Overview

The Multi-Timeframe Liquidity Sweep Trend Confirmation Quantitative Trading Strategy is a quantitative trading approach that combines high timeframe trend analysis with liquidity sweep signals. This strategy primarily identifies trading opportunities by detecting liquidity sweeps (price breaking above recent highs or below recent lows) and confirming them with high timeframe trend bias. The strategy is specifically optimized for short-term trading on 5-minute charts and uses ATR (Average True Range) to dynamically set stop-loss and take-profit levels, thereby improving win rates and risk-reward ratios. By precisely targeting market structure change points, the strategy executes high-probability trades in the direction of the trend, achieving consistent profitability.

Strategy Principles

The core principles of this strategy are based on the combination of market liquidity and multi-timeframe trend analysis. Specifically:

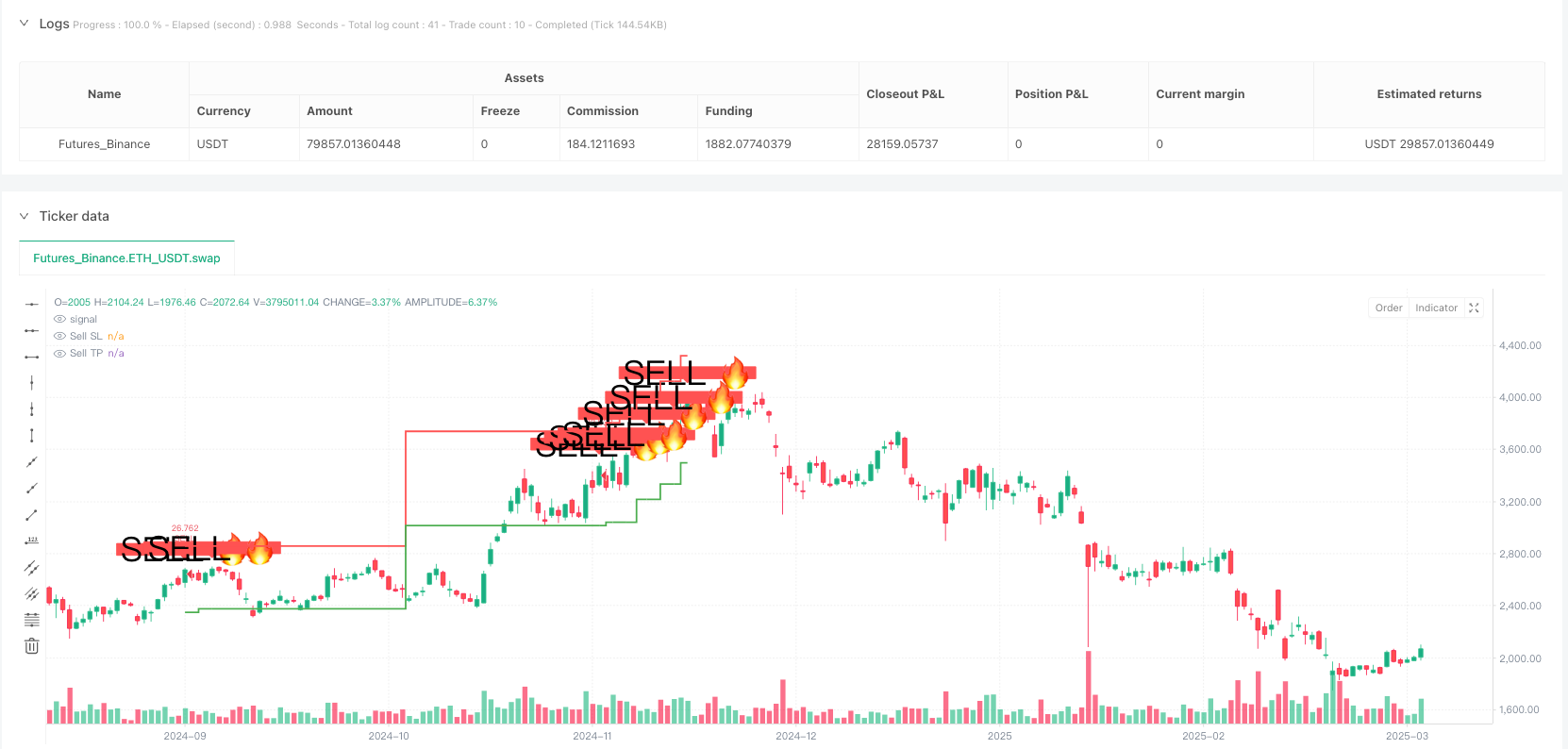

Liquidity Sweep Detection: The strategy identifies liquidity sweep events by comparing current prices with the highest/lowest prices over the past 20 periods. When price breaks above the highest level of the past 20 periods, it’s considered a high liquidity sweep; when price breaks below the lowest level of the past 20 periods, it’s considered a low liquidity sweep. These breakouts typically represent potential turning points in market structure.

High Timeframe Trend Confirmation: The strategy uses a 4-hour timeframe as a trend filter. By comparing the high timeframe’s high point with the lowest point of the past 10 periods, it determines the overall market trend direction. This step ensures that the trading direction aligns with the larger market trend.

Trade Signal Generation: Buy signals are triggered when two conditions are simultaneously met: a low liquidity sweep occurs and the high timeframe trend is upward; sell signals are triggered when two conditions are simultaneously met: a high liquidity sweep occurs and the high timeframe trend is downward.

Dynamic Risk Management: The strategy uses ATR (14 periods) to dynamically calculate stop-loss and take-profit levels. Stop-loss is set at ATR multiplied by the stop-loss multiplier, while take-profit is set at ATR multiplied by the take-profit multiplier, automatically adjusting risk parameters based on market volatility.

The theoretical basis of this approach is that price often reverses after liquidity sweeps, and high timeframe trend confirmation enhances the reliability of trading signals, effectively filtering out low-quality trade setups.

Strategy Advantages

Through in-depth analysis of the strategy’s code implementation, the following significant advantages can be summarized:

High Win-Rate Trading Opportunities: By combining liquidity sweeps with high timeframe trend filtering, the strategy can identify high-probability trading opportunities, significantly improving win rates.

Adaptive Risk Management: Using ATR to dynamically adjust stop-loss and take-profit levels enables risk management to adapt to volatility changes in different market environments, avoiding the limitations of fixed-level stops and targets.

Clear Visual Signals: The strategy displays buy and sell signals and corresponding stop-loss and take-profit levels intuitively on the chart, allowing traders to clearly grasp the risk-reward ratio of each trade.

Multi-Timeframe Analysis Framework: By integrating market information from different timeframes, the strategy can comprehensively grasp market dynamics and reduce false signals.

Automated Execution: The strategy can be fully automated on trading platforms, reducing human intervention and emotional factors, and improving trading discipline.

Flexible Parameter Adjustment: Users can adjust stop-loss and take-profit multipliers according to personal risk preferences and instrument characteristics, achieving strategy customization.

Real-Time Alert Function: The built-in alert function can promptly notify traders of potential trading opportunities, facilitating quick responses to market changes.

Strategy Risks

Despite its multiple advantages, the following potential risk points were identified through code analysis:

False Breakout Risk: The market may exhibit false liquidity sweeps, especially in highly volatile market environments, potentially leading to erroneous signals. Solution: Consider adding confirmation indicators, such as volume confirmation or price pullback confirmation.

Trend Reversal Risk: High timeframe trend determination may have latency; when market trends suddenly reverse, the strategy may generate untimely signals. Solution: Introduce more sensitive trend detection methods or multiple trend confirmation mechanisms.

Parameter Sensitivity: The settings of stop-loss and take-profit multipliers significantly impact strategy performance, and different market environments may require different parameter settings. Solution: Conduct targeted parameter optimization tests or introduce adaptive parameter adjustment mechanisms.

Overtrading Risk: In highly volatile markets, too many liquidity sweep signals may lead to overtrading. Solution: Add signal filtering conditions or set trading cooldown periods.

ATR Calculation Period Impact: The current 14-period ATR may not be responsive enough under certain market conditions. Solution: Test different ATR period settings or use multiple-period ATR combinations.

Single Market Dependency: Strategy performance may vary in different market environments (trending markets, ranging markets). Solution: Add market environment recognition logic and adjust strategy parameters or trading logic for different market states.

Strategy Optimization Directions

Based on code analysis, the strategy can be optimized in the following directions:

Liquidity Sweep Confirmation Mechanism: The current strategy only uses price breakouts as the basis for liquidity sweep determination. Consider adding volume breakout confirmation or price action pattern confirmation to reduce false breakout signals. This optimization can improve signal quality because effective market structure breakouts are usually accompanied by significant volume changes.

Multi-Level Trend Filtering: Introduce trend determination from more timeframes (such as daily, weekly trends) to build a more comprehensive trend confirmation system. Multi-timeframe analysis can provide a more comprehensive market perspective and reduce contradictions between signals.

Dynamic Take-Profit Strategy: Implement dynamic trailing take-profit, such as setting moving take-profit points based on ATR or price fluctuations, to maximize profit potential. This optimization allows for capturing more profit in strong market movements rather than exiting at fixed levels prematurely.

Market Environment Adaptability: Add market environment recognition functionality to dynamically adjust strategy parameters or trading logic in different market states. Market conditions (trending, ranging) significantly impact strategy performance; targeted adjustments can substantially enhance strategy stability.

Signal Quality Scoring System: Develop a signal quality scoring mechanism to rate each signal based on multiple factors (such as trend strength, breakout magnitude, volume confirmation), and only execute high-quality signals. This approach can further improve the strategy’s win rate.

Capital Management Optimization: Introduce more sophisticated capital management logic, such as adjusting position size based on volatility or adjusting trade size based on signal quality scores. Refined capital management is a key factor for long-term profitability.

Machine Learning Enhancement: Consider using machine learning algorithms to optimize parameter selection or signal filtering to adapt to different market environments. Machine learning can identify patterns from historical data that are difficult for humans to discover, enhancing strategy adaptability.

Summary

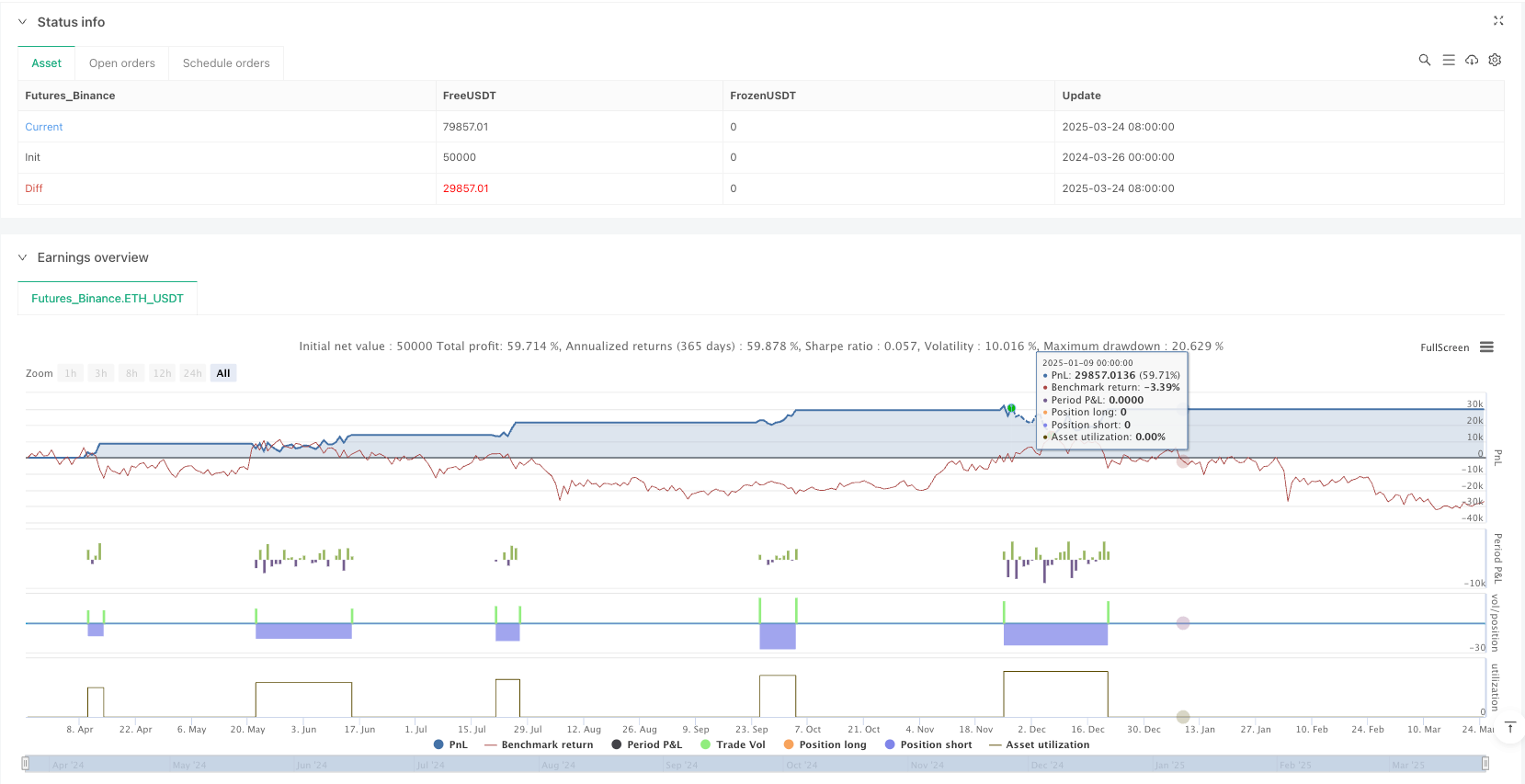

The Multi-Timeframe Liquidity Sweep Trend Confirmation Quantitative Trading Strategy provides traders with a high win-rate trading method by combining liquidity sweep signals with high timeframe trend analysis. The strategy is particularly suitable for short-term trading on 5-minute charts and achieves flexible risk management through ATR dynamic adjustment of risk parameters.

The core advantages of the strategy lie in its multi-timeframe analysis framework and precise liquidity sweep identification capability, which can capture high-probability trading opportunities at key points of market structure changes. At the same time, clear visual signal display and automated execution capabilities enable traders to manage the trading process in a disciplined manner.

Although the strategy has some potential risks, such as false breakouts and parameter sensitivity, through the suggested optimization directions, such as enhanced liquidity sweep confirmation mechanisms, multi-level trend filtering, and dynamic take-profit strategies, the stability and profitability of the strategy can be further improved.

Overall, this is a quantitative trading strategy designed on solid market principles, with a sound theoretical foundation and practical value. Through continuous optimization and targeted adjustments, this strategy can become a powerful tool in a trader’s toolkit, helping to achieve consistent trading performance.

/*backtest

start: 2024-03-26 00:00:00

end: 2025-03-25 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("High-Win-Rate Liquidity AI", overlay=true, shorttitle="Liquidity AI", default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === SETTINGS ===

high_tf = input.timeframe("240", "High Timeframe Bias") // ✅ Fixed timeframe issue

sl_factor = input.float(1.5, "Stop Loss Multiplier", step=0.1)

tp_factor = input.float(3.0, "Take Profit Multiplier", step=0.1)

alerts_on = input(true, "Enable Alerts")

// === HIGH TIMEFRAME BIAS ===

high_tf_high = request.security(syminfo.tickerid, high_tf, high)

high_tf_low = request.security(syminfo.tickerid, high_tf, low)

high_tf_trend = high_tf_high > ta.highest(high_tf_low, 10) ? 1 : -1

// === ENTRY CONDITIONS ===

liq_sweep_high = high > ta.highest(high, 20)[1]

liq_sweep_low = low < ta.lowest(low, 20)[1]

buy_signal = liq_sweep_low and high_tf_trend == 1

sell_signal = liq_sweep_high and high_tf_trend == -1

// === STOP LOSS & TAKE PROFIT ===

long_sl = low - (ta.atr(14) * sl_factor) // SL for Buy

long_tp = low + (ta.atr(14) * tp_factor) // TP for Buy

short_sl = high + (ta.atr(14) * sl_factor) // SL for Sell

short_tp = high - (ta.atr(14) * tp_factor) // TP for Sell

// === PLOT SIGNALS ===

plotshape(buy_signal, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="BUY 🚀")

plotshape(sell_signal, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="SELL 🔥")

// Plot SL & TP

plot(buy_signal ? long_sl : na, style=plot.style_stepline, color=color.red, linewidth=2, title="Buy SL")

plot(buy_signal ? long_tp : na, style=plot.style_stepline, color=color.green, linewidth=2, title="Buy TP")

plot(sell_signal ? short_sl : na, style=plot.style_stepline, color=color.red, linewidth=2, title="Sell SL")

plot(sell_signal ? short_tp : na, style=plot.style_stepline, color=color.green, linewidth=2, title="Sell TP")

// === EXECUTE STRATEGY TRADES ===

if buy_signal

strategy.entry("BUY", strategy.long)

strategy.exit("Take Profit", from_entry="BUY", limit=long_tp, stop=long_sl)

if sell_signal

strategy.entry("SELL", strategy.short)

strategy.exit("Take Profit", from_entry="SELL", limit=short_tp, stop=short_sl)

// === ALERTS ===

if alerts_on and buy_signal

alert("BUY Signal on " + syminfo.ticker + " | TP: " + str.tostring(long_tp) + " | SL: " + str.tostring(long_sl))

if alerts_on and sell_signal

alert("SELL Signal on " + syminfo.ticker + " | TP: " + str.tostring(short_tp) + " | SL: " + str.tostring(short_sl))