Overview

The Intelligent Momentum Mixed Indicator Zero-Day Options Strategy Model is a short-term options trading system that combines multiple technical indicators, specifically designed for zero-day to expiration options (0DTE). This strategy integrates Moving Average Convergence Divergence (MACD), Volume Weighted Average Price (VWAP), Relative Strength Index (RSI), and two Exponential Moving Averages (EMA5 and EMA13) to create a multi-dimensional trade signal generation mechanism. The strategy aims to capture short-term market trend changes by using strict entry conditions to filter high-probability trading opportunities while utilizing reversal signals for risk management.

Strategy Principles

The Intelligent Momentum Mixed Indicator Zero-Day Options Strategy Model is based on the following core principles:

Multi-Indicator Confirmation: The strategy requires all four technical indicators to simultaneously meet specific conditions before generating a trading signal, significantly improving signal reliability. Specifically:

- MACD: Determines short-term momentum direction, bullish when the fast line is above the slow line, bearish when reversed.

- VWAP: Serves as an important price reference, judging the current price position relative to the day’s volume-weighted average price.

- RSI: Measures market overbought/oversold conditions, using a 7-period RSI with 50 as the bullish/bearish dividing line.

- EMA Cross: Uses 5-period and 13-period EMAs to determine recent trend direction.

Logically Rigorous Signal System:

- Bullish (Call) Condition: MACD fast line above signal line + Price above VWAP + RSI above 50 + EMA5 above EMA13.

- Bearish (Put) Condition: MACD fast line below signal line + Price below VWAP + RSI below 50 + EMA5 below EMA13.

Reversal Signal Exit Mechanism: When a signal opposite to the current position appears, the strategy automatically closes the position, helping to limit losses and secure profits promptly.

Capital Management: The strategy defaults to using 10% of the account equity for each trade, helping to control risk exposure and achieve effective capital utilization.

Strategy Advantages

Through in-depth analysis of the code, this strategy demonstrates the following significant advantages:

Multi-dimensional Confirmation Mechanism: By requiring four different types of technical indicators to confirm simultaneously, the strategy effectively filters out potentially misleading signals from single indicators, improving trading accuracy.

Adaptation to Short-term Market Fluctuations: Strategy parameters are optimized for intraday short-term trading, with MACD periods (6,13,5), RSI period (7), and EMA periods (5,13) all shorter than traditional settings, allowing for quick responses to market changes.

Liquidity Consideration: By incorporating VWAP as a key reference line, the strategy takes market liquidity factors into account, helping to execute trades at reasonable price levels.

Clear Trading Rules: Strategy conditions are clearly defined without ambiguity, making it easy for traders to execute and follow, reducing the impact of subjective judgment.

Dynamic Risk Management: The reversal signal exit mechanism provides a dynamic risk management solution that doesn’t rely on fixed stop-loss points but adjusts positions according to market conditions.

Alert Function Integration: The code includes built-in trade signal alerts, allowing traders to receive timely signal notifications, enhancing the strategy’s practicality.

Strategy Risks

Despite its rational design, the strategy still presents the following potential risks:

Overtrading Risk: Due to the short-period parameters used, the strategy may generate frequent trading signals in highly volatile markets, leading to overtrading and increased transaction costs.

- Solution: Consider adding additional filtering conditions, such as signal duration requirements or trading time window restrictions.

Correlated Indicator Risk: Multiple indicators in the strategy (such as MACD and EMA) have certain correlations and may collectively fail under specific market conditions.

- Solution: Consider adding non-correlated indicators, such as independent indicators based on volatility or trading volume.

0DTE-Specific Risks: Zero-day options face the issue of rapidly decaying time value, requiring extremely precise timing.

- Solution: Add entry time restrictions to avoid the last trading sessions when options value decays most rapidly.

Parameter Sensitivity: Strategy performance may be sensitive to parameter settings (such as the RSI threshold of 50).

- Solution: Conduct comprehensive backtesting to test different parameter combinations under various market environments.

Lack of Stop-Loss Mechanism: The strategy only closes positions on reversal signals and lacks explicit stop-loss mechanisms, potentially facing significant losses during extreme market fluctuations.

- Solution: Add hard stop-loss conditions based on percentage or price levels.

Strategy Optimization Directions

Based on code analysis, the strategy has the following optimization potential:

Add Time Filters:

- For 0DTE trading characteristics, add trading time window restrictions, such as avoiding the first 30 minutes of the market open and the last hour of high volatility sessions.

- Reason: These periods have higher volatility that may generate false signals, and option time value decays faster near the close.

Optimize Signal Confirmation Mechanism:

- Consider adding duration requirements after signal generation (e.g., signals must persist for at least 2 time periods).

- Reason: This helps filter out temporary market noise and improves signal quality.

Introduce Volatility Filtering Conditions:

- Add filtering conditions based on implied volatility or historical volatility.

- Reason: Options prices fluctuate more in high-volatility environments, increasing risk and warranting more cautious trading.

Dynamic Position Sizing:

- Change from a fixed percentage (10%) to dynamic position management based on market volatility or signal strength.

- Reason: Position sizes should vary under different market conditions to optimize the risk-reward ratio.

Add Partial Profit-Taking Mechanisms:

- Consider partial position closing when reaching certain profit levels.

- Reason: Given the characteristics of 0DTE options, a more aggressive profit-locking strategy is recommended.

Add Trend Filters:

- Introduce longer-period trend indicators as directional filters.

- Reason: Trades aligned with larger market trends typically have higher success rates.

Summary

The Intelligent Momentum Mixed Indicator Zero-Day Options Strategy Model is a rigorously designed short-term trading system that provides a comprehensive framework for signal generation and management in zero-day options trading by integrating multiple technical indicators including MACD, VWAP, RSI, and EMA. The core advantage of this strategy lies in its multi-dimensional signal confirmation mechanism, which effectively filters market noise and improves the reliability of trading signals.

Although the strategy considers various market factors in its design, users should still be aware of risks related to overtrading, indicator correlation, and the time decay specific to zero-day options when applying it in practice. By adding time filters, optimizing signal confirmation mechanisms, incorporating volatility considerations, dynamically adjusting position sizes, and enhancing profit-taking and stop-loss mechanisms, this strategy has the potential to further improve its performance and stability.

Most importantly, any strategy should undergo thorough backtesting before live trading, with parameters and rules adjusted based on backtesting results. For high-risk products like zero-day options, traders should maintain a cautious attitude and reasonably control risk exposure.

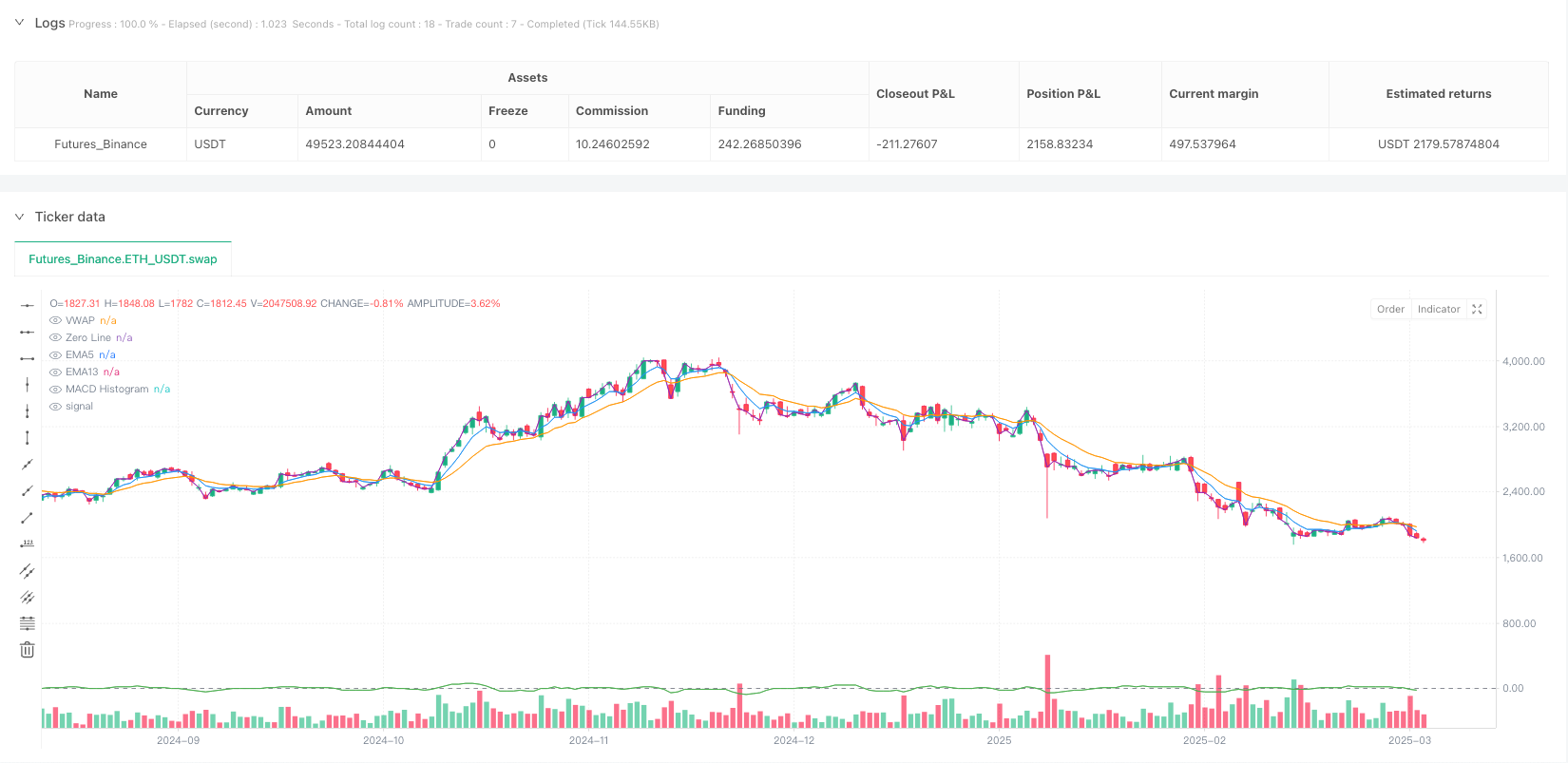

/*backtest

start: 2024-04-01 00:00:00

end: 2025-03-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © oxycodine

//@version=5

strategy("Pierre's 0DTE Option Strategy with MACD, VWAP, RSI, EMA5/13", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// INPUTS for 0DTE parameters

rsiPeriod = input.int(7, title="RSI Period (0DTE)")

rsiThreshold = input.int(50, title="RSI Threshold (0DTE)")

macdFast = input.int(6, title="MACD Fast Length (0DTE)")

macdSlow = input.int(13, title="MACD Slow Length (0DTE)")

macdSignal = input.int(5, title="MACD Signal Smoothing (0DTE)")

// INDICATOR CALCULATIONS

[macdLine, signalLine, histLine] = ta.macd(close, macdFast, macdSlow, macdSignal)

vwapValue = ta.vwap(close)

rsiValue = ta.rsi(close, rsiPeriod)

emaShort = ta.ema(close, 5) // Faster EMA for quick moves

emaLong = ta.ema(close, 13) // Longer EMA for trend confirmation

// PLOT INDICATORS

plot(emaShort, color=color.blue, title="EMA5")

plot(emaLong, color=color.orange, title="EMA13")

plot(vwapValue, color=color.purple, title="VWAP")

// SIGNAL CONDITIONS FOR 0DTE

// A bullish (Call) signal is generated when:

// • MACD is bullish (macdLine > signalLine)

// • Price is above VWAP

// • RSI is above threshold

// • Short EMA is above long EMA

callCondition = (macdLine > signalLine) and (close > vwapValue) and (rsiValue > rsiThreshold) and (emaShort > emaLong)

// A bearish (Put) signal is generated when the opposite conditions hold

putCondition = (macdLine < signalLine) and (close < vwapValue) and (rsiValue < rsiThreshold) and (emaShort < emaLong)

// EXECUTE STRATEGY ENTRIES

if callCondition

strategy.entry("Call", strategy.long)

if putCondition

strategy.entry("Put", strategy.short)

// OPTIONAL: Close positions on reversal signals

strategy.close("Call", when=putCondition)

strategy.close("Put", when=callCondition)

// ADDITIONAL PLOTS

hline(0, title="Zero Line", color=color.gray)

plot(macdLine - signalLine, color=color.green, title="MACD Histogram")

// ALERT CONDITIONS

alertcondition(callCondition, title="Call Signal", message="Call Option Signal")

alertcondition(putCondition, title="Put Signal", message="Put Option Signal")