Overview

This strategy is a comprehensive quantitative trading method that integrates multiple technical indicators (MACD, Supertrend, and Parabolic SAR) to identify market trends and trading signals. The strategy aims to provide a flexible and rigorous decision-making framework adaptable to different market environments.

Strategy Principles

The strategy is based on the dynamic combination of three key technical indicators: 1. MACD Indicator: Evaluates price momentum and trend direction 2. Supertrend Indicator: Determines the dominant market trend (bullish or bearish) 3. Parabolic SAR: Provides precise entry and exit signals

The strategy makes trading decisions through the following logic: - Long Entry Conditions: - MACD line above signal line - Supertrend is green (bullish) - Closing price above Parabolic SAR - Short Entry Conditions: - MACD line below signal line - Supertrend is red (bearish) - Closing price below Parabolic SAR

Strategy Advantages

- Multi-indicator Verification: Reduces false signal risk

- Flexible Signal Triggering: No strict order requirement for indicators

- Full Position Trading Strategy: Maximizes potential earnings per trade

- Symmetric Trading Logic: Consistent performance in bullish and bearish markets

- Dynamic Exit Mechanism: Confirms exit through two consecutive candles

Strategy Risks

- Indicator Lag Risk: Technical indicators based on historical data may have delays

- Full Position Trading Risk: Lack of stop-loss can lead to significant capital fluctuations

- Severe Market Volatility Risk: Complex market environments may affect strategy performance

- Parameter Sensitivity: Indicator parameter selection directly impacts strategy effectiveness

Strategy Optimization Directions

- Introduce Dynamic Position Management: Adjust position size based on market volatility

- Add Stop-Loss Mechanism: Reduce maximum loss per trade

- Optimize Indicator Parameters: Find the best parameter combination through backtesting

- Introduce Additional Filter Conditions: Such as trading volume, volatility indicators

- Increase Multi-Timeframe Verification: Improve signal reliability

Summary

The Vishal Adaptive Multi-Indicator Trading Strategy is an innovative quantitative trading approach that provides a comprehensive and flexible trading decision framework through the synergistic action of MACD, Supertrend, and Parabolic SAR. Despite certain risks, its multi-indicator verification and symmetric trading logic offer investors a trading model worth in-depth research.

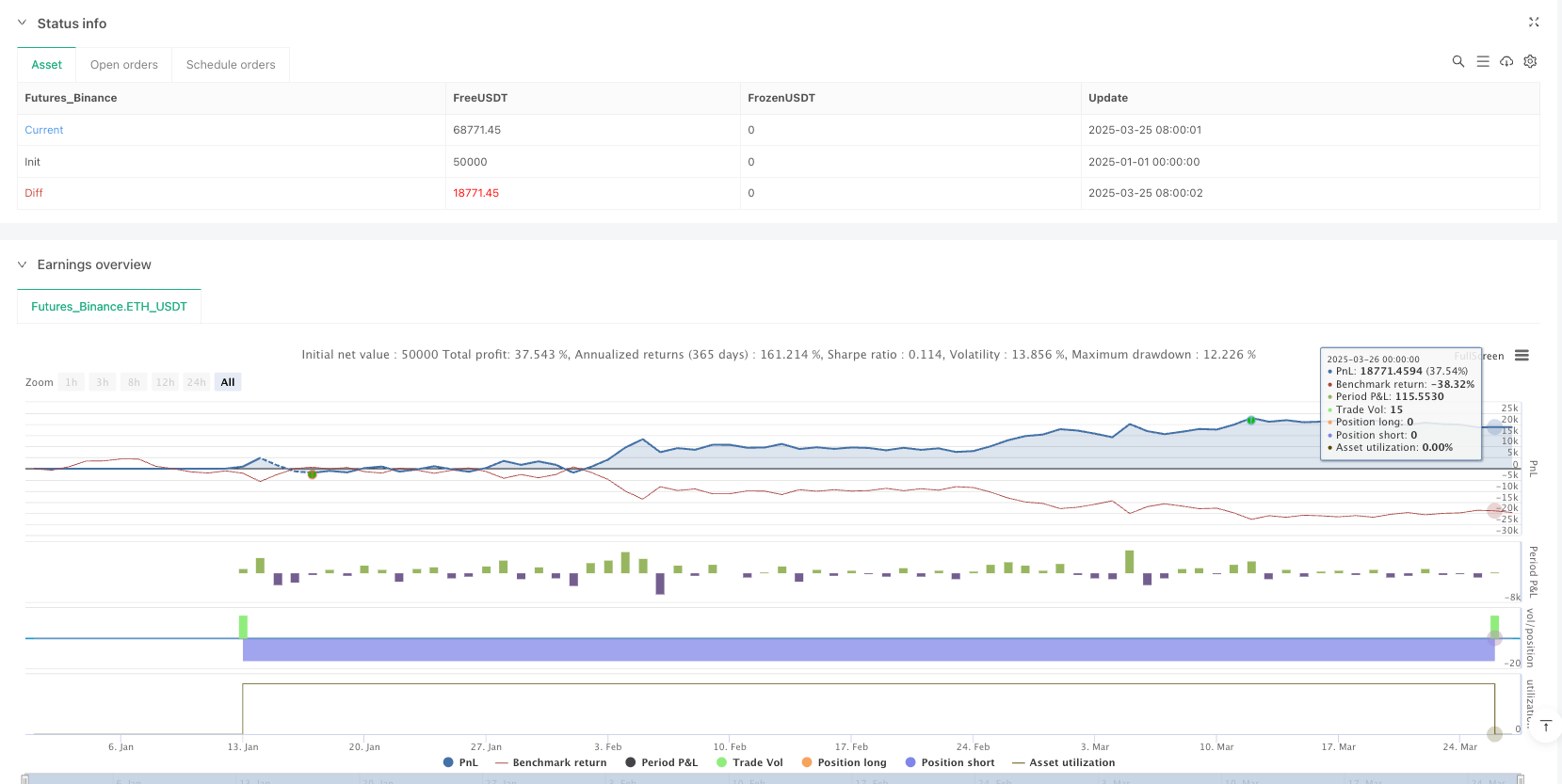

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-27 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Vishal Strategy", overlay=true, margin_long=100, margin_short=100, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// **MACD Inputs & Calculation**

fast_length = input.int(13, title="MACD Fast Length")

slow_length = input.int(27, title="MACD Slow Length")

signal_length = input.int(9, title="MACD Signal Smoothing")

fast_ma = ta.ema(close, fast_length)

slow_ma = ta.ema(close, slow_length)

macd = fast_ma - slow_ma

signal = ta.ema(macd, signal_length)

hist = macd - signal

// **Supertrend Inputs & Calculation**

atrPeriod = input.int(11, "ATR Length", minval = 1)

factor = input.float(3.0, "Factor", minval = 0.01, step = 0.01)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

bullTrend = direction < 0 // Uptrend Condition

bearTrend = direction > 0 // Downtrend Condition

// **Parabolic SAR Inputs & Calculation**

sarStep = input.float(0.02, "Parabolic SAR Step")

sarMax = input.float(0.2, "Parabolic SAR Max")

sar = ta.sar(sarStep, sarStep, sarMax)

// **Trade Entry Conditions**

macdBullish = macd > signal // MACD in Bullish Mode

macdBearish = macd < signal // MACD in Bearish Mode

priceAboveSAR = close > sar // Price above SAR (Bullish)

priceBelowSAR = close < sar // Price below SAR (Bearish)

// **Boolean Flags to Track Conditions Being Met**

var bool macdConditionMet = false

var bool sarConditionMet = false

var bool trendConditionMet = false

// **Track if Each Condition is Met in Any Order**

if (macdBullish)

macdConditionMet := true

if (macdBearish)

macdConditionMet := false

if (priceAboveSAR)

sarConditionMet := true

if (priceBelowSAR)

sarConditionMet := false

if (bullTrend)

trendConditionMet := true

if (bearTrend)

trendConditionMet := false

// **Final Long Entry Signal (Triggers When All Three Flags Are True)**

longSignal = macdConditionMet and sarConditionMet and trendConditionMet

// **Final Short Entry Signal (Triggers When All Three Flags Are False)**

shortSignal = not macdConditionMet and not sarConditionMet and not trendConditionMet

// **Execute Full Equity Trades**

if (longSignal)

strategy.entry("Long", strategy.long)

if (shortSignal)

strategy.entry("Short", strategy.short)

// **Exit Logic - Requires 2 Consecutive Candle Closes Below/Above SAR**

var int belowSARCount = 0

var int aboveSARCount = 0

if (strategy.position_size > 0) // Long position is active

belowSARCount := close < sar ? belowSARCount + 1 : 0

if (belowSARCount >= 1)

strategy.close("Long")

if (strategy.position_size < 0) // Short position is active

aboveSARCount := close > sar ? aboveSARCount + 1 : 0

if (aboveSARCount >= 1)

strategy.close("Short")

// **Plot Indicators**

plot(supertrend, title="Supertrend", color=bullTrend ? color.green : color.red, linewidth=2, style=plot.style_linebr)

plot(sar, title="Parabolic SAR", color=color.blue, style=plot.style_cross, linewidth=2)

plot(macd, title="MACD Line", color=color.blue, linewidth=2)

plot(signal, title="MACD Signal", color=color.orange, linewidth=2)

plot(hist, title="MACD Histogram", style=plot.style_columns, color=hist >= 0 ? color.green : color.red)