level, the strategy automatically closes positions to lock in profits. Take-profit levels can be visually displayed on the chart, and users can enable or disable this visualization as needed.

Strategy Advantages

After deep analysis of this code, I’ve identified the following significant advantages:

Volatility Adaptability: The SuperTrend indicator is based on ATR calculation, allowing it to automatically adjust tracking distance according to market volatility conditions. It increases protection distance in high-volatility markets and tracks price more closely in low-volatility markets, improving the strategy’s adaptability to different market environments.

Multiple Risk Controls: The strategy integrates three layers of risk management: time filtering, price filtering, and take-profit settings. This multi-dimensional risk control mechanism significantly enhances trading safety.

Flexible Trading Direction: Options for long-only, short-only, or bidirectional trading allow the strategy to adapt to different market preferences and trading restrictions.

Time-Intelligent Optimization: The unique Moscow time filter allows trading during specific time periods, helping to avoid inefficient market sessions and specifically capturing efficient trading windows, particularly suitable for traders who need to consider international trading sessions.

Visualization Advantages: Through background color changes, SuperTrend line colors, and take-profit level markers, the strategy provides intuitive visual trading references, reducing analytical complexity.

Commission-Optimized Design: The strategy incorporates commission considerations (0.06%), making backtesting results closer to real trading environments.

Close Price Execution Mechanism: The strategy uses close price order execution (process_orders_on_close=true), reducing slippage impact and improving backtesting reliability.

Strategy Risks

Despite its excellent design, the strategy still has the following potential risks:

Trend Reversal Delay: The SuperTrend indicator is inherently a lagging indicator and may produce delayed signals during sharp market reversals, leading to untimely entries or exits and increased drawdown risk. The solution is to adjust ATR periods and multiplier factors to balance sensitivity and stability.

Fixed Take-Profit Limitations: Using a fixed percentage take-profit may lock in profits too early, missing out on additional gains during strong trends. It’s recommended to dynamically adjust take-profit percentages based on market volatility or optimize take-profit strategies by combining other technical indicators.

Parameter Sensitivity: Strategy performance is highly dependent on parameter settings (ATR period, multiplier factor, take-profit percentage, etc.). Inappropriate parameters may lead to overtrading or missed signals. Optimal parameter combinations should be sought through historical data backtesting.

Over-Restrictive Filters: Overly strict time and price filtering may cause missed valid trading opportunities. Filter conditions should be adjusted according to the actual trading instrument and market characteristics.

Market Condition Dependency: This strategy performs excellently in markets with clear trends but may frequently produce false signals in oscillating markets. Consider adding market state recognition mechanisms to enable the strategy only in trending markets.

Lack of Stop-Loss Mechanism: Although SuperTrend can serve as a dynamic stop-loss reference, the code does not explicitly set stop-loss conditions, potentially facing significant losses in extreme market conditions. Adding a hard stop-loss mechanism is recommended.

Strategy Optimization Directions

Based on code analysis, I recommend the following optimization directions:

Dynamic Parameter Adaptation: Functions can be written to automatically adjust SuperTrend’s ATR period and multiplier factor based on market states (such as volatility, volume, etc.), improving the strategy’s adaptability. The advantage of this approach is that parameters can be automatically optimized as market conditions change, without manual intervention.

Multi-Timeframe Confirmation: By introducing SuperTrend direction confirmation from higher timeframes, low-quality signals can be effectively filtered. For example, executing trades on the 1-hour chart only when the SuperTrend direction on both daily and 4-hour charts align can significantly reduce losses from false breakouts.

Intelligent Take-Profit System: The current fixed percentage take-profit can be improved to a multi-tiered take-profit strategy, such as dividing positions into two parts with the first part taking profit at a smaller target (e.g., 0.8%) and the second part at a higher level (e.g., 2.5%), or dynamically setting take-profit levels based on ATR values to better adapt to current market volatility.

Market State Recognition: Integrate ADX (Average Directional Index) to measure trend strength, activating the strategy only when ADX is above a specific threshold (e.g., 25) to avoid frequent trading in oscillating markets. A volatility filter could also be added to pause trading during periods of abnormally high volatility.

Enhanced Risk Management: Add maximum loss limits for each trade and implement money management rules (such as the Kelly criterion or fixed proportion risk) to ensure that single trade risk does not exceed a specific percentage (e.g., 2%) of the total account.

Multi-Indicator Fusion: Combine SuperTrend with other technical indicators (such as moving average crossovers, RSI overbought/oversold zones, or MACD histogram) to establish multiple confirmation systems and improve signal quality. For example, execute long trades only when RSI shows oversold conditions and SuperTrend gives a buy signal.

Trading Volume Adaptation Logic: Dynamically adjust trading size based on market volatility and liquidity, for example, reducing position size when ATR values are large and increasing positions when ATR values are small and trends are clear, optimizing capital utilization efficiency.

Extended Backtesting Period: Conduct comprehensive backtesting across different market environments (bull markets, bear markets, ranging markets) and different time periods to ensure long-term stability and adaptability of the strategy. It’s particularly important to test strategy performance under extreme market conditions.

Summary

The SuperTrend Dynamic Take-Profit with Time Filter Strategy is a comprehensive trading system that integrates trend following, time filtering, and take-profit management. Its core advantage lies in the volatility-adaptive SuperTrend indicator calculation and multi-level trading filtering mechanisms, enabling it to maintain relatively stable performance in changing market environments.

The strategy’s main innovation point is combining the Moscow time filter with traditional SuperTrend trading logic, making it particularly suitable for traders considering the impact of international trading sessions. Meanwhile, the built-in fixed percentage take-profit function provides a simple yet effective profit protection mechanism, preventing profit giveback due to market reversals.

However, the strategy also faces challenges such as indicator lag and parameter sensitivity. By implementing the suggested optimization measures, such as dynamic parameter adjustment, multiple indicator confirmation, and enhanced risk management, the strategy’s robustness and profitability can be significantly improved. Particularly through market state recognition mechanisms, the strategy can become more “intelligent,” executing trades only under suitable market conditions.

For practical application, traders need to fine-tune strategy parameters according to the characteristics of specific trading instruments and personal risk preferences. Through continuous monitoring and regular optimization, this strategy can become an effective component of medium to long-term quantitative trading systems, contributing stable returns to investment portfolios.

In conclusion, this is a well-designed, clearly structured quantitative trading strategy with high practical value and expansion potential. With reasonable parameter settings and necessary risk controls, it can function effectively in various market environments, providing traders with reliable trading signals and profit protection mechanisms.

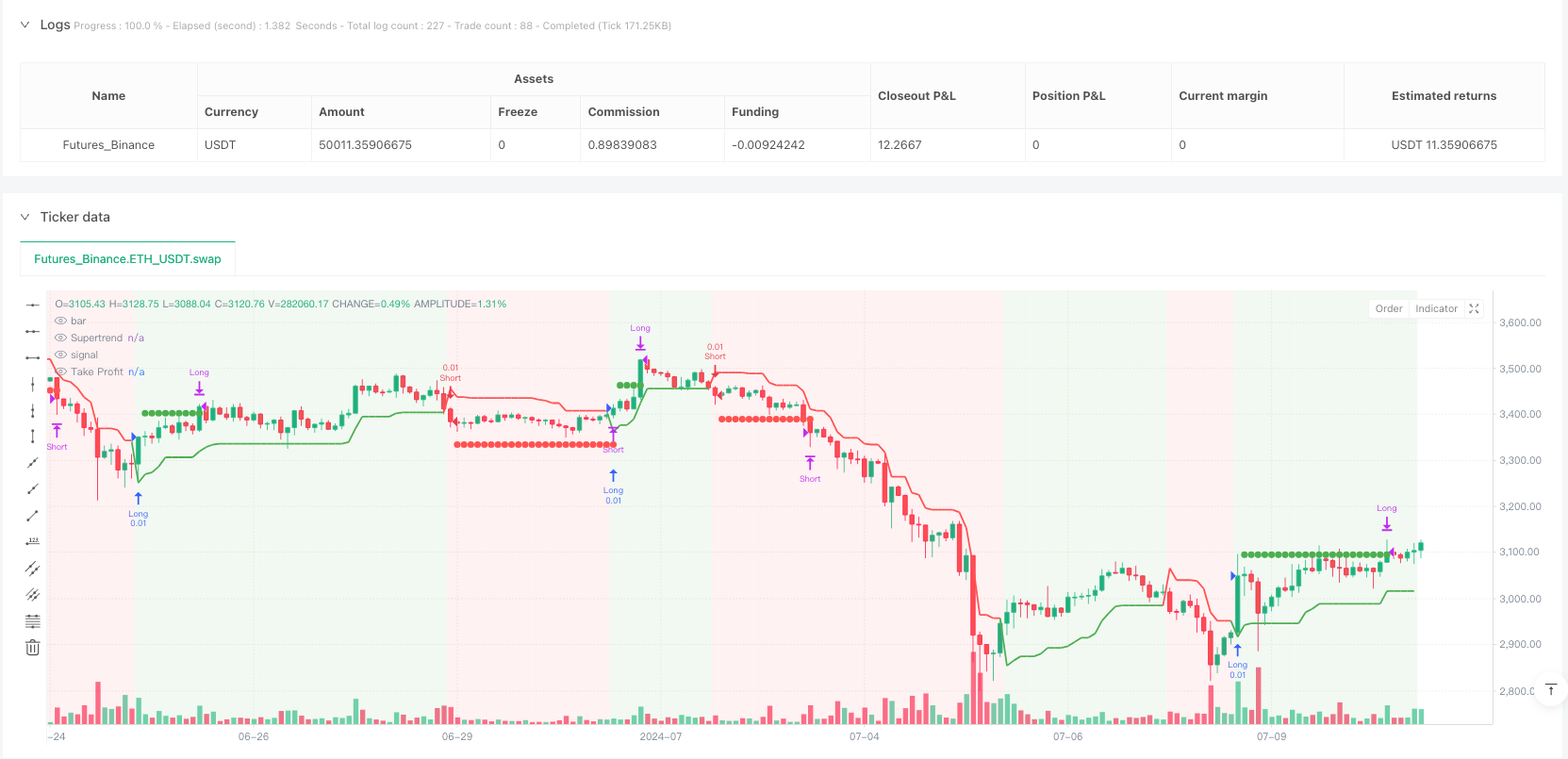

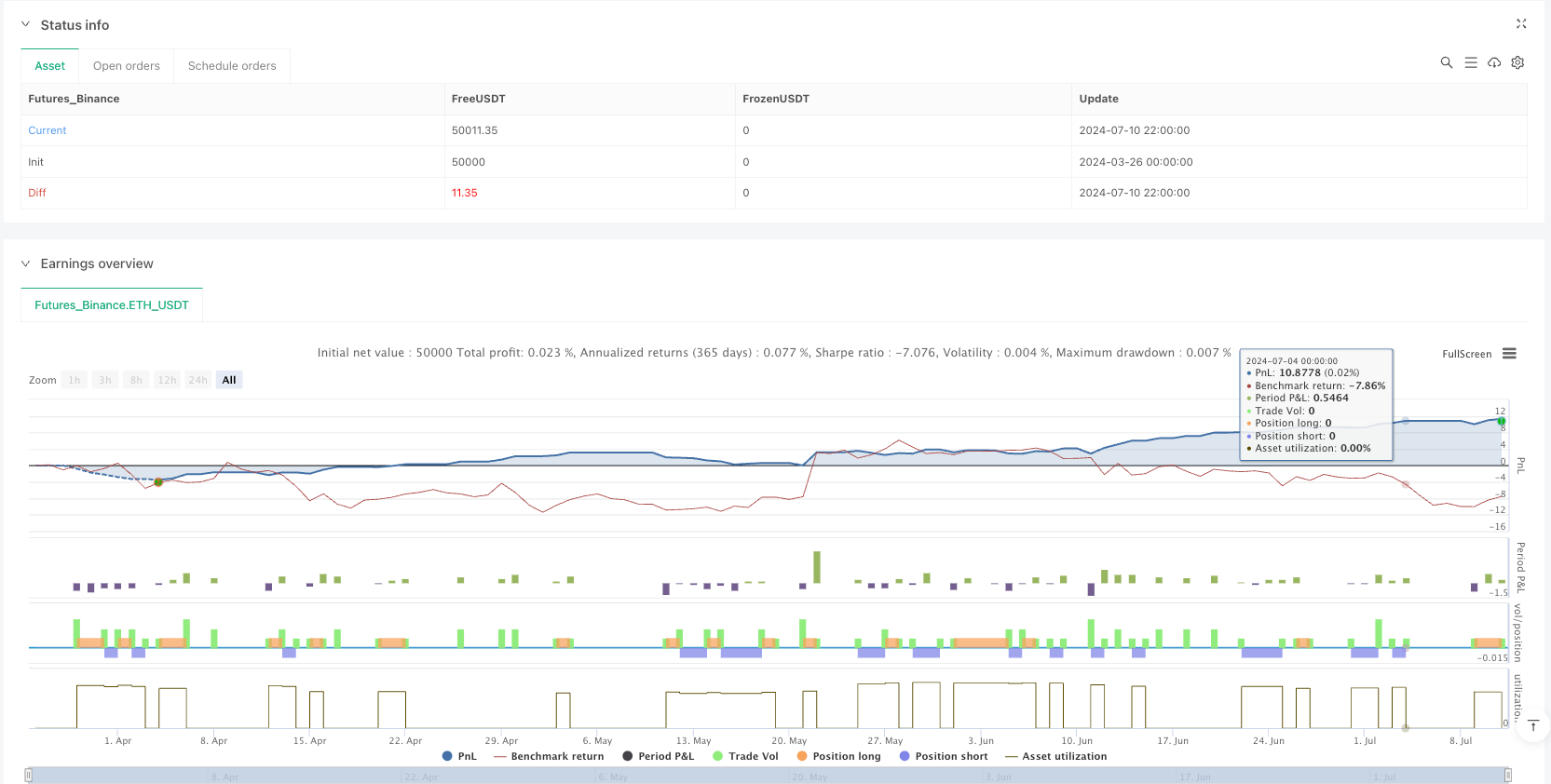

/*backtest

start: 2024-03-26 00:00:00

end: 2024-07-11 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Supertrend Fixed TP Unified with Time Filter (MSK)", overlay=true,

default_qty_value=0.01,

commission_type=strategy.commission.percent,

commission_value=0.06,

pyramiding=0,

process_orders_on_close=true)

// Настройки индикатора

atrPeriod = input(23, "ATR Length")

factor = input.float(1.8, "Factor", step=0.1, minval=0.1)

tradeMode = input.string("Both", "Trade Mode", options=["Long Only", "Short Only", "Both"])

// Общий параметр тейк-профита

takeProfitPercent = input.float(1.5, "Take Profit (%)", minval=0.01)

showTP = input.bool(true, "▲▼ Показывать ТП") // Добавлен переключатель

// Фильтр цены

price_param = input.float(10000.0, "Цена фильтра", step=1.0)

use_price_filter = input.bool(false, "Использовать фильтр цены")

// Фильтр по времени (Московское время)

useTimeFilter = input.bool(true, "▲▼ Использовать фильтр по времени") // Переключатель фильтра времени

timeFrom = input.int(0, "Время С (часы MSK)", minval=0, maxval=23, step=1)

timeTo = input.int(23, "Время ДО (часы MSK)", minval=0, maxval=23, step=1)

// Функция проверки времени (с учетом Московского времени UTC+3)

isTimeInRange() =>

if not useTimeFilter

true // Фильтр отключен

else

// Переводим время сервера (UTC) в Московское время (UTC+3)

mskHour = (hour(time) + 3) % 24 // Добавляем 3 часа для MSK

if timeFrom <= timeTo

mskHour >= timeFrom and mskHour < timeTo // До timeTo (не включая timeTo)

else

mskHour >= timeFrom or mskHour < timeTo // До timeTo (не включая timeTo)

// Расчет Supertrend

[supertrend, dir] = ta.supertrend(factor, atrPeriod)

// Визуализация Supertrend

plot(supertrend, "Supertrend",

color = dir < 0 ? color.green : color.red,

linewidth = 2,

style = plot.style_linebr)

bgcolor(dir < 0 ? color.new(color.green, 90) : color.new(color.red, 90))

// Сигналы входа с фильтром по времени

longEntry = (dir < 0 and dir[1] > 0) and (use_price_filter ? close > price_param : true) and isTimeInRange()

shortEntry = (dir > 0 and dir[1] < 0) and (use_price_filter ? close < price_param : true) and isTimeInRange()

// Логика стратегии

if tradeMode == "Both"

if longEntry

strategy.close("Short", comment="Close Short")

strategy.entry("Long", strategy.long)

if shortEntry

strategy.close("Long", comment="Close Long")

strategy.entry("Short", strategy.short)

else if tradeMode == "Long Only"

if longEntry

strategy.entry("Long", strategy.long)

if shortEntry

strategy.close("Long", comment="Close Long")

else if tradeMode == "Short Only"

if shortEntry

strategy.entry("Short", strategy.short)

if longEntry

strategy.close("Short", comment="Close Short")

// Управление тейк-профитом

var color tpColor = na

var float tpLevel = na

var label tpLabel = na

// Сброс при закрытии позиции

if strategy.position_size == 0 and strategy.position_size[1] != 0

tpLevel := na

tpColor := na

label.delete(tpLabel)

tpLabel := na

// Обновление ТП при открытии позиции

if strategy.position_size > 0

entryPrice = strategy.opentrades.entry_price(0)

tpLevel := entryPrice * (1 + takeProfitPercent/100)

tpColor := color.green

// Закрытие лонга по TP на закрытии бара

if close >= tpLevel

strategy.close("Long", comment="TP Long")

// Обновление метки

if showTP

label.delete(tpLabel)

tpLabel := label.new(

bar_index, tpLevel,

text = str.tostring(tpLevel, "#.##"),

color = color.green,

textcolor = color.white,

style = label.style_label_down,

yloc = yloc.price)

if strategy.position_size < 0

entryPrice = strategy.opentrades.entry_price(0)

tpLevel := entryPrice * (1 - takeProfitPercent/100)

tpColor := color.red

// Закрытие шорта по TP на закрытии бара

if close <= tpLevel

strategy.close("Short", comment="TP Short")

// Обновление метки

if showTP

label.delete(tpLabel)

tpLabel := label.new(

bar_index, tpLevel,

text = str.tostring(tpLevel, "#.##"),

color = color.red,

textcolor = color.white,

style = label.style_label_up,

yloc = yloc.price)

// Визуализация ТП

plot(showTP ? tpLevel : na, "Take Profit",

color = tpColor,

linewidth = 1,

style = plot.style_circles)

// Обновление позиции метки

if showTP and not na(tpLevel)

label.set_xy(tpLabel, bar_index, tpLevel)