Overview

This strategy is a pyramid trading system combining dual moving average crossover signals with the RSI indicator. The core approach utilizes crossovers between a 4-period EMA and an 8-period SMA to generate trading signals, allowing for two entries to form pyramid positions, while implementing dynamic take-profit through the RSI indicator. The strategy design follows trend-following principles, capturing market momentum changes through short-term and medium-term moving average crossovers, while avoiding holding positions in extreme overbought or oversold areas.

Strategy Principles

The strategy is built on several key principles:

Dual Moving Average System: Uses a 4-period EMA (Exponential Moving Average) and an 8-period SMA (Simple Moving Average) as signal generators. EMA responds more sensitively to price changes, while SMA provides more stable trend confirmation.

Candle Midpoint Price Evaluation: The strategy uses the average of the daily open and close prices (candleMid) for crossover comparisons with moving averages, which better reflects the entire day’s price movement compared to using only the closing price.

Pyramid Position Building Logic: The strategy allows up to two entries (pyramiding=2), triggered by crossover signals from different moving averages, forming a layered position building mechanism:

- When the candle midpoint price crosses above EMA4 or SMA8, a long signal is triggered

- When the candle midpoint price crosses below EMA4 or SMA8, a short signal is triggered

Signal Priority and Position Management: The strategy checks and closes opposite positions when new signals appear, ensuring no simultaneous long and short positions.

RSI Overbought/Oversold Take-Profit: Uses the RSI indicator as a dynamic take-profit mechanism:

- When holding long positions and RSI exceeds 70, all long positions are closed for profit

- When holding short positions and RSI falls below 30, all short positions are closed for profit

Strategy Advantages

Through deep code analysis, this strategy demonstrates several key advantages:

Flexible Entry Mechanism: Provides multi-dimensional entry signals through crossovers of two different period moving averages, capturing both quick reversals (EMA4) and confirming stronger trend signals (SMA8).

Adaptive Position Management: The pyramid position building mechanism allows the strategy to increase risk exposure when trends strengthen, optimizing capital efficiency.

Dynamic Take-Profit Strategy: The take-profit mechanism combined with the RSI indicator automatically secures profits when the market reaches overbought or oversold conditions, avoiding drawdowns caused by excessive trend chasing.

Prevention of Trend Reversal Losses: The strategy quickly closes positions and opens reverse positions when detecting counter signals, effectively reducing losses during trend reversals.

Simple Parameters for Easy Adjustment: The strategy uses only a few parameters (4-period EMA, 8-period SMA, and 14-period RSI), making it easy to understand and optimize.

Strategy Risks

Despite its sound design, the strategy has the following potential risks:

False Signals in Ranging Markets: In consolidation zones, frequent moving average crossovers may lead to false signals, causing frequent trading and commission costs. Additional trend filtering conditions, such as ADX or volatility indicators, could be added as a solution.

Lack of Stop-Loss Mechanism: The strategy relies on reverse signals to close positions, but in volatile markets, reverse signals may appear late, leading to significant drawdowns. Fixed stop-loss or trailing stop-loss should be considered.

RSI Take-Profit May Be Premature: In strong trends, RSI may remain in overbought/oversold territories for extended periods, causing premature profit-taking and missing continued trend gains. Consider dynamically adjusting RSI thresholds based on market conditions.

Pyramid Position Risk: In volatile markets, pyramid positioning may amplify losses. It’s advisable to set maximum loss limits and risk exposure caps.

Fixed Parameters Lack Adaptability: Fixed moving average periods may perform inconsistently across different market environments. Consider using adaptive moving averages or adjusting parameters in different volatility environments.

Optimization Directions

Based on strategy analysis, here are several feasible optimization directions:

Add Trend Filters: Introduce ADX or directional indicators to execute trades only when trends are confirmed, significantly reducing false signals in ranging markets.

Dynamic RSI Thresholds: Automatically adjust RSI overbought/oversold thresholds based on market volatility, raising thresholds in high-volatility markets and lowering them in low-volatility markets.

Introduce Stop-Loss Mechanisms: Add percentage-based stops or ATR multiple stops to set clear risk limits for each trade.

Optimize Pyramid Position Logic: Adjust position sizes based on trend strength or set profit-based conditions for additional entries, considering second entries only after the first position becomes profitable.

Time Filter Enhancement: The current strategy already has a start date restriction; further trading session filters could be added to avoid specific high-volatility or low-liquidity periods.

Capital Management Optimization: Currently fixed at trading 1 lot each time, this could be changed to dynamic position sizing based on account equity ratio or volatility.

Summary

The “Dual Moving Average Crossover with RSI Overbought/Oversold Pyramid Dynamic Trend Trading Strategy” combines classic moving average crossover systems with the RSI indicator, forming a quantitative trading framework that both captures trends and controls risk. The strategy generates buy and sell decisions through crossover signals from the 4-period EMA and 8-period SMA, amplifies trend returns using pyramid position building, and dynamically manages profit-taking with the RSI indicator.

The strategy’s greatest advantage lies in its multi-level signal confirmation mechanism and flexible position management, but attention must be paid to false signal risks in ranging markets and the lack of explicit stop-loss mechanisms. By adding trend filters, optimizing capital management, and improving risk control mechanisms, the strategy has the potential to achieve more stable performance across various market environments.

For traders looking to build medium to long-term trend-following systems, this strategy provides an excellent starting point that can be further customized and optimized according to individual risk preferences and trading objectives.

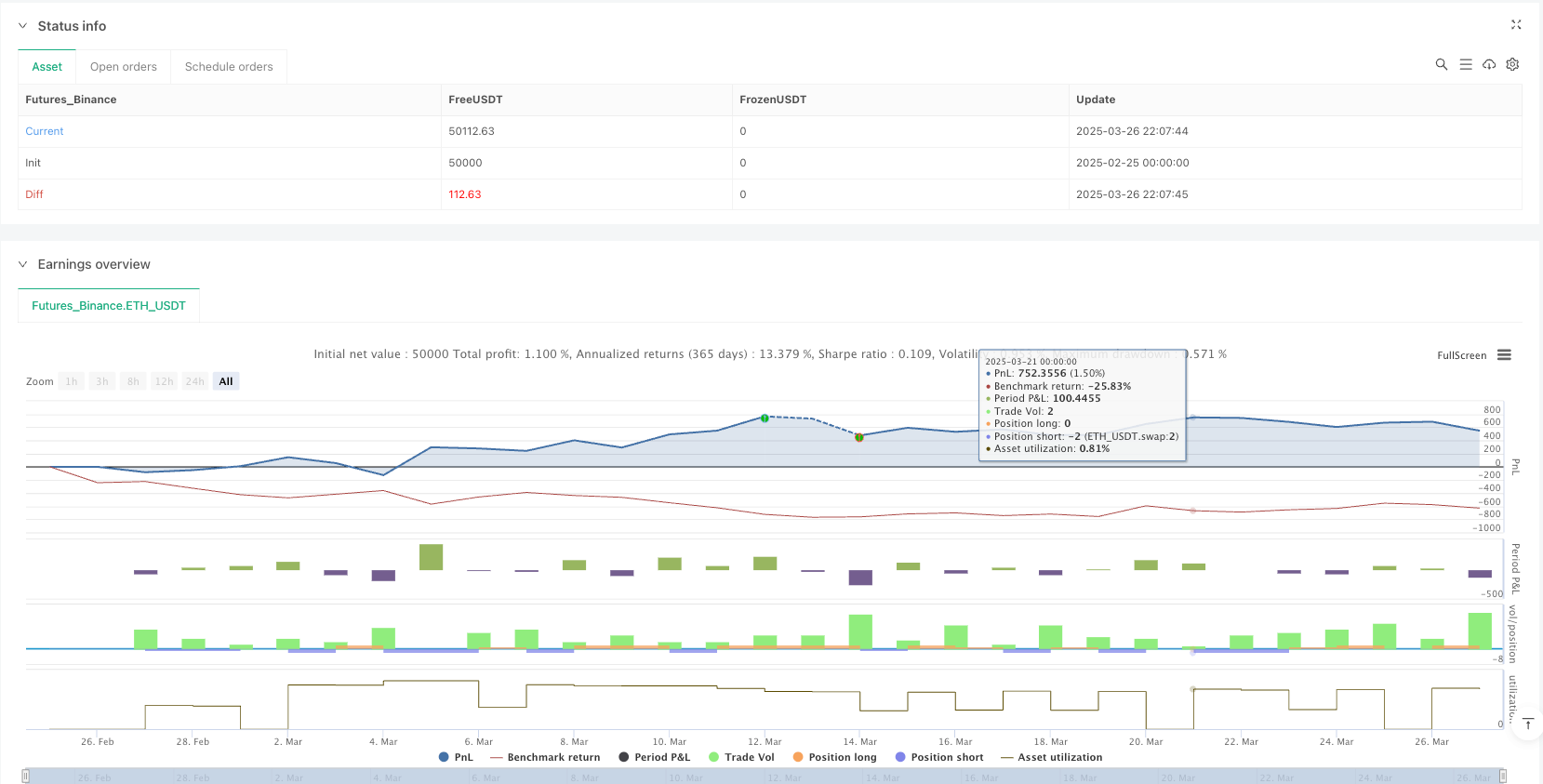

/*backtest

start: 2025-02-25 00:00:00

end: 2025-03-27 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("D-4EMA-8SMA", overlay=true, process_orders_on_close=true, pyramiding=2, initial_capital=70000, currency=currency.EUR)

// Başlangıç tarihi: 10 Temmuz 2024 (UTC)

startDate = timestamp(2024, 01, 01, 00, 00)

// SMA hesaplamaları

sma8 = ta.sma(close, 8)

ema4 = ta.ema(close, 4)

plot(sma8, color=color.blue, title="8 Günlük SMA")

plot(ema4, color=color.red, title="4 Günlük EMA")

// İşlemlerin yalnızca belirtilen tarihten sonra yapılması

validTime = time >= startDate

// Günlük mumun açılış ve kapanış fiyatlarının ortalaması

candleMid = (open + close) / 2

// RSI hesaplaması (14 periyot)

rsiValue = ta.rsi(close, 14)

// Long sinyalleri

longCondition8 = validTime and ta.crossover(candleMid, sma8)

longCondition4 = validTime and ta.crossover(candleMid, ema4)

// Short sinyalleri

shortCondition8 = validTime and ta.crossunder(candleMid, sma8)

shortCondition4 = validTime and ta.crossunder(candleMid, ema4)

// Long işlemleri:

if longCondition8

// Eğer mevcut pozisyon ters yöndeyse önce kapat

if strategy.position_size < 0

strategy.close("Short")

// SMA8 kırılması: 1 lotluk long emri

strategy.entry("Long8", strategy.long, qty=1)

if longCondition4

if strategy.position_size < 0

strategy.close("Short")

// EMA4 kırılması: 1 lotluk long emri

strategy.entry("Long4", strategy.long, qty=1)

// Short işlemleri:

if shortCondition8

if strategy.position_size > 0

strategy.close("Long")

// SMA8 kırılması: 1 lotluk short emri

strategy.entry("Short8", strategy.short, qty=1)

if shortCondition4

if strategy.position_size > 0

strategy.close("Long")

// EMA4 kırılması: 1 lotluk short emri

strategy.entry("Short4", strategy.short, qty=1)

// RSI TP koşulları:

// Long pozisyonda: RSI 70'in üzerine çıkarsa tüm long pozisyonlar kapatılır.

if strategy.position_size > 0 and rsiValue > 70

strategy.close_all(comment="RSI TP Long")

// Short pozisyonda: RSI 30'un altına düşerse tüm short pozisyonlar kapatılır.

if strategy.position_size < 0 and rsiValue < 30

strategy.close_all(comment="RSI TP Short")