Overview

This is a long-short trend tracking strategy based on Average True Range (ATR) and Exponential Moving Average (EMA). The strategy achieves precise market trend capture and risk management through dynamic stop-loss and trend determination.

Strategy Principle

The core principles include: 1. Calculate dynamic stop-loss points using ATR 2. Determine price trend direction with EMA 3. Confirm trading signals through price and stop-loss point relationship 4. Optional Heikin Ashi candle optimization

Key Calculation Logic: - Dynamic Stop-Loss = Current Price ± (ATR * Sensitivity Coefficient) - Trend Determined by EMA and Stop-Loss Point Crossover - Trading Signals Generated When Price Breaks Stop-Loss and EMA Crosses

Strategy Advantages

- Dynamic Risk Management: ATR adaptive stop-loss calculation

- Precise Trend Tracking: EMA quickly responds to price changes

- High Flexibility: Customizable ATR period and sensitivity

- Optional Heikin Ashi Candles for Signal Refinement

- Low-Frequency Trading, Reduced Transaction Costs

- Multi-Market and Multi-Variety Adaptability

Strategy Risks

- Potential Frequent False Signals in Volatile Markets

- Improper Parameter Settings May Cause Over-Trading

- Does Not Consider Fundamental Factors

- Potential Divergence Between Backtesting and Live Trading

Risk Control Recommendations: - Optimize Parameters - Combine with Confirmation Indicators - Implement Stop-Loss and Position Management - Continuous Monitoring and Dynamic Adjustment

Strategy Optimization Directions

- Introduce Machine Learning for Parameter Optimization

- Add Multi-Timeframe Verification

- Combine with Additional Technical Indicators

- Develop Adaptive Parameter Selection Mechanism

- Enhance Risk Adjustment Module

Optimization Goals: Improve Strategy Stability, Reduce Drawdown, Enhance Profit Efficiency

Summary

A dynamic trend tracking strategy based on ATR and EMA, achieving stable market participation through flexible stop-loss mechanisms and trend judgment. The strategy demonstrates good adaptability and risk management characteristics, requiring continuous optimization and validation.

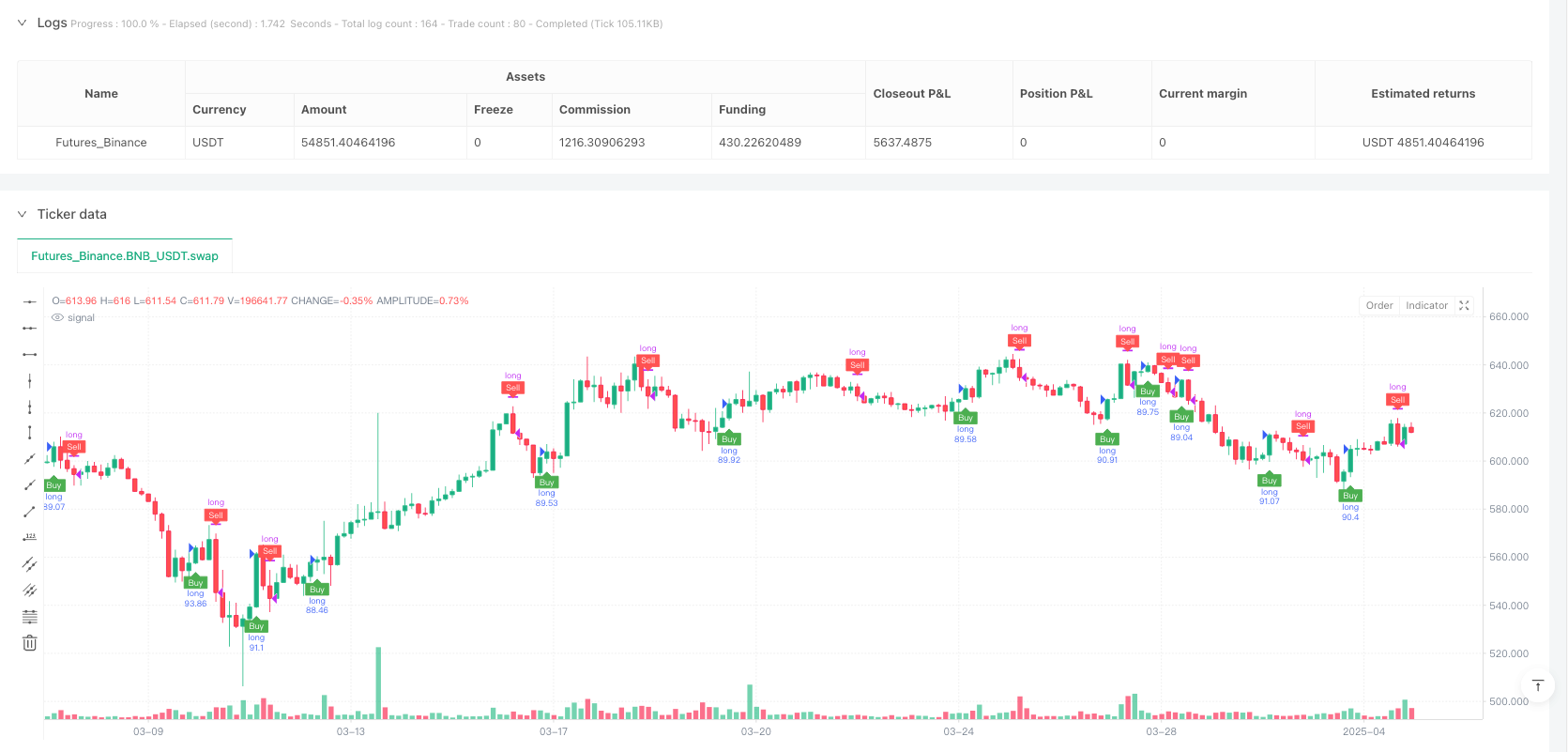

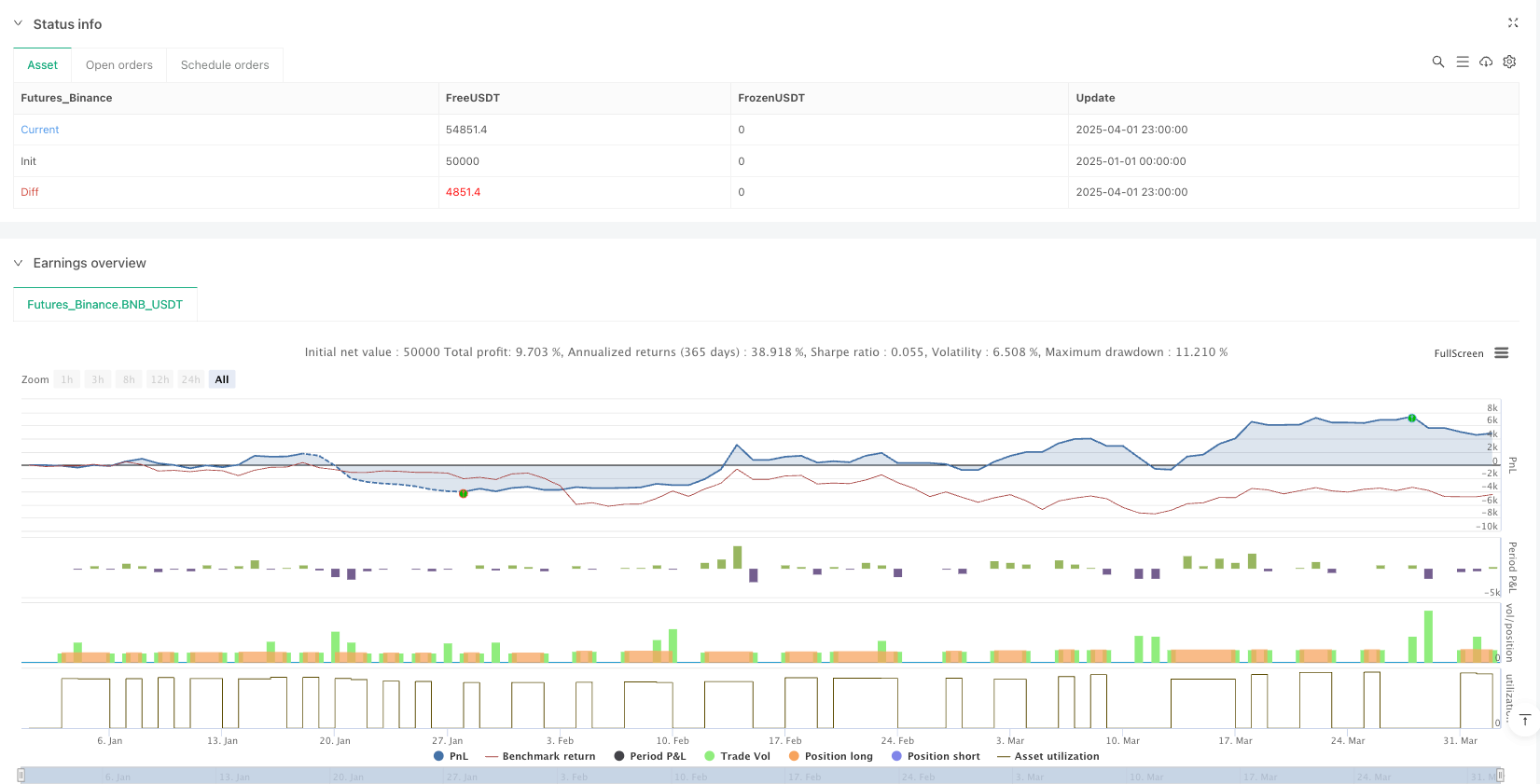

/*backtest

start: 2025-01-01 00:00:00

end: 2025-04-02 00:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//@version=6

strategy("ducanhmaster v1", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Inputs

a = input.int(1, title="Key Value. 'This changes the sensitivity'")

c = input.int(10, title="ATR Period")

h = input.bool(false, title="Signals from Heikin Ashi Candles")

xATR = ta.atr(c)

nLoss = a * xATR

// Compute Heikin Ashi values

heikinAshiOpen = (open + close) / 2

heikinAshiClose = (open + high + low + close) / 4

heikinAshiHigh = math.max(high, math.max(heikinAshiOpen, heikinAshiClose))

heikinAshiLow = math.min(low, math.min(heikinAshiOpen, heikinAshiClose))

src = h ? heikinAshiClose : close

// Declare xATRTrailingStop as a float variable and initialize it with 'na'

var float xATRTrailingStop = na

if (src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0))

xATRTrailingStop := math.max(nz(xATRTrailingStop[1]), src - nLoss)

else if (src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0))

xATRTrailingStop := math.min(nz(xATRTrailingStop[1]), src + nLoss)

else

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

// Declare 'pos' as an integer variable instead of leaving it undefined

var int pos = na

if (src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0))

pos := 1

else if (src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0))

pos := -1

else

pos := nz(pos[1], 0)

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

// Plot buy/sell signals on the chart

plotshape(buy, title="Buy", text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.white, size=size.tiny)

plotshape(sell, title="Sell", text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.white, size=size.tiny)

// Change bar color when buy/sell conditions are met

barcolor(barbuy ? color.green : na)

barcolor(barsell ? color.red : na)

// Enter a Long trade when a buy signal appears and exit when a sell signal appears

if (buy)

strategy.entry("long", strategy.long)

if (sell)

strategy.close("long")