Overview

The Dynamic Trend Momentum Breakout Strategy is a professional quantitative trading method specifically designed for high-momentum stocks. By combining Exponential Moving Averages (EMA), Relative Strength Index (RSI) filtering, volume confirmation, and Average True Range (ATR)-based trailing stop-loss, the strategy aims to capture strong market breakouts while avoiding false signals.

Strategy Principles

The core principle of the strategy is based on multi-dimensional market signal verification: 1. Use fast and slow EMAs to determine overall trend direction 2. Utilize RSI to assess momentum and avoid negative divergences 3. Confirm trading signals through volume breakouts 4. Apply ATR for dynamic stop-loss and trailing profit management

Strategy Advantages

- High-precision signal filtering: Multiple condition verifications reduce error signal probability

- Dynamic risk management: ATR-based stop-loss mechanism protects capital

- Trend following: EMA combination ensures entry only in strong trends

- Momentum capture: Volume and RSI filtering ensure trade quality

Strategy Risks

- Severe market volatility may trigger stop-losses

- More invalid signals may occur in ranging markets

- Over-reliance on technical indicators might miss important fundamental information

Strategy Optimization Directions

- Introduce machine learning algorithms to optimize parameter selection

- Add cross-timeframe verification mechanisms

- Develop more complex multi-factor filtering algorithms

- Incorporate sentiment indicators and fundamental data

Summary

The Dynamic Trend Momentum Breakout Strategy builds a relatively robust quantitative trading method by integrating multiple technical analysis tools. Its core lies in balancing signal capture capability and risk control, providing traders with a systematic trading decision framework.

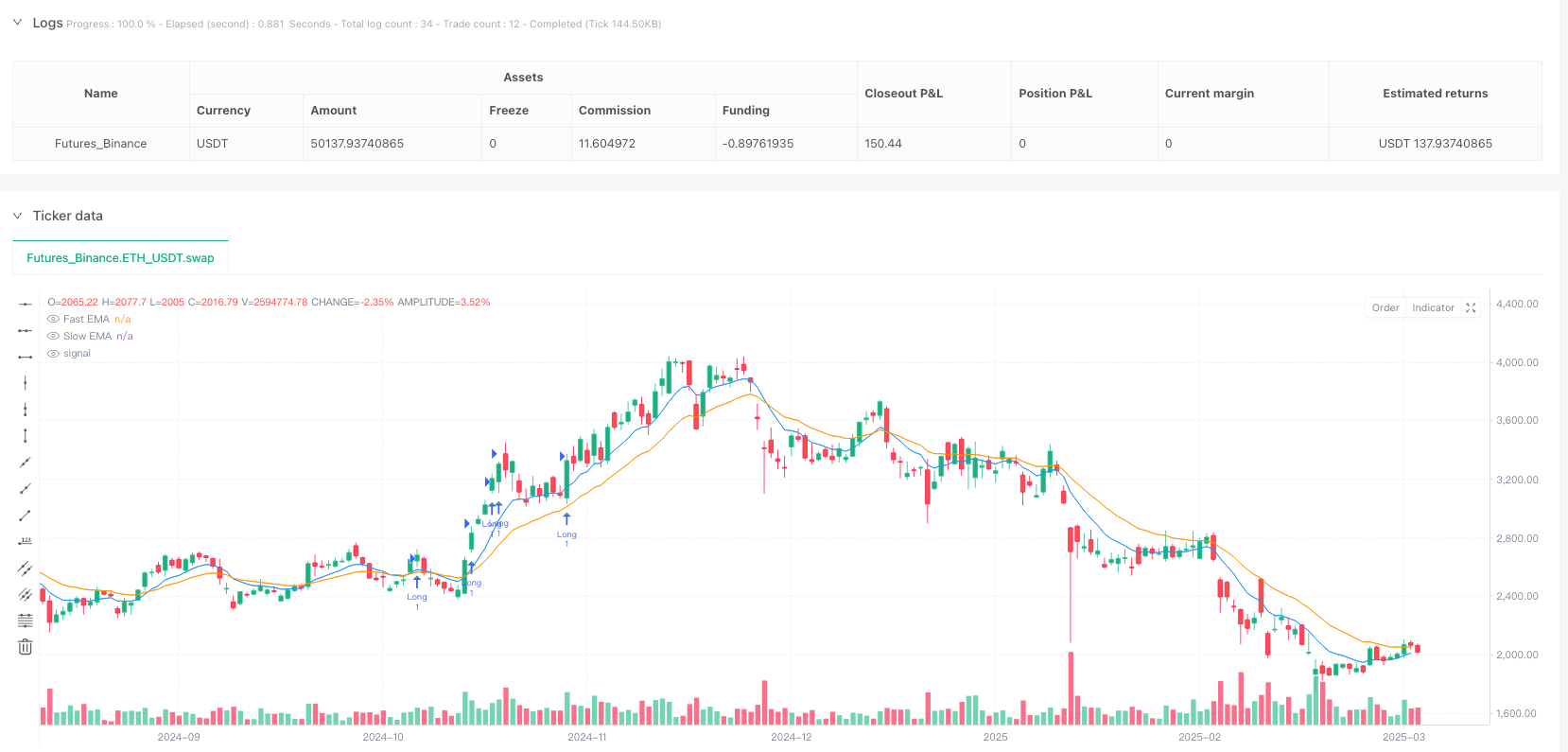

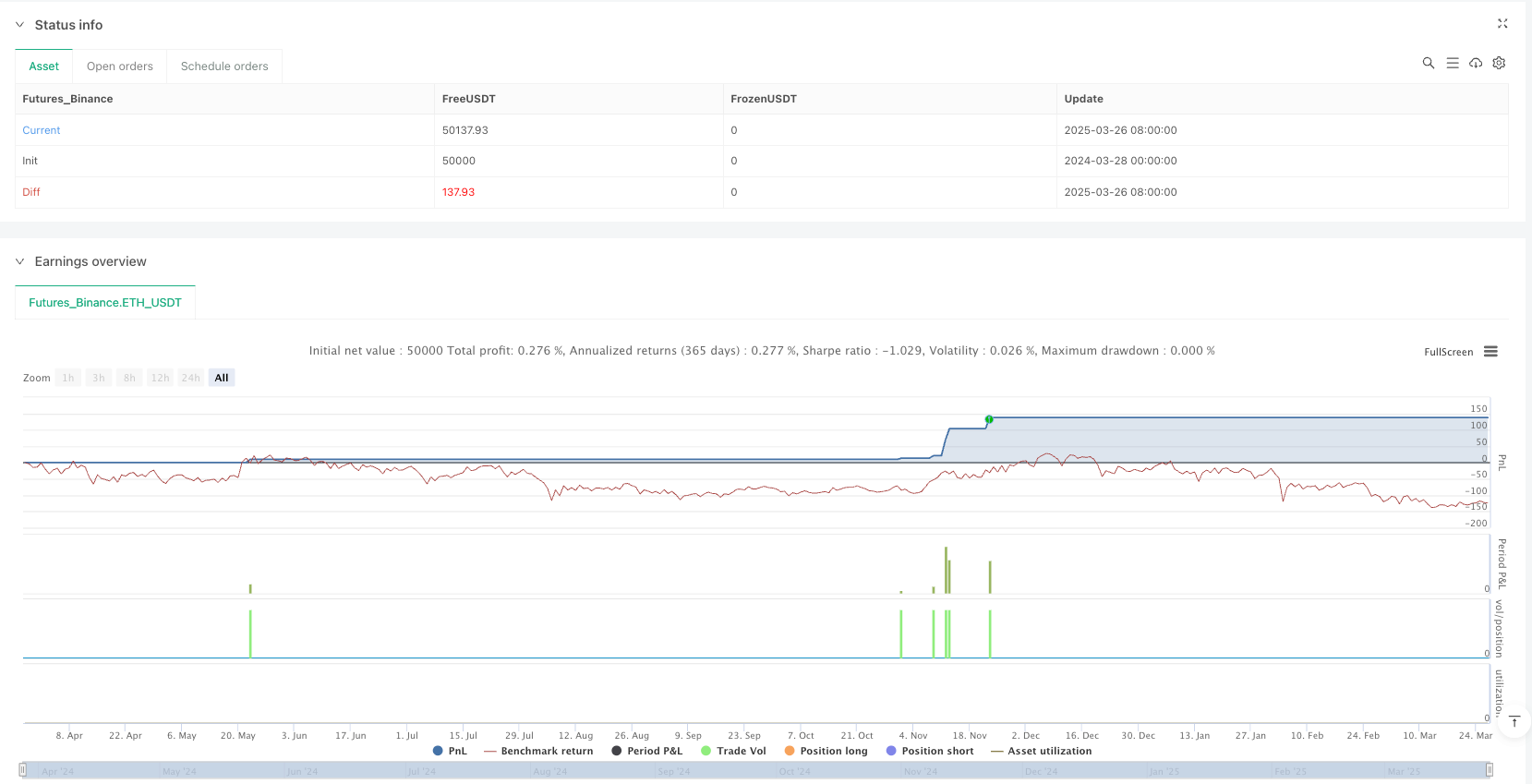

/*backtest

start: 2024-03-28 00:00:00

end: 2025-03-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Enhanced First High Break Strategy v3", overlay=true, margin_long=100, margin_short=100)

// Input Parameters

emaFastLength = input.int(9, "Fast EMA Length")

emaSlowLength = input.int(20, "Slow EMA Length")

rsiLength = input.int(14, "RSI Length")

volumeAvgLength = input.int(20, "Volume Average Length")

atrLength = input.int(14, "ATR Length")

// Calculate Indicators

emaFast = ta.ema(close, emaFastLength)

emaSlow = ta.ema(close, emaSlowLength)

rsi = ta.rsi(close, rsiLength)

volAvg = ta.sma(volume, volumeAvgLength)

atr = ta.atr(atrLength)

// Pre-calculate lowest values (FIXED)

rsiLowCurrent = ta.lowest(rsi, 5)

rsiLowPrevious = ta.lowest(rsi[5], 5)

lowLowPrevious = ta.lowest(low[5], 5)

// Trend Conditions

bullishTrend = emaFast > emaSlow and emaFast > emaFast[1]

bearishDivergence = rsiLowCurrent > rsiLowPrevious and low < lowLowPrevious

// Entry Conditions

validBreakout = close > high[1] and close > emaFast

volumeConfirmation = volume > volAvg * 1.5

trendConfirmed = close > emaSlow and close[1] > emaSlow

rsiConfirmation = rsi > 50 and not bearishDivergence

// Final Entry Signal

entryCondition = validBreakout and volumeConfirmation and trendConfirmed

// Exit Conditions

stopLossPrice = low[1] - (atr * 0.50)

trailOffset = atr * 2

// Strategy Execution

if (entryCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Exit", "Long", stop=stopLossPrice,trail_points=close > emaFast ? trailOffset : na,trail_offset=trailOffset)

// Plotting

plot(emaFast, "Fast EMA", color.new(color.blue, 0))

plot(emaSlow, "Slow EMA", color.new(color.orange, 0))

plotshape(entryCondition, style=shape.triangleup, color=color.green, location=location.belowbar)