Overview

TrendSync Pro (SMC) is a quantitative trading strategy based on a Higher Timeframe (HTF) filter and trend momentum, designed to capture strong market trend movements. The strategy provides traders with a systematic trading approach by combining multi-timeframe analysis, trend line detection, and strict risk management.

Strategy Principles

The core principles of the strategy include the following key components:

Higher Timeframe (HTF) Filter: Use higher-level timeframes (such as 1-hour, 4-hour, or daily) to confirm the overall market trend direction, ensuring trades align with the primary trend.

Trend Line Detection: Dynamically identify market trend direction by analyzing key turning points (pivot highs and lows) and visualize trend lines.

Entry and Exit Logic:

- Long Entry Conditions: Price breaks above trend value with HTF trend upward

- Short Entry Conditions: Price breaks below trend value with HTF trend downward

Risk Management:

- Fixed Stop Loss: Set at 1% of entry price

- Take Profit Target: Set at 10% of entry price

- Optional dynamic stop loss using ATR (Average True Range)

Strategy Advantages

Multi-Timeframe Confirmation: Combining different timeframes reduces the probability of false signals.

Trend Following: Focus on capturing strong trending market movements rather than frequent, low-quality trades.

Strict Risk Management:

- Small stop loss (1%) protects capital

- High risk-reward ratio (1:10)

- Profitable even with a 50% win rate

Flexibility: Adjustable higher timeframe settings for different trading types (scalping, day trading, swing trading)

Visual Assistance: Provides trend line drawing to help traders intuitively understand market trends.

Strategy Risks

Market Condition Limitations:

- Poor performance in ranging or non-trending markets

- Ineffective in low volatility environments

Parameter Sensitivity:

- Trend period and higher timeframe selection directly impact strategy performance

- Requires parameter adjustments for different markets and trading instruments

Stop Loss Risks:

- Fixed 1% stop loss might be too tight in high volatility markets

- Increased likelihood of being “stopped out”

Strategy Optimization Directions

Dynamic Stop Loss:

- Introduce ATR-based dynamic stop loss methods

- Adjust stop loss range based on market volatility

Filter Enhancement:

- Integrate volume analysis

- Incorporate liquidity sweeps

- Add order block confirmation

Multi-Strategy Combination:

- Combine with ICT Power of 3 method

- Integrate VWAP and market profile analysis

- Incorporate liquidation heatmap (especially in crypto markets)

Machine Learning Optimization:

- Use machine learning algorithms to optimize parameter selection

- Develop adaptive parameter adjustment mechanisms

Summary

TrendSync Pro (SMC) is a strategy that prioritizes quality over quantity. By providing multi-timeframe confirmation, strict risk management, and trend-following logic, the strategy offers traders a systematic trading framework. The key is selective trading - capturing just 1-2 high-quality trade opportunities per day, rather than frequent but inefficient trading.

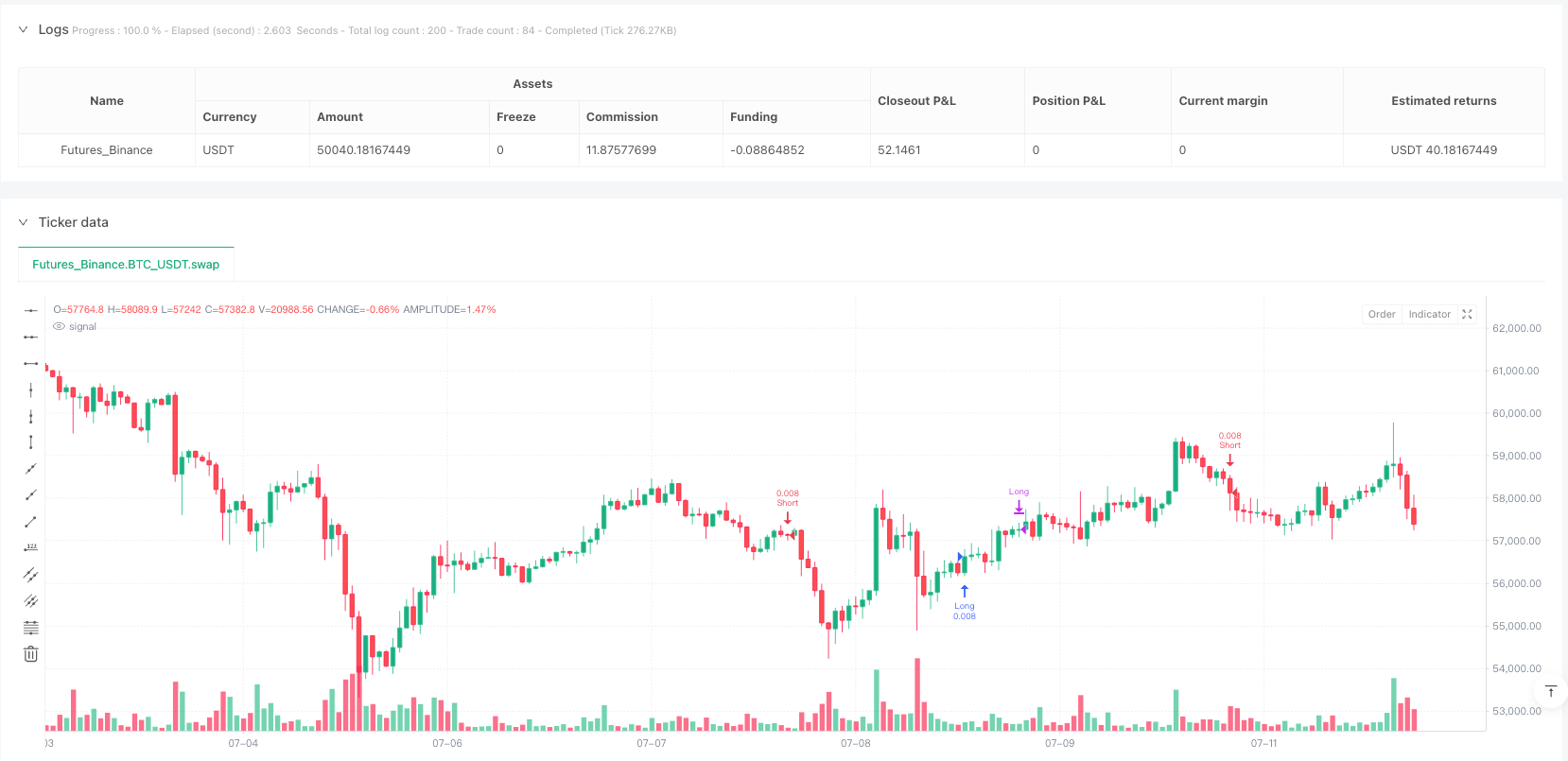

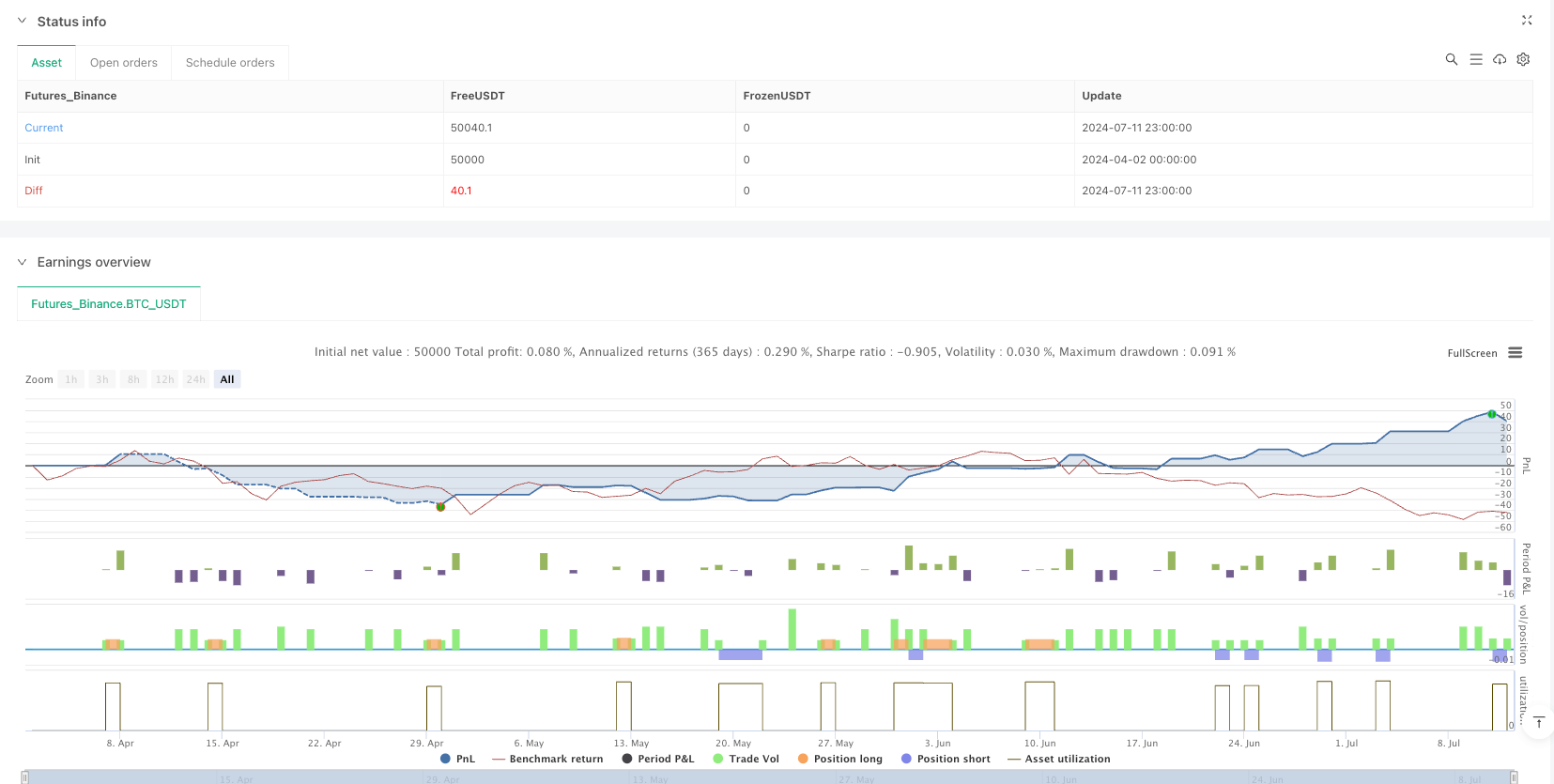

/*backtest

start: 2024-04-02 00:00:00

end: 2024-07-12 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy('TrendSync Pro (SMC)', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// Created by Shubham Singh

// Inputs

bool show_trendlines = input.bool(true, "Show Trendlines", group="Visual Settings")

int trend_period = input(20, 'Trend Period', group="Strategy Settings")

string htf = input.timeframe("60", "Higher Timeframe", group="Strategy Settings")

// Risk Management

float sl_percent = input.float(1.0, "Stop Loss (%)", minval=0.1, maxval=10, step=0.1, group="Risk Management")

float tp_percent = input.float(2.0, "Take Profit (%)", minval=0.1, maxval=10, step=0.1, group="Risk Management")

// Created by Shubham Singh

// Trendline Detection

var line trendline = na

var float trend_value = na

var bool trend_direction_up = false // Initialize with default value

pivot_high = ta.pivothigh(high, trend_period, trend_period)

pivot_low = ta.pivotlow(low, trend_period, trend_period)

if not na(pivot_high)

trend_value := pivot_high

trend_direction_up := false

if not na(pivot_low)

trend_value := pivot_low

trend_direction_up := true

// Created by Shubham Singh

// Higher Timeframe Filter

htf_close = request.security(syminfo.tickerid, htf, close)

htf_trend_up = htf_close > htf_close[1]

htf_trend_down = htf_close < htf_close[1]

// Trading Logic

long_condition = ta.crossover(close, trend_value) and htf_trend_up and trend_direction_up

short_condition = ta.crossunder(close, trend_value) and htf_trend_down and not trend_direction_up

// Created by Shubham Singh

// Entry/Exit with SL/TP

if strategy.position_size == 0

if long_condition

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long", stop=close*(1-sl_percent/100), limit=close*(1+tp_percent/100))

if short_condition

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short", stop=close*(1+sl_percent/100), limit=close*(1-tp_percent/100))

// Created by Shubham Singh

// Manual Trendline Exit

if strategy.position_size > 0 and ta.crossunder(close, trend_value)

strategy.close("Long")

if strategy.position_size < 0 and ta.crossover(close, trend_value)

strategy.close("Short")