Overview

This strategy is a high-precision trading method based on the market’s dynamic range midpoint, capturing price fluctuation characteristics within a specific time range to achieve precise entry and exit timing. The core of the strategy is to use a configurable lookback period to dynamically calculate the price range’s high, low, and midpoint, and execute limit orders during New York Stock Exchange trading hours.

Strategy Principles

The strategy principles are based on the following key mechanisms: 1. Dynamic Range Calculation: Real-time calculation of price highs, lows, and midpoints by setting an adjustable lookback period (default 30 candles). 2. Time-Constrained Trading: Strictly limited to New York Stock Exchange trading hours (9:30 AM to 3:00 PM). 3. Midpoint Breakthrough Signals: Generate long or short signals when closing prices cross the range midpoint. 4. Limit Order Strategy: Place orders at the range midpoint with take profit and stop loss set at range high and low points.

Strategy Advantages

- High-Precision Entry: Provide more accurate entry timing through dynamic midpoint calculation.

- Controllable Risk: Strict take profit and stop loss mechanisms effectively control single trade risk.

- Time Selectivity: Trade only during active exchange hours, avoiding low liquidity periods.

- Flexible Parameters: Adjustable lookback period adapts to different market environments.

- Overnight Risk Avoidance: Automatic position closure before trading day end.

Strategy Risks

- Range Calculation Limitations: Fixed lookback periods may not accurately reflect real-time market conditions during volatile markets.

- Trading Frequency Risks: Frequent trading may increase transaction costs and slippage risks.

- Parameter Sensitivity: Lookback period and trading hours significantly impact strategy performance.

- Market Adaptability: Strategy may not apply to all instruments and market environments.

Strategy Optimization Directions

- Dynamic Lookback Period: Introduce adaptive algorithms to dynamically adjust lookback periods based on market volatility.

- Multi-Timeframe Verification: Combine signals from different timeframes to improve signal accuracy.

- Volatility Filtering: Add volatility indicators to filter low-quality trading signals.

- Machine Learning Optimization: Use machine learning algorithms to dynamically adjust entry and exit parameters.

- Enhanced Risk Management: Introduce more complex position management and dynamic stop-loss mechanisms.

Summary

This strategy provides traders with a systematic, rule-clear trading method through precise range midpoint breakthrough and limit order trading mechanisms. Its core advantages lie in high-precision entry, risk control, and time selectivity. Future optimization will focus on improving the strategy’s adaptability and stability.

Key Technical Indicators

- Lookback Period

- Range High

- Range Low

- Range Midpoint

- NYSE Trading Hours

Trading Logic Summary

Capture short-term price trends and reversal opportunities by dynamically calculating price ranges and executing limit trades near the midpoint within a strict time and risk management framework.

Risk Disclaimer

This strategy is for reference only. Actual trading requires adjustment based on individual risk tolerance and market environment.

Recommended Application Scenarios

Suitable for medium and short-term investors seeking stable, systematic trading strategies, especially those focusing on index futures and high-liquidity instruments.

Conclusion

The core of quantitative trading is continuous optimization and adaptation. This strategy provides traders with a trading framework worth in-depth research and improvement.

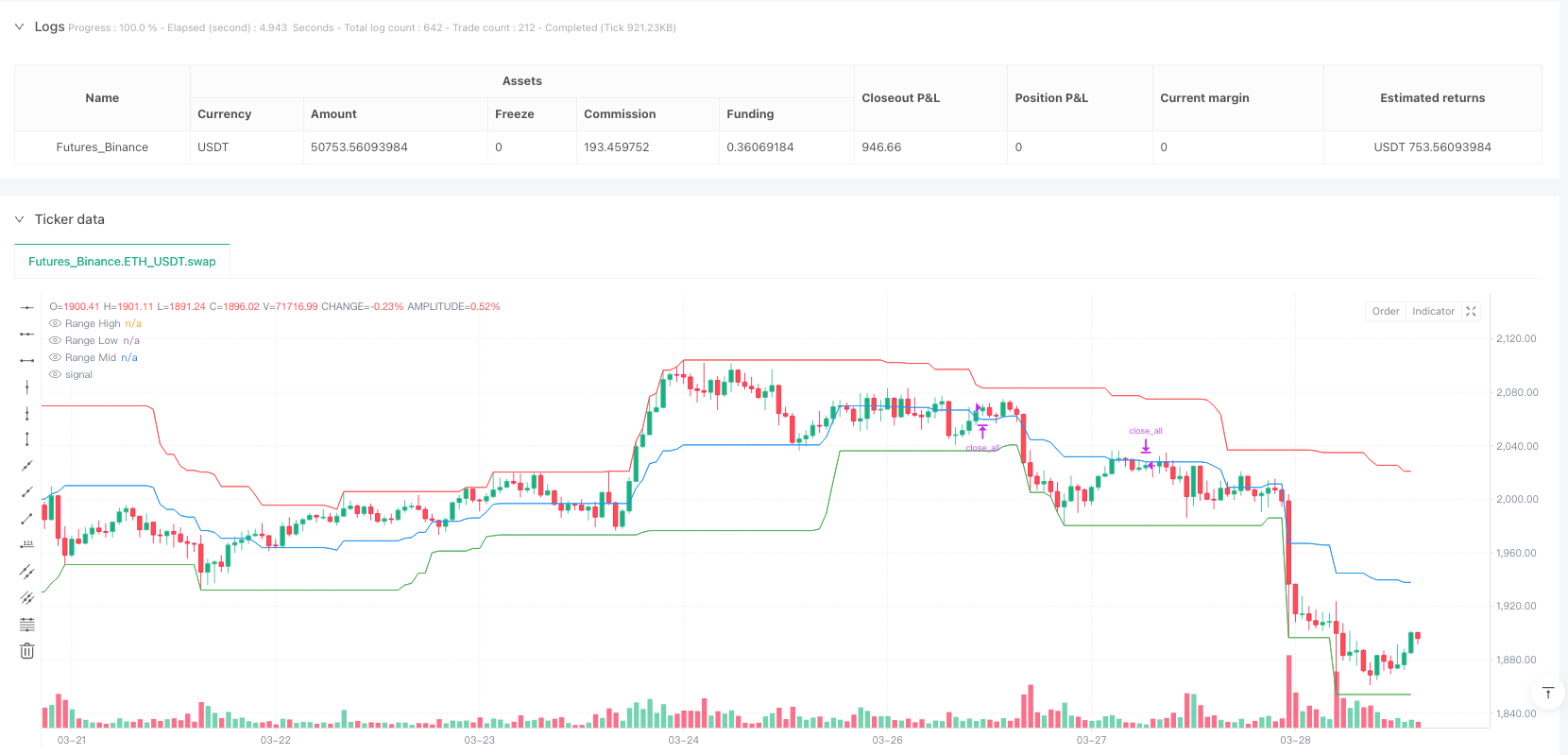

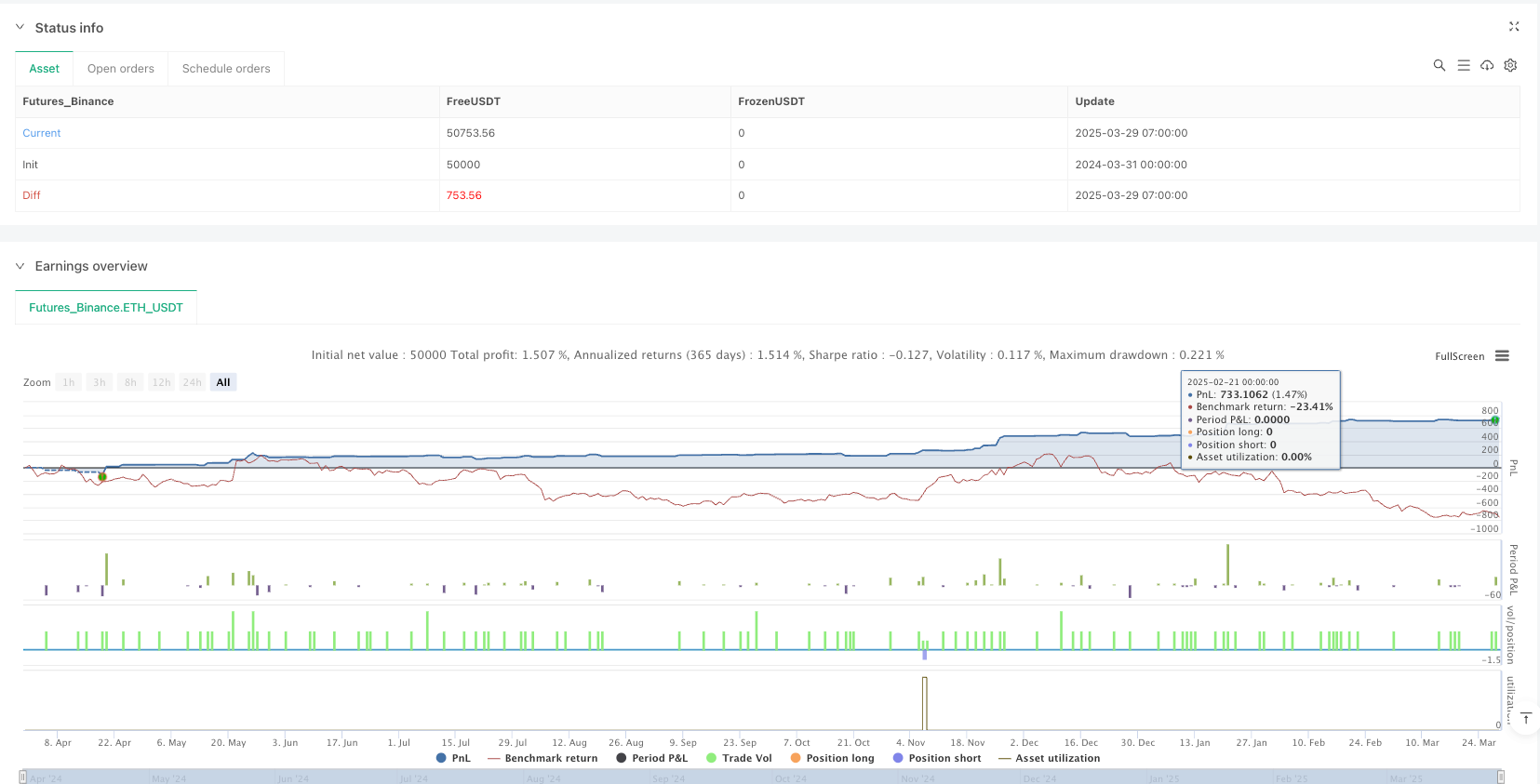

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Midpoint Crossing Strategy", overlay=true)

// Input for lookback period

lookback = input.int(30, title="Lookback Period", minval=1)

// Input for NYSE trading hours

startHour = 9

startMinute = 30

endHour = 15

endMinute = 0

// Variables to store high, low, and midpoint of the lookback period

var float rangeHigh = na

var float rangeLow = na

var float rangeMid = na

// Calculate high, low, and midpoint based on lookback period

if (bar_index >= lookback)

rangeHigh := ta.highest(high, lookback)

rangeLow := ta.lowest(low, lookback)

rangeMid := (rangeHigh + rangeLow) / 2

// Plot high, low, and midpoint for reference

plot(rangeHigh, color=color.red, title="Range High")

plot(rangeLow, color=color.green, title="Range Low")

plot(rangeMid, color=color.blue, title="Range Mid")

// Time condition for NYSE hours

currentTime = timestamp("GMT-5", year, month, dayofmonth, hour, minute)

startTime = timestamp("GMT-5", year, month, dayofmonth, startHour, startMinute)

endTime = timestamp("GMT-5", year, month, dayofmonth, endHour, endMinute)

// Check if the current time is within NYSE hours

isNYSEHours = currentTime >= startTime and currentTime <= endTime

// Entry conditions (only during NYSE hours)

longCondition = ta.crossover(close, rangeMid) and isNYSEHours

shortCondition = ta.crossunder(close, rangeMid) and isNYSEHours

// Define stop loss and take profit levels based on the range

longStopLoss = rangeLow

longTakeProfit = rangeHigh

shortStopLoss = rangeHigh

shortTakeProfit = rangeLow

// Place limit order at mid-price

if (longCondition and not strategy.opentrades)

strategy.order("Long Limit", strategy.long, limit=rangeMid)

strategy.exit("Take Profit", "Long Limit", limit=longTakeProfit, stop=longStopLoss)

if (shortCondition and not strategy.opentrades)

strategy.order("Short Limit", strategy.short, limit=rangeMid)

strategy.exit("Take Profit", "Short Limit", limit=shortTakeProfit, stop=shortStopLoss)

// Close open positions at 4:00 PM to avoid overnight risk

if (currentTime >= endTime)

strategy.close_all(comment="Close All at 4:00 PM")

// Add a check for open positions

if (strategy.opentrades > 0)

// Ensure no recalculation while a position is open

rangeHigh := na

rangeLow := na

rangeMid := na