Overview

The Multi-Dimensional Trend Momentum Value Filtering Trading Strategy is a quantitative trading approach that combines multiple technical indicators to identify strong trend-based entry and exit opportunities. This strategy relies on four core indicators: ADX, RSI, Stochastic RSI, and VWAP, using their collaborative confirmation to filter out market noise and select only high-probability trading signals. The strategy follows a “multiple confirmation” principle, requiring at least three conditions to be simultaneously satisfied before triggering a trade signal, which significantly enhances the accuracy and reliability of trades.

Strategy Principles

The core principle of this strategy is based on a multi-dimensional analysis framework, integrating three dimensions: trend strength, momentum, and value assessment:

Trend Strength Evaluation: Uses Average Directional Index (ADX) to confirm whether the market is in a defined trend. ADX greater than 25 is considered a signal of strong trend presence, serving as the base filter for the strategy.

Momentum Indicator Analysis:

- Relative Strength Index (RSI) identifies oversold (below 30) and overbought (above 70) conditions

- Stochastic RSI further detects momentum shifts, with oversold (below 20) and overbought (above 80) zones used for signal confirmation

Value Filtering:

- Volume Weighted Average Price (VWAP) serves as a value reference

- Buy conditions require price below VWAP (potentially undervalued)

- Sell conditions require price above VWAP (potentially overvalued)

The specific trigger conditions for trading signals are: - Buy Signal: ADX > 25 AND RSI < 30 AND Stochastic RSI < 20 AND Close < VWAP - Sell Signal: ADX > 25 AND RSI > 70 AND Stochastic RSI > 80 AND Close > VWAP

The strategy employs a manual ADX calculation method, comparing upward and downward movements to calculate +DI and -DI, then further calculating the ADX value, providing a more refined measurement of trend strength.

Strategy Advantages

This strategy demonstrates several significant advantages:

Multi-Dimensional Confirmation System: By integrating multiple indicators of different types (trend, momentum, and value), the strategy can verify trading signals from different angles, greatly reducing false signals.

Strong Trend Identification Capability: The use of ADX ensures the strategy only trades when clear trends exist, avoiding frequent trading in oscillating markets.

Sound Risk Management: By using extreme momentum indicator values (overbought/oversold) as signal conditions, the strategy can capture potential reversal points, improving the precision of entry and exit timing.

Value Assessment Integration: The inclusion of VWAP provides the strategy with a perspective on the relationship between price and trading volume, helping to confirm whether the price has deviated from reasonable value zones.

Flexible Timeframe Adaptability: Although the code comments suggest using 15-minute charts, the core logic of the strategy is applicable to multiple time periods and can be adjusted according to trading requirements.

Clean and Efficient Code: The strategy implementation code is clearly structured, logically compact, and computationally efficient, making it easy to understand and maintain.

Strategy Risks

Despite its numerous advantages, the strategy still has the following risks that need attention:

Over-Optimization Risk: The strategy uses specific thresholds for multiple indicators (such as ADX > 25, RSI < 30, etc.), which may be subject to over-optimization risk and might need adjustment in different market environments.

Signal Lag Issues: All technical indicators used are inherently lagging indicators, which may lead to slightly delayed entry and exit timing, especially in rapidly changing markets.

Delayed Trend Reversal Recognition: Dependence on ADX may lead to false signals when a trend is about to end but ADX is still above the threshold.

Lack of Stop-Loss Mechanism: The current strategy implementation does not include explicit stop-loss settings, which may increase risk exposure during sudden market changes.

Indicator Conflicts: Under certain market conditions, different indicators may give contradictory signals, requiring additional judgment mechanisms.

Insufficient Drawdown Control: The strategy mainly focuses on entry conditions but has fewer risk control mechanisms during the holding period, which may lead to giving back previously earned profits.

Optimization Directions

In response to the above risks, the strategy can be optimized in the following directions:

Introduce Adaptive Parameters: Replace fixed thresholds (such as ADX > 25) with dynamic thresholds that automatically adjust based on market volatility, improving the strategy’s adaptability to different market environments.

Add Stop-Loss Mechanism: Introduce ATR (Average True Range) based stop-loss settings to establish clear risk limits for each trade.

Time Filter: Add time filtering conditions to avoid high volatility periods at market open and close, or specific economic data release periods.

Trend Confirmation Enhancement: Combine moving average systems (such as EMA crossover or MACD) as additional trend confirmation to reduce false breakouts.

Partial Profit-Taking Mechanism: Implement a staged position-closing strategy, closing part of the position when certain profit targets are reached, both securing profits and retaining upside potential.

Volume Confirmation: Add a volume analysis component to ensure sufficient trading volume supports signals, improving signal reliability.

Volatility Filter: Adjust strategy parameters or pause trading in low volatility environments, as multi-indicator strategies tend to generate noise in low volatility environments.

Summary

The Multi-Dimensional Trend Momentum Value Filtering Trading Strategy integrates indicators like ADX, RSI, Stochastic RSI, and VWAP to build a comprehensive trading decision system capable of effectively identifying key trading opportunities in strong trends. The core value of the strategy lies in its multiple confirmation mechanism, cross-validating trading signals through different dimensions of market analysis, significantly improving signal quality.

This strategy is particularly suitable for market environments with moderate volatility, especially for trading after clear trends have been established. In practical application, traders can adjust indicator parameters and the strictness of confirmation conditions according to specific market characteristics and risk tolerance to achieve the optimal risk-reward ratio.

By introducing the optimization suggestions proposed in this article, especially adaptive parameter systems and comprehensive risk management mechanisms, this strategy can further enhance its robustness and long-term profitability. For quantitative traders seeking technically-driven trading systems, this strategy provides a structured and extensible framework worth trying in actual trading and further customization.

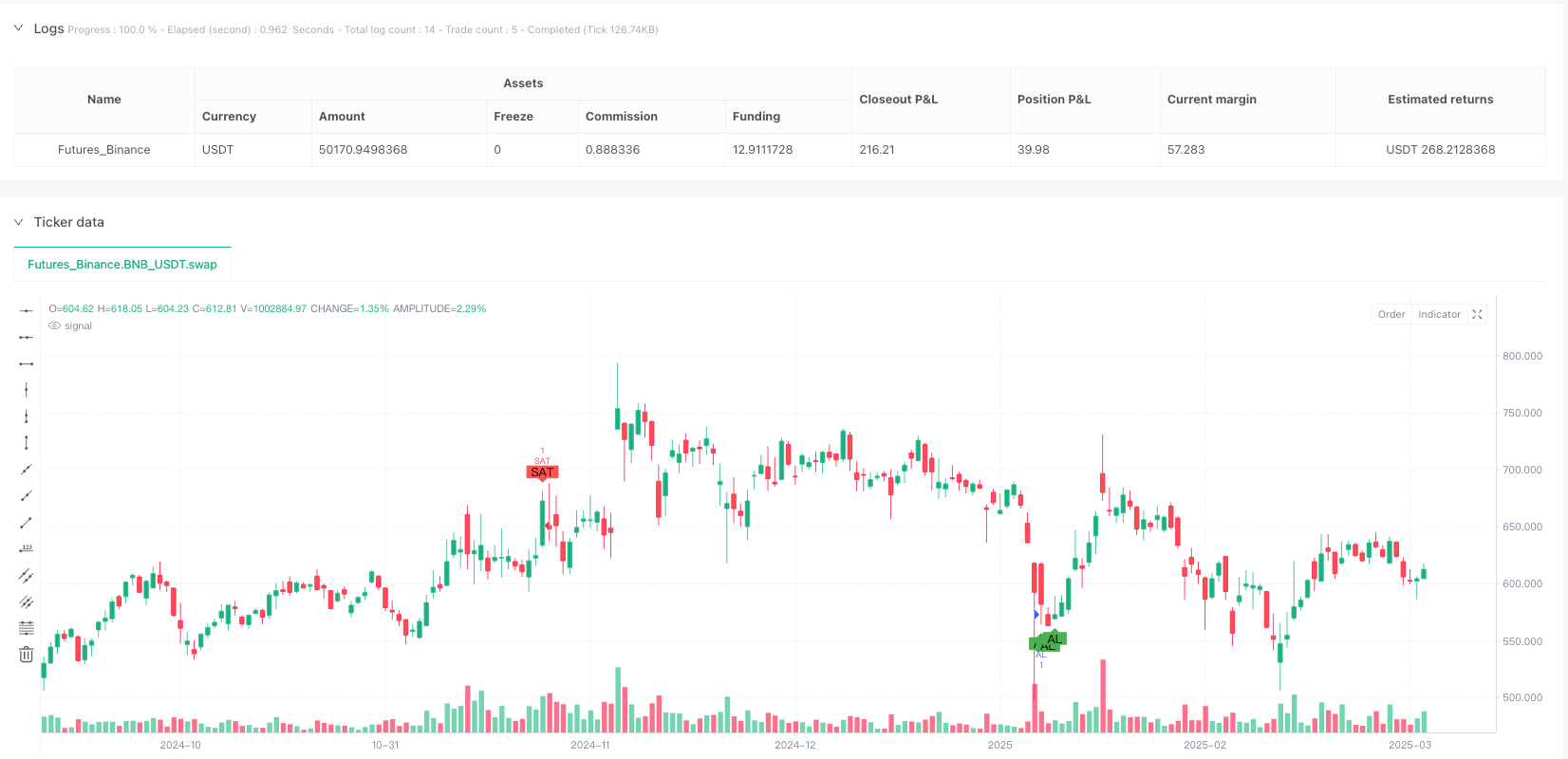

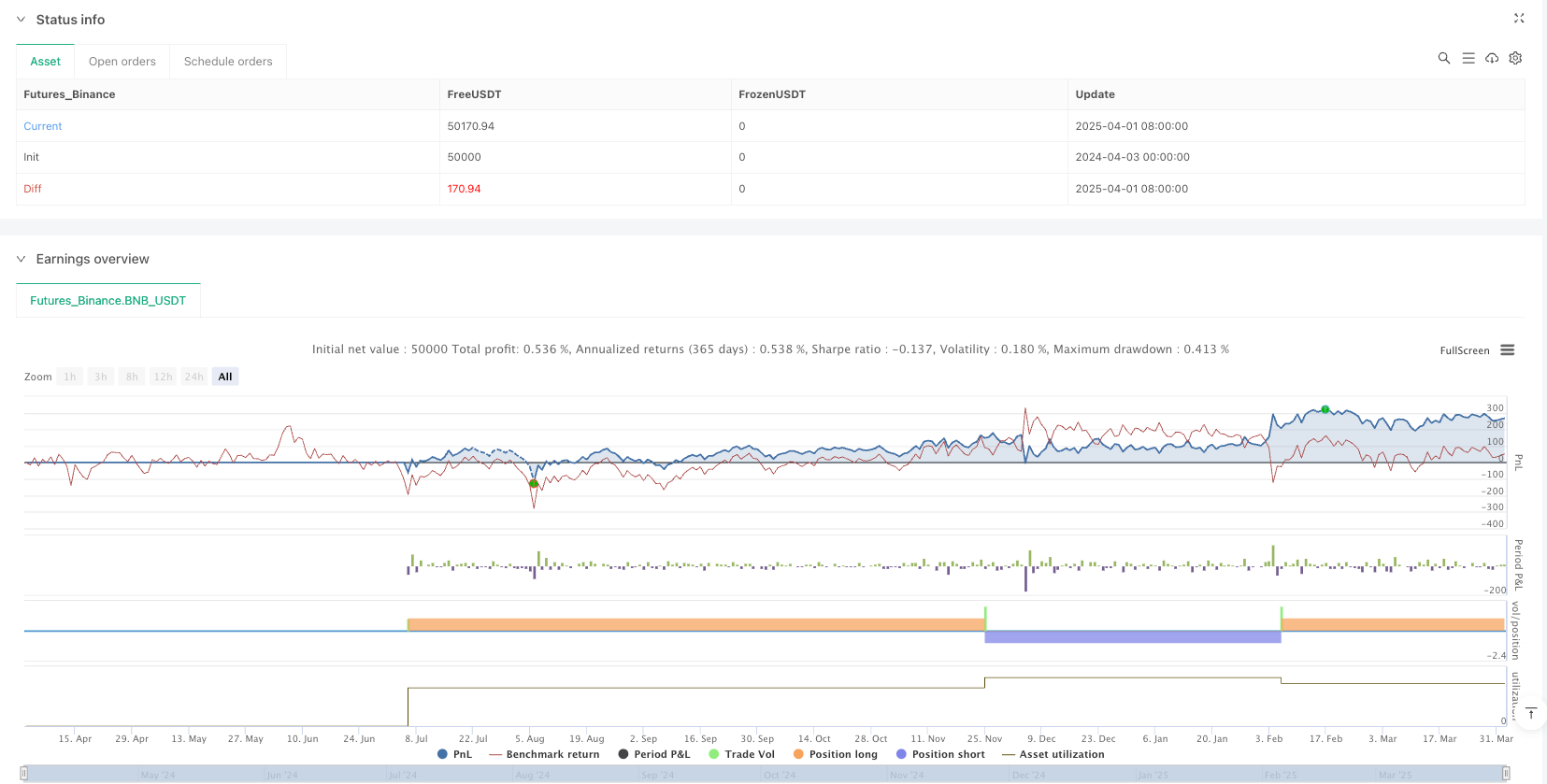

/*backtest

start: 2024-04-03 00:00:00

end: 2025-04-02 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//@version=5

strategy("BuySell Strategy OD", overlay=true)

// === INPUTS === //

rsiPeriod = input.int(14, "RSI Period")

stochPeriod = input.int(14, "Stoch RSI Period")

adxPeriod = input.int(14, "ADX Period")

// === INDICATORS === //

// RSI

rsi = ta.rsi(close, rsiPeriod)

// Stoch RSI

rsiMin = ta.lowest(rsi, stochPeriod)

rsiMax = ta.highest(rsi, stochPeriod)

stochRsi = rsiMax != rsiMin ? (rsi - rsiMin) / (rsiMax - rsiMin) * 100 : 0

// ADX (manual calculation)

upMove = high - high[1]

downMove = low[1] - low

plusDM = (upMove > downMove and upMove > 0) ? upMove : 0

minusDM = (downMove > upMove and downMove > 0) ? downMove : 0

tr = math.max(math.max(high - low, high - close[1]), low - close[1])

atr = ta.rma(tr, adxPeriod)

plusDI = 100 * ta.rma(plusDM, adxPeriod) / atr

minusDI = 100 * ta.rma(minusDM, adxPeriod) / atr

dx = 100 * ((plusDI - minusDI) >= 0 ? (plusDI - minusDI) : (minusDI - plusDI)) / (plusDI + minusDI)

adx = ta.rma(dx, adxPeriod)

// VWAP

vwap = ta.vwap(hlc3)

// === BUY CONDITION === //

buyCond = (adx > 25) and (rsi < 30) and (stochRsi < 20) and (close < vwap)

// === SELL CONDITION === //

sellCond = (adx > 25) and (rsi > 70) and (stochRsi > 80) and (close > vwap)

// === PLOTS === //

plotshape(buyCond, title="BUY", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sellCond, title="SELL", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// === STRATEGY ORDERS === //

if buyCond

strategy.entry("BUY", strategy.long)

if sellCond

strategy.entry("SELL", strategy.short)