#### Overview

This is an Average True Range (ATR)-based trend-following strategy designed to capture high-probability trades by combining multiple technical indicators. The strategy integrates ATR filtering, Supertrend indicator, Exponential Moving Average (EMA) and Simple Moving Average (SMMA) trend bands, Relative Strength Index (RSI) confirmation, and a dynamic stop-loss system, aiming to provide a comprehensive and flexible trading approach.

Strategy Principles

The core principle is based on the synergistic action of multiple technical indicators:

Trend Identification: Using Supertrend indicator (parameters: factor 2, length 5) and 50-day EMA with 8-day SMMA trend bands to define market trend direction. Trends are color-coded:

- Green: Bullish trend

- Red: Bearish trend

- Gray: Neutral phase

ATR Smart Filtering: Detecting volatility expansion through 14-period ATR and 50-period Simple Moving Average, trading only when ATR is rising or above 101% of its SMA, ensuring entries only in strong trends.

Entry Conditions:

- Long Entry: Price above 50-day EMA, Supertrend bullish, RSI > 45, ATR confirms trend strength

- Short Entry: Price below 50-day EMA, Supertrend bearish, RSI < 45, ATR confirms trend strength

Dynamic Stop-Loss and Take-Profit:

- Take-Profit: Adaptive based on 5x ATR

- Stop-Loss: Trailing stop-loss at 3.5x ATR

- Break-Even Stop: Activated after price moves 2x ATR

- Fixed Stop-Loss: Risk management using 0.8x ATR multiplier

Strategy Advantages

- Effectively filter volatile markets, avoiding trading in low volatility zones

- Prevent over-trading through take-profit lock mechanism

- Capture strong trends, allowing profits to run with trailing stop-loss

- Reduce drawdowns with ATR-based stop-loss

- Adjustable parameters for fine-tuning across different markets

Strategy Risks

- Over-reliance on technical indicators may lead to false signals

- Potential poor performance in ranging markets

- Improper parameter settings may increase trading costs

- RSI confirmation might miss rapid trend changes

Strategy Optimization Directions

- Integrate machine learning algorithms for dynamic parameter adjustment

- Add additional filters like volume confirmation

- Explore optimal parameter combinations across different markets and timeframes

- Develop multi-timeframe verification mechanisms

Conclusion

This is an advanced trend-following strategy that provides traders with a flexible and powerful trading tool through multi-indicator synergy and dynamic risk management. Continuous backtesting and optimization are key to successful application.

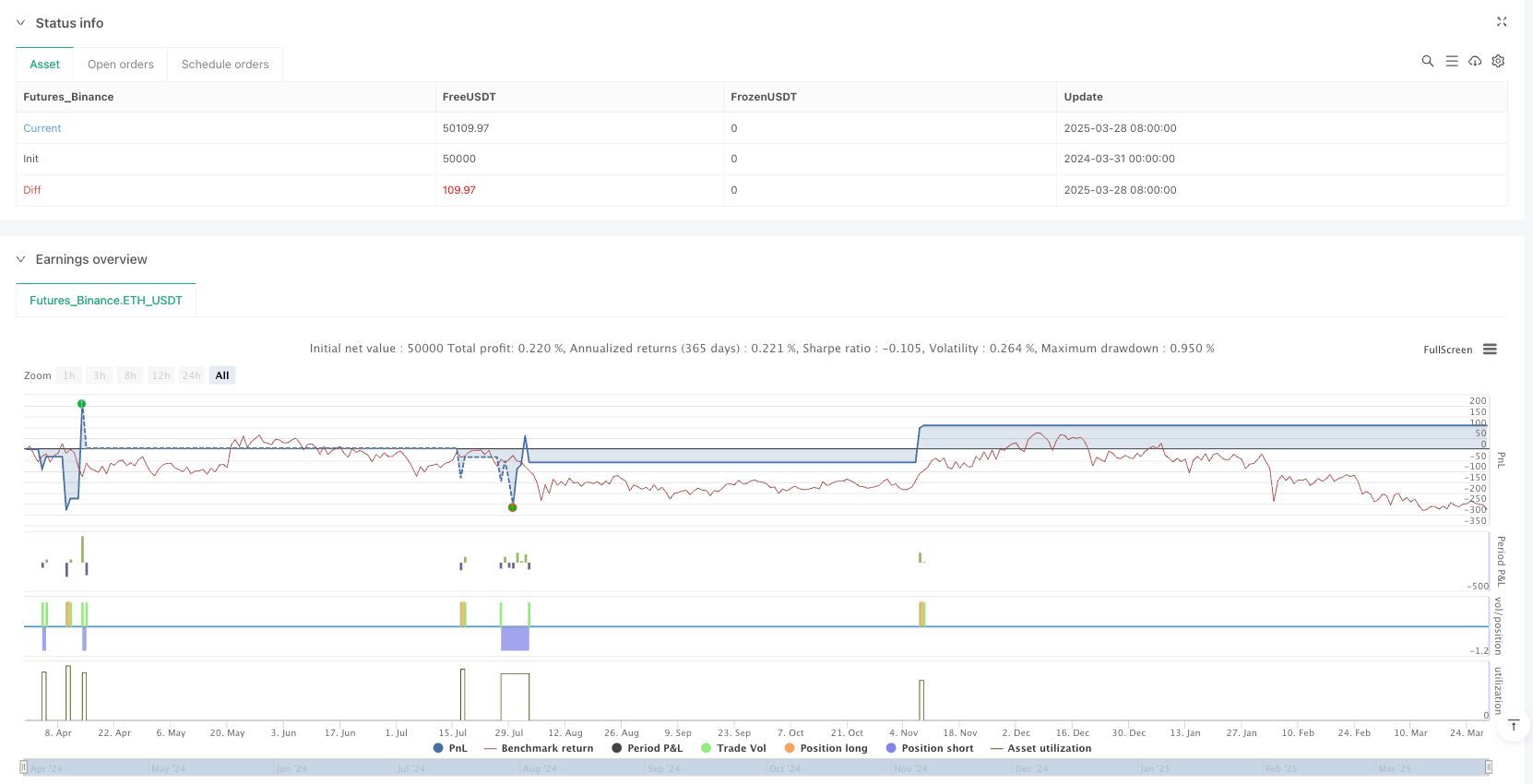

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Optimized ATR-Based Trend Strategy v6 (Fixed Trend Capture)", overlay=true)

// 🔹 Input parameters

lengthSMMA = input(8, title="SMMA Length")

lengthEMA = input(50, title="EMA Length")

supertrendFactor = input(2.0, title="Supertrend Factor")

supertrendLength = input(5, title="Supertrend Length")

atrLength = input(14, title="ATR Length")

atrSmoothing = input(50, title="ATR Moving Average Length")

atrMultiplierTP = input.float(5.0, title="ATR Multiplier for Take-Profit", minval=1.0, step=0.5)

atrMultiplierTSL = input.float(3.5, title="ATR Multiplier for Trailing Stop-Loss", minval=1.0, step=0.5) // 🔹 Increased to ride trends

atrStopMultiplier = input.float(0.8, title="ATR Stop Multiplier", minval=0.5, step=0.1)

breakEvenMultiplier = input.float(2.0, title="Break-Even Trigger ATR Multiplier", minval=1.0, step=0.1)

rsiLength = input(14, title="RSI Length")

// 🔹 Indicator calculations

smma8 = ta.sma(ta.sma(close, lengthSMMA), lengthSMMA)

ema50 = ta.ema(close, lengthEMA)

// 🔹 Supertrend Calculation

[superTrend, _] = ta.supertrend(supertrendFactor, supertrendLength)

// 🔹 Supertrend Conditions

isBullishSupertrend = close > superTrend

isBearishSupertrend = close < superTrend

// 🔹 ATR Calculation for Smarter Filtering

atrValue = ta.atr(atrLength)

atrMA = ta.sma(atrValue, atrSmoothing)

atrRising = ta.rising(atrValue, 3) // 🔹 More sensitive ATR detection

isTrending = atrValue > atrMA * 1.01 or atrRising // 🔹 Loosened ATR filter

// 🔹 RSI Calculation

rsi = ta.rsi(close, rsiLength)

// 🔹 RSI Conditions (More Flexible)

isRSIBullish = rsi > 45 // 🔹 Lowered to capture early trends

isRSIBearish = rsi < 45

// 🔹 TP Lock Mechanism

var bool tpHit = false

if strategy.position_size == 0 and strategy.closedtrades > 0

tpHit := true

// 🔹 Supertrend Flip Detection (Resumes Trading After Trend Change)

trendFlip = (isBullishSupertrend and not isBullishSupertrend[1]) or (isBearishSupertrend and not isBearishSupertrend[1])

if trendFlip

tpHit := false

// 🔹 Entry Conditions

bullishEntry = close > ema50 and isBullishSupertrend and isRSIBullish and isTrending and not tpHit

bearishEntry = close < ema50 and isBearishSupertrend and isRSIBearish and isTrending and not tpHit

// 🔹 Dynamic Take-Profit, Stop-Loss, and Break-Even Stop

longTakeProfit = close + (atrValue * atrMultiplierTP)

shortTakeProfit = close - (atrValue * atrMultiplierTP)

longTrailStop = atrValue * atrMultiplierTSL

shortTrailStop = atrValue * atrMultiplierTSL

// ✅ Adjusted SL to Reduce Drawdown

longStopLoss = close - (atrValue * atrMultiplierTSL * atrStopMultiplier)

shortStopLoss = close + (atrValue * atrMultiplierTSL * atrStopMultiplier)

// ✅ Break-Even Stop Trigger (More Room for Trends)

longBreakEven = strategy.position_avg_price + (atrValue * breakEvenMultiplier)

shortBreakEven = strategy.position_avg_price - (atrValue * breakEvenMultiplier)

// 🔹 Strategy Execution (Fixed Take-Profit & Stop-Loss)

if (bullishEntry)

strategy.entry("Buy", strategy.long)

strategy.exit("TSL/TP", from_entry="Buy", stop=longStopLoss, trail_offset=longTrailStop, limit=longTakeProfit)

strategy.exit("BreakEven", from_entry="Buy", stop=longBreakEven)

if (bearishEntry)

strategy.entry("Sell", strategy.short)

strategy.exit("TSL/TP", from_entry="Sell", stop=shortStopLoss, trail_offset=shortTrailStop, limit=shortTakeProfit)

strategy.exit("BreakEven", from_entry="Sell", stop=shortBreakEven)

// 🔹 Trend Band

trendColor = isBullishSupertrend and smma8 > ema50 and close > ema50 ? color.green :

isBearishSupertrend and smma8 < ema50 and close < ema50 ? color.red : color.gray

fill(plot(smma8, color=color.new(trendColor, 60), title="8 SMMA Band"),

plot(ema50, color=color.new(trendColor, 60), title="50 EMA Band"),

color=color.new(trendColor, 80), title="Trend Band")

// 🔹 Supertrend Line

plot(superTrend, color=color.gray, title="Supertrend", style=plot.style_line)