Overview

The Opening Bell High-Low Breakout Dynamic Trailing Strategy is a short-term trading approach focused on the stock market’s opening session. This strategy primarily establishes key support and resistance levels based on the price high and low points at 8:30 AM, and executes trades when prices break through these levels. The strategy utilizes the price range formed during the early morning as a crucial reference, combined with a dynamic trailing stop mechanism, allowing it to capture intraday volatility while effectively controlling risk. By precisely identifying the high and low points of the 8:30 AM session, the strategy monitors price breakouts during the subsequent trading hours (8:40 AM to 3:00 PM), executes only the first valid breakout trade of the day, and employs trailing stops and fixed take-profit levels to manage positions.

Strategy Principles

The core principle of this strategy is to use the price range formed during the pre-market opening at 8:30 AM as a key reference point. The detailed workflow of the strategy is as follows:

- Identify and record the highest and lowest prices of the 8:30 AM candle

- Maintain these price levels as key support and resistance lines throughout the trading day

- Trigger a trading signal when price first breaks above or below the 8:30 AM high or low and confirms with a close

- Execute trades only within the specified trading time (8:40 AM to 3:00 PM)

- Execute only one trade per trading day (either long or short)

- Use a dynamic trailing stop mechanism to protect profits

- Set fixed take-profit and stop-loss levels as additional protection

The strategy uses several key variables to track trading status: high830 and low830 record the highest and lowest prices of the 8:30 AM candle respectively; tradeTakenToday ensures only one trade is executed per day; firstBreakoutHappened confirms whether the first breakout has occurred. Trading conditions must simultaneously satisfy: price breaking through the 8:30 AM high or low, being the first breakout of the day, no trade executed yet that day, and being within the allowed trading time period.

Exit conditions include: price touching the dynamic trailing stop line, reaching the preset take-profit level, or hitting the fixed stop-loss line. The dynamic trailing stop line adjusts as the price moves in a favorable direction, thereby locking in partial profits.

Strategy Advantages

Through in-depth analysis of the code, this strategy has several significant advantages:

Clear Trading Rules: The strategy sets entry signals based on clear price levels (8:30 AM highs and lows), with trading conditions that are explicit and easy to understand and execute.

Comprehensive Risk Management: The strategy combines multiple risk control mechanisms, including dynamic trailing stops, fixed stop-losses, and take-profit settings, effectively controlling the risk of each trade.

Avoids Overtrading: By limiting execution to just one trade per day, the strategy avoids the increased transaction costs and emotional fluctuations that come with frequent trading.

Time Filter: By setting a specific trading time window (8:40 AM to 3:00 PM), the strategy avoids the high volatility of market opening and closing sessions.

Dynamic Profit Protection: The trailing stop mechanism adjusts the stop position as the price moves in a favorable direction, both protecting existing profits and not prematurely ending potential large trends.

Automated Execution: The strategy is fully automated, avoiding human emotional interference and executing trades strictly according to preset rules.

High Adaptability: Through parameter settings (such as trailing stop points, take-profit points), the strategy can be adjusted according to different market environments and personal risk preferences.

Strategy Risks

Despite its reasonable design, the strategy still has the following potential risks:

False Breakout Risk: Prices may quickly retrace after breaking through the 8:30 AM high or low, leading to false signals and unnecessary losses. The solution is to add confirmation mechanisms, such as requiring the price to maintain a certain time or magnitude after breakout.

Insufficient Volatility: If market volatility is low, prices may not effectively break through the range set at 8:30 AM, resulting in reduced trading opportunities. Consider adjusting strategy parameters or pausing the strategy in low-volatility environments.

Over-reliance on a Single Time Point: The strategy highly depends on the price performance at 8:30 AM, and if abnormal fluctuations occur during this period, it may set an unreasonable trading range. Consider using the average of multiple time points or combining with other technical indicators.

Parameter Sensitivity: Trailing stops and take-profit settings have a significant impact on strategy performance, and different market environments may require different parameter settings. It is recommended to conduct comprehensive backtesting to find the optimal parameter combination.

Lack of Money Management: The current strategy does not include specific position management rules, which may lead to insufficient risk control. It is advisable to add a position adjustment mechanism based on volatility.

Market Gap Risk: If the market experiences a large gap, fixed stop-losses may not be effectively executed, resulting in losses beyond expectations. Consider using percentage-based stop-losses instead of fixed point stop-losses.

Strategy Optimization Directions

Based on code analysis, the strategy has the following areas for optimization:

Add Volume Confirmation: The current strategy is based solely on price breakouts without considering volume factors. Adding volume confirmation can improve the reliability of breakout signals and filter out false breakouts with low volume. The optimization method is to add a requirement in the entry conditions that the volume exceeds the average volume of the previous few K-lines by a certain percentage.

Introduce Market Environment Filtering: Strategy performance may vary greatly in different market environments (trend, consolidation). By adding trend indicators (such as ADX, moving averages, etc.) or volatility indicators (such as ATR), trades can be executed only in suitable market environments.

Optimize Stop-Loss and Take-Profit Parameters: Currently fixed point settings are used for stop-loss and take-profit. These could be changed to dynamically adjust based on market volatility (such as ATR multiples), making the strategy more adaptable to different market environments.

Increase Multi-Timeframe Analysis: Combining the market direction of higher timeframes with signals from the current timeframe can improve trading success rates. For example, execute trades only when the daily trend direction is consistent with the breakout direction.

Add Reverse Signal Filtering: Consider reverse signals from other market indicators (such as overbought/oversold indicator RSI, MACD, etc.) to avoid trading under extreme conditions.

Introduce Dynamic Take-Profit Mechanism: In addition to trailing stops, consider dynamically adjusting take-profit targets, such as setting multiple take-profit targets based on support and resistance levels or volatility multiples.

Optimize Trading Time Window: Through historical data analysis, find the optimal trading time window, as different markets or products may have different optimal trading times.

Summary

The Opening Bell High-Low Breakout Dynamic Trailing Strategy is an intraday trading method based on price range breakouts, capturing intraday price breakout opportunities by identifying the high and low points formed during the 8:30 AM session, combined with a dynamic trailing stop mechanism. The strategy has clear rules and comprehensive risk management, effectively controlling the risk of overtrading by limiting the number of daily trades and setting trading time windows. At the same time, the strategy also has potential issues such as false breakout risk and parameter sensitivity, which can be further improved by adding volume confirmation, market environment filtering, optimizing parameter settings, and other methods. For short-term traders, this strategy provides a structured trading approach that can capture opportunities brought by intraday price breakouts while controlling risk.

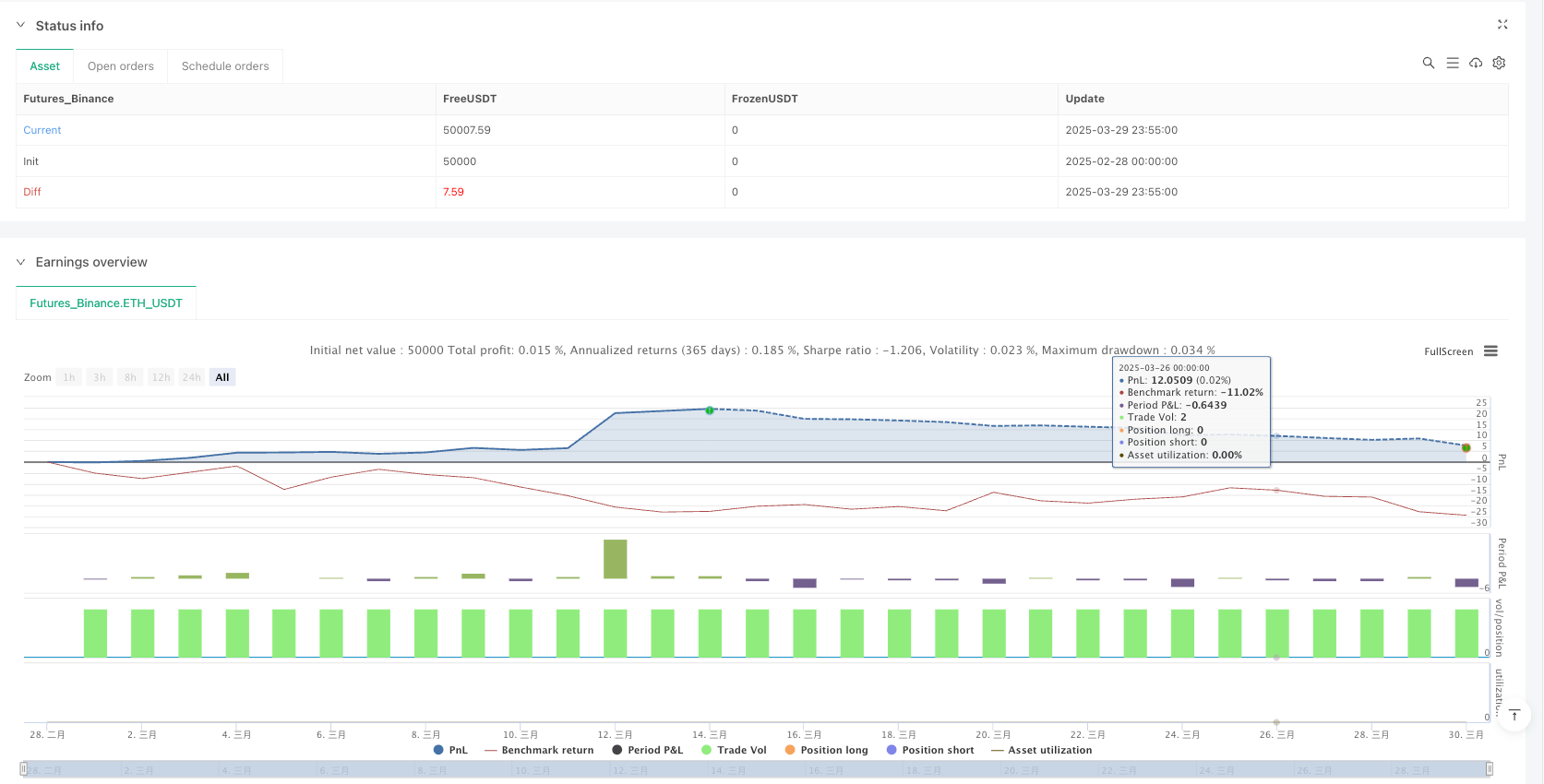

/*backtest

start: 2025-02-28 00:00:00

end: 2025-03-30 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Breakout of 8:30 AM High/Low", overlay=true)

// Identify 8:30 AM candle

is830 = (hour == 8 and minute == 30)

// Persistent variables for tracking

var float high830 = na

var float low830 = na

var int lastTradeDay = na

var bool tradeTakenToday = false

// Store 8:30 AM high and low

if is830

high830 := high

low830 := low

// Ensure high/low persist throughout the day

high830 := nz(high830, high830)

low830 := nz(low830, low830)

// Plot the high and low of the 8:30 AM candle

plot(high830, color=color.green, title="8:30 High", linewidth=2)

plot(low830, color=color.red, title="8:30 Low", linewidth=2)

// Reset tradeTakenToday at the start of each new trading day

if dayofweek != lastTradeDay or (hour == 0 and minute == 0)

tradeTakenToday := false

lastTradeDay := dayofweek // Update last trade day to the current day

// Track first breakout candle that closes outside the range

firstBreakoutHappened = ta.barssince(close > high830 or close < low830) == 0

// Time restriction: Only trade between 8:40 AM and 3:00 PM

isTradingTime = (hour == 8 and minute >= 40) or (hour > 8 and hour < 15)

// Entry conditions: first 15-min candle close outside the range & within trading time

longEntry = close > high830 and firstBreakoutHappened and not tradeTakenToday and isTradingTime

shortEntry = close < low830 and firstBreakoutHappened and not tradeTakenToday and isTradingTime

// Trailing stop and take profit logic inputs

ticks = input.int(15, title="Trailing Stop Loss Ticks", minval=1) // Trailing stop in ticks

takeProfit = input.int(30, title="Take Profit (in Ticks)", minval=1) // Take profit in ticks

// Variables to track trailing stop levels

var float longTrailingStop = na

var float shortTrailingStop = na

// Update trailing stop levels for long trades

if (longEntry)

longTrailingStop := close - ticks * syminfo.mintick // Initialize trailing stop for long

// Update trailing stop levels for short trades

if (shortEntry)

shortTrailingStop := close + ticks * syminfo.mintick // Initialize trailing stop for short

// Update trailing stop levels during the trade

if (not na(longTrailingStop))

longTrailingStop := math.max(longTrailingStop, close - ticks * syminfo.mintick) // Move trailing stop up for long

if (not na(shortTrailingStop))

shortTrailingStop := math.min(shortTrailingStop, close + ticks * syminfo.mintick) // Move trailing stop down for short

// Exit Conditions (Trailing Stop)

endLongTrade = not na(longTrailingStop) and close <= longTrailingStop

endShortTrade = not na(shortTrailingStop) and close >= shortTrailingStop

// Reset trailing stop levels after exit

if (endLongTrade)

longTrailingStop := na

if (endShortTrade)

shortTrailingStop := na

// Stop loss and take profit settings

stopLoss = 100

// Execute trades (only one per day)

if longEntry

strategy.entry("Long", strategy.long, comment="Breakout Long")

strategy.exit("Long TP/SL", from_entry="Long", stop=close - stopLoss, limit=close + takeProfit * syminfo.mintick)

tradeTakenToday := true

if shortEntry

strategy.entry("Short", strategy.short, comment="Breakout Short")

strategy.exit("Short TP/SL", from_entry="Short", stop=close + stopLoss, limit=close - takeProfit * syminfo.mintick)

tradeTakenToday := true

// Exit trades using trailing stops

if endLongTrade

strategy.close("Long", comment="Trailing Stop Hit for Long")

if endShortTrade

strategy.close("Short", comment="Trailing Stop Hit for Short")