Overview

This article elaborates on a trend trading strategy based on the Relative Strength Index (RSI) low-high point divergence. The strategy captures potential trend reversal opportunities by identifying divergences between price and RSI indicators, providing traders with precise entry and exit signals. The strategy uniquely combines visual signals and technical indicator analysis to enhance the accuracy and timeliness of trading decisions.

Strategy Principles

The core principle is based on the RSI low-high point divergence theory. Key implementation steps include:

- RSI Calculation: Using 14-period RSI length to assess market overbought and oversold states.

- Price Extreme Identification: Determining low and high points through lookback period.

- Divergence Judgment Mechanism:

- Bullish Divergence: Price makes a new low, but RSI does not synchronously decline

- Bearish Divergence: Price makes a new high, but RSI does not synchronously rise

- Signal Generation:

- Bullish divergence in oversold zone (below 30)

- Bearish divergence in overbought zone (above 70)

Strategy Advantages

- High-precision Signal Identification: Reduce false signals through strict divergence conditions.

- Visualization of Signals: Large triangular markers and background highlighting enhance readability.

- High Flexibility: Adjustable RSI parameters, lookback periods, and overbought/oversold thresholds.

- Multi-timeframe Adaptability: Best performance on 1-hour to 4-hour periods.

- Debugging Functionality: Built-in debug table for verifying key indicators.

Strategy Risks

- Misjudgment Risk: Divergence signals are not 100% accurate.

- Market Volatility: May underperform in strongly trending markets.

- Parameter Sensitivity: Improper RSI and lookback period settings can reduce strategy effectiveness.

- Transaction Costs: Frequent trading may incur high commission and slippage expenses.

Strategy Optimization Directions

- Multi-indicator Confirmation: Incorporate moving averages, MACD to improve signal accuracy.

- Dynamic Parameter Adjustment: Intelligently adjust RSI parameters based on market volatility.

- Stop-loss Mechanism: Introduce ATR-based dynamic stop-loss strategy.

- Machine Learning Optimization: Use machine learning algorithms to optimize entry and exit points.

- Risk Management: Adjust position sizes based on market volatility.

Summary

The Dynamic RSI Low-High Point Divergence Trend Strategy provides traders with an efficient trend trading method through precise technical indicator analysis and visual signals. Continuous optimization and risk management can help maintain stable performance across different market environments.

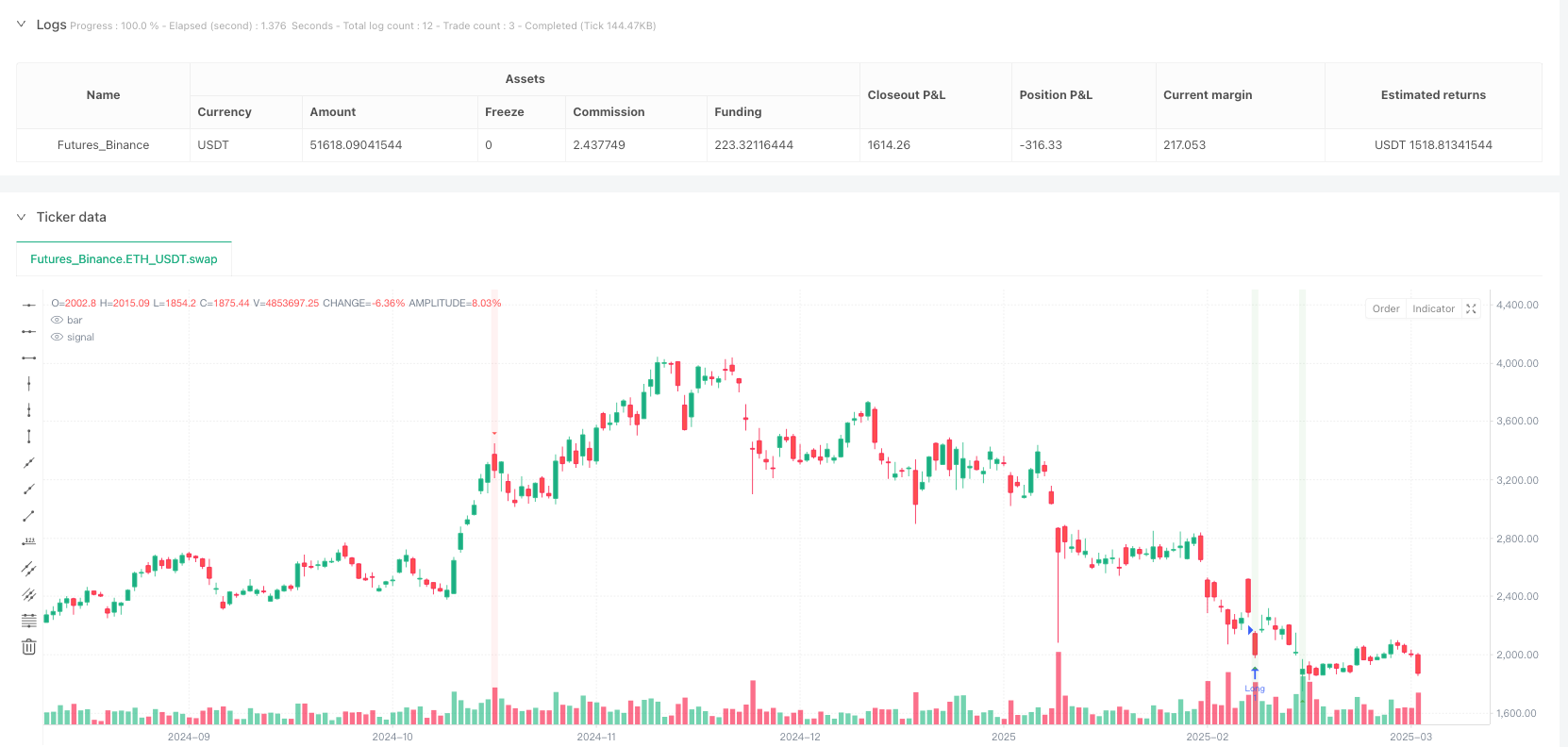

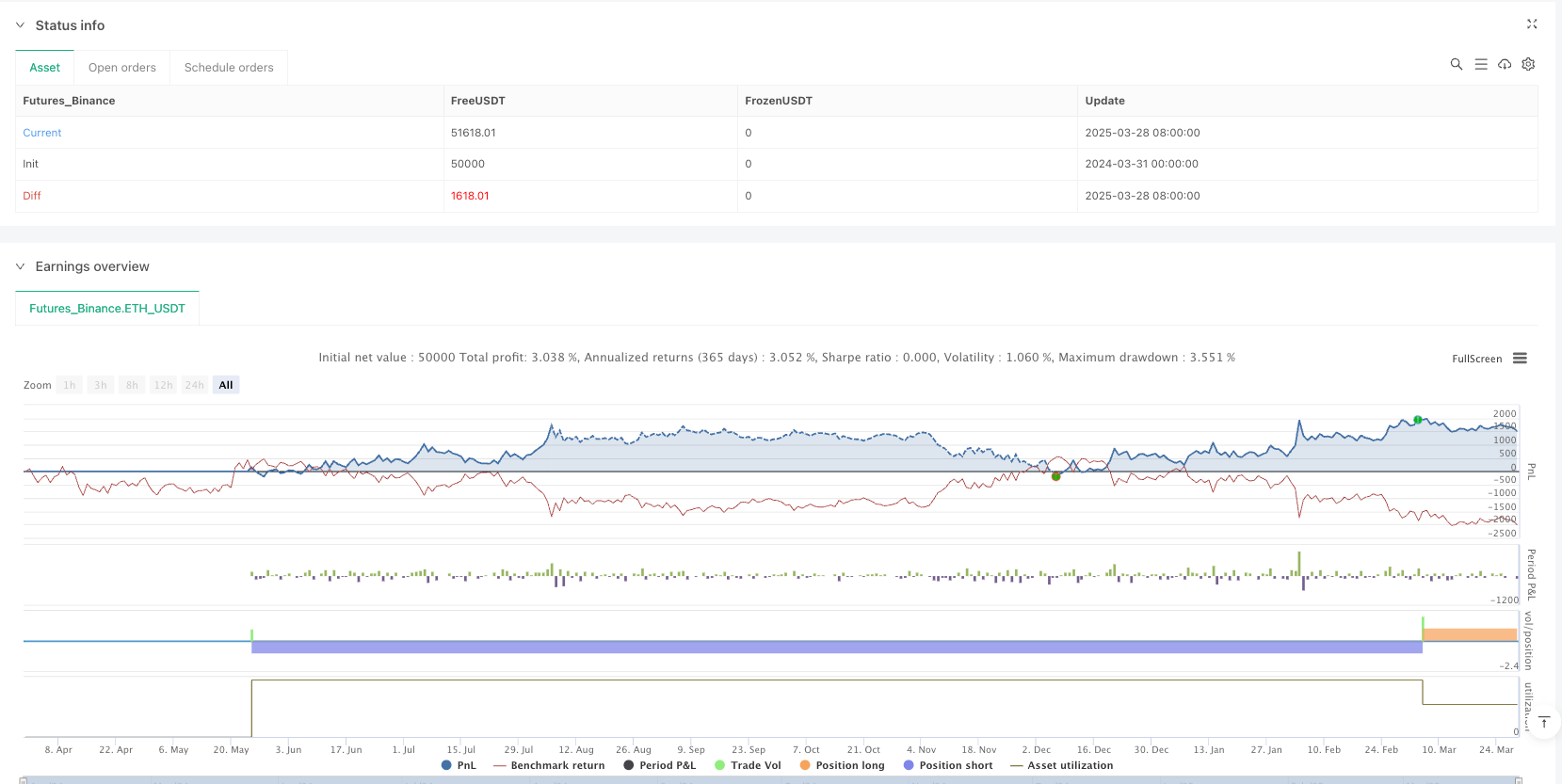

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("RSI Divergence Strategy - Visible Signals", overlay=true)

// 1. Basic Inputs (Keep it simple)

rsiLength = input.int(14, "RSI Length")

lookback = input.int(10, "Lookback Period", minval=5)

oversold = input.int(30, "Oversold Level")

overbought = input.int(70, "Overbought Level")

// 2. Calculate Indicators

rsi = ta.rsi(close, rsiLength)

priceLow = ta.lowest(low, lookback)

priceHigh = ta.highest(high, lookback)

rsiLow = ta.lowest(rsi, lookback)

rsiHigh = ta.highest(rsi, lookback)

// 3. Simple Divergence Detection

bullishDiv = low == priceLow and rsi > rsiLow and rsi < oversold

bearishDiv = high == priceHigh and rsi < rsiHigh and rsi > overbought

// 4. Visual Signals (Large and Clear)

plotshape(bullishDiv, "Buy", shape.triangleup, location.belowbar,

color=color.new(color.green, 0), size=size.large)

plotshape(bearishDiv, "Sell", shape.triangledown, location.abovebar,

color=color.new(color.red, 0), size=size.large)

// 5. Optional: Add Background for Better Visibility

bgcolor(bullishDiv ? color.new(color.green, 90) : bearishDiv ? color.new(color.red, 90) : na)

// 6. Basic Strategy Execution

if bullishDiv

strategy.entry("Long", strategy.long)

if bearishDiv

strategy.entry("Short", strategy.short)

// 7. Debugging Table (To verify values)

var table debugTable = table.new(position.top_right, 4, 1)

if barstate.islast

table.cell(debugTable, 0, 0, "RSI: " + str.tostring(rsi))

table.cell(debugTable, 1, 0, "Price Low: " + str.tostring(priceLow))

table.cell(debugTable, 2, 0, "RSI Low: " + str.tostring(rsiLow))

table.cell(debugTable, 3, 0, "Signal: " + (bullishDiv ? "BUY" : bearishDiv ? "SELL" : "NONE"))

// Test Settings (paste these above the strategy call)

//rsiLength := 5

//lookback := 5

//oversold := 20

//overbought := 80