Overview

The Dual-Mode Adaptive Trend Trading Strategy is a highly flexible quantitative trading system capable of intelligently switching between trend-following and counter-trend trading modes. This strategy utilizes EMA crossover signals as its core entry indicator, while employing the RSI indicator to determine market conditions, and integrating ATR volatility metrics for precise risk management. The strategy implements a fixed 5x leverage and features an automated position sizing mechanism based on account risk percentage, ensuring strict risk control for each trade.

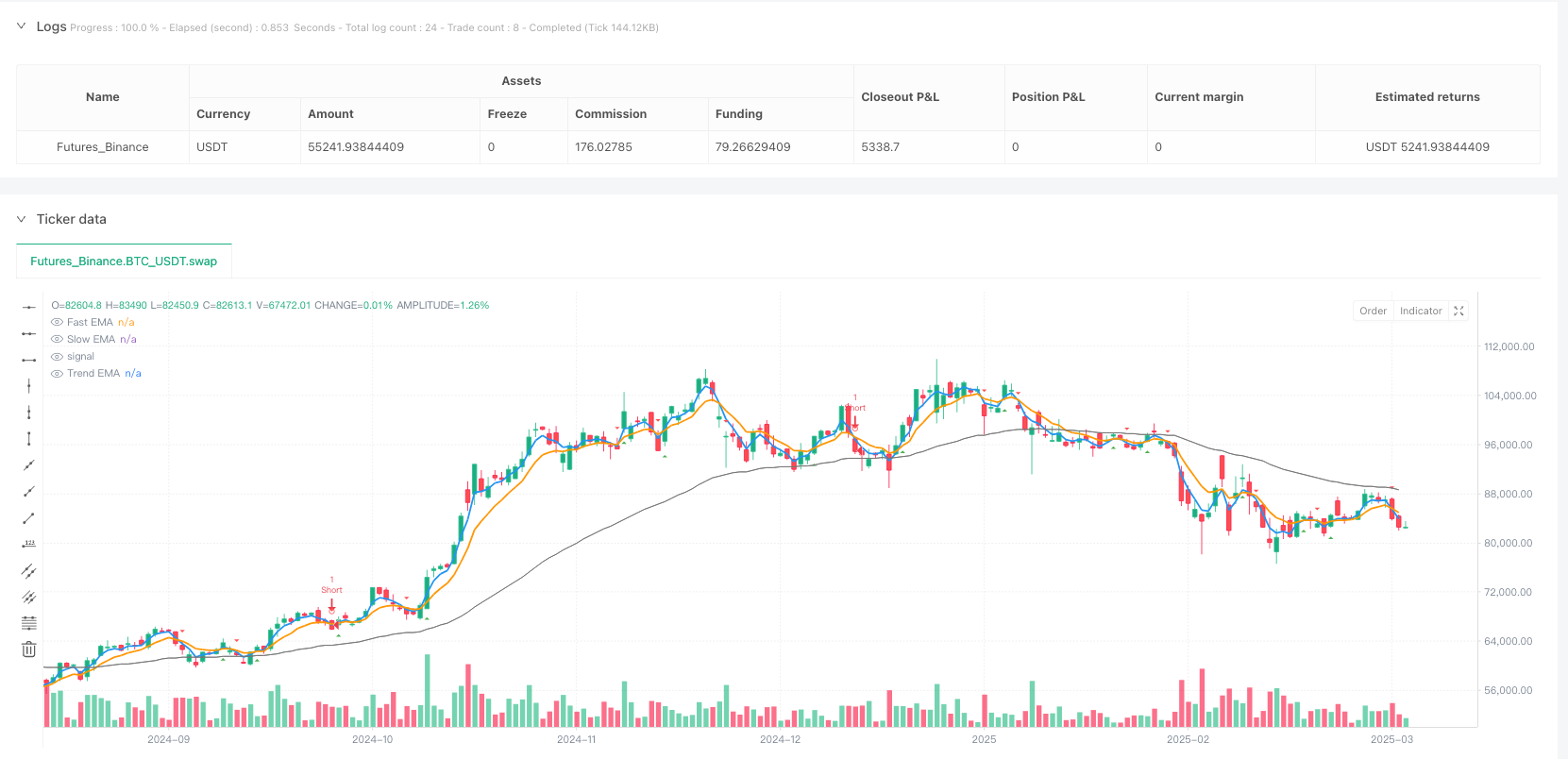

Analysis of the code reveals that the strategy generates trading signals through crossovers between the fast EMA(3) and slow EMA(8), while using the trend EMA(55) to confirm the overall market direction. The innovation lies in its adaptive mechanism—when RSI indicates the market is in a clear trend state, the strategy executes trend-following logic; when the market is volatile but lacks a clear direction, the strategy automatically switches to counter-trend mode, capturing oversold/overbought rebound opportunities.

Strategy Principles

The core principle of this strategy is to combine multiple indicators to determine market conditions and generate trading signals. The specific implementation logic is as follows:

Indicator Calculation:

- Fast EMA(3): Captures short-term price movements

- Slow EMA(8): Filters short-term market noise

- Trend EMA(55): Determines overall market direction

- ATR(14): Measures market volatility, used for stop-loss and take-profit settings

- RSI(14): Evaluates whether the market is in a trending state

Adaptive Trend Detection:

- Calculates trend strength through the distance between RSI and 50:

trendStrength = math.abs(rsiValue - 50) / 50 - Determines the market is trending when trend strength exceeds 0.3

- Uses comparison between 5-period and 20-period SMAs to determine trend direction

- Calculates trend strength through the distance between RSI and 50:

Intelligent Trading Logic:

- Trend Market Mode (RSI far from 50, trend strength > 0.3):

- Long: Fast EMA crosses above Slow EMA + Price above Trend EMA + Short-term MA above Long-term MA

- Short: Fast EMA crosses below Slow EMA + Price below Trend EMA + Short-term MA below Long-term MA

- Oscillating Market Mode (RSI near 50, trend strength < 0.3):

- Long: Fast EMA crosses above Slow EMA + Price below Trend EMA (oversold rebound)

- Short: Fast EMA crosses below Slow EMA + Price above Trend EMA (overbought pullback)

- Trend Market Mode (RSI far from 50, trend strength > 0.3):

Risk Management Mechanism:

- Stop-loss set at 1.2 times ATR

- Take-profit set at 2.0 times ATR

- Dynamic position size calculation based on account risk percentage (default 1%)

- Fixed 5x leverage

Trade Execution Control:

- Minimum trade interval setting (default 72 minutes) to prevent overtrading

- Ensures new signals are generated only when there is no existing position

At the execution level, the strategy selects the appropriate trading mode based on current market conditions, calculates precise position size, and sets dynamic stop-loss and take-profit levels based on ATR, thereby achieving adaptive risk management.

Strategy Advantages

Analysis of the code reveals several significant advantages of this strategy:

Adaptive Market Capability: The greatest advantage is the ability to automatically switch trading modes according to market conditions, allowing the strategy to remain effective in different market environments. This adaptability enables the strategy to profit in both trending and oscillating markets.

Precise Risk Management: Dynamic stop-loss and take-profit settings based on ATR ensure that stop levels consider current market volatility rather than using fixed points or percentages. This means wider stops when volatility is high and tighter stops when volatility is low.

Intelligent Position Management: Position size calculation through risk percentage and ATR ensures relatively constant risk for each trade, preventing excessive risk exposure due to market volatility changes.

Filtering False Signals: Multiple confirmation conditions (EMA crossover, trend direction, market state assessment) effectively reduce the impact of false breakouts and signals.

Prevention of Overtrading: Trade interval control avoids frequent trading within short periods, reducing transaction fees and emotional decision-making.

Visualization of Trading Signals: The strategy provides rich chart markers, including EMA lines, crossover signals, entry points, stop-loss and take-profit lines, allowing traders to intuitively understand the strategy logic and execution process.

Flexible Parameters: All key parameters can be adjusted through the input interface, allowing the strategy to be optimized according to different markets and personal risk preferences.

Strategy Risks

Despite its sophisticated design, this strategy still has some potential risks and limitations:

Fast EMA Sensitivity: Using a 3-period fast EMA may be overly sensitive to market noise, potentially leading to excessive false signals in oscillating markets. Solution: Consider increasing the EMA period or adding additional filtering conditions during high volatility periods.

Fixed Leverage Risk: 5x fixed leverage may cause significant drawdowns under extreme market conditions. Solution: Consider dynamically adjusting leverage based on market volatility, reducing leverage during high volatility periods.

Trend Judgment Dependency: The strategy has a high dependency on the accuracy of RSI and moving averages for trend determination. Trend judgments may be inaccurate during early trend transitions. Solution: Incorporate other trend indicators such as ADX to enhance trend determination accuracy.

Fixed ATR Multiplier Limitation: Using the same ATR multiplier for all markets and time periods may not be optimal. Solution: Adjust ATR multipliers according to different market and timeframe characteristics, or implement adaptive ATR multipliers.

Slippage and Liquidity Risk: In actual trading, issues of slippage and insufficient liquidity may arise, especially during high volatility periods. Solution: Set maximum acceptable slippage and avoid trading during low liquidity periods.

Backtest vs. Real Trading Discrepancy: Backtest performance may not fully reflect real trading performance, especially when considering factors such as slippage, fees, and liquidity. Solution: Conduct forward testing or real trading with small capital, gradually increasing the capital size.

Strategy Optimization Directions

Based on code analysis, this strategy can be optimized in the following directions:

Dynamic Parameter Adaptation: Currently, the strategy uses fixed EMA and ATR periods. An adaptive parameter mechanism could be introduced to automatically adjust these parameters based on market volatility. Specific implementation could be based on recent volatility or cyclical analysis to dynamically adjust EMA lengths and ATR periods.

Enhanced Trend Determination: Introduce more professional trend indicators like ADX to improve trend judgment accuracy. For example, an additional condition could be added:

adxValue = ta.adx(14) > 25as further confirmation of strong trends.Market Cycle Analysis: Add market cycle recognition algorithms to apply more specialized strategy variants in different market cycles. For instance, Fourier transforms or wavelet analysis could be used to identify whether the current market is in obvious cyclical fluctuations.

Optimized Take-Profit Mechanism: Implement trailing take-profit functionality to lock in more profits when trends are strong. This could be achieved by adding dynamic trailing stops based on ATR, allowing profits to continue growing while protecting existing gains.

Time Filters: Filter trades based on market active sessions, avoiding low activity and high volatility periods. For example, trading time window settings could be added to generate signals only during specific periods.

Integrated Sentiment Indicators: Introduce volume or market sentiment indicators to enhance signal quality. For example, volume confirmation conditions or volatility indicators such as Bollinger Band width could be considered.

Optimized Capital Management: Implement gradient position management or compound position strategies, increasing position size when trend confirmation is higher. Specifically, risk ratios could be adjusted based on signal strength or trend strength.

Multi-Timeframe Analysis: Integrate higher timeframe trend confirmation to achieve multi-timeframe consistency trading. For example, daily trend direction confirmation could be added, generating signals only when daily and current timeframe trends are consistent.

Summary

The Dual-Mode Adaptive Trend Trading Strategy is a well-designed quantitative trading system that achieves adaptive trading capability across different market environments by combining EMA crossovers, RSI trend determination, and ATR risk management. The core innovation lies in its mechanism to automatically switch between trend-following and counter-trend modes, allowing the strategy to adapt well to changing market conditions.

The strategy’s risk management system is meticulously designed, effectively controlling risk for each trade through ATR dynamic stop-loss/take-profit and position sizing based on risk percentage. Meanwhile, the trade interval control mechanism reduces overtrading issues, helping to lower transaction costs and improve signal quality.

Despite some limitations, such as sensitivity to fast EMA and risks associated with fixed leverage, these issues can be effectively improved through the suggested optimization directions, including dynamic parameter adaptation, enhanced trend determination, and optimized take-profit mechanisms.

Overall, this is a strategy framework with practical value, suitable as a foundation for mid to long-term trading systems. Through further optimization and personalized adjustments, it can meet the needs and risk preferences of different traders.

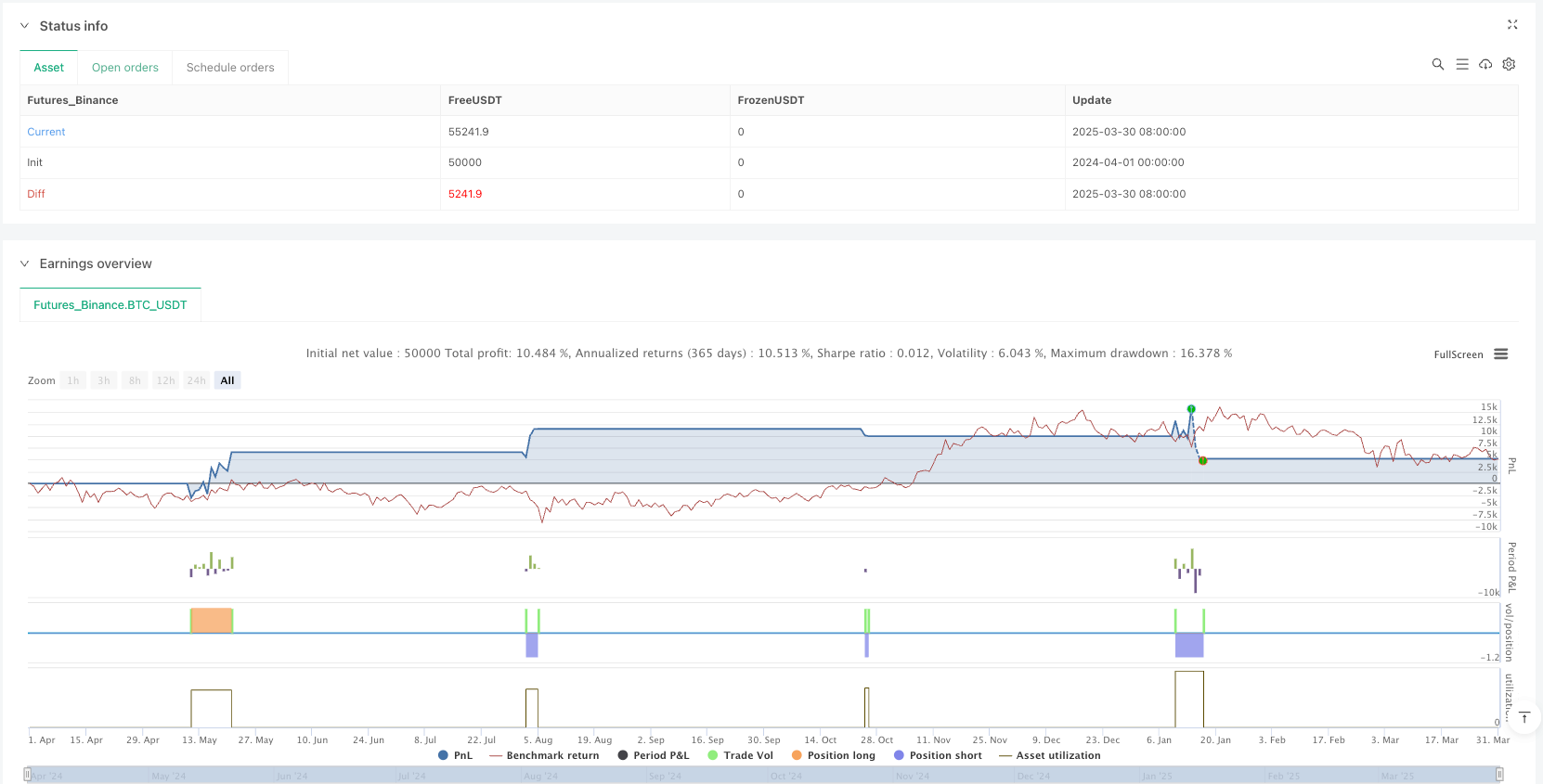

/*backtest

start: 2024-04-01 00:00:00

end: 2025-03-31 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("DOGE/USDT 5X Adaptive Trend Strategy", overlay=true, margin_long=20, margin_short=20)

// === Core Parameters ===

fastEMA = input.int(3, "Fast EMA Length", minval=1, maxval=20)

slowEMA = input.int(8, "Slow EMA Length", minval=2, maxval=50)

trendEMA = input.int(55, "Trend EMA Length", minval=10, maxval=200)

atrPeriod = input.int(14, "ATR Period", minval=1, maxval=50)

tradeInterval = input.int(72, "Minutes Between Trades", minval=1, maxval=1440)

// Risk Management

slMultiplier = input.float(1.2, "Stop-Loss (ATR Multiple)", minval=0.5, maxval=5.0, step=0.1)

tpMultiplier = input.float(2.0, "Take-Profit (ATR Multiple)", minval=0.5, maxval=10.0, step=0.1)

riskPct = input.float(1.0, "Risk Per Trade (%)", minval=0.1, maxval=10.0, step=0.1)

leverage = 5.0 // Fixed 5x leverage

// Adaptive mode selection

useAdaptive = input.bool(true, "Use Adaptive Mode")

adaptivePeriod = input.int(14, "Adaptive Period")

// === Calculate Indicators ===

fastLine = ta.ema(close, fastEMA)

slowLine = ta.ema(close, slowEMA)

trendLine = ta.ema(close, trendEMA)

atrValue = ta.atr(atrPeriod)

// === Adaptive Trend Detection ===

// Determine market direction strength

rsiValue = ta.rsi(close, adaptivePeriod)

trendStrength = math.abs(rsiValue - 50) / 50 // 0 to 1 scale

isTrending = trendStrength > 0.3 // Above 0.3 indicates trending

// Determine trend direction

uptrend = ta.sma(close, 5) > ta.sma(close, 20)

downtrend = ta.sma(close, 5) < ta.sma(close, 20)

// === Visualize Indicators ===

p1 = plot(fastLine, "Fast EMA", color=#2196F3, linewidth=2)

p2 = plot(slowLine, "Slow EMA", color=#FF9800, linewidth=2)

p3 = plot(trendLine, "Trend EMA", color=#757575, linewidth=1)

// Cross detection

crossUp = ta.crossover(fastLine, slowLine)

crossDown = ta.crossunder(fastLine, slowLine)

plotshape(crossUp, "EMA Cross Up", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(crossDown, "EMA Cross Down", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// === Trade Logic ===

var int lastTradeBarIndex = 0

timeElapsed = (bar_index - lastTradeBarIndex) >= tradeInterval

noActivePosition = strategy.position_size == 0

// Adaptive entry conditions

longTrendEntry = crossUp and close > trendLine and uptrend and isTrending

shortTrendEntry = crossDown and close < trendLine and downtrend and isTrending

// Counter-trend entries (when market is not strongly trending)

longCounterEntry = crossUp and close < trendLine and not isTrending

shortCounterEntry = crossDown and close > trendLine and not isTrending

// Final entry signals

validLong = (useAdaptive ? (isTrending ? longTrendEntry : longCounterEntry) : crossUp) and timeElapsed and noActivePosition

validShort = (useAdaptive ? (isTrending ? shortTrendEntry : shortCounterEntry) : crossDown) and timeElapsed and noActivePosition

// Position sizing calculation

equity = strategy.equity

riskAmount = equity * (riskPct / 100)

stopDistance = atrValue * slMultiplier

positionSize = math.round((riskAmount / stopDistance) * leverage)

// Visualize entry signals

plotshape(validLong, "Long Entry", style=shape.circle, location=location.belowbar, color=color.lime, size=size.normal)

plotshape(validShort, "Short Entry", style=shape.circle, location=location.abovebar, color=color.red, size=size.normal)

// === Strategy Execution ===

if (validLong)

strategy.entry("Long", strategy.long, qty=positionSize)

stopPrice = close - (atrValue * slMultiplier)

targetPrice = close + (atrValue * tpMultiplier)

strategy.exit("Exit Long", "Long", stop=stopPrice, limit=targetPrice)

lastTradeBarIndex := bar_index

if (validShort)

strategy.entry("Short", strategy.short, qty=positionSize)

stopPrice = close + (atrValue * slMultiplier)

targetPrice = close - (atrValue * tpMultiplier)

strategy.exit("Exit Short", "Short", stop=stopPrice, limit=targetPrice)

lastTradeBarIndex := bar_index