Overview

This strategy is a scalping approach that combines multi-timeframe analysis, support and resistance levels, momentum indicators, and volatility measurements. It first identifies support and resistance levels on a higher timeframe (15-minute), then looks for breakout or breakdown signals on the 1-minute chart. The strategy uses Relative Strength Index (RSI) and Average True Range (ATR) to confirm momentum and volatility, while utilizing Exponential Moving Averages (EMA) and volume to confirm trend direction. The strategy implements dynamic stop-loss and take-profit levels adjusted based on ATR, achieving a 2:1 risk-reward ratio.

Strategy Principles

The core principle of this strategy lies in the synergy between multi-timeframe analysis and price momentum. The implementation method is as follows:

Support and Resistance Identification: The strategy uses the 15-minute timeframe to calculate the lowest point over 15 periods as support and the highest point as resistance. These key price levels provide a higher timeframe market structure perspective.

Breakout Confirmation: When the closing price on the 1-minute chart breaks through the aforementioned support or resistance levels, the strategy identifies a potential trading signal. This is specifically manifested as price breaking below support (breakdown confirmation) or breaking above resistance (breakout confirmation).

Momentum and Volatility Filtering: The strategy uses the RSI indicator to confirm price momentum, requiring RSI below 35 for short signals and above 65 for long signals. Additionally, it requires the current ATR to be greater than the 14-period ATR average to ensure sufficient market volatility, and the price must break through support or resistance by a certain margin (0.2 times ATR).

Trend and Volume Confirmation: The strategy uses 9-period and 50-period EMAs as trend indicators, requiring the price to be above both EMAs (for longs) or below both EMAs (for shorts). Furthermore, it requires volume to be greater than the 20-period average volume, ensuring sufficient market participation.

Risk Management: The strategy sets dynamic stop-loss levels based on the highest/lowest price over 5 periods plus/minus 0.2 times ATR. Take-profit targets are set at the entry price plus/minus 2 times ATR, thus achieving a 2:1 risk-reward ratio.

Strategy Advantages

Through in-depth analysis of the strategy code, we can summarize the following advantages:

Multiple Confirmation Mechanisms: The strategy combines price breakouts, momentum indicators, trend indicators, and volume confirmation, greatly reducing the risk of false breakout signals.

Dynamic Risk Management: ATR-based dynamic stop-loss and take-profit settings allow the strategy to automatically adjust risk parameters according to market volatility, maintaining stable risk control in different volatility environments.

Higher Risk-Reward Ratio: By setting a 2:1 risk-reward ratio (take-profit target is 10 times the stop-loss range), long-term profitability may be achieved even with a lower win rate.

Multi-Timeframe Synergy: By combining 15-minute and 1-minute timeframes, the strategy can maintain short-term flexibility while gaining structural support from higher timeframes.

Market Structure-Based Trading: The strategy is based on the classic market structure theory of support and resistance, which are often active zones for large market participants and have a higher probability of success.

Strategy Risks

Despite its multiple advantages, the strategy still has the following potential risks in practical application:

Frequent Trading Risk: As a scalping strategy on the 1-minute chart, it may generate a large number of trading signals, leading to overtrading and higher transaction costs.

Market Noise Impact: On lower timeframes, market noise is greater, and unnecessary trades may still be triggered even with multiple filtering mechanisms.

Fast Market Risk: During major news or extreme market conditions, prices may quickly break through stop-loss levels, resulting in actual losses exceeding expectations.

Parameter Optimization Risk: The strategy uses multiple fixed parameters (such as RSI 35⁄65 thresholds, ATR multipliers, etc.), which may need to be re-optimized in different market environments.

Trend Reversal Risk: Despite using EMA filtering, the strategy may still generate signals when a trend is about to reverse, especially in consolidating markets.

To mitigate these risks, it is recommended to: - Limit the number of daily trades to avoid overtrading - Analyze the overall trend in higher timeframes before trading - Consider pausing trading during major economic data releases - Regularly backtest and optimize strategy parameters - Combine other indicators such as trend strength indicators for trade filtering

Optimization Directions

After in-depth analysis, the strategy can be further optimized in the following directions:

Adaptive Parameter Adjustment: The current strategy uses fixed RSI thresholds and ATR multipliers. Consider automatically adjusting these parameters based on market volatility or trend strength, for example, using stricter RSI thresholds and larger ATR multipliers in high-volatility environments.

Market Environment Filtering: Add a market environment recognition module to distinguish between trending and consolidating markets, and adjust strategy parameters or pause trading accordingly. For example, the Average Directional Index (ADX) can be used to evaluate trend strength.

Time Filtering: Some market sessions have lower liquidity or more unpredictable volatility. Adding time filters can help avoid trading during these periods.

Multi-Instrument Correlation Filtering: Add references to related markets or indices, only trading when the direction of related markets is consistent. For example, only going long on individual stocks when the overall stock index trend is upward.

Take-Profit and Stop-Loss Optimization: Consider implementing a partial profit-taking strategy, such as closing part of the position when reaching 1 times ATR and the remainder at 2 times ATR, to improve overall profitability.

Machine Learning Enhancement: Machine learning algorithms can be used to optimize parameter selection, or models can be trained on historical data to predict which breakout signals are more likely to succeed.

Implementing these optimization directions will help improve the strategy’s stability and profitability, especially its adaptability in different market environments.

Summary

The Multi-Timeframe Support-Resistance Momentum Scalping Strategy combines various classic methods in technical analysis, including support and resistance, trend following, momentum confirmation, and volume analysis. By identifying key price levels on higher timeframes and executing trades on lower timeframes, the strategy maintains flexibility while gaining more reliable market structure support.

The strategy’s dynamic risk management mechanism and 2:1 risk-reward setup provide good long-term profit potential. However, as a scalping strategy, users need to pay attention to controlling transaction costs and the risk of overtrading. Through appropriate market environment filtering and parameter optimization, the strategy’s stability and adaptability can be further improved.

For quantitative traders pursuing short-term trading opportunities, this strategy provides a structured framework, but it is recommended to conduct thorough historical backtesting and paper trading before live trading to ensure the strategy performs as expected in different market environments.

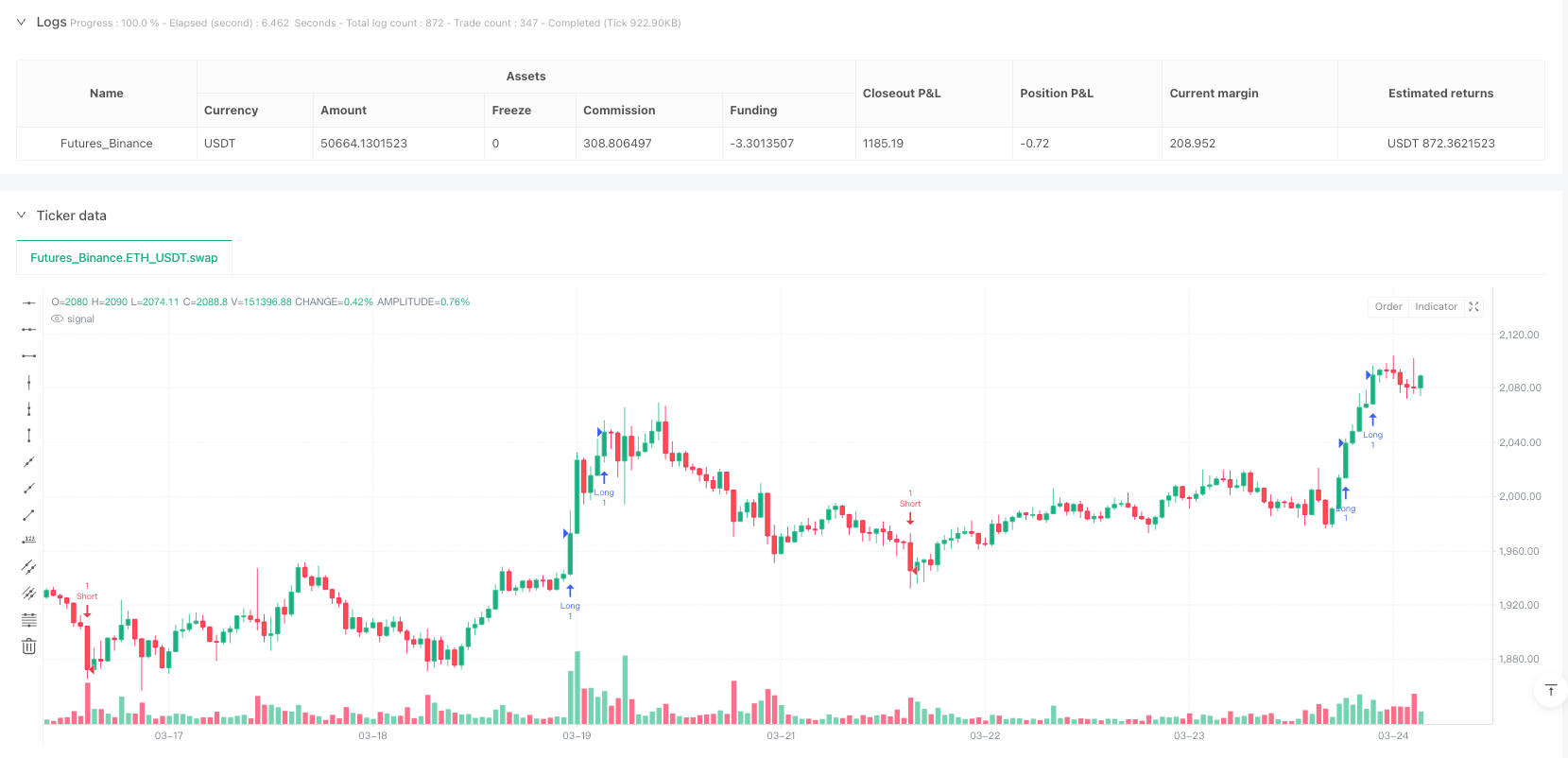

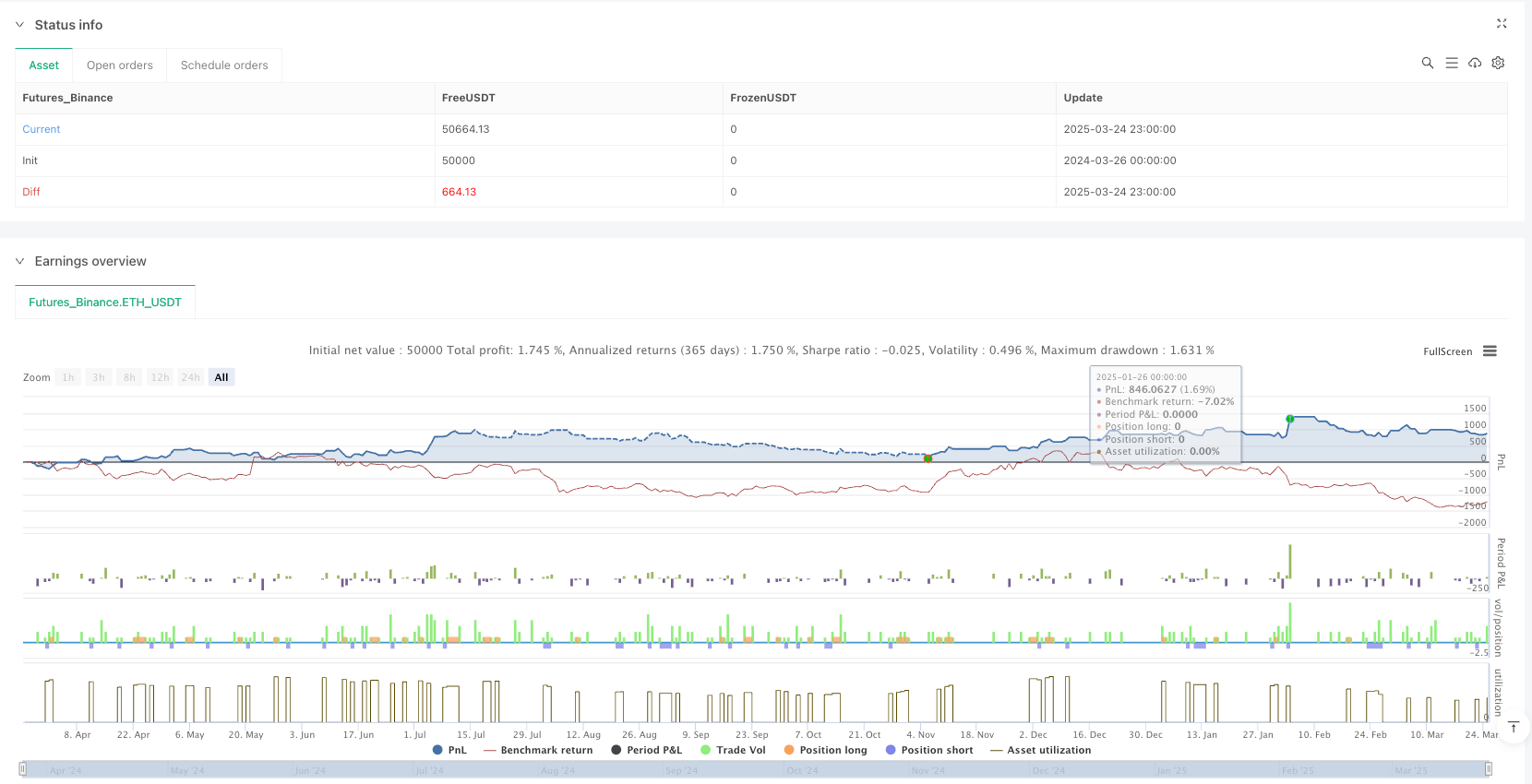

/*backtest

start: 2024-03-26 00:00:00

end: 2025-03-25 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Support & Resistance Scalping", overlay=true)

// Identify Higher Timeframe Support & Resistance Levels

htf = "15"

htfLow = request.security(syminfo.tickerid, htf, ta.lowest(low, 15))

htfHigh = request.security(syminfo.tickerid, htf, ta.highest(high, 15))

// Detect Breakdown & Breakout on 1-Minute Chart with Confirmation

breakdownConfirmed = ta.crossunder(close, htfLow) and close < htfLow

breakoutConfirmed = ta.crossover(close, htfHigh) and close > htfHigh

// Momentum Confirmation (RSI and ATR for Volatility)

rsiValue = ta.rsi(close, 14)

atr = ta.atr(14)

avgAtr = ta.sma(atr, 14)

strongDownMomentum = rsiValue < 35 and close < htfLow - atr * 0.2 and atr > avgAtr

strongUpMomentum = rsiValue > 65 and close > htfHigh + atr * 0.2 and atr > avgAtr

// Trend Confirmation using EMA

emaFast = ta.ema(close, 9)

emaSlow = ta.ema(close, 50) // Added 50 EMA for stronger trend confirmation

volumeAvg = ta.sma(volume, 20) // Average volume for confirmation

highVolume = volume > volumeAvg // Require higher volume on breakdown

shortCondition = breakdownConfirmed and strongDownMomentum and close < emaFast and close < emaSlow and highVolume

longCondition = breakoutConfirmed and strongUpMomentum and close > emaFast and close > emaSlow and highVolume

// Dynamic Stop-Loss & Take-Profit Adjustments (Improved R:R 2:1)

shortSL = ta.highest(high, 5) + atr * 0.2 // Reduced SL multiplier to limit risk

shortTP = close - atr * 2.0 // Increased TP for better reward

longSL = ta.lowest(low, 5) - atr * 0.2 // Reduced SL multiplier to limit risk

longTP = close + atr * 2.0 // Increased TP for better reward

// Execute Trades with Entry and Exit Markers

if (shortCondition)

strategy.entry("Short", strategy.short)

label.new(bar_index, close, "▼", color=color.red, textcolor=color.white, size=size.small)

strategy.exit("Take Profit Short", from_entry="Short", limit=shortTP, stop=shortSL)

label.new(bar_index, shortTP, "▲", color=color.green, textcolor=color.white, size=size.small)

if (longCondition)

strategy.entry("Long", strategy.long)

label.new(bar_index, close, "▲", color=color.green, textcolor=color.white, size=size.small)

strategy.exit("Take Profit Long", from_entry="Long", limit=longTP, stop=longSL)

label.new(bar_index, longTP, "▼", color=color.red, textcolor=color.white, size=size.small)