Overview

This is an innovative quantitative trading strategy that provides a structured approach to trading by integrating liquidity zone entries, ATR volatility thresholds, and dynamic risk management. The strategy combines multiple technical analysis indicators to identify high-probability trading opportunities and automatically calculate take profit and stop loss levels.

Strategy Principles

The core principles of the strategy are based on the following key elements:

- Liquidity Zone Analysis: Identifying potential support and resistance areas by calculating the lowest and highest points over a specific period.

- ATR Volatility Filtering: Using Average True Range (ATR) as a dynamic threshold for entry and risk management.

- Trend Filtering: Combining 50-period Exponential Moving Average (EMA) and Relative Strength Index (RSI) to confirm market trend and momentum.

- Dynamic Risk Management: Automatically calculating take profit and stop loss levels based on ATR, with flexible risk/reward ratio adjustment.

Strategy Advantages

- Multi-Dimensional Signal Generation: Combining liquidity, volatility, and trend filtering to improve signal quality.

- Adaptive Risk Management: Dynamically adjusting take profit and stop loss to effectively control trading risk.

- Flexible Parameter Configuration: Customizable ATR length, liquidity period, and trading session.

- Visualization Support: Providing visualization of liquidity lines and first candle level.

- Performance Tracking: Built-in trading statistics table displaying win rate and trade outcomes directly on the chart.

Strategy Risks

- Parameter Sensitivity: Strategy performance highly depends on parameter selection, requiring continuous backtesting and optimization.

- Market Adaptability: Potential instability in markets with unclear trends or high volatility.

- False Breakout Risk: Potential for misreported liquidity zone breakouts.

- Trading Frequency: Session filtering and multiple conditions may reduce trading opportunities.

- Backtest Bias: The 64% historical win rate may not fully represent future performance.

Strategy Optimization Directions

- Machine Learning Integration: Introducing machine learning algorithms for dynamic parameter and signal generation adjustment.

- Multi-Market Adaptability: Developing more universal parameter settings applicable to different markets and instruments.

- Advanced Risk Management: Implementing more complex position sizing and risk allocation algorithms.

- Signal Confirmation Mechanism: Adding additional confirmation indicators like volume or other technical indicators.

- Real-Time Performance Monitoring: Developing real-time performance assessment and adaptive adjustment modules.

Summary

The ThinkTech AI Trading Strategy provides traders with a powerful quantitative trading tool through an innovative multi-factor approach. By leveraging liquidity analysis, volatility filtering, and dynamic risk management, the strategy aims to identify high-quality trading opportunities. However, traders must continuously backtest, optimize, and apply the strategy cautiously to fully realize its potential.

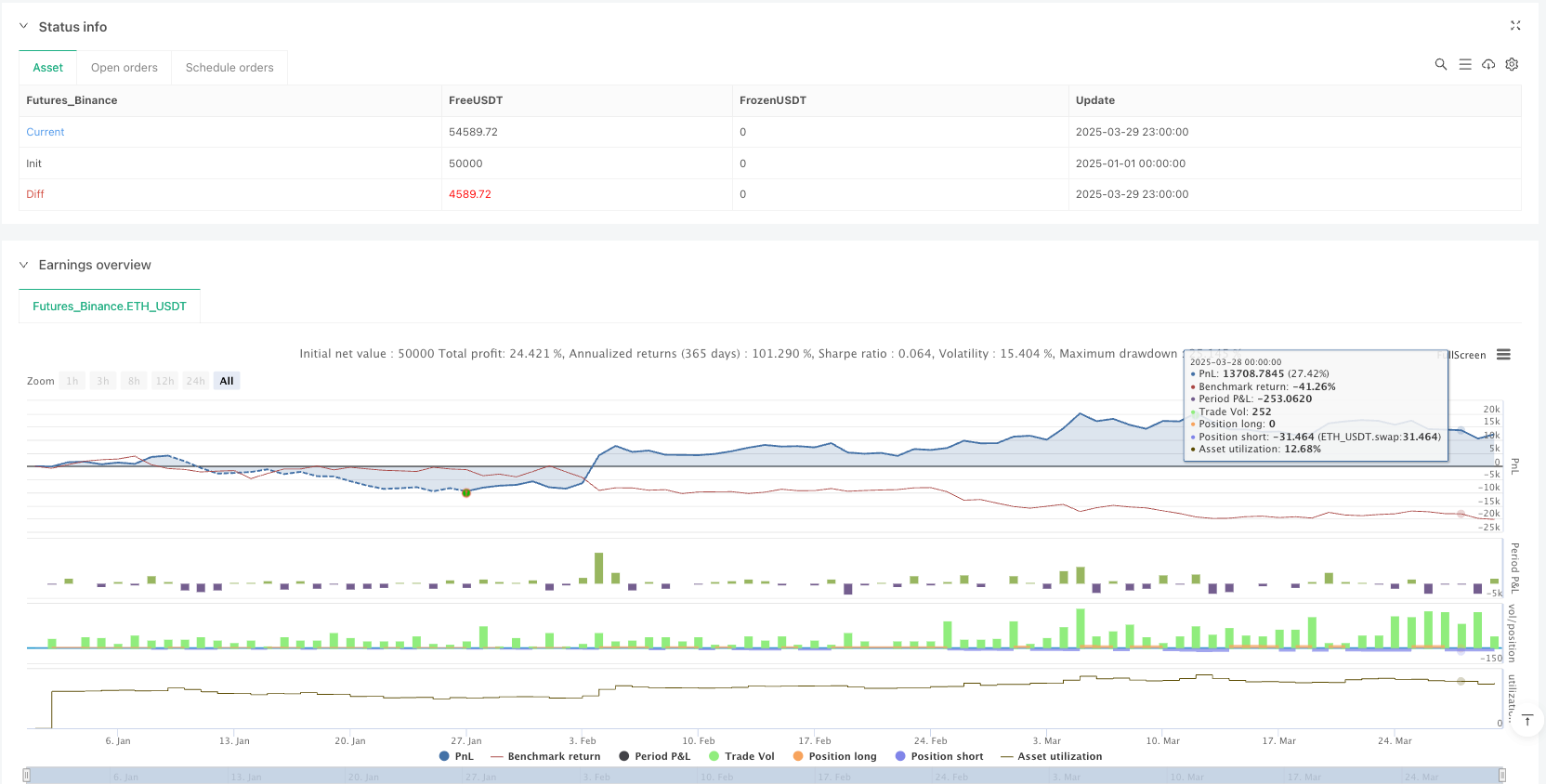

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-30 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

if high > ta.highest(high[1], 5)

strategy.entry("Enter Long", strategy.long)

else if low < ta.lowest(low[1], 5)

strategy.entry("Enter Short", strategy.short)//@version=6

strategy("ThinkTech AI Signals", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

//──────────────────────────────

// Input Settings

//──────────────────────────────

riskRewardRatio = input.float(title="Risk/Reward Ratio", defval=2.0, minval=1.0, step=0.1)

// Inputs from second script

liquidity_period = input.int(20, title="Liquidity Base Period")

atr_length = input.int(14, title="ATR Length")

atr_threshold = input.float(0.3, title="ATR Breakout Threshold")

take_profit_mult = input.float(0.25, title="Take-Profit Multiplier")

stop_loss_mult = input.float(0.75, title="Stop-Loss Multiplier")

vol_filter = input.bool(true, title="Enable Volume Filter")

session_filter = input.bool(true, title="Limit to Trading Session")

// Additional inputs for further filtering and settings

atrMultiplier = input.float(title="ATR Multiplier for Stop Loss", defval=1.5, minval=0.1, step=0.1)

retestCushionLong = input.float(title="Retest Cushion Factor for BUY", defval=1.0, minval=1.0, step=0.001)

retestCushionShort = input.float(title="Retest Cushion Factor for SELL", defval=1.0, minval=0.0, maxval=1.0, step=0.001)

useTrendFilter = input.bool(title="Use 50 EMA Trend Filter", defval=true)

useRSIFilter = input.bool(title="Use RSI Filter", defval=false)

rsiPeriod = input.int(title="RSI Period", defval=14, minval=1)

rsiOversold = input.float(title="RSI Oversold Level", defval=30.0, minval=1, maxval=50)

rsiOverbought = input.float(title="RSI Overbought Level", defval=70.0, minval=50, maxval=100)

// Option to remove plotted lines

showLiquidityLines = input.bool(true, title="Show Liquidity Lines")

showFirstCandleLines = input.bool(true, title="Show First Candle Level Lines")

//──────────────────────────────

// Calculations & Variables (Liquidity & ATR Based)

//──────────────────────────────

price = close

atr = ta.atr(atr_length)

vol_condition = volume > ta.sma(volume, 20)

// Define Liquidity Base and Apex for support/resistance

liquidity_base = ta.lowest(low, liquidity_period)

apex = ta.highest(high, liquidity_period)

// Track recent highs and lows for filtering

hh = ta.highest(high, 30)

ll = ta.lowest(low, 30)

//──────────────────────────────

// Trade Stats Variables

//──────────────────────────────

var float take_profit = na

var float stop_loss = na

var bool in_trade = false

var int win_count = 0

var int loss_count = 0

//──────────────────────────────

// ENTRY LOGIC (BUY) Based on Liquidity & ATR

//──────────────────────────────

breakout_up = price > liquidity_base + (atr * atr_threshold)

point_of_release = ta.crossover(price, liquidity_base) and breakout_up

retest_buy = price > liquidity_base and price < hh and not in_trade

// Session condition (e.g. trading between 9AM–12PM)

session_condition = (hour >= 9 and hour <= 12) or not session_filter

if (point_of_release or retest_buy) and (vol_condition or not vol_filter) and session_condition

strategy.entry("Buy", strategy.long)

take_profit := price + (atr * take_profit_mult)

stop_loss := liquidity_base - (atr * stop_loss_mult)

in_trade := true

alert("Buy Signal - Price: " + str.tostring(price), alert.freq_once_per_bar)

//──────────────────────────────

// ENTRY LOGIC (SELL) Based on Liquidity & ATR

//──────────────────────────────

breakout_down = price < apex - (atr * atr_threshold)

clean_break = ta.crossunder(price, apex) and breakout_down

retest_sell = price < apex and price > ll and not in_trade

if (clean_break or retest_sell) and (vol_condition or not vol_filter) and session_condition

strategy.entry("Sell", strategy.short)

take_profit := price - (atr * take_profit_mult)

stop_loss := apex + (atr * stop_loss_mult)

in_trade := true

alert("Sell Signal - Price: " + str.tostring(price), alert.freq_once_per_bar)

//──────────────────────────────

// EXIT LOGIC (For BUY & SELL)

//──────────────────────────────

if strategy.position_size > 0

if price >= take_profit

strategy.close("Buy", comment="Take Profit")

win_count += 1

in_trade := false

if price <= stop_loss

strategy.close("Buy", comment="Stop Loss")

loss_count += 1

in_trade := false

if strategy.position_size < 0

if price <= take_profit

strategy.close("Sell", comment="Take Profit")

win_count += 1

in_trade := false

if price >= stop_loss

strategy.close("Sell", comment="Stop Loss")

loss_count += 1

in_trade := false

//──────────────────────────────

// Plot Liquidity Lines (Support/Resistance)

//──────────────────────────────

plot(showLiquidityLines ? liquidity_base : na, color=color.green, title="Liquidity Base (Support)")

plot(showLiquidityLines ? apex : na, color=color.red, title="Apex (Resistance)")

//──────────────────────────────

// Debugging Signal Shapes

//──────────────────────────────

plotshape(series=point_of_release, location=location.belowbar, color=color.green, style=shape.triangleup, title="Buy Signal")

plotshape(series=clean_break, location=location.abovebar, color=color.red, style=shape.triangledown, title="Sell Signal")

//──────────────────────────────

// Win/Loss Table Display

//──────────────────────────────

var table t = table.new(position.top_right, 1, 2)

if bar_index == last_bar_index

table.cell(t, 0, 0, "Wins: " + str.tostring(win_count), bgcolor=color.new(color.green, 80))

table.cell(t, 0, 1, "Losses: " + str.tostring(loss_count), bgcolor=color.new(color.red, 80))

//──────────────────────────────

// Alert Conditions for Entries and Exits

//──────────────────────────────

alertcondition(point_of_release, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(clean_break, title="Sell Alert", message="Sell Signal Triggered")

var int lastClosedTrades = 0

var bool exitSignal = false

if strategy.closedtrades > lastClosedTrades

exitSignal := true

lastClosedTrades := strategy.closedtrades

alertcondition(exitSignal, title="EXIT Signal", message="EXIT signal triggered: Trade has closed (TP or SL reached).")

//──────────────────────────────

// FIRST 15-MINUTE CANDLE CAPTURE (9:30–9:45 AM EST)

//──────────────────────────────

newDay = dayofmonth != dayofmonth[1]

var float fHigh = na

var float fLow = na

var bool firstCandleCaptured = false

if newDay

fHigh := high

fLow := low

firstCandleCaptured := true

//──────────────────────────────

// Additional Filters & Calculations

//──────────────────────────────

// Trend Filter: 50 EMA

ema50 = ta.ema(close, 50)

longFilter = not useTrendFilter or (close > ema50)

shortFilter = not useTrendFilter or (close < ema50)

// ATR-Based Stop Loss Buffer

atrValue = ta.atr(14)

stopLossBuffer = atrValue * atrMultiplier

// RSI Calculation (if enabled)

rsiValue = ta.rsi(close, rsiPeriod)

//──────────────────────────────

// ENTRY CONDITIONS (15-Minute Candle Retest)

//──────────────────────────────

// Breakout/Breakdown based on the first candle levels

buyBreakout = firstCandleCaptured and ta.crossover(close, fHigh)

sellBreakdown = firstCandleCaptured and ta.crossunder(close, fLow)

// Retest conditions: price must retest the level after the breakout/breakdown

buyRetest = firstCandleCaptured and (low <= fHigh) and (close > fHigh)

sellRetest = firstCandleCaptured and (high >= fLow) and (close < fLow)

// Final entry signals (with optional RSI filter)

buySignal = buyBreakout and buyRetest and longFilter and (strategy.position_size == 0) and (not useRSIFilter or (rsiValue < rsiOversold))

sellSignal = sellBreakdown and sellRetest and shortFilter and (strategy.position_size == 0) and (not useRSIFilter or (rsiValue > rsiOverbought))

//──────────────────────────────

// Trade Parameters for 15-Minute Candle Retest

//──────────────────────────────

candleRange = fHigh - fLow

stopLossBuy = fLow - stopLossBuffer

takeProfitBuy = fHigh + (candleRange * riskRewardRatio)

stopLossSell = fHigh + stopLossBuffer

takeProfitSell = fLow - (candleRange * riskRewardRatio)

//──────────────────────────────

// Execute Trades for 15-Minute Candle Retest

//──────────────────────────────

if buySignal

strategy.entry("BUY", strategy.long)

strategy.exit("TP/SL BUY", "BUY", stop=stopLossBuy, limit=takeProfitBuy)

if sellSignal

strategy.entry("SELL", strategy.short)

strategy.exit("TP/SL SELL", "SELL", stop=stopLossSell, limit=takeProfitSell)

//──────────────────────────────

// Plot First Candle Level Lines (Optional)

//──────────────────────────────

plot(showFirstCandleLines and firstCandleCaptured ? fHigh : na, title="First Candle High", color=color.blue, linewidth=2)

plot(showFirstCandleLines and firstCandleCaptured ? fLow : na, title="First Candle Low", color=color.red, linewidth=2)