Overview

The Important Zone MACD Crossover Momentum Trend Capture Strategy is a quantitative trading approach based on the Moving Average Convergence Divergence (MACD) indicator. This strategy innovatively introduces the concept of an “important zone,” filtering MACD crossover signals within a specific threshold range to capture more reliable market trend changes and momentum shifts. The core focus is on identifying crossovers between the MACD line and signal line within predetermined upper and lower thresholds, thereby selecting higher quality trading signals and effectively reducing the risks associated with false breakouts.

Strategy Principle

The core principle of this strategy combines MACD crossover signals with important zone filtering:

MACD Indicator Calculation:

- Fast moving average (default parameter: 12)

- Slow moving average (default parameter: 26)

- Signal line (default parameter: 9)

- The MACD line is the difference between the fast and slow moving averages

- The signal line is the moving average of the MACD line

Important Zone Definition:

- Upper threshold set (default: 0.5) and lower threshold (default: -0.5)

- Crossover signals are only considered valid when the MACD line is within this zone

Entry Signal Identification:

- Long signal: MACD line crosses above the signal line within the important zone

- Short signal: MACD line crosses below the signal line within the important zone

Exit Conditions:

- Long positions are closed when the MACD line crosses below the signal line

- Short positions are closed when the MACD line crosses above the signal line

The strategy code calculates MACD values using the ta.macd(close, fastLength, slowLength, signalLength) function and detects crossover events using the ta.crossover and ta.crossunder functions. Trade signal execution is implemented through the strategy.entry and strategy.close functions, ensuring appropriate position management when conditions are met.

Strategy Advantages

Analyzing the code implementation of this strategy reveals the following significant advantages:

Extreme Value Filtering: By setting an important zone, the strategy effectively filters out crossover signals in extreme areas of the MACD, which often represent overbought or oversold conditions that are prone to reversal.

Flexible Parameters: The strategy allows traders to flexibly adjust MACD parameters (fast line, slow line, and signal line periods) and important zone thresholds according to different market environments and trading instruments, enhancing adaptability.

Signal Visualization: The code implements comprehensive visualization features, including the plotting of MACD lines, signal lines, zero lines, and threshold lines, as well as buy/sell signal markers, enabling traders to intuitively monitor strategy performance.

Clear and Concise Logic: The strategy logic structure is clear, and the code is concise and efficient. The core idea revolves around “crossovers within the important zone,” avoiding the risk of overfitting caused by complex logic.

Bidirectional Trading Mechanism: Supports both long and short trading, capable of capturing trading opportunities in different market environments (rising, falling), maximizing the strategy’s profit potential.

Strategy Risks

Despite its elegant design, the strategy still has the following potential risks:

Lag Issue: MACD itself is a lagging indicator based on moving averages, which may not capture turning points in time in rapidly changing markets, leading to delayed entries or exits. A solution could be to reduce moving average periods or incorporate other leading indicators to assist decision-making.

Oscillating Market Risk: In sideways, oscillating markets, even with important zone filtering, MACD may still produce frequent crossovers, leading to overtrading and capital erosion. Consider adding trend confirmation mechanisms or pausing trading in oscillating markets.

Threshold Selection Challenge: There’s no objective standard for setting important zone thresholds. Too wide a zone may include too many noise signals, while too narrow may miss effective trading opportunities. It’s recommended to determine the optimal threshold range through historical backtesting.

False Breakout Risk: Despite using important zone filtering, the market may still exhibit false breakouts, leading to incorrect trading signals. Consider adding confirmation periods or incorporating volume analysis to verify signal validity.

Parameter Optimization Trap: Over-optimizing MACD parameters and thresholds may cause the strategy to perform well on historical data but poorly in future live trading. It’s advisable to use out-of-sample testing and robustness analysis to evaluate the strategy.

Strategy Optimization Directions

Based on the strategy principles and risk analysis, the following potential optimization directions are proposed:

Add Trend Confirmation Mechanism: Combine long-period moving averages or ADX indicator to determine the overall trend direction, only accepting trading signals consistent with clear trends, which can significantly improve the strategy’s win rate. This optimization effectively addresses the frequent trading problem in oscillating markets.

Introduce Dynamic Thresholds: Replace fixed upper and lower thresholds with dynamic thresholds based on historical volatility or ATR, allowing the important zone to automatically adjust with market conditions. The rationale is that MACD fluctuation amplitudes vary greatly in different market phases, and static thresholds are difficult to adapt to all market environments.

Integrate Volume Confirmation: Add volume conditions confirmation when crossover signals are generated, such as requiring significant volume increases during breakouts, to improve signal quality. Volume can verify the validity of price movements and reduce false breakout risks.

Optimize Exit Mechanism: The current strategy only exits on reverse crossovers. Consider adding take-profit and stop-loss conditions, or time-based forced exit mechanisms, to better control risk and lock in profits. Reasonable money management is key to long-term profitability.

Multi-Timeframe Analysis: Before generating trading signals, verify the MACD status in higher timeframes to ensure that the trading direction is consistent with the larger trend. Multi-timeframe analysis provides a more comprehensive market perspective and reduces counter-trend trading risks.

Summary

The Important Zone MACD Crossover Momentum Trend Capture Strategy innovatively combines MACD crossover signals with important zone filtering mechanisms, providing an efficient solution for trend capture and momentum trading. The core advantage of this strategy lies in its ability to filter potential false signals in extreme areas while retaining effective trading opportunities within the value zone.

The adjustable parameter design allows traders to flexibly configure according to different market environments and trading instruments, while clear signal visualization features also provide convenience for strategy monitoring and optimization. Despite facing the inherent lag issues of MACD and challenges in oscillating markets, through the suggested optimization directions such as adding trend confirmation mechanisms, introducing dynamic thresholds, and integrating volume analysis, the strategy’s performance can be further enhanced.

Overall, this strategy provides quantitative traders with a clear structure and logically rigorous trading framework, suitable as a foundation component for medium to long-term trend capture systems. Through reasonable parameter configuration and the addition of necessary risk control mechanisms, this strategy has the potential to demonstrate relatively stable performance across various market environments.

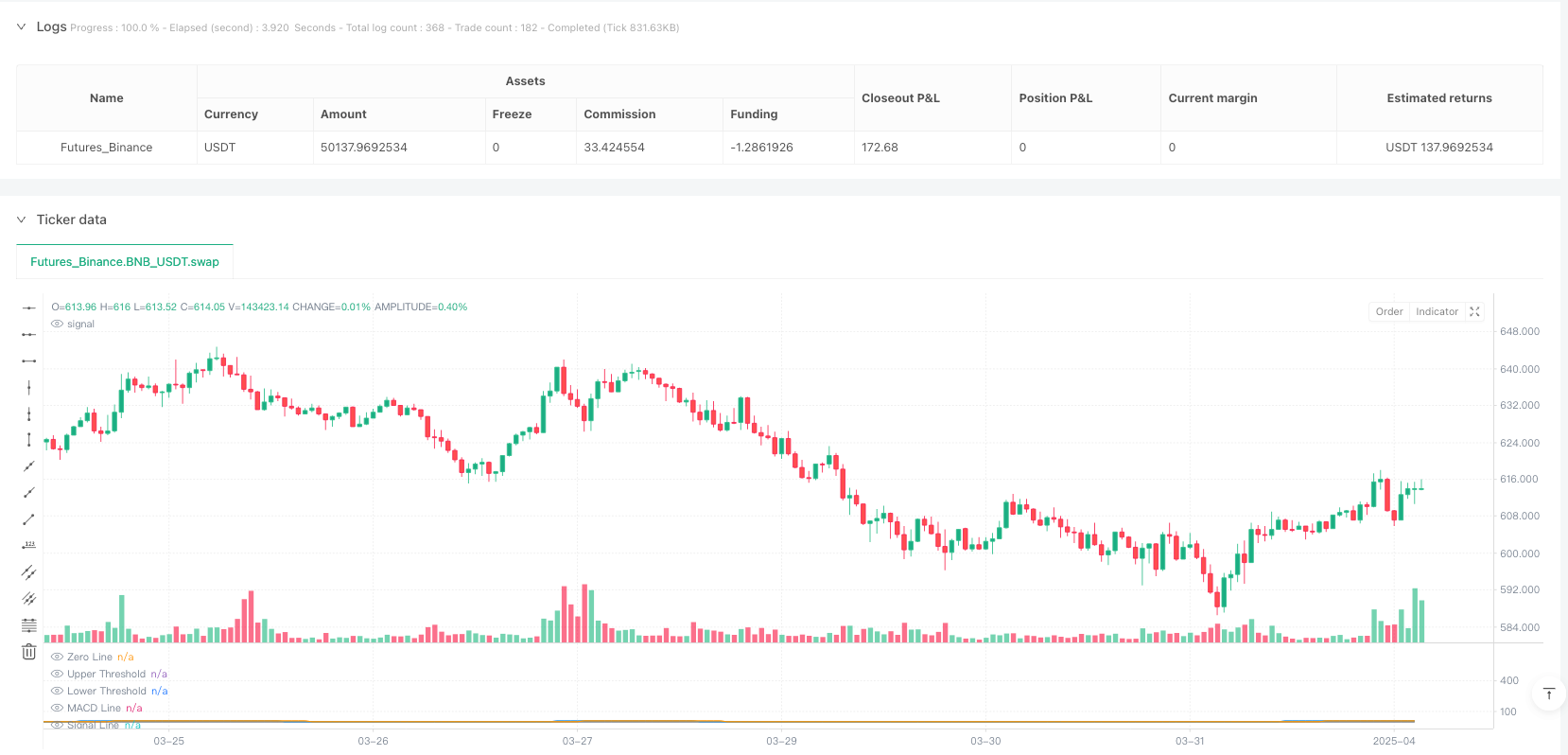

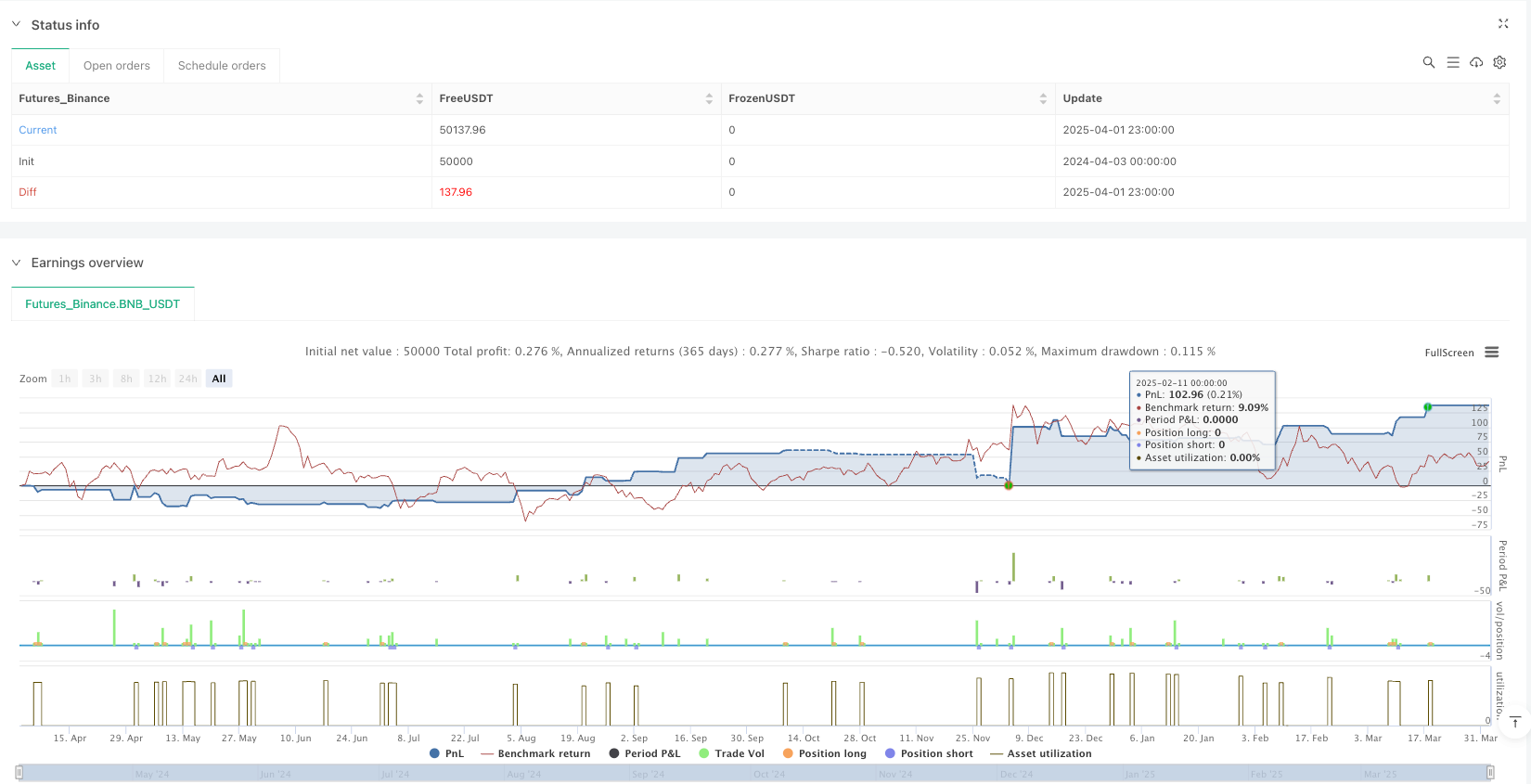

/*backtest

start: 2024-04-03 00:00:00

end: 2025-04-02 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//@version=5

strategy("MACD Crossover Strategy", overlay=false)

// MACD parameters

fastLength = input(12, "Fast Length")

slowLength = input(26, "Slow Length")

signalLength = input(9, "Signal Length")

// Important zone parameters

lowerThreshold = input.float(-0.5, "Lower Threshold", step=0.1)

upperThreshold = input.float(0.5, "Upper Threshold", step=0.1)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

// Plot MACD lines

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

plot(0, color=color.white, title="Zero Line")

plot(upperThreshold, color=color.gray, style=plot.style_linebr, title="Upper Threshold")

plot(lowerThreshold, color=color.gray, style=plot.style_linebr, title="Lower Threshold")

// Define crossover conditions

crossOverUp = ta.crossover(macdLine, signalLine)

crossOverDown = ta.crossunder(macdLine, signalLine)

// Define important crossover zone

isImportantZone = macdLine >= lowerThreshold and macdLine <= upperThreshold

// Strategy entries

if (crossOverUp and isImportantZone)

strategy.entry("Long", strategy.long)

if (crossOverDown and isImportantZone)

strategy.entry("Short", strategy.short)

// Optional: Add exits based on opposite signals

if (crossOverDown)

strategy.close("Long")

if (crossOverUp)

strategy.close("Short")

// Plot buy/sell signals

plotshape(series=crossOverUp and isImportantZone, title="Buy Signal", location=location.bottom, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=crossOverDown and isImportantZone, title="Sell Signal", location=location.top, color=color.red, style=shape.triangledown, size=size.small)