Advanced Dynamic Range Breakout Trend Following Strategy

EMA ATR RSI Keltner Channel Trend Analysis Volatility Filter Momentum Indicator

Overview

The Advanced Dynamic Range Breakout Trend Following Strategy is a quantitative trading system that combines Keltner Channels, trend filtering, and momentum confirmation. The core idea of this strategy is to identify the starting points of strong trends, enter the market at appropriate positions, and manage risk using dynamic stop-loss and take-profit mechanisms. The strategy uses Keltner Channel breakouts as entry signals, combined with moving average trend filtering and RSI momentum confirmation to improve trade quality. This strategy is suitable for markets with higher volatility and can effectively capture significant price trends.

Strategy Principles

The core mechanism of this strategy is based on several key components:

Keltner Channel: Uses a 20-period EMA as the middle band, with upper and lower bands calculated as the middle band plus or minus 2 times ATR. The Keltner Channel dynamically adapts to market volatility, automatically expanding during increased volatility and narrowing during decreased volatility.

Trend Filter: Uses a 200-period EMA as a long-term trend judgment standard. When the price is above this moving average, the market is considered to be in an uptrend; otherwise, it’s considered to be in a downtrend. This filter ensures that the strategy trades in the direction of the main trend.

Momentum Confirmation: Uses the RSI indicator (14-period) as additional entry confirmation. An RSI value greater than 50 supports long entries, while a value less than 50 supports short entries, ensuring trades are only made when momentum aligns with the price trend.

Entry Conditions:

- Long: Price breaks above the upper Keltner band, while the price is above the 200 EMA, and RSI > 50

- Short: Price breaks below the lower Keltner band, while the price is below the 200 EMA, and RSI < 50

Exit Conditions:

- Long: Price falls below the middle EMA band

- Short: Price rises above the middle EMA band

Risk Management: The strategy uses ATR-based dynamic stop-loss and take-profit levels

- Long stop-loss is set at entry price minus 1.5 times ATR

- Long take-profit is set at entry price plus 2 times ATR

- Short stop-loss is set at entry price plus 1.5 times ATR

- Short take-profit is set at entry price minus 2 times ATR

This design allows stop-loss and take-profit levels to automatically adjust based on current market volatility, rather than using fixed points, which is more aligned with actual market conditions.

Strategy Advantages

Strong Dynamic Adaptability: By using ATR to calculate Keltner Channel and risk management parameters, the strategy can automatically adapt to volatility changes in different market phases, avoiding excessive trading during low volatility periods while fully capturing opportunities during high volatility periods.

Multi-layer Confirmation Mechanism: The strategy combines channel breakouts, moving average trends, and momentum indicators for three layers of confirmation, significantly improving signal quality and reducing false signals.

Comprehensive Risk Management: The ATR-based dynamic stop-loss and take-profit mechanism makes risk management more flexible, allowing for adjustments to protection levels based on actual market volatility.

Balance Between Trend Following and Oscillation Response: Although primarily a trend-following strategy, the EMA crossover exit mechanism provides some capability to respond to short-term reversals, avoiding excessive holding that could lead to drawdowns.

Clear Strategy Logic: The relationships between components are well-defined, without overly complex rules, making the strategy easy to understand and optimize.

Strategy Risks

Poor Performance in Sideways Markets: In range-bound, oscillating markets without a clear trend, the strategy may generate frequent entry and exit signals, leading to consecutive losses. A solution could be to add a market type identification indicator that automatically reduces position size or pauses trading when a sideways market is detected.

Slippage and Commission Impact: The strategy may have multiple trades in the short term, and in live trading, slippage and commissions can significantly affect strategy performance. It is recommended to include reasonable slippage and commission assumptions in backtesting to obtain a more realistic performance assessment.

Parameter Sensitivity: Strategy effectiveness is relatively sensitive to the Keltner Channel length and multiplier parameters, and different markets may require different parameter settings. Extensive parameter optimization and robustness testing are recommended to avoid overfitting.

Rapid Reversal Risk: In the case of sudden market reversals, the EMA-based exit may not react quickly enough, causing previously gained profits to be given back. Consider adding volatility surge detection mechanisms or more sensitive short-term stop-loss conditions to address this situation.

Long-term Trend Filter Lag: The 200 EMA as a trend filter has significant lag, potentially missing opportunities at the beginning of trends and generating unnecessary trades at the end of trends. Consider using multi-period trend judgment or adding trend momentum indicators to improve this issue.

Strategy Optimization Directions

Adaptive Parameters: The strategy could consider setting the Keltner Channel multiplier parameter as an adaptive value, dynamically adjusting based on recent market volatility states. Use smaller multipliers in low volatility environments to capture minor breakouts, and larger multipliers in high volatility environments to avoid false breakouts.

Add Volume Filter: Incorporate a volume confirmation mechanism into the strategy, requiring increased volume when price breaks out, which can improve the reliability of breakout signals and reduce false breakout trades.

Optimize Time Filtering: Add time filtering conditions to avoid known low-quality trading sessions, such as midday sessions in certain markets or specific periods before and after economic data releases.

Introduce Dynamic Take-Profit Mechanism: The existing fixed-ratio ATR take-profit can be improved to a trailing take-profit, allowing profits to continue growing in strong trends rather than being limited by early take-profit. For example, an ATR channel tracking could be used to implement dynamic take-profit.

Market Environment Classification: Add a market environment classification mechanism to use different strategy parameters or even different trading logic in different types of markets. Volatility indicators, trend strength indicators, or market breadth indicators can be used to identify the current market environment.

Optimize RSI Application: Currently, RSI is only used as a fixed threshold (50) filter. Consider using the dynamic characteristics of RSI, such as overbought/oversold areas, RSI divergence, or RSI trends, for more advanced applications to improve signal quality.

Summary

The Advanced Dynamic Range Breakout Trend Following Strategy is a well-structured quantitative trading system that excels in capturing significant trends by combining Keltner Channels, trend judgment, and momentum confirmation. Its core advantage lies in its ability to dynamically adapt to market volatility changes and its multi-level signal confirmation mechanism, effectively reducing the risk of false signals.

The strategy uses ATR-based risk management methods, allowing stop-loss and take-profit levels to dynamically adjust based on actual market conditions, which is more reasonable than fixed points. At the same time, the EMA crossover exit mechanism prevents excessive holding at the end of trends that could lead to drawdowns.

Although the strategy may perform poorly in oscillating markets and has some sensitivity to parameter settings, these shortcomings can be effectively improved through the suggested optimization directions, such as adaptive parameters, volume confirmation, and market environment classification.

Overall, this strategy provides a solid trend trading framework suitable for investors with medium to long-term holding styles, especially in markets with higher volatility. With reasonable parameter optimization and strategy improvements, it has the potential to maintain stable performance across various market environments.

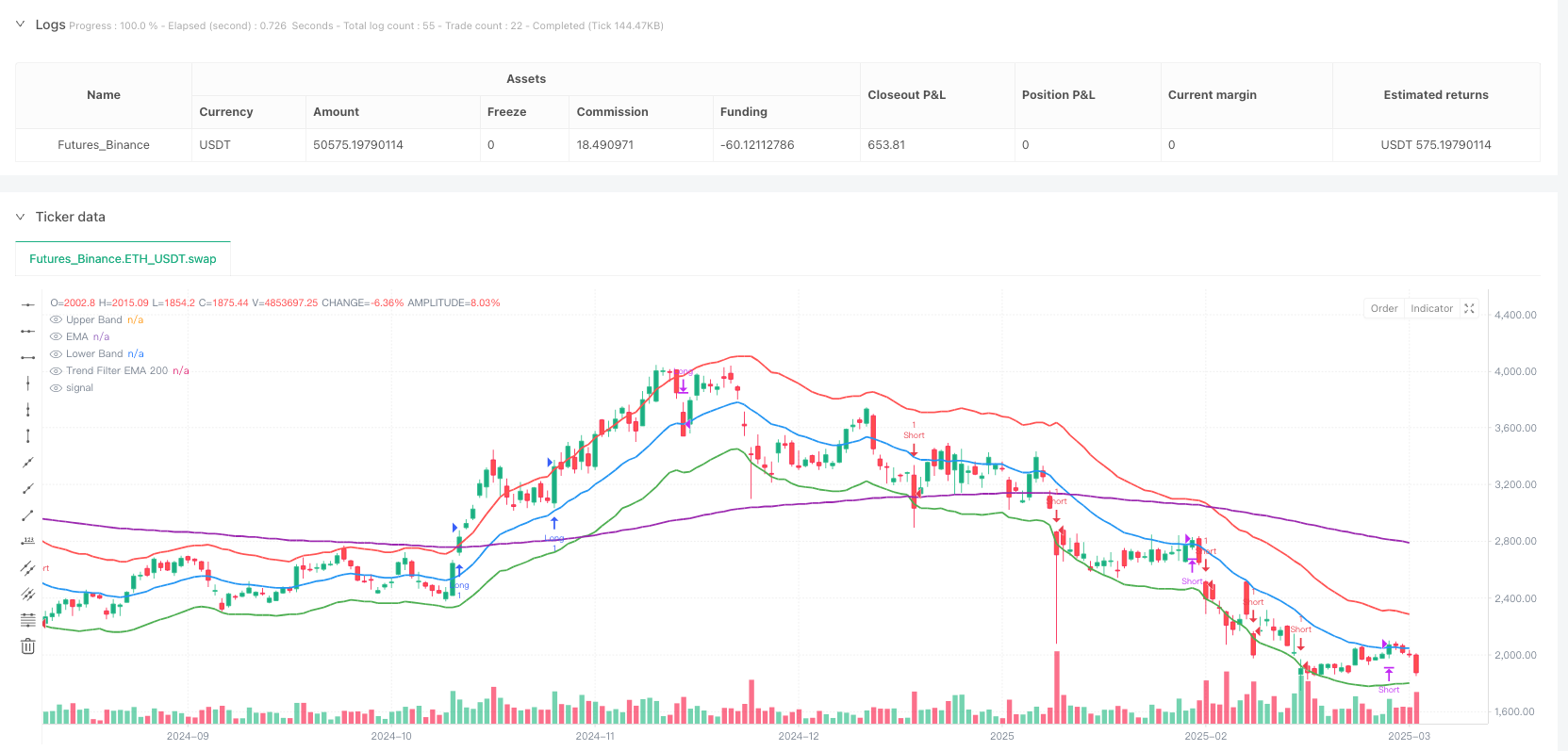

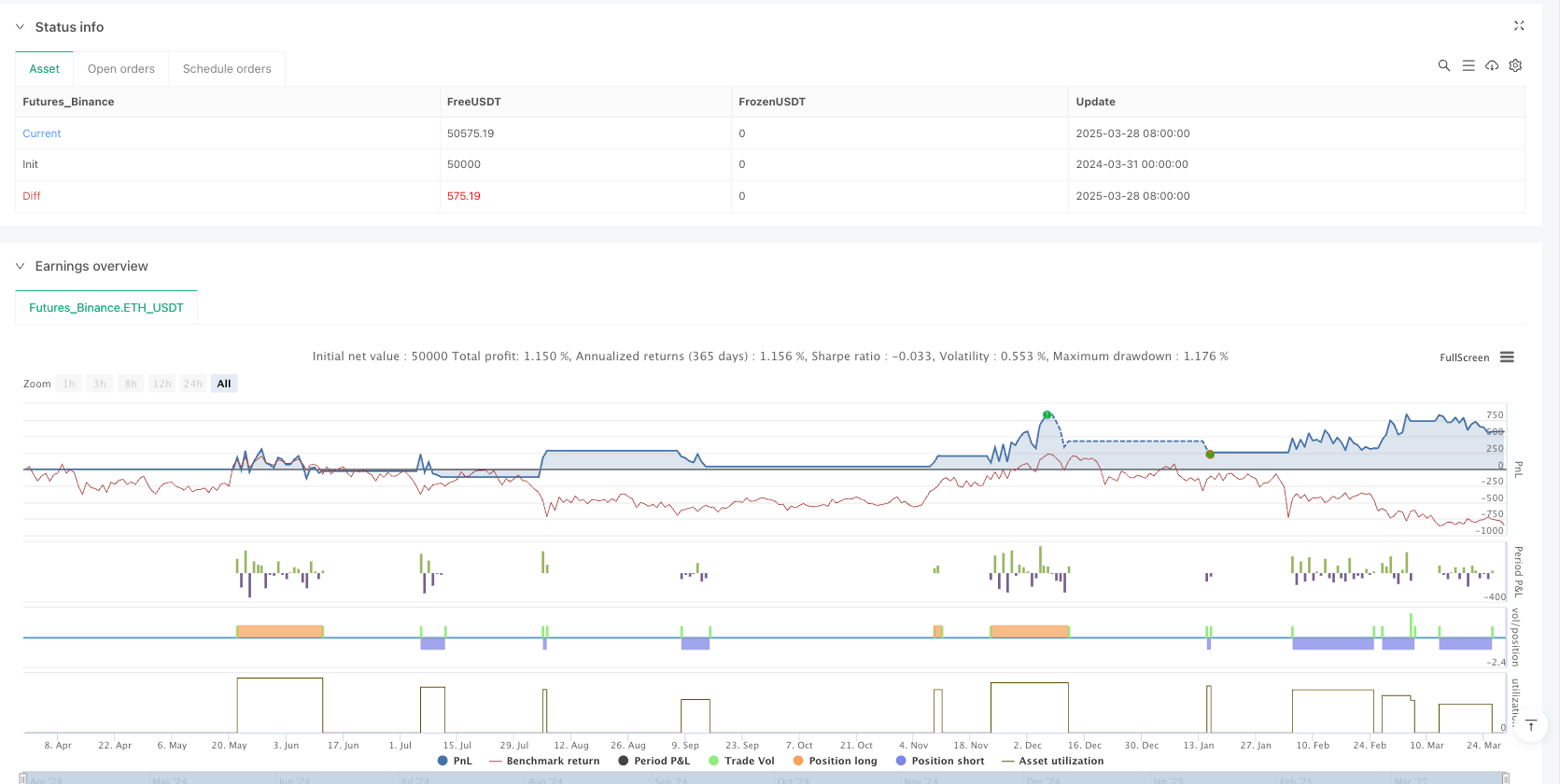

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Enhanced Keltner Channel Strategy", overlay = true)

// Inputs for Keltner Channel

length = input.int(20, "EMA Length")

mult = input.float(2.0, "Multiplier")

// Trend Filter - 200 EMA

trendEMA = input.int(200, "Trend EMA Length")

ema200 = ta.ema(close, trendEMA)

// Keltner Channel Calculation

ema = ta.ema(close, length)

atr = ta.atr(length)

upper_band = ema + mult * atr

lower_band = ema - mult * atr

// Additional Confirmation - RSI

rsiLength = input.int(14, "RSI Length")

rsi = ta.rsi(close, rsiLength)

// Entry Conditions

longCondition = ta.crossover(close, upper_band) and close > ema200 and rsi > 50

shortCondition = ta.crossunder(close, lower_band) and close < ema200 and rsi < 50

// Exit Conditions

exitLongCondition = ta.crossunder(close, ema)

exitShortCondition = ta.crossover(close, ema)

// ATR-Based Stop Loss and Take Profit

atrValue = ta.atr(14)

stopLossLong = close - 1.5 * atrValue

takeProfitLong = close + 2 * atrValue

stopLossShort = close + 1.5 * atrValue

takeProfitShort = close - 2 * atrValue

// Strategy Execution

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Long", stop=stopLossLong, limit=takeProfitLong)

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Short", stop=stopLossShort, limit=takeProfitShort)

if exitLongCondition

strategy.close("Long")

if exitShortCondition

strategy.close("Short")

// Plotting

plot(upper_band, color=color.red, linewidth=2, title="Upper Band")

plot(ema, color=color.blue, linewidth=2, title="EMA")

plot(lower_band, color=color.green, linewidth=2, title="Lower Band")

plot(ema200, color=color.purple, linewidth=2, title="Trend Filter EMA 200")