Overview

This high-frequency mean reversion strategy is a professional quantitative trading system designed to capture short-term market fluctuations. The core of the strategy is based on the combined use of Bollinger Bands, Relative Strength Index (RSI), and Volume Weighted Moving Average (VWMA) to identify extreme price deviations from the mean and potential reversion opportunities. The strategy employs fixed percentage stop-loss and take-profit targets, coupled with adaptive risk management mechanisms, allowing it to maintain stability across different market conditions. The strategy includes both strict and aggressive entry modes, providing traders flexibility to trade according to different risk preferences.

Strategy Principles

The core principle of the strategy is based on mean reversion theory, which suggests that prices may deviate from their mean in the short term but tend to revert over the long term. The implementation involves several key steps:

Technical Indicator Setup: Utilizes Bollinger Bands with a period of 20 and 2.5 standard deviations, 5-period RSI, and 50-period VWMA as the basic signal system.

Entry Condition Design:

- Long Strict Condition: RSI below 25 (oversold), price below the lower Bollinger Band, but still above VWMA

- Short Strict Condition: RSI above 75 (overbought), price above the upper Bollinger Band, but still below VWMA

- Long Aggressive Condition: Uses more relaxed conditions with RSI below 30 and price below the mid-lower band

- Short Aggressive Condition: Uses more relaxed conditions with RSI above 70 and price above the mid-upper band

Risk Management Mechanism:

- Fixed Percentage Stop-Loss: Set at 1% of price

- Fixed Percentage Take-Profit: Set at 2% of price

- Adaptive Stop-Loss Multiplier: Adjusted according to market volatility, 2 for high volatility and 1.5 for low volatility

- Maximum Stop-Loss Limit: 20 minimum price movement units

Order Execution Logic:

- Strict condition entries use standard stop-loss and profit levels

- Aggressive condition entries use larger stop-loss (1.2x) and smaller take-profit targets (0.8x)

This design enables the strategy to identify overbought/oversold conditions while using VWMA as a trend filter to avoid counter-trend trading in strong trends.

Strategy Advantages

Through in-depth code analysis, the strategy demonstrates the following significant advantages:

Dual Confirmation Mechanism: Combines RSI overbought/oversold states with Bollinger Band breakouts, reducing the possibility of false signals.

Trend Filtering: Uses VWMA as additional trend confirmation, avoiding incorrect mean reversion trades during strong trends.

Risk Adaptation: Dynamically adjusts stop-loss multipliers through volatility indicators, providing more breathing room in highly volatile markets.

Fixed Percentage Risk Control: Uses 1% stop-loss and 2% take-profit settings, ensuring a 1:2 risk-reward ratio, in line with sound money management principles.

Trading Mode Flexibility: Provides both strict and aggressive entry conditions, allowing traders to choose appropriate trading modes based on market conditions and personal risk preferences.

Visual Support: Through chart markers and indicators, traders can intuitively grasp entry points and key price levels.

Maximum Stop-Loss Limit: By setting a maximum stop-loss of 20 price units, avoids excessive losses under extreme market conditions.

Strategy Risks

Despite the well-designed strategy, there are still risk factors that need attention:

Mean Reversion Failure Risk: In strong trend markets, prices may continue to deviate from the mean without reverting, leading to consecutive losses. Solution: Add trend strength filters to pause strategy operation in clear trend markets.

Excessive Trading in Ranging Markets: High-frequency strategies may generate too many trading signals in range-bound markets, increasing trading costs. Solution: Introduce trade interval control or signal quality scoring systems.

Fixed Percentage Risk Inflexibility: Fixed percentages may be too large or too small for market phases with different price volatility characteristics. Solution: Automatically adjust stop-loss and take-profit percentages based on historical volatility.

Aggressive Entry Mode Risk: While aggressive conditions provide more trading opportunities, they also have higher false signal rates. Solution: Add additional confirmation conditions for aggressive signals or reduce capital allocation ratios.

Trading Cost Impact: The profitability of high-frequency strategies can easily be eroded by trading costs. Solution: Optimize entry conditions to reduce the number of trades or adjust profit targets to accommodate trading costs.

Strategy Optimization Directions

Based on code analysis, the strategy can be optimized in the following directions:

Dynamic Parameter Adjustment: RSI and Bollinger Band parameters can be set to adjust automatically based on market conditions. For example, using wider Bollinger Bands and more extreme RSI thresholds during high volatility periods improves strategy adaptability.

Market Environment Filtering: Add market type recognition logic to pause or modify strategy parameters in determined trend markets, avoiding trading in environments unsuitable for mean reversion.

Time Filter Optimization: Add time filters to avoid major economic data releases or periods of insufficient market liquidity, improving signal quality.

Partial Position Management: Implement a graduated entry and exit mechanism, allowing building and closing positions in batches at different price levels, improving average entry and exit prices.

Trade Duration Control: Set maximum holding time for each trade to prevent ineffective signals from occupying capital for extended periods.

Related Market Confirmation: Integrate signals from related markets or indices as trade confirmations, enhancing strategy robustness.

Machine Learning Optimization: Utilize machine learning techniques to optimize entry parameters and risk management parameters, enabling the strategy to automatically adjust optimal parameter combinations based on historical data.

Implementing these optimization directions will significantly enhance the strategy’s adaptability and stability, especially its performance across different market environments.

Summary

This high-frequency mean reversion strategy forms a complete trading system through clever combination of technical indicators, dual-layer entry conditions, and intelligent risk management. The core advantages of the strategy lie in its risk control mechanisms and signal filtering systems, effectively balancing trading frequency and signal quality. While there are some inherent risks associated with mean reversion strategies, through the suggested optimization directions, particularly market environment adaptability improvements and dynamic parameter adjustments, the strategy’s robustness and long-term performance can be further enhanced. For traders seeking to capture short-term market fluctuations, this strategy provides a structured framework, particularly suitable for application in volatile range-bound markets. Ultimately, the strategy successfully integrates mean reversion theory, technical analysis, and risk management principles into an actionable trading system.

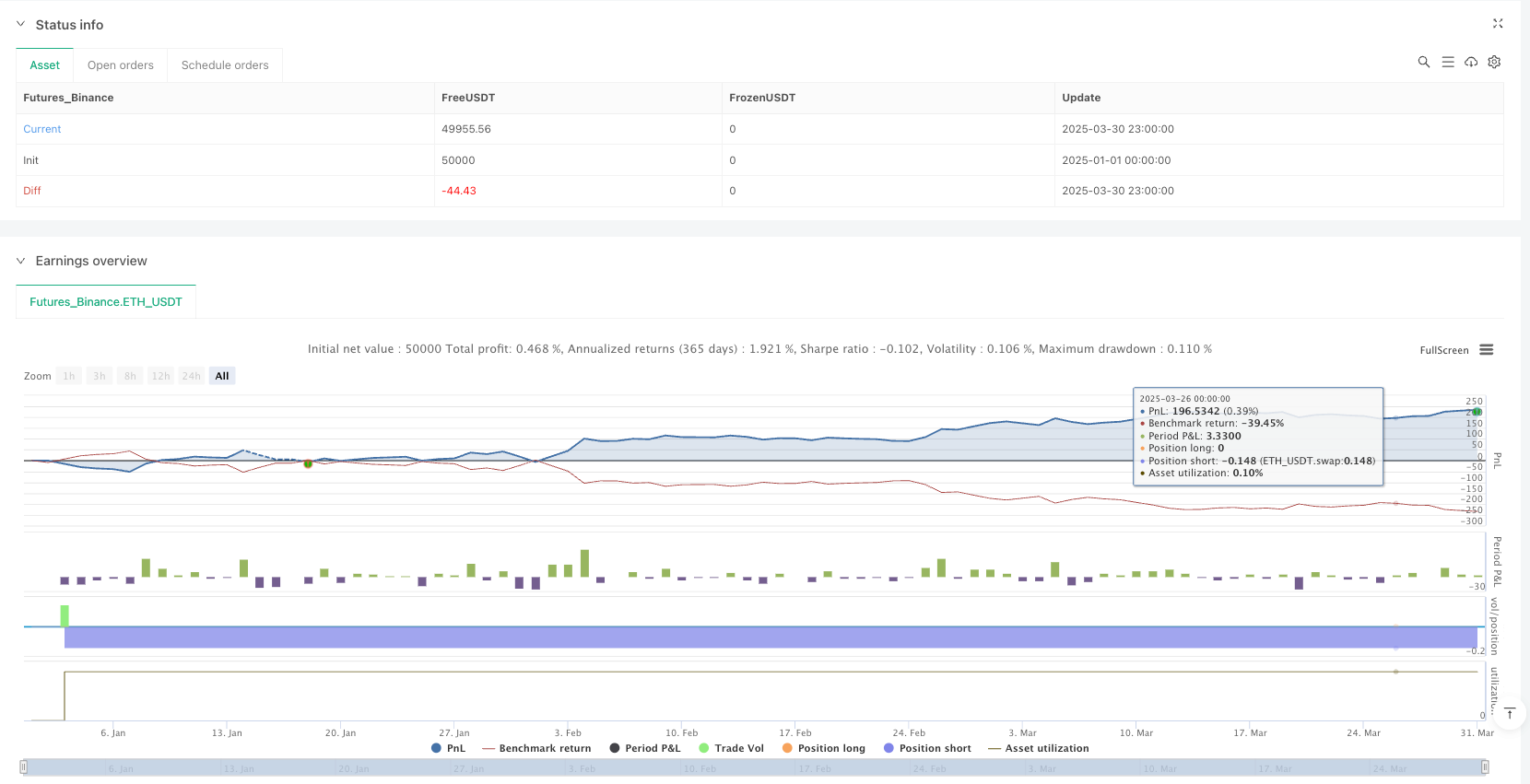

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-31 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("XAU/USD High-Frequency Mean Reversion with Fixed SL and TP", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=1, commission_value=0.04)

// === 1. BASIC INDICATORS ===

[bbUpper, bbMiddle, bbLower] = ta.bb(close, 20, 2.5) // Wider Bollinger Bands

rsi = ta.rsi(close, 5)

vwma = ta.vwma(close, 50)

// === 2. EXTENDED PARAMETERS (INCREASED SIGNALS) ===

rsiOverbought = input(75, "RSI Overbought") // Increased from 72 to 75

rsiOversold = input(25, "RSI Oversold") // Decreased from 28 to 25

bbMidUpper = bbMiddle + (bbUpper - bbMiddle) * 0.5

bbMidLower = bbMiddle - (bbMiddle - bbLower) * 0.5

// === 3. ENTRY CONDITIONS ===

longStrict = rsi <= rsiOversold and close <= bbLower and close > vwma

shortStrict = rsi >= rsiOverbought and close >= bbUpper and close < vwma

// Expanded signal (higher risk)

longAggressive = rsi <= rsiOversold + 5 and close <= bbMidLower and close > vwma

shortAggressive = rsi >= rsiOverbought - 5 and close >= bbMidUpper and close < vwma

// === 4. ADAPTIVE RISK MANAGEMENT ===

atr = ta.atr(14) // ATR over 14 periods to measure volatility

volatility = ta.stdev(close, 14) // Standard deviation of closing prices

useAdaptiveSL = input(true, "Use Adaptive SL") // Enable Adaptive Stop Loss

slMultiplier = useAdaptiveSL ? (volatility > ta.sma(volatility, 20) ? 2 : 1.5) : 1.8 // Adjust SL based on volatility

stopLoss = atr * slMultiplier // Stop Loss dynamically adjusts based on ATR and volatility

// === 5. FIXED STOP LOSS & TAKE PROFIT SETTINGS ===

// Fixed Stop Loss and Take Profit ratios (e.g., 1% Stop Loss and 2% Take Profit)

stopLossPercentage = 0.01 // 1% Stop Loss

takeProfitPercentage = 0.02 // 2% Take Profit

// Calculate Stop Loss and Take Profit levels based on percentage

fixedStopLoss = close * stopLossPercentage

fixedTakeProfit = close * takeProfitPercentage

// === 6. LIMIT STOP LOSS TO 20 PIPS ===

// Maximum Stop Loss of 20 pips (for XAU/USD, 1 pip = 0.01)

// Ensure Stop Loss does not exceed 20 pips

maxStopLoss = 20 * syminfo.mintick // Maximum Stop Loss = 20 pips

finalStopLoss = math.min(stopLoss, maxStopLoss) // Use SL that does not exceed 20 pips

// === 7. EXECUTION OF TRADES ===

if (longStrict)

strategy.entry("Long Strict", strategy.long, stop=close-finalStopLoss, limit=close+fixedTakeProfit)

if (shortStrict)

strategy.entry("Short Strict", strategy.short, stop=close+finalStopLoss, limit=close-fixedTakeProfit)

if (longAggressive and strategy.position_size == 0)

strategy.entry("Long Aggressive", strategy.long, stop=close-finalStopLoss*1.2, limit=close+fixedTakeProfit*0.8)

if (shortAggressive and strategy.position_size == 0)

strategy.entry("Short Aggressive", strategy.short, stop=close+finalStopLoss*1.2, limit=close-fixedTakeProfit*0.8)

// === 8. DISPLAY ===

// Remove TP/SL markers and labels, keeping only buy/sell signals

plot(bbUpper, "BB Upper", color=color.blue)

plot(bbLower, "BB Lower", color=color.blue)

plot(bbMidUpper, "BB Mid-Upper", color=color.new(color.blue, 70), style=plot.style_circles)

plot(bbMidLower, "BB Mid-Lower", color=color.new(color.blue, 70), style=plot.style_circles)

plotshape(longStrict, "Buy Strict", shape.labelup, location.belowbar, color=color.new(#00FF00, 0), text="STRICT\nBUY", size=size.small)

plotshape(shortStrict, "Sell Strict", shape.labeldown, location.abovebar, color=color.new(#FF0000, 0), text="STRICT\nSELL", size=size.small)

plotshape(longAggressive, "Buy Aggressive", shape.triangleup, location.belowbar, color=color.new(#00AAFF, 0), size=size.small)

plotshape(shortAggressive, "Sell Aggressive", shape.triangledown, location.abovebar, color=color.new(#FFAA00, 0), size=size.small)