Multi-Factor Spinning Top Reversal Strategy with Risk-Reward Optimization

Spinning Top Price Action Trend Reversal RRR SL TP

Overview

The Multi-Factor Spinning Top Reversal Strategy with Risk-Reward Optimization is a quantitative trading strategy based on candlestick patterns and price action. This strategy primarily identifies specific Spinning Top candlestick formations, combined with color reversal signals after consecutive same-colored candles, establishing trading opportunities at potential market reversal points. The strategy incorporates automated Stop-Loss (SL) and Take-Profit (TP) mechanisms, adopting a 1:1.5 risk-reward ratio, effectively balancing risk management and profit optimization. This strategy is suitable for traders seeking clear entry points, fixed risk control, and definite profit targets.

Strategy Principles

The core principles of this strategy combine multiple technical analysis factors to form a comprehensive trading system:

Color Continuity and Reversal Detection: The strategy first identifies three consecutive candles of the same color (three consecutive bullish or bearish candles), then looks for a color reversal on the fourth candle. This pattern typically indicates that market sentiment may be changing.

Spinning Top Pattern Recognition: The strategy further filters for candles with “Spinning Top” characteristics, which have the following features:

- Small body (the body part of the candle is less than 30% of the entire candle’s height)

- Balanced upper and lower wicks (the difference between upper and lower wicks does not exceed 20% of the entire candle’s height)

Integrated Signal Trigger: A trading signal is only triggered when both the color reversal and Spinning Top pattern occur simultaneously.

Automated Risk Management:

- Long signals: Entry price is the closing price, stop-loss is set 4 points below the low, and profit target is 1.5 times the risk

- Short signals: Entry price is the closing price, stop-loss is set 4 points above the high, and profit target is 1.5 times the risk

The strategy implements a fully automated trading decision process, from market state analysis and pattern recognition to position management and exit strategies, forming a complete trading system loop.

Strategy Advantages

Through in-depth analysis, this strategy demonstrates the following significant advantages:

Multi-Factor Confirmation Mechanism: The combination of consecutive same-colored candles, color reversal, and specific pattern confirmation effectively reduces false signals and improves trading quality.

Precise Pattern Definition: Through strict mathematical definitions (body size ratio, wick balance, etc.), subjective pattern recognition is transformed into objective quantitative standards.

Automated Risk Management: The built-in stop-loss and take-profit mechanisms ensure that each trade has predefined risk limits and clear profit objectives, eliminating the need for subjective judgment by the trader.

Optimized Risk-Reward Ratio: The 1:1.5 risk-reward ratio means that even with a win rate of only 40%, the strategy can theoretically still be profitable, providing a statistical advantage.

Visualized Trading Signals: The strategy generates clear visual markers, including labels and graphic boxes showing entry price, stop-loss, and take-profit levels, allowing traders to visually assess each trade.

Integrated Capital Management: The strategy uses a percentage of account equity (10%) for position sizing, automatically adjusting trade size as the account grows.

Strategy Risks

Despite its well-designed structure, the strategy still has the following potential risks:

False Breakout Risk: The market may continue its original trend after showing color reversal and Spinning Top patterns, triggering stop-losses. A solution is to consider adding additional filtering conditions, such as trend indicators or volume confirmation.

Fixed Stop-Loss Risk: The strategy uses a fixed point value (4 points) to set stop-losses, which may not be suitable for all markets and timeframes. An improvement would be to use dynamic indicators like ATR (Average True Range) to adjust stop-loss distances.

Overtrading Risk: In oscillating markets, qualifying signals may appear frequently, increasing trading costs. It is recommended to add trading frequency limitations or trend filters.

Market Gap Risk: In scenarios with large gaps, prices may jump directly past stop-loss levels, causing actual losses to exceed expectations. Consider using options or other derivatives as hedging tools.

Parameter Sensitivity: The strategy relies on specific parameters (such as 30% body ratio, 20% wick balance), which may need adjustment in different markets. Backtesting optimization and sensitivity analysis are recommended.

Strategy Optimization Directions

Based on an in-depth analysis of the strategy logic, here are possible optimization directions:

Dynamic Stop-Loss Mechanism: Replace fixed point stop-losses with ATR-based dynamic stop-losses to better adapt to changes in market volatility. This would tighten stops during low volatility periods and widen them during high volatility periods, better matching market characteristics.

Market Environment Filtering: Add market state recognition mechanisms, such as trend strength indicators or volatility filters, to trade only in market environments suitable for the strategy. For example, avoid counter-trend trading in strong trend markets, or adjust parameters in high volatility environments.

Time Filtering: Add time filtering conditions to avoid periods with high volatility such as important economic data releases or market open/close times, reducing noise signals.

Adaptive Parameters: Implement adaptive parameter adjustment, dynamically adjusting pattern recognition standards based on recent market behavior, such as adjusting the definition of “small body” based on the average body ratio of the last N candles.

Multiple Timeframe Confirmation: Add multiple timeframe analysis to ensure that the trading direction is consistent with the trend in larger timeframes, improving win rates.

Dynamic Risk-Reward Adjustment: Dynamically adjust the risk-reward ratio based on market conditions and historical performance, pursuing higher returns in favorable environments and trading conservatively in unfavorable environments.

Machine Learning Optimization: Utilize machine learning techniques to identify optimal parameter combinations and market conditions, further enhancing strategy performance and adaptability.

Conclusion

The Multi-Factor Spinning Top Reversal Strategy with Risk-Reward Optimization is a complete trading system combining technical analysis and quantitative methods. It provides a systematic trading framework by identifying specific candlestick patterns and price action models, coupled with strict risk management rules.

The core advantages of this strategy lie in its multi-factor confirmation mechanism, precise pattern definition, and automated risk management, which effectively reduce subjective judgment and improve trading consistency. Meanwhile, the built-in 1:1.5 risk-reward ratio provides the strategy with a statistical advantage for long-term profitability.

However, traders should be aware of potential risks when applying this strategy, such as false breakout risks, limitations of fixed stop-losses, and the impact of market environments. By implementing the suggested optimization measures, such as dynamic stop-losses, market environment filtering, and parameter adaptation, the robustness and adaptability of the strategy can be further enhanced.

Ultimately, this strategy not only provides clear trading rules but also demonstrates how to transform subjective technical analysis into an objective quantitative system, offering a methodological framework worth referencing in the field of quantitative trading.

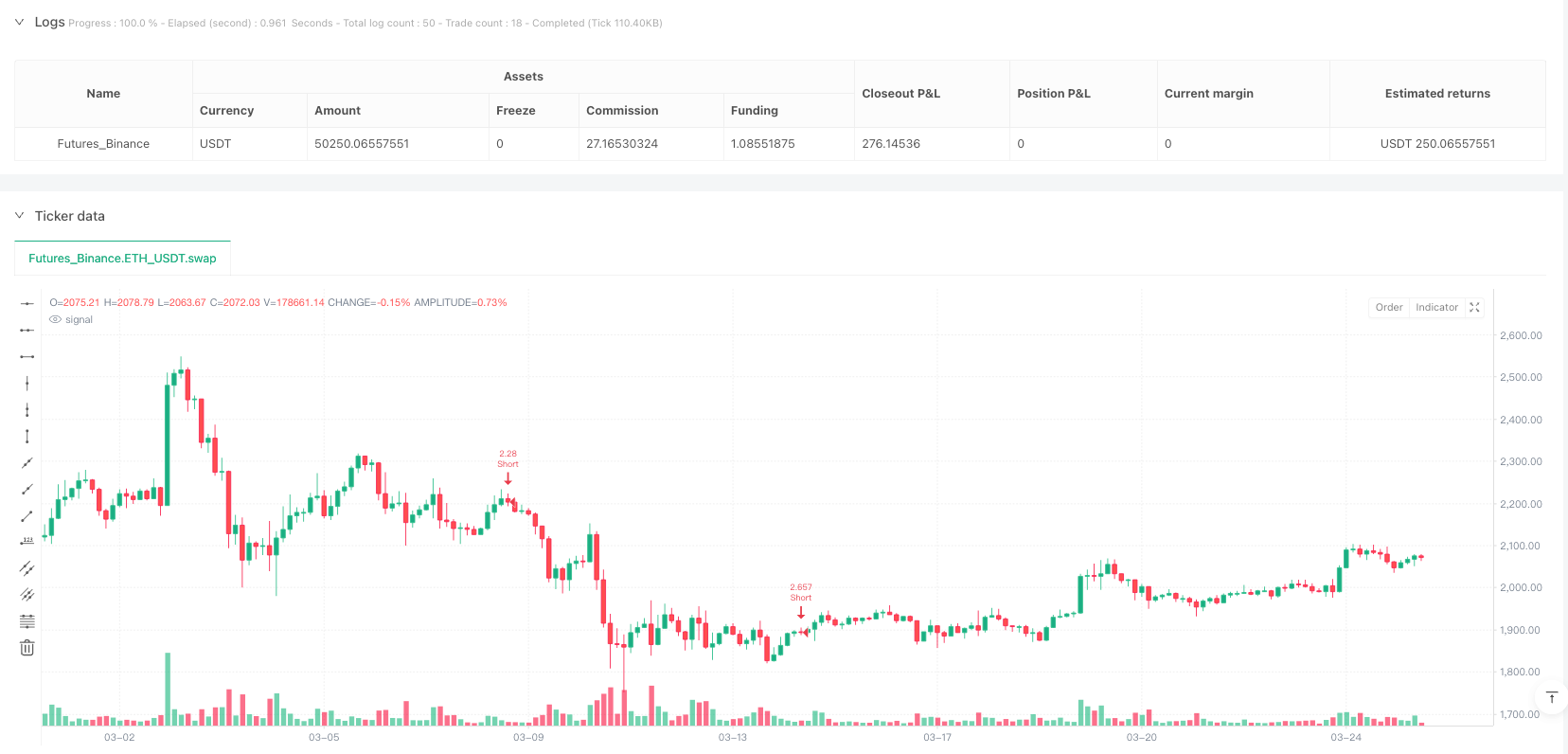

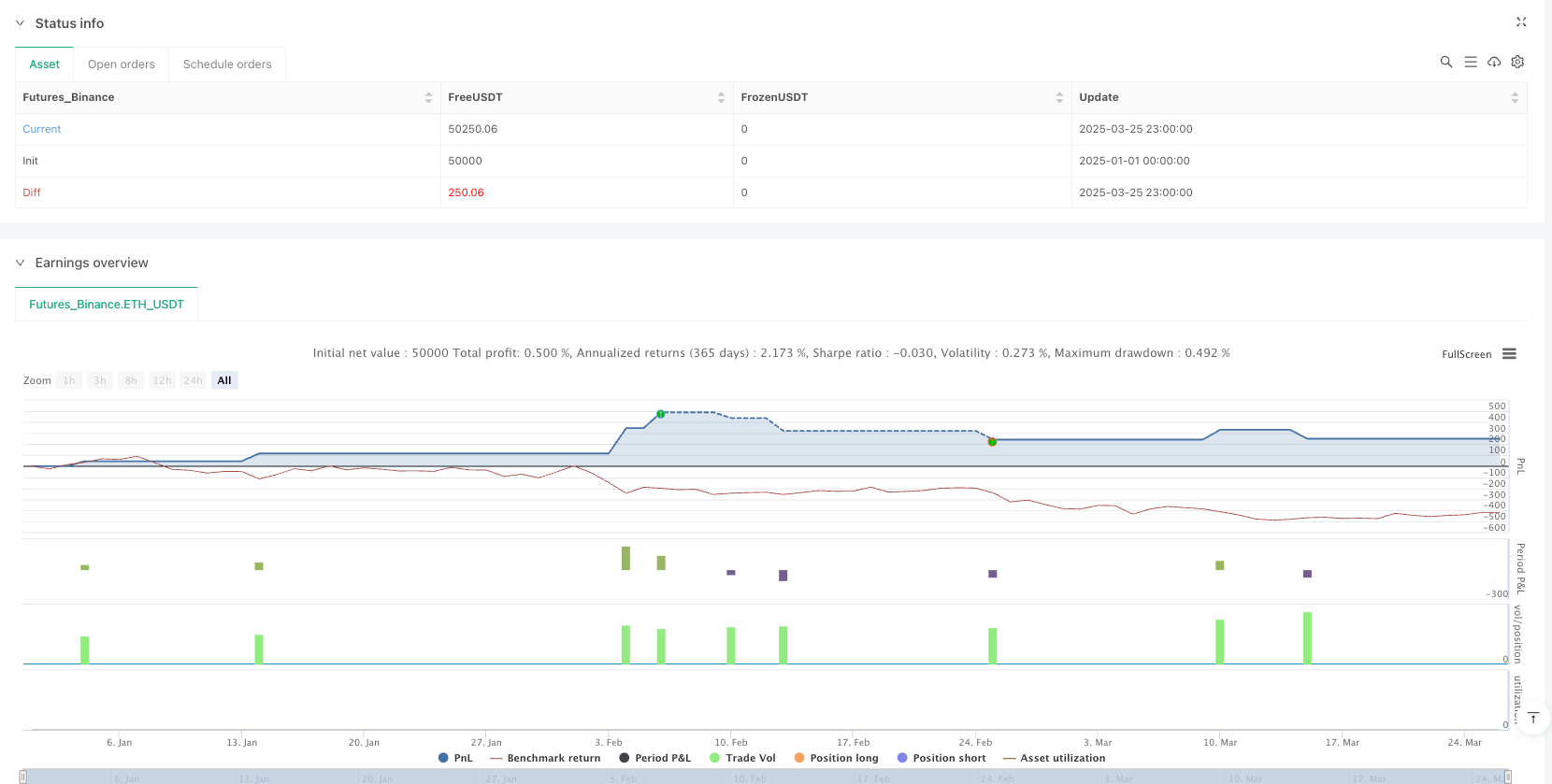

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-26 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Strategy Spinning Top with SL & TP", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Check candlestick color

isGreen = close > open

isRed = close < open

// Check if the previous 3 candles are the same color

threePrevGreen = isGreen[1] and isGreen[2] and isGreen[3]

threePrevRed = isRed[1] and isRed[2] and isRed[3]

// Check if the current candle is the opposite color of the previous 3 candles

colorChangeBullish = threePrevRed and isGreen

colorChangeBearish = threePrevGreen and isRed

// Spinning Top conditions

bodySize = math.abs(close - open)

upperWick = high - math.max(close, open)

lowerWick = math.min(close, open) - low

// Spinning Top conditions

isSmallBody = bodySize < ((high - low) * 0.3)

isWicksBalanced = math.abs(upperWick - lowerWick) <= (high - low) * 0.2

isSpinningTop = isSmallBody and isWicksBalanced

// Combine all conditions

finalCondition = (colorChangeBullish or colorChangeBearish) and isSpinningTop

// Entry, SL, TP

if finalCondition

if colorChangeBullish

entryPrice = close

slPrice = low - 4

tpPrice = entryPrice + (entryPrice - slPrice) * 1.5

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=slPrice, limit=tpPrice)

label.new(bar_index + 1, high, "Long Entry\nEntry: " + str.tostring(entryPrice) + "\nSL: " + str.tostring(slPrice) + "\nTP: " + str.tostring(tpPrice), color=color.green)

else if colorChangeBearish

entryPrice = close

slPrice = high + 4

tpPrice = entryPrice - (slPrice - entryPrice) * 1.5

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=slPrice, limit=tpPrice)

label.new(bar_index + 1, high, "Short Entry\nEntry: " + str.tostring(entryPrice) + "\nSL: " + str.tostring(slPrice) + "\nTP: " + str.tostring(tpPrice), color=color.red)