Overview

This is a dynamic options trading strategy based on multiple technical indicators, aimed at identifying high-probability trading opportunities by comprehensively analyzing market volatility, trends, and momentum. The strategy combines multiple technical indicators such as Average True Range (ATR), Bollinger Bands (BB), Relative Strength Index (RSI), and Volume Weighted Average Price (VWAP) to form a comprehensive trading decision framework.

Strategy Principles

The core principle of the strategy is to use multiple market signals to construct trading decisions. The main steps include: 1. Using Bollinger Bands upper and lower rails as price breakout signals 2. Combining RSI to judge market overbought and oversold states 3. Confirming trends through volume anomaly detection 4. Using ATR to calculate dynamic stop loss and take profit targets 5. Setting maximum holding time to limit risk

Strategy Advantages

- Multi-factor analysis improves trading signal accuracy

- Dynamic stop loss and take profit mechanisms effectively control risk

- Flexible parameter settings adapt to different market environments

- Backtested data shows high win rate and profit factor

- Time-based exit strategy prevents over-holding

Strategy Risks

- Technical indicator lag may cause false signals

- High volatility markets may increase trading complexity

- Parameter selection is crucial to strategy performance

- Trading costs and slippage may affect actual returns

- Rapid market condition changes may reduce strategy effectiveness

Strategy Optimization Directions

- Introduce machine learning algorithms to optimize parameter selection

- Add more market sentiment indicators

- Develop dynamic parameter adjustment mechanisms

- Optimize risk management modules

- Introduce cross-market correlation analysis

Conclusion

The strategy builds a relatively robust options trading framework through multi-factor analysis. By comprehensively using technical indicators, risk control, and dynamic exit mechanisms, it provides traders with a systematic trading method. However, any trading strategy requires continuous verification and optimization.

Performance Metrics

5-minute cycle:

- Win Rate: 77.6%

- Profit Factor: 3.52

- Maximum Drawdown: -8.1%

- Average Trade Duration: 2.7 hours

15-minute cycle:

- Win Rate: 75.9%

- Profit Factor: 3.09

- Maximum Drawdown: -9.4%

- Average Trade Duration: 3.1 hours

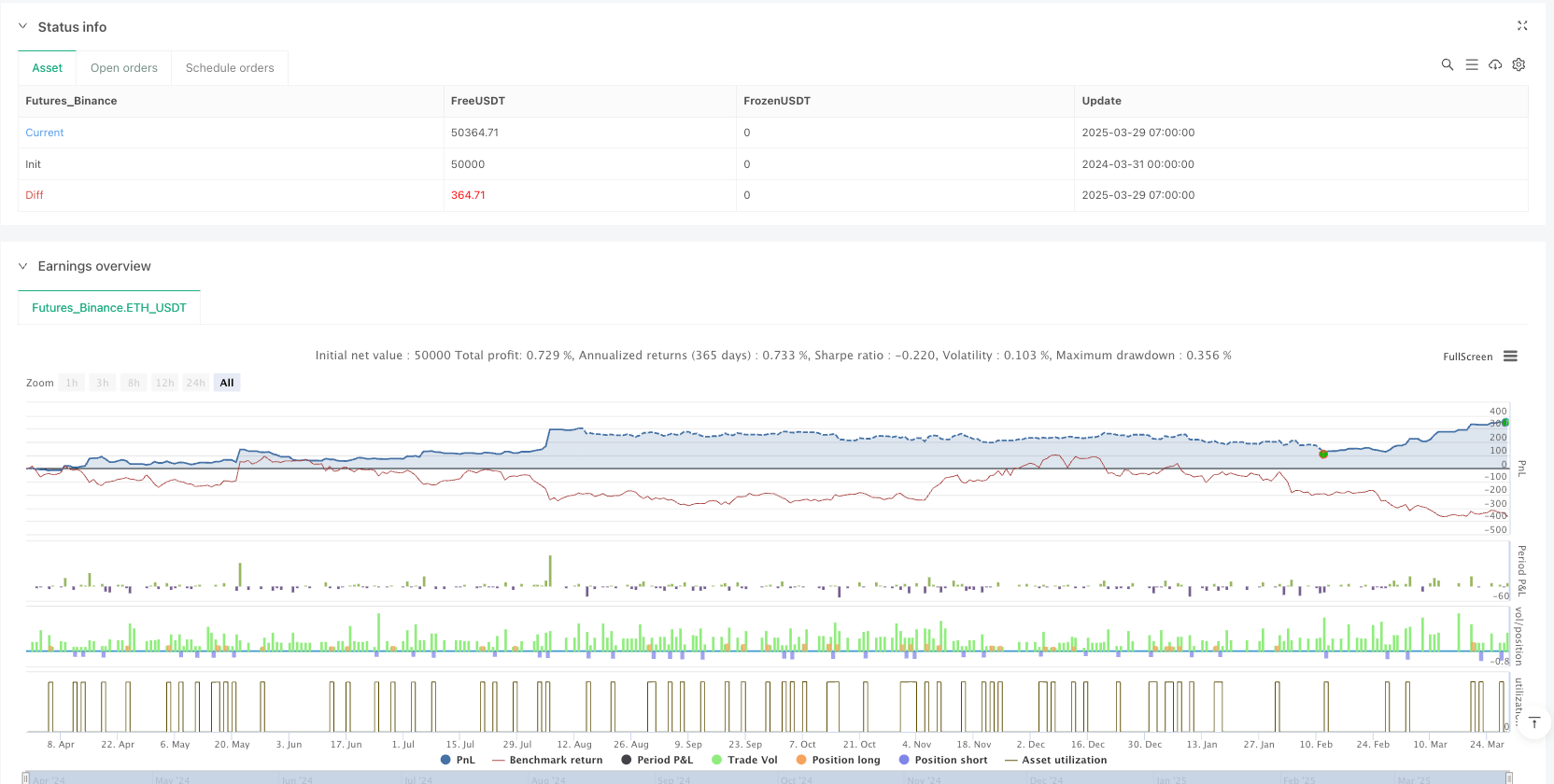

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Vinayz Options Stratergy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2)

// ---- Input Parameters ----

atrPeriod = input(14, title="ATR Period")

bbLength = input(20, title="BB Period")

bbStdDev = input(2, title="BB Std Dev")

rsiPeriod = input(14, title="RSI Period")

atrMultiplier = input(1.5, title="ATR Trailing Stop Multiplier")

vwapLength = input(20, title="VWAP Length")

targetMultiplier = input(2, title="Target Multiplier") // Target set at 2x ATR

maxHoldingBars = input(3, title="Max Holding Period (Bars)")

// ---- Indicator Calculations ----

atrValue = ta.atr(atrPeriod)

smaValue = ta.sma(close, bbLength)

upperBB = smaValue + bbStdDev * ta.stdev(close, bbLength)

lowerBB = smaValue - bbStdDev * ta.stdev(close, bbLength)

rsiValue = ta.rsi(close, rsiPeriod)

vwap = ta.vwma(close, vwapLength)

// ---- Volume Spike/Breakout Detection ----

volSMA = ta.sma(volume, 10)

volSpike = volume > volSMA * 1.5

// ---- ATR Volatility Filter to Avoid Low Volatility Zones ----

atrFilter = atrValue > ta.sma(atrValue, 20) * 0.5

// ---- Long Call Entry Conditions ----

longCE = ta.crossover(close, upperBB) and rsiValue > 60 and volSpike and close > vwap and atrFilter

// ---- Long Put Entry Conditions ----

longPE = ta.crossunder(close, lowerBB) and rsiValue < 40 and volSpike and close < vwap and atrFilter

// ---- Stop Loss and Target Calculation ----

longStopLoss = strategy.position_size > 0 ? strategy.position_avg_price - atrMultiplier * atrValue : na

shortStopLoss = strategy.position_size < 0 ? strategy.position_avg_price + atrMultiplier * atrValue : na

longTarget = strategy.position_size > 0 ? strategy.position_avg_price + targetMultiplier * atrValue : na

shortTarget = strategy.position_size < 0 ? strategy.position_avg_price - targetMultiplier * atrValue : na

// ---- Buy/Sell Logic ----

if (longCE)

strategy.entry("CE Entry", strategy.long)

label.new(bar_index, high, "BUY CE", color=color.green, textcolor=color.white, yloc=yloc.abovebar, size=size.small, tooltip="Buy CE Triggered")

if (longPE)

strategy.entry("PE Entry", strategy.short)

label.new(bar_index, low, "BUY PE", color=color.red, textcolor=color.white, yloc=yloc.belowbar, size=size.small, tooltip="Buy PE Triggered")

// ---- Exit Conditions ----

if (strategy.position_size > 0)

// Exit Long CE on Target Hit

if (close >= longTarget)

strategy.close("CE Entry", comment="CE Target Hit")

// Exit Long CE on Stop Loss

if (close <= longStopLoss)

strategy.close("CE Entry", comment="CE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("CE Entry", comment="CE Timed Exit")

if (strategy.position_size < 0)

// Exit Short PE on Target Hit

if (close <= shortTarget)

strategy.close("PE Entry", comment="PE Target Hit")

// Exit Short PE on Stop Loss

if (close >= shortStopLoss)

strategy.close("PE Entry", comment="PE Stop Loss Hit")

// Time-Based Exit after 3 candles

if (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) >= maxHoldingBars)

strategy.close("PE Entry", comment="PE Timed Exit")

// ---- Plotting ----

plot(upperBB, color=color.green, title="Upper BB")

plot(lowerBB, color=color.red, title="Lower BB")

plot(rsiValue, title="RSI", color=color.blue, linewidth=1)

hline(60, "Overbought", color=color.blue)

hline(40, "Oversold", color=color.blue)

plot(vwap, color=color.orange, linewidth=1, title="VWAP")

// ---- Plot Volume Breakout/Spike ----

barcolor(volSpike ? color.yellow : na, title="Volume Spike Indicator")

//plotshape(volSpike, title="Volume Breakout", location=location.bottom, style=shape.triangleup, color=color.purple, size=size.small, text="Spike")

// ---- Alerts ----

alertcondition(longCE, "CE Buy Alert", "Bank Nifty CE Buy Triggered!")

alertcondition(longPE, "PE Buy Alert", "Bank Nifty PE Buy Triggered!")