Overview

The SPY Enhanced Short Signals Strategy is a quantitative trading system designed for the SPY market on a 5-minute timeframe. This strategy captures market downtrend signals through comprehensive analysis of price-resistance relationships, RSI indicator, MACD momentum, and volume factors. When price approaches resistance levels and meets specific bearish conditions (RSI below 45, downward MACD momentum, volume breakout), the system triggers short trade signals. The strategy employs a dynamic exit mechanism based on ATR (Average True Range) with adaptive take-profit and stop-loss settings for effective risk management. The core advantage lies in its precise entry timing and risk control capabilities, enabling consistent profit opportunities during market downtrends.

Strategy Principles

The strategy operates based on collaborative verification of multiple technical indicators, including these key elements:

Resistance Identification: The system determines resistance levels by calculating the highest price over a specified lookback period (default 20 periods). The first entry condition is met when price approaches resistance (within 1% below) or crosses below resistance.

RSI Filter: The strategy requires the RSI (20-period) indicator to be below a preset threshold (default 45), ensuring the market is in a relatively oversold or neutral-bearish state.

MACD Momentum Confirmation: Using the MACD (12,26,9) indicator to determine momentum direction, when the MACD line is below the signal line, it indicates downward price momentum, aligning with the short strategy direction.

Volume Verification: The strategy requires current volume to exceed the 20-period simple moving average of volume by a specific multiple (default 1.5x), ensuring sufficient market participation supports the price movement.

Dynamic Exit Mechanism: Using the 14-period ATR indicator to calculate dynamic take-profit and stop-loss levels. The take-profit target is set at entry price minus ATR multiplied by a profit multiplier (default 1.5), while the stop-loss level is entry price plus ATR multiplied by a loss multiplier (default 1.0).

When all conditions are simultaneously met, the strategy triggers a short entry signal and manages the trade according to preset dynamic exit conditions.

Strategy Advantages

Multi-dimensional Signal Confirmation: The strategy combines price, technical indicators, and volume for multi-dimensional analysis, effectively filtering false signals and improving trade quality. The combination of price near resistance, low RSI, downward MACD, and increased volume effectively captures genuine short opportunities.

Precise Entry Timing: By identifying the relationship between price and resistance levels, the strategy can enter precisely at technical reversal points, increasing profit probability.

Dynamic Risk Management: Using ATR-based dynamic take-profit and stop-loss mechanisms adapts risk management to market volatility, providing wider stops in high-volatility environments and tighter stops in low-volatility environments, optimizing the risk-reward ratio.

Strong Adaptability: The strategy features highly adjustable parameters, allowing users to adapt RSI thresholds, volume multipliers, and ATR multipliers according to market conditions and personal risk preferences for flexible strategy optimization.

Focus on High-Quality Trades: The strategy’s strict conditions avoid overtrading, focusing on capturing high-probability short opportunities, reducing transaction costs and emotional interference.

Strategy Risks

False Breakout Risk: Prices may temporarily break through resistance levels before quickly rebounding, leading to false signals. The solution is to add time filters, requiring price to maintain below resistance for a certain period, or add confirmation signals such as candlestick pattern analysis.

Counter-trend Trading Risk: Shorting in strong upward markets may face challenges of continued upward movement. It’s recommended to add long-term trend filters, disabling or raising signal thresholds during uptrends.

Parameter Sensitivity: Strategy performance is sensitive to changes in parameters such as RSI thresholds and volume multipliers. Comprehensive historical backtesting and sensitivity analysis are recommended to find optimal parameter combinations and regularly check parameter validity.

Liquidity Risk: During low-volume trading sessions, volume breakout conditions may be unreliable. The solution is to add restrictions on trading times, avoiding periods of insufficient market liquidity.

Inadequate Dynamic Stop-Loss: A single ATR multiplier may not be optimized across different market environments. Consider volatility-based adaptive ATR multipliers or dynamically adjusting stop-loss levels based on trend strength.

Strategy Optimization Directions

Trend Filtering: Add long-term trend judgment mechanisms, such as 20⁄50 period moving average relationships or longer-period trend indicators, ensuring the strategy operates in the overall market trend direction, avoiding counter-trend trading. This can improve win rates and reduce unnecessary losses.

Time Filtering: Incorporate time filtering functionality to avoid specific market periods such as 30 minutes before market open or during major economic data releases, when volatility is typically unpredictable and may lead to poor strategy performance.

Adaptive Parameters: Implement parameter adaptation mechanisms based on market volatility, such as increasing RSI thresholds or volume multipliers when volatility increases, allowing the strategy to better adapt to changing market environments.

Enhanced Signal Confirmation: Consider adding candlestick pattern analysis or price action pattern recognition as additional confirmation signals to improve entry precision. For example, require bearish candlestick formations such as “evening star” or “bearish engulfing pattern” near entry points.

Scaled Exit Strategy: Optimize the current single exit mechanism with a scaled exit strategy. For example, close part of the position when price reaches certain profit levels, while moving the stop-loss for remaining positions to breakeven or profit, effectively locking in partial profits while allowing for continued growth.

Multi-timeframe Analysis: Integrate signal confirmation from higher timeframes (such as 15-minute, 1-hour), ensuring short-term signals align with larger timeframe trends, improving strategy robustness.

Conclusion

The SPY Enhanced Short Signals Strategy is an efficient quantitative trading system based on multiple technical indicators and precise entry conditions. Through comprehensive analysis of price-resistance relationships, RSI, MACD momentum, and volume changes, the strategy captures high-probability shorting opportunities in the market. Its ATR-based dynamic risk management mechanism provides adaptive take-profit and stop-loss levels, effectively balancing risk and reward.

The strategy’s core advantages lie in its strict entry condition filtering and precise timing, avoiding overtrading and emotional interference. Meanwhile, the strategy’s adaptability and adjustable parameters allow it to accommodate different market environments. Nevertheless, users should remain aware of potential risks such as false breakouts, counter-trend trading, and parameter sensitivity, making targeted optimizations based on actual trading performance.

By incorporating trend filtering, time filtering, adaptive parameters, and multi-timeframe analysis, the strategy’s performance can be further enhanced. Overall, this is a quantitative trading strategy with clear concepts, rigorous logic, and practical application value, suitable for experienced traders to apply in live trading under appropriate risk management.

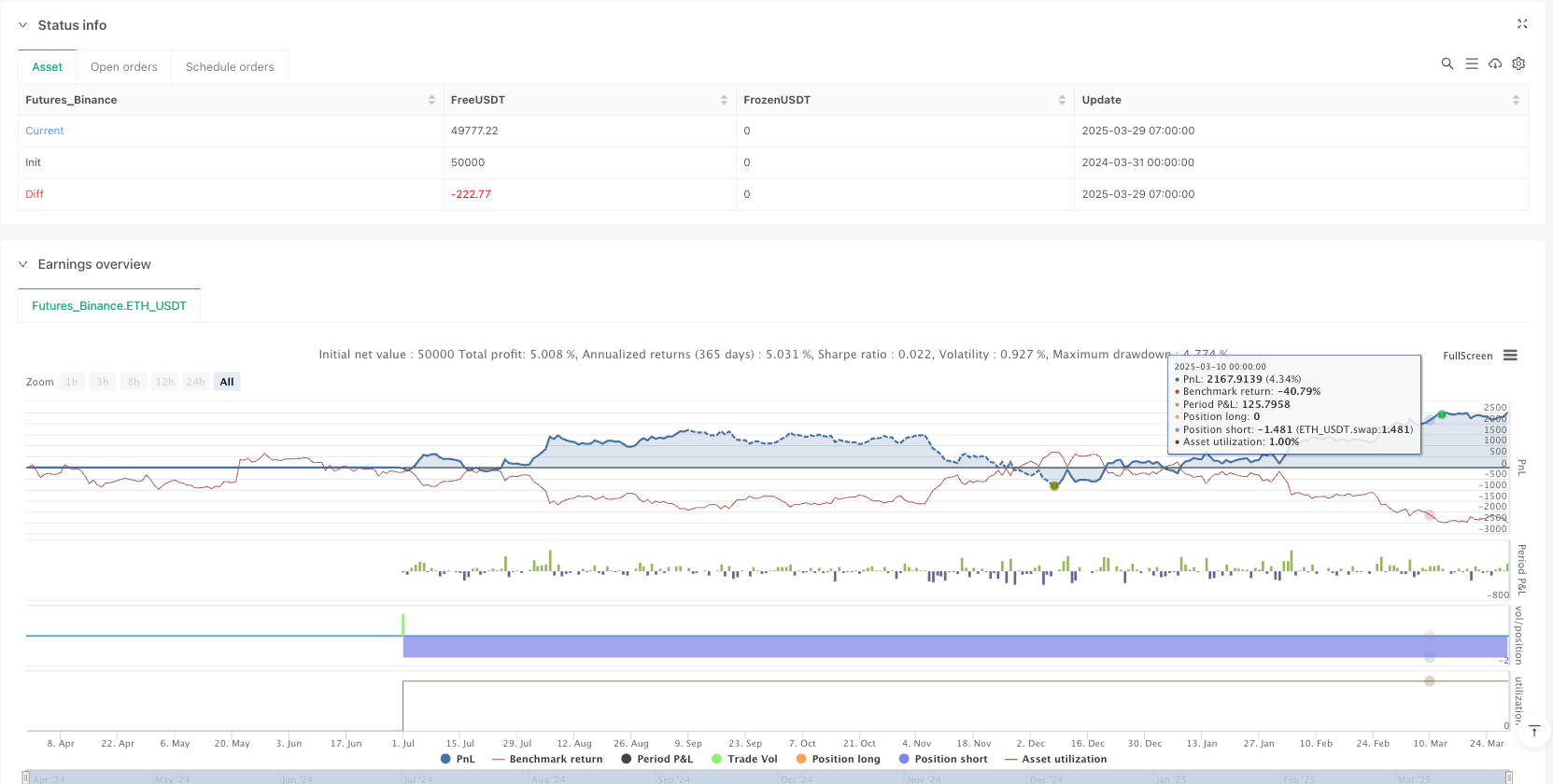

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("SPY Enhanced Short Signals – Fixed", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ===== Inputs =====

length = input.int(20, "Lookback Period", minval=5)

rsiThreshold = input.float(45, "RSI Threshold", minval=1, maxval=50)

volMultiplier = input.float(1.5, "Volume Spike Multiplier", step=0.1)

// ATR multipliers for dynamic exits

atrProfitMultiplier = input.float(1.5, "ATR Profit Multiplier", step=0.1)

atrLossMultiplier = input.float(1.0, "ATR Stop Loss Multiplier", step=0.1)

// ===== Level Calculations =====

support = ta.lowest(low, length)

resistance = ta.highest(high, length)

// ===== Short Entry Conditions =====

// nearResistance: Price is within 1% *below* resistance.

nearResistance = close >= resistance * 0.99

// bearishRSI: RSI (period 20) must be below the specified threshold.

bearishRSI = ta.rsi(close, 20) < rsiThreshold

// MACD for momentum

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

bearishMomentum = macdLine < signalLine

// Volume spike: volume exceeds the 20-period SMA times the multiplier.

volSMA = ta.sma(volume, 20)

volumeSpike = volume > volSMA * volMultiplier

// Compute the crossunder result once and assign it to a global variable.

crossunderRes = ta.crossunder(close, resistance)

// Combine conditions: Enter short if either nearResistance or a crossunder occurs, and RSI, MACD, and volume conditions are met.

enterShort = (nearResistance or crossunderRes) and bearishRSI and bearishMomentum and volumeSpike

// ===== Dynamic Exit Conditions =====

dynamicATR = ta.atr(14)

dynamicProfit = dynamicATR * atrProfitMultiplier

dynamicLoss = dynamicATR * atrLossMultiplier

// ===== Execute Short Trade =====

if (enterShort)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", limit = strategy.position_avg_price - dynamicProfit, stop = strategy.position_avg_price + dynamicLoss)

// ===== Plotting =====

plot(resistance, title="Resistance", color=color.red, linewidth=2)

plot(support, title="Support", color=color.green, linewidth=2)

plotshape(enterShort, title="SELL Signal", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, text="SELL")