Overview

This strategy is a hybrid trading system combining Keltner Channels and multiple Exponential Moving Averages (EMAs). It captures overbought and oversold conditions by monitoring price interactions with Keltner Channel boundaries while confirming trend momentum through short-term and medium-term EMA crossovers. This dual approach enables traders to operate in various market conditions: executing reversal trades when prices reach channel edges and trend-following trades when trends are confirmed. The system also incorporates Average True Range (ATR) based risk management parameters, providing dynamic adjustment capabilities for stop-losses and profit targets.

Strategy Principles

The core of this strategy relies on two distinct trading signal systems:

Keltner Channel Reversal Trades:

- Long signals (longEntryKC) trigger when price breaks below the lower band (lowerKC)

- Short signals (shortEntryKC) trigger when price breaks above the upper band (upperKC)

- Reversal trades close when price returns to the middle band (emaBasis)

Trend-Following Trades:

- Long signals (longEntryTrend) trigger when 9-period EMA crosses above 21-period EMA with price above 50-period EMA

- Short signals (shortEntryTrend) trigger when 9-period EMA crosses below 21-period EMA with price below 50-period EMA

- Trend trades close when the short-term EMA crosses back over the medium-term EMA

The Keltner Channel itself is constructed with a 20-period EMA as the middle band, with upper and lower bands calculated by adding and subtracting 1.5 times the ATR value. This construction allows the channel to dynamically adjust its width according to market volatility, automatically expanding during high volatility periods and contracting during low volatility periods.

The system’s risk management mechanism employs ATR-based dynamic stop-losses and profit targets: - Long stop-losses are set 1.5 times ATR below entry price - Short stop-losses are set 1.5 times ATR above entry price - Long profit targets are set 3 times ATR above entry price (2×1.5 ATR) - Short profit targets are set 3 times ATR below entry price (2×1.5 ATR)

Strategy Advantages

Multiple Strategy Integration: Combines reversal trading and trend following strategies, enabling the system to maintain flexibility across different market environments, capturing both short-term price reversals and following medium to long-term trends.

Dynamic Risk Management: Stop-losses and profit targets calculated through ATR automatically adjust with market volatility, providing wider stop-loss margins during high volatility periods and tightening risk control during low volatility periods.

Signal Confirmation Mechanism: The trend trading component requires multiple conditions to be simultaneously satisfied (short-term and medium-term EMA crossover plus price position relative to long-term EMA), significantly reducing false signals.

Strong Adaptability: Keltner Channel width automatically adjusts according to market volatility, allowing the strategy to adapt to various market environments without manual parameter adjustments.

Complete Trading Cycle: The strategy clearly defines entry, exit, stop-loss, and profit conditions, forming a comprehensive trading framework.

Automated Alerts: Integration with TradingView alert functionality enables fully automated trading signal notifications.

Strategy Risks

False Breakout Risk: In highly volatile markets, prices may frequently touch Keltner Channel boundaries and quickly return, generating false reversal signals. Mitigation: Consider adding confirmation conditions, such as requiring price to remain outside the channel for a certain period or incorporating additional technical indicators.

Trend Change Lag: EMA crossover signals are inherently lagging indicators, potentially causing delayed entries or exits near trend turning points. Mitigation: Consider introducing more sensitive momentum indicators as auxiliary confirmation.

Insufficient Stop-Loss Range: In some extreme volatility situations, a 1.5 times ATR stop-loss setting may be insufficient to avoid being triggered by market noise. Mitigation: For specific high-volatility instruments, consider adjusting the stop-loss multiplier to 2 times or higher.

Multiple Signal Conflicts: Reversal and trend strategies may simultaneously generate opposing signals, creating decision-making difficulties. Mitigation: Establish signal priority or apply the two strategies on different timeframes.

Parameter Sensitivity: Strategy performance is relatively sensitive to the choice of Keltner Channel multiplier (mult) and EMA periods. Mitigation: Thorough parameter optimization and backtesting verification are recommended before live trading.

Strategy Optimization Directions

Add Trading Time Filters: Implement trading time window filters to avoid abnormal volatility and low liquidity periods at market open and close, executing trade signals only during the most active market sessions.

Introduce Volatility Assessment: Add ATR relative to historical values judgment, pausing reversal trades during excessive volatility periods and only executing trend trades; prioritizing reversal trades during low volatility periods.

Optimize Capital Management: The current strategy uses a fixed proportion (10%) for position management, which could be improved to volatility-based dynamic position adjustment, increasing positions in low volatility environments and reducing positions in high volatility environments.

Add Trading Filter Conditions: Incorporate additional filtering conditions to improve signal quality, such as:

- Combining RSI indicators to filter Keltner Channel reversal signals

- Requiring volume confirmation for EMA crossover signals

- Only executing trades in the direction of the primary trend

Multi-Timeframe Analysis: Introduce higher timeframe trend judgments, only executing lower timeframe signals in the direction of higher timeframe trends.

Optimize Profit-Taking Method: Currently using fixed multiple ATR as profit targets, this could be improved to a trailing stop mechanism to maximize trend profit capture.

Summary

This Keltner Channel and EMA hybrid trading system is a comprehensive and flexible trading strategy that achieves adaptability across different market environments by combining reversal and trend-following signals. Its core strengths lie in dynamic channel width adjustment and ATR-based risk management, allowing the strategy to automatically adapt to changes in market volatility. However, the strategy still has some inherent risks, such as false breakouts and signal lag issues.

Through a series of optimization measures, such as adding trading filters, optimizing capital management, and introducing multi-timeframe analysis, this strategy has significant room for improvement. For traders, it is recommended to thoroughly backtest across different market conditions and timeframes before live application, and adjust parameter settings according to specific trading instrument characteristics. Overall, this is a well-structured, logically clear, and highly practical quantitative trading strategy.

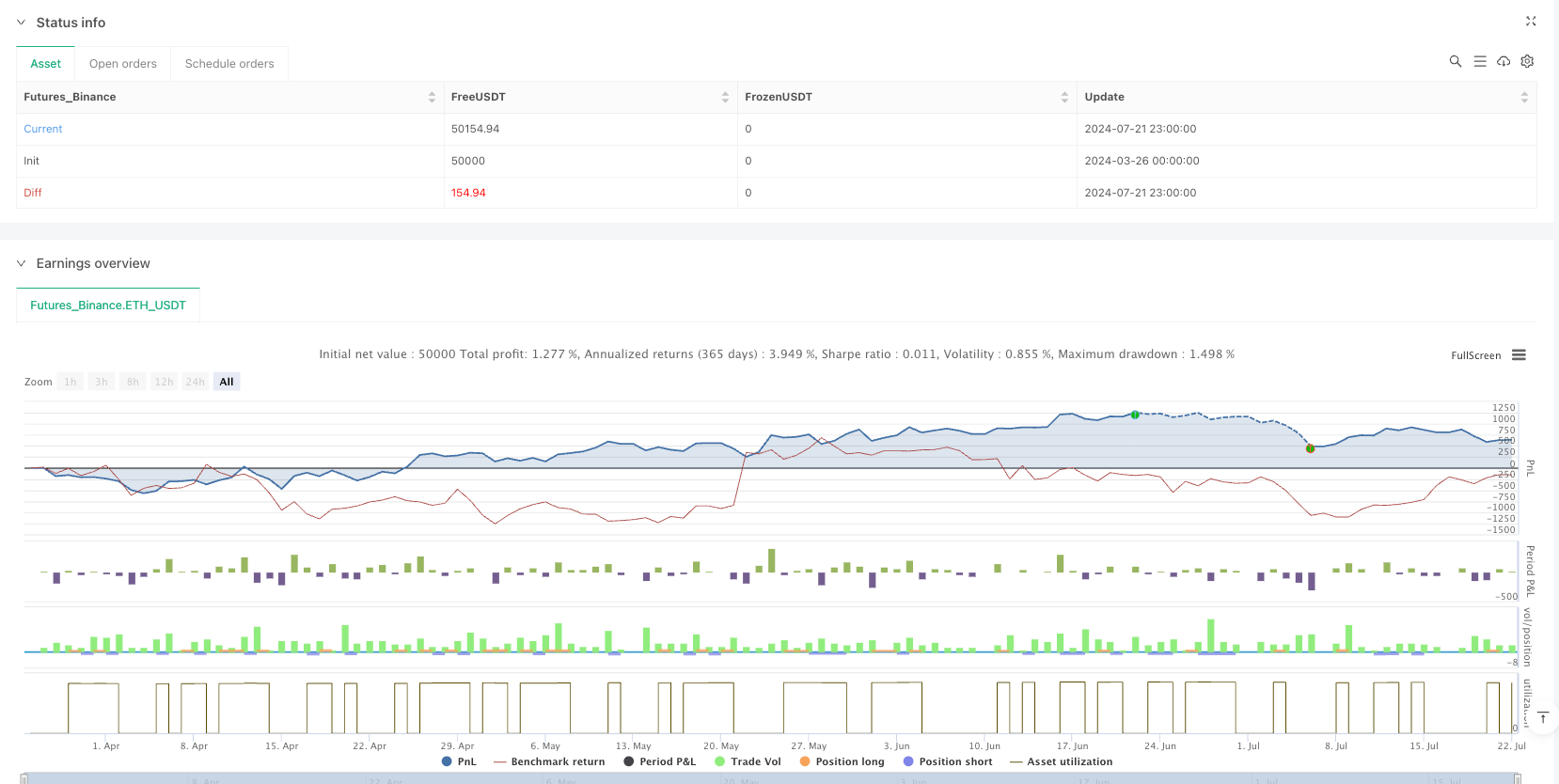

/*backtest

start: 2024-03-26 00:00:00

end: 2024-07-22 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Keltner Channel Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Keltner Channel Settings

length = 20

mult = 1.5

emaBasis = ta.ema(close, length)

atrVal = ta.atr(length)

upperKC = emaBasis + (mult * atrVal)

lowerKC = emaBasis - (mult * atrVal)

// Entry Conditions for Different Strategies

longEntryKC = ta.crossunder(close, lowerKC)

shortEntryKC = ta.crossover(close, upperKC)

longEntryTrend = ta.crossover(ta.ema(close, 9), ta.ema(close, 21)) and close > ta.ema(close, 50)

shortEntryTrend = ta.crossunder(ta.ema(close, 9), ta.ema(close, 21)) and close < ta.ema(close, 50)

// Stop-Loss and Take-Profit Levels

atrMultiplier = 1.5

stopLossLong = close - (atrMultiplier * atrVal)

stopLossShort = close + (atrMultiplier * atrVal)

takeProfitLong = close + (2 * atrMultiplier * atrVal)

takeProfitShort = close - (2 * atrMultiplier * atrVal)

// Exit Conditions

exitLongKC = ta.crossover(close, emaBasis)

exitShortKC = ta.crossunder(close, emaBasis)

exitLongTrend = ta.crossunder(ta.ema(close, 9), ta.ema(close, 21))

exitShortTrend = ta.crossover(ta.ema(close, 9), ta.ema(close, 21))

// Plot Keltner Channels

plot(upperKC, title="Upper Keltner Band", color=color.blue)

plot(lowerKC, title="Lower Keltner Band", color=color.red)

plot(emaBasis, title="Mid Keltner Band", color=color.gray)

// Execute Trades

strategy.entry("Long_KC", strategy.long, when=longEntryKC)

strategy.close("Long_KC", when=exitLongKC)

strategy.entry("Short_KC", strategy.short, when=shortEntryKC)

strategy.close("Short_KC", when=exitShortKC)

strategy.entry("Long_Trend", strategy.long, when=longEntryTrend)

strategy.close("Long_Trend", when=exitLongTrend)

strategy.entry("Short_Trend", strategy.short, when=shortEntryTrend)

strategy.close("Short_Trend", when=exitShortTrend)

// Stop-Loss and Take-Profit Implementation

strategy.exit("Long_KC_Exit", from_entry="Long_KC", stop=stopLossLong, limit=takeProfitLong)

strategy.exit("Short_KC_Exit", from_entry="Short_KC", stop=stopLossShort, limit=takeProfitShort)

strategy.exit("Long_Trend_Exit", from_entry="Long_Trend", stop=stopLossLong, limit=takeProfitLong)

strategy.exit("Short_Trend_Exit", from_entry="Short_Trend", stop=stopLossShort, limit=takeProfitShort)

// Alerts

alertcondition(longEntryKC, title="Long Entry KC Alert", message="Price touched Lower Keltner Band - Possible Long Setup")

alertcondition(shortEntryKC, title="Short Entry KC Alert", message="Price touched Upper Keltner Band - Possible Short Setup")

alertcondition(longEntryTrend, title="Long Entry Trend Alert", message="9 EMA crossed above 21 EMA - Possible Long Setup")

alertcondition(shortEntryTrend, title="Short Entry Trend Alert", message="9 EMA crossed below 21 EMA - Possible Short Setup")