Overview

The Dynamic ATR Swing Breakout Strategy is a quantitative trading approach that combines technical indicators with risk management techniques. It primarily identifies entry opportunities when price breaks above historical highs while positioned above a long-term moving average. The strategy employs a dynamic risk management system based on ATR (Average True Range) and designs a multi-tiered profit-taking plan, while using moving averages for trend confirmation and final exit signals. This strategy is particularly suitable for medium to long-term swing trading, allowing traders to capture significant upward movements while effectively controlling risk and securing profits.

Strategy Principles

The core logic of this strategy is based on the following key elements:

Trend Confirmation and Entry Conditions: The strategy uses a 50-day Simple Moving Average (SMA) as a trend filter, only considering entries when price is above the 50-day MA, ensuring that trades align with the medium-term trend. The entry signal is triggered when price breaks above the highest point of the past 20 periods, a classic breakout trading signal indicating the potential start of a new upward move.

ATR-Based Risk Management: The strategy uses a 14-period ATR to dynamically set stop losses and profit targets, rather than fixed points. This allows the strategy to automatically adjust according to market volatility, setting wider stops and targets in volatile markets and narrower ranges in less volatile conditions. The initial stop loss is set at 1 ATR below the entry price.

Multi-Tiered Profit Strategy:

- The first profit target is set at 2 ATR above the entry price, at which point 25% of the position is closed

- When the price exceeds the 10-day MA by more than 2 ATR, considered an overextension, another 25% of the position is closed

- The final exit signal is triggered when price falls below the 10-day MA, closing the remaining position

Dynamic Stop Loss Adjustment: After reaching the first profit target, the stop loss level is raised to breakeven or the lowest point of the past 4 candles (whichever is higher), this trailing stop mechanism effectively locks in profits already gained.

Strategy Advantages

Combination of Trend Following and Momentum: The strategy utilizes both trend following (via moving averages) and momentum breakout (via historical high breakouts) trading concepts, increasing the reliability of entry signals.

Dynamic Risk Control: Using ATR to set stop loss and target positions allows the strategy to adapt to volatility changes in different market environments, avoiding the problem of fixed-point stops triggering too early in highly volatile markets.

Gradual Profit-Taking Mechanism: By adopting a staged position-closing approach, the strategy both secures partial profits when price reaches targets and allows remaining positions to continue benefiting from potential large upward movements, implementing the trading philosophy of “letting profits run.”

Adaptive Stop Loss Adjustment: Moving the stop loss higher after partial profit-taking reduces the overall risk of a single trade while protecting already secured profits.

Clear Exit Conditions: Using the 10-day MA as the final exit signal avoids subjective judgment, making the strategy more systematic and disciplined.

Integrated Capital Management: The strategy combines risk percentage (0.3%) with ATR, maintaining consistent risk exposure for each trade, contributing to long-term stable capital growth.

Strategy Risks

False Breakout Risk: Price may quickly retrace after breaking above the highest point, resulting in false breakouts. Solutions include: adding volume confirmation, using longer timeframe breakout confirmation, or adding requirements for breakout duration.

Delayed Exit in Trend Reversals: Relying on the 10-day MA as an exit signal may react too slowly in rapidly reversing markets, leading to profit giveback. Consider incorporating other more sensitive indicators such as RSI overbought zones or price channel breakouts as supplementary exit conditions.

Parameter Sensitivity: Strategy performance is quite sensitive to the choice of moving average periods (10 and 50) and ATR period (14). It is recommended to backtest different parameter combinations on historical data to find optimal parameters for specific markets.

Insufficient Drawdown Control: Despite the stop-loss mechanism, actual stop points may be far lower than expected during rapid and significant market declines (such as gap-down openings), increasing risk. Consider setting maximum drawdown limits or using options to hedge extreme risks.

Consecutive Loss Risk: Any strategy may experience periods of consecutive losses, especially in ranging, choppy markets where breakout signal reliability decreases. It is recommended to implement an overall capital management plan that limits the percentage of capital used by any single strategy.

Strategy Optimization Directions

Entry Signal Optimization:

- Add volume confirmation conditions, confirming breakouts only when volume significantly increases

- Consider adding momentum indicators such as Relative Strength Index (RSI) or Stochastic as auxiliary confirmation

- Test different historical high periods (currently 20) to find the optimal balance

Stop Loss Strategy Improvements:

- Test different ATR multiples (currently 1x), as 1.5x or 2x ATR may be more suitable in certain markets

- Implement intelligent stops based on support levels, rather than simple ATR multiples

- Consider implementing time-based stops, exiting when price fails to reach expected targets within a specific timeframe

Profit Strategy Refinement:

- Optimize partial profit-taking proportions (currently 25% and 25%), testing different allocations like 20%/30%/50%

- Try targets based on Fibonacci extensions rather than fixed ATR multiples

- Implement intelligent target setting based on market structure (such as high-low formations)

Trend Filter Enhancement:

- Test multi-timeframe trend confirmation, such as requiring both daily and weekly moving averages to be in uptrends

- Add ADX (Average Directional Index) indicator to confirm trend strength

- Consider using Exponential Moving Averages (EMA) instead of Simple Moving Averages (SMA) for greater sensitivity to price changes

Adaptive Optimization:

- Implement mechanisms that automatically adjust parameters based on market volatility

- Use different parameter sets for different market states (trending, ranging, high volatility, low volatility)

- Incorporate machine learning algorithms to dynamically optimize parameters, such as adjusting strategy parameters based on recent market behavior through reinforcement learning

Summary

The Dynamic ATR Swing Breakout Strategy is a comprehensive trading system combining technical analysis, risk management, and systematic trading. The strategy confirms entry timing through moving averages and breakout confirmation, uses ATR-based dynamic risk management to set stops and targets, and employs a multi-tiered exit mechanism to lock in profits while preserving upside potential.

The main advantage of the strategy lies in its systematic approach to risk control and profit management, achieving adaptability to different market environments by combining risk units ® with ATR. The multi-tiered profit mechanism effectively balances the contradiction between securing profits and following trends, implementing the trading philosophy of “cut losses short, let profits run.”

However, the strategy also faces risks such as false breakouts, parameter sensitivity, and potential drawdowns. Traders are recommended to optimize parameters through backtesting and consider enhancing strategy effectiveness by adding volume confirmation, multi-timeframe trend filtering, and other methods. At the same time, any trading strategy should be part of a complete trading system, combined with appropriate capital management and risk control to achieve long-term stable trading results.

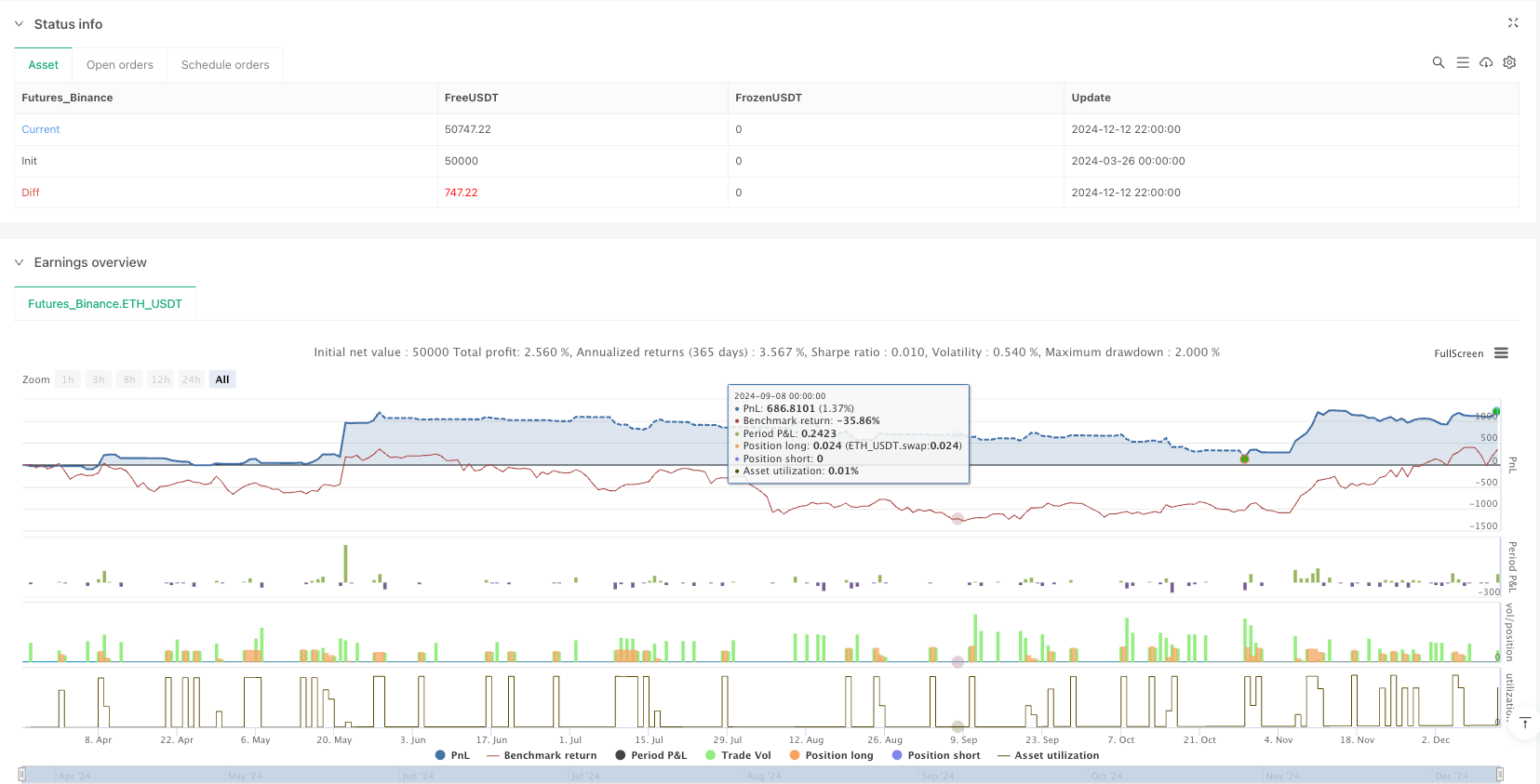

/*backtest

start: 2024-03-26 00:00:00

end: 2024-12-13 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Swing Trading Bot", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Define Moving Averages

ma50 = ta.sma(close, 50)

ma10 = ta.sma(close, 10)

// Entry Condition: Price above 50-day MA and breakout above recent high

highestHigh = ta.highest(high, 20)

entryCondition = close > ma50 and high > highestHigh[1]

// Define Risk Unit (R)

riskPercentage = 0.3 // Define risk percentage per trade

atrValue = ta.atr(14)

stopLoss = close - 1 * atrValue // Initial stop loss at -1R

// Initial take profit levels

firstProfitTarget = close + 2 * atrValue

secondProfitTarget = close + 4 * atrValue

// Variables for tracking position

var float entryPrice = na

var float stopLevel = na

var float firstSellPrice = na

var float secondSellPrice = na

var int positionSize = 0

// Entry logic

if entryCondition

strategy.entry("SwingEntry", strategy.long)

entryPrice := close

stopLevel := stopLoss

firstSellPrice := firstProfitTarget

secondSellPrice := secondProfitTarget

positionSize := 100

// Stop Loss Logic (Adjustable after first exit)

stopLossCondition = close < stopLevel

if stopLossCondition

strategy.close("SwingEntry", comment="Stop Loss Hit")

// First partial sell (25-30% at 2-2.5R profit)

firstSellCondition = close >= firstSellPrice

if firstSellCondition and positionSize > 0

strategy.close("SwingEntry", qty_percent=25, comment="Partial Exit at 2R")

stopLevel := math.max(entryPrice, ta.lowest(low, 4)) // Adjust stop to breakeven or lowest of last 4 candles

positionSize -= 25

// Second partial sell (25% if price moves far above MA10)

distanceFromMA10 = close - ma10

secondSellCondition = distanceFromMA10 > 2 * atrValue

if secondSellCondition and positionSize > 0

strategy.close("SwingEntry", qty_percent=25, comment="Partial Exit - Overextended")

positionSize -= 25

// Final exit (when price closes below 10-day MA)

finalExitCondition = close < ma10

if finalExitCondition and positionSize > 0

strategy.close("SwingEntry", comment="Final Exit - MA10 Cross")

positionSize = 0