Overview

The Multi-Indicator MACD Momentum Options Strategy is a quantitative trading system designed to capture strong momentum shifts in the market. This strategy integrates multiple technical indicators, including MACD crossover signals, percentage-based MACD divergence analysis, 50-period moving average, RSI confirmation signals, and volume filters. Through the synergistic action of these indicators, the strategy accurately identifies high-probability trading opportunities. Primarily targeting the 30-minute timeframe, it’s especially suitable for options trading, utilizing call options to capture upward movements and put options for downward trends. Additionally, the strategy implements strict risk management mechanisms, including a 1% stop-loss and 2% take-profit, ensuring disciplined capital management.

Strategy Principle

The core principle of this strategy is to identify momentum shifts through multi-indicator confirmation, with specific logic including:

MACD Indicator Crossover: Using MACD with fast period 12, slow period 26, and signal smoothing period 9. When the MACD line crosses above the signal line, consider buying call options; when it crosses below, consider buying put options.

Percentage MACD Divergence Analysis: Calculate the percentage difference between the MACD line and signal line. When this difference exceeds the set threshold (default 1%), confirm momentum strength.

Trend Filtering: Use a 50-period moving average as trend direction confirmation. Price must be above the MA to consider buying calls and below it to consider buying puts.

RSI Filtering: Use a 14-period RSI indicator for overbought/oversold determination. RSI value must be greater than 30 to consider buying calls and less than 70 to consider buying puts.

Volume Confirmation: Require current volume to be higher than the 20-period average volume, ensuring sufficient market participation.

When all the above conditions are met, the strategy generates a trading signal. Conditions for buying call options are: MACD crosses above signal line, percentage difference exceeds threshold, price is above 50-period MA, RSI is greater than 30, and volume is above average. Conditions for buying put options are: MACD crosses below signal line, percentage difference is below negative threshold, price is below 50-period MA, RSI is less than 70, and volume is above average.

The exit strategy employs a fixed percentage mechanism, including a 1% stop-loss and 2% take-profit, creating an asymmetric risk-reward ratio (1:2) that helps improve the strategy’s overall expected return.

Strategy Advantages

Multi-Indicator Collaborative Confirmation: Combining MACD, moving averages, RSI, and volume indicators significantly reduces the possibility of false signals and improves trading signal reliability.

Momentum Percentage Quantification: By calculating the percentage difference between MACD and signal line, momentum strength becomes quantifiable, effectively filtering weak signals and capturing only movements with sufficient momentum.

Bidirectional Trading Mechanism: The strategy can capture upward trends through call options and downward trends through put options, realizing profit potential across all market conditions.

Strict Risk Management: Clear stop-loss and take-profit levels ensure that maximum loss per trade does not exceed 1%, while potential returns can reach 2%, forming a favorable risk-reward ratio.

High Adaptability: The strategy is particularly suitable for markets and assets with higher volatility, especially for options trading, effectively utilizing leverage to amplify returns.

Operational Clarity: The strategy provides clear entry and exit conditions, reducing subjective judgment and making the trading process more standardized and systematic.

Built-in Alert Functionality: The strategy includes alert condition settings, facilitating automated trading or manual execution, improving trading efficiency.

Strategy Risks

Signal Lag: Indicators based on MACD and moving averages inherently have a certain lag, potentially causing missed optimal entry or exit points in rapidly changing markets.

Over-optimization Risk: Multiple indicator combinations may cause the strategy to perform well on historical data but face uncertain adaptability to future markets, presenting a risk of overfitting.

Ranging Market Challenges: In sideways markets lacking clear trends, the strategy may produce frequent false signals, leading to consecutive losses.

Fixed Stop-Loss Positioning: Using a fixed percentage stop-loss may not adapt to volatility characteristics across different market conditions, sometimes being too tight and easily triggered, other times too loose to stop losses timely.

Options-Specific Risks: Since the strategy targets options trading, there are options-specific risk factors such as time decay and implied volatility changes that can affect strategy performance.

Parameter Sensitivity: Strategy performance may be highly sensitive to parameter settings (such as MACD parameters, momentum threshold, MA period), with small parameter changes potentially leading to significantly different results.

Volume Dependency: Reliance on high volume means the strategy may struggle to generate effective signals in markets or time periods with lower liquidity.

Strategy Optimization Directions

Dynamic Parameter Adjustment: Consider dynamically adjusting MACD parameters and momentum thresholds based on market volatility, increasing thresholds in high-volatility environments and decreasing them in low-volatility environments to adapt to different market states.

Enhanced Market Environment Filtering: Introduce volatility indicators (such as ATR or VIX) to identify the current market environment and adjust strategy parameters or pause trading accordingly.

Improved Stop-Loss Mechanism: Replace fixed percentage stop-losses with ATR-based dynamic stop-losses to better adapt to market volatility characteristics, giving prices more room in highly volatile markets.

Options Characteristic Optimization: Consider incorporating options Greeks (such as Delta, Theta, Vega) into decision logic to select optimal option contracts and expiration dates.

Time Filtering: Add time filtering conditions to avoid high volatility periods around market opening and closing, or focus on specific trading sessions to improve signal quality.

Profit Locking Mechanism: Implement stepped take-profit levels, moving stop-loss points to cost or profit points after prices reach specific profit levels, securing partial profits.

Machine Learning Enhancement: Consider using machine learning methods to optimize parameter selection and signal generation, training models on historical data to predict the best trading opportunities.

Multi-Timeframe Confirmation: Use trend direction from higher timeframes (such as daily or weekly) as additional filtering conditions to ensure trade direction aligns with broader market trends.

Summary

The Multi-Indicator MACD Momentum Options Strategy is a systematic trading approach combining multiple technical indicators, particularly suitable for options trading. Through MACD crossover signals, percentage momentum measurement, moving average trend confirmation, RSI overbought/oversold filtering, and volume confirmation, the strategy can identify trading opportunities with high probability of success. Strict risk management mechanisms ensure capital safety, providing traders with a structured decision-making framework.

Although the strategy has advantages such as multi-indicator confirmation, bidirectional trading capability, and clear risk control, it also faces challenges including signal lag, over-optimization, and poor performance in ranging markets. To further enhance the strategy’s robustness and adaptability, consider introducing dynamic parameter adjustment, market environment filtering, improved stop-loss mechanisms, and multi-timeframe confirmation.

Overall, this strategy provides options traders with a systematic approach, confirming market momentum from multiple angles combined with strict risk management, with the potential to achieve stable returns in appropriate market environments. However, any strategy requires thorough backtesting and validation. It is recommended to test on a demo account before live implementation and continuously adjust and optimize based on actual market feedback.

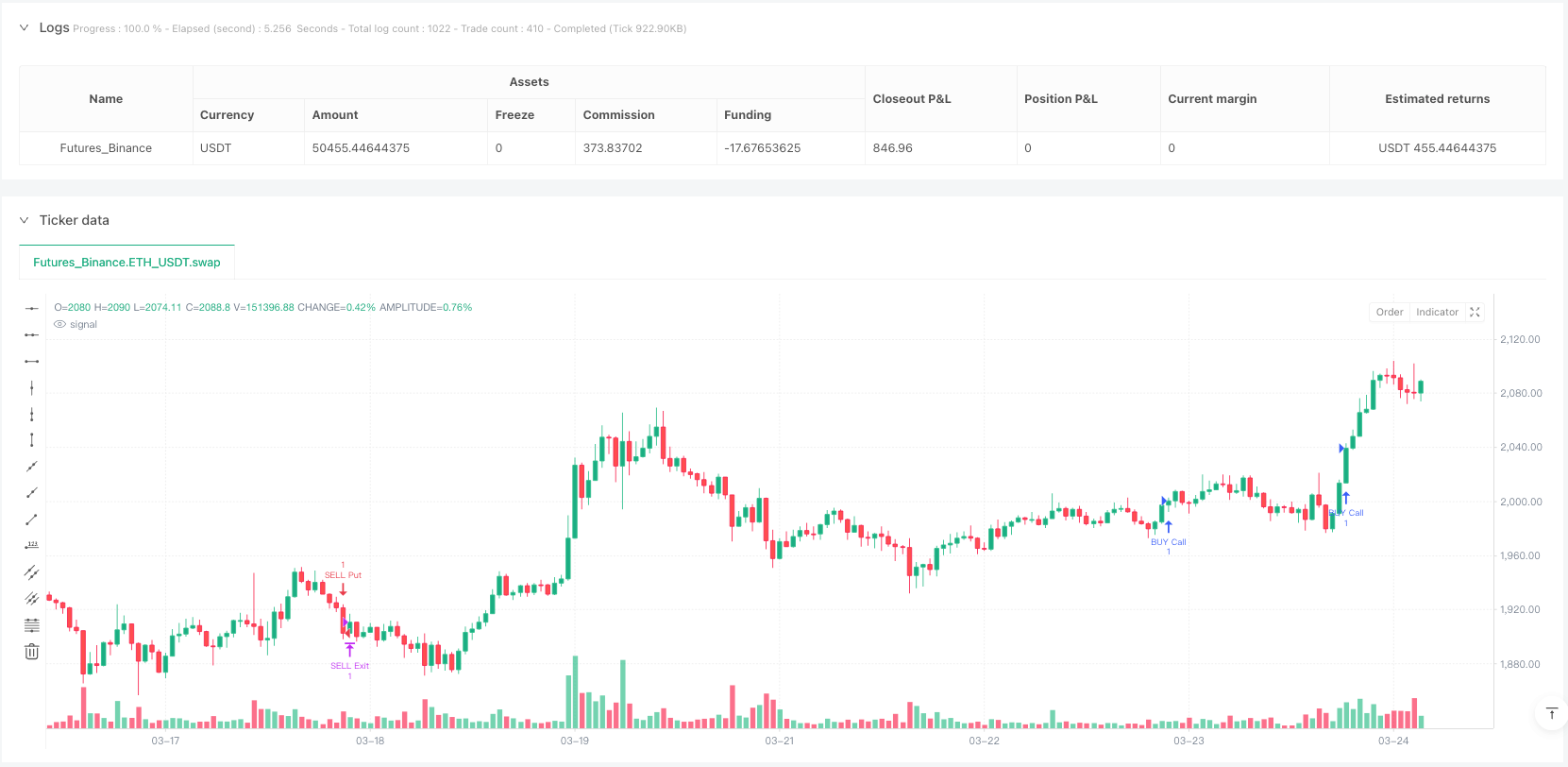

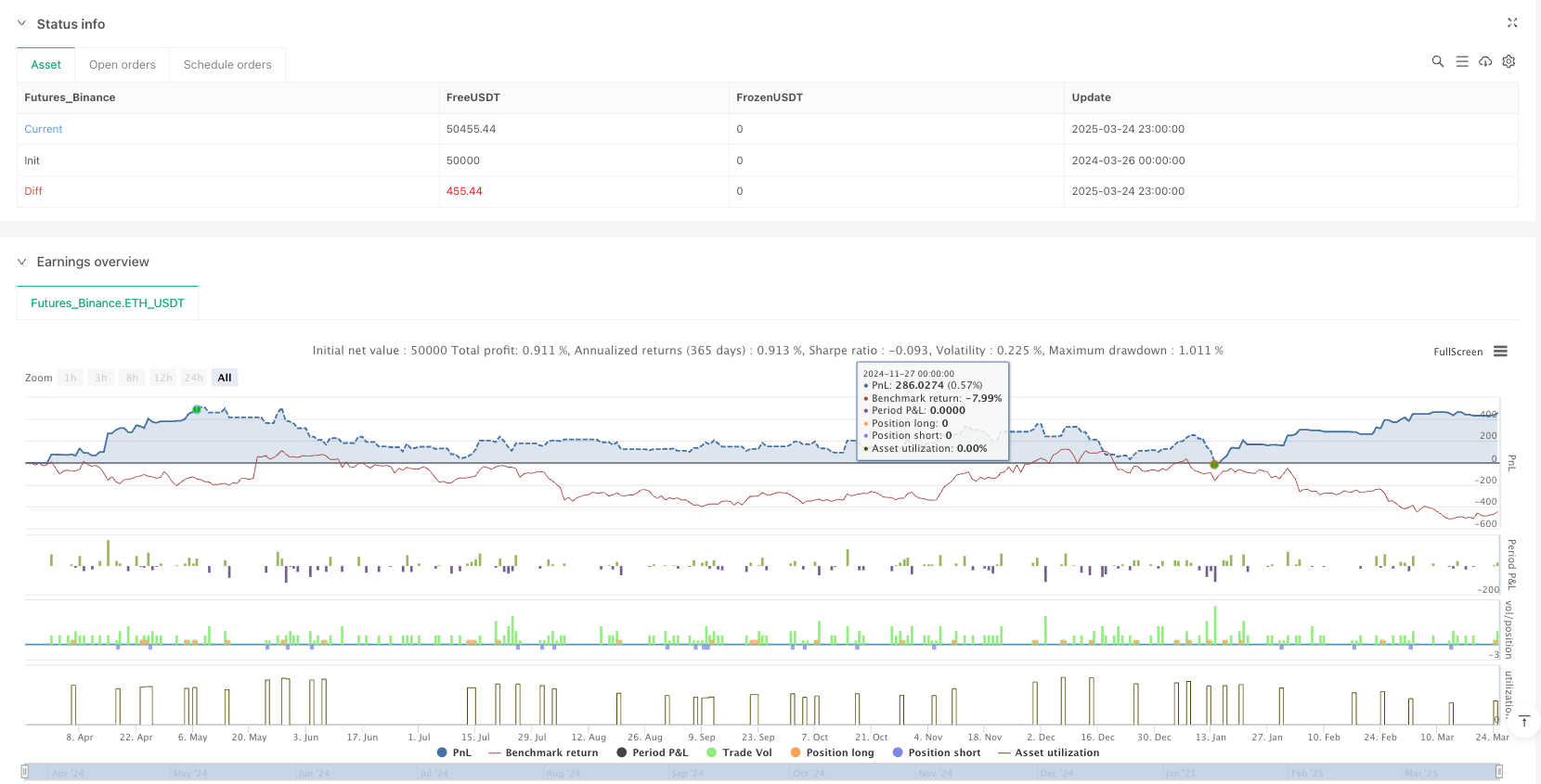

/*backtest

start: 2024-03-26 00:00:00

end: 2025-03-25 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("MACD Options Trader - 30-Min (Simplified)", overlay=true)

// MACD Settings

fastLength = 12

slowLength = 26

signalSmoothing = 9

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

// Calculate the percentage difference between MACD and Signal Line

percentDiff = ((macdLine - signalLine) / math.abs(signalLine)) * 100

// Threshold for detecting sharp moves (more aggressive threshold)

sharpMoveThreshold = input.float(1.0, title="Sharp Move Threshold (%)") // Increased threshold for faster moves

// Trend Filter (50-period Moving Average)

maLength = 50

ma = ta.sma(close, maLength)

// RSI Filter (Overbought/Oversold Levels)

rsiLength = 14

rsi = ta.rsi(close, rsiLength)

rsiOverbought = 70 // Overbought threshold

rsiOversold = 30 // Oversold threshold

// Volume Filter: Confirm trades with high volume

volumeFilter = ta.sma(volume, 20) // 20-period average volume

isHighVolume = volume > volumeFilter

// Entry Conditions: Buy signal if MACD shows sharp move, price above MA, RSI > 30, and high volume

bullishMove = ta.crossover(macdLine, signalLine) and percentDiff > sharpMoveThreshold and close > ma and rsi > rsiOversold and isHighVolume

bearishMove = ta.crossunder(macdLine, signalLine) and percentDiff < -sharpMoveThreshold and close < ma and rsi < rsiOverbought and isHighVolume

// Exit Conditions: Stop-Loss & Take-Profit for risk management

stopLossPercent = input.float(1, title="Stop-Loss %") / 100 // Aggressive Stop-Loss (1%)

takeProfitPercent = input.float(2, title="Take-Profit %") / 100 // Aggressive Take-Profit (2%)

// Execute Buy & Sell Orders for SPY, Tesla, Apple, and ETFs

if bullishMove

strategy.entry("BUY Call", strategy.long)

if bearishMove

strategy.entry("SELL Put", strategy.short)

// Define Stop-Loss & Take-Profit Prices

entryPrice = strategy.position_avg_price

stopLossPrice = entryPrice * (1 - stopLossPercent)

takeProfitPrice = entryPrice * (1 + takeProfitPercent)

// Exit Conditions for positions

strategy.exit("BUY Exit", from_entry="BUY Call", limit=takeProfitPrice, stop=stopLossPrice)

strategy.exit("SELL Exit", from_entry="SELL Put", limit=takeProfitPrice, stop=stopLossPrice)

// Alerts for Auto-Trading (options trades)

alertcondition(bullishMove, title="BUY Call Alert", message="Bullish MACD crossover. Signal for buying SPY/Tesla/Apple Calls.")

alertcondition(bearishMove, title="SELL Put Alert", message="Bearish MACD crossunder. Signal for buying SPY/Tesla/Apple Puts.")