Overview

The OneTrend Lite EMA strategy is an innovative trend-tracking trading approach that combines Exponential Moving Averages (EMA), Average Directional Index (ADX), and Average True Range (ATR) to identify and capture market trends. The strategy aims to provide clear, rule-based trading signals while dynamically adjusting sensitivity to market volatility.

Strategy Principles

The strategy’s core revolves around three key technical indicators: 1. Fast and Slow EMAs: Capturing price trend changes by calculating exponential moving averages of different period lengths 2. Custom ADX Calculation: Evaluating trend strength and market momentum 3. Dynamic ATR Threshold: Adaptively adjusting trend determination sensitivity based on ADX values

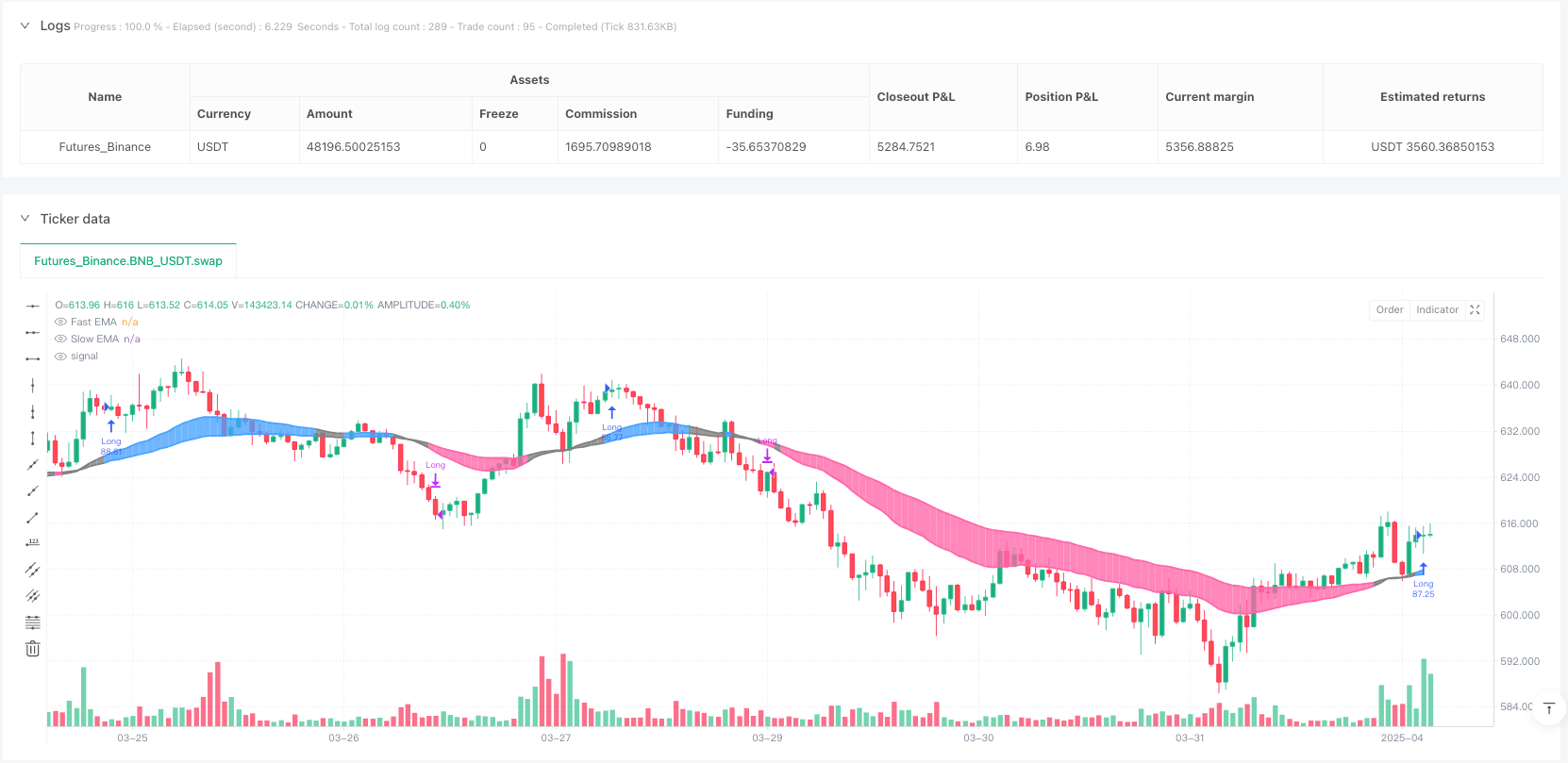

The strategy uses a 30-period fast EMA and a 60-period slow EMA, generating trading signals by combining their difference with an adaptive ATR multiplier. It enters the blue trend zone (bullish) when the fast EMA exceeds the dynamic threshold and enters the pink zone (bearish) when it falls below the threshold.

Strategy Advantages

- High adaptability: Dynamic ADX threshold allows sensitivity adjustment based on different market conditions

- Multi-dimensional indicator combination: Integrating EMA, ADX, and ATR improves signal accuracy

- Clear visual trading intervals: Blue and pink areas intuitively display trend changes

- Flexible risk management: Adjustable EMA periods, ATR multipliers, and ADX thresholds

Strategy Risks

- Lagging nature: EMAs inherently have a lag, potentially delaying response in rapidly changing markets

- Performance in oscillating markets: May generate frequent and ineffective trading signals in markets lacking clear trends

- Parameter sensitivity: Strategy performance highly depends on chosen parameters, requiring continuous backtesting and optimization

Strategy Optimization Directions

- Incorporate machine learning algorithms: Using AI to dynamically optimize parameter selection

- Multi-timeframe validation: Verifying strategy stability across different time scales

- Combine additional indicators: Integrating momentum indicators like RSI, MACD to improve signal accuracy

- Adaptive stop-loss mechanism: Dynamically adjusting stop-loss strategies based on ATR

Summary

The OneTrend Lite EMA strategy provides traders with a flexible and intuitive trend-tracking method through innovative indicator combinations and adaptive thresholds. Despite inherent risks, its multi-dimensional analysis and dynamic adjustment capabilities make it a strategy worthy of in-depth research.

/*backtest

start: 2024-04-03 00:00:00

end: 2025-04-02 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BNB_USDT"}]

*/

//============================== OneTrend Lite Historical Performance ==============================/

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//| Ticker | Total P&L | Drawdown | # Trades | Profitable Trades | Profit Factor | Best Method |

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//| BTC | 557x | 55.29% | 11 | 72.73% | 13.579 | OneTrend Pro |

//| ETH | 207x | 55.11% | 13 | 46.15% | 1.696 | OneTrend Pro |

//| XRP | 29x | 99.85% | 23 | 30.43% | 1.261 | OneTrend Gaus |

//| SOL | 152x | 40.20% | 8 | 62.50% | 4.341 | OneTrend Gaus |

//| BNB | 519x | 64.29% | 12 | 50.00% | 3.351 | OneTrend Lite |

//| DOGE | 21x | 89.63% | 22 | 27.27% | 1.521 | OneTrend Gaus |

//| ADA | 9x | 76.18% | 9 | 55.56% | 9.039 | OneTrend Pro |

//| SUI | 6.6x | 11.44% | 2 | 100.00% | ∞ | OneTrend Pro |

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//============================== OneTrend Pro Historical Performance ===============================/

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//| Ticker | Total P&L | Drawdown | # Trades | Profitable Trades | Profit Factor | Best Method |

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//| BTC | 723x | 50.99% | 41 | 53.66% | 2.625 | OneTrend Pro |

//| ETH | 1925x | 40.07% | 31 | 58.06% | 3.472 | OneTrend Pro |

//| XRP | 298x | 99.97% | 53 | 37.74% | 1.87 | OneTrend Gaus |

//| SOL | 917x | 73.31% | 18 | 44.44% | 2.71 | OneTrend Gaus |

//| BNB | 353x | 49.44% | 31 | 45.16% | 2.849 | OneTrend Lite |

//| DOGE | 238x | 92.38% | 40 | 40.00% | 2.389 | OneTrend Gaus |

//| ADA | 39x | 71.96% | 31 | 35.48% | 1.684 | OneTrend Pro |

//| SUI | 8.7x | 31.53% | 4 | 50.00% | 13.457 | OneTrend Pro |

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//=========================== OneTrend Gaussian Historical Performance =============================/

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//| Ticker | Total P&L | Drawdown | # Trades | Profitable Trades | Profit Factor | Best Method |

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//| BTC | 107x | 72.45% | 26 | 57.69% | 5.5 | OneTrend Pro |

//| ETH | 10x | 40.07% | 31 | 58.06% | 3.472 | OneTrend Pro |

//| XRP | 1125x | 99.94% | 29 | 48.28% | 1.509 | OneTrend Gaus |

//| SOL | 925x | 52.10% | 11 | 63.64% | 11.338 | OneTrend Gaus |

//| BNB | 434x | 58.10% | 22 | 59.09% | 4.845 | OneTrend Lite |

//| DOGE | 487x | 90.48% | 40 | 32.50% | 2.263 | OneTrend Gaus |

//| ADA | 20x | 71.96% | 31 | 35.48% | 1.684 | OneTrend Pro |

//| SUI | 3.3x | 31.53% | 4 | 50.00% | 13.457 | OneTrend Pro |

//+--------+-----------+-----------+-----------+--------------------+---------------+---------------+

//@version=6

strategy("OneTrend Lite EMA", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital = 10000)

// ——— USER INPUTS ———

// EMA settings

emaFastLen = 30

emaSlowLen = 60

atrLen = 60

// ADX settings

adxLen = 14

adxThreshold = 20

// ATR multipliers for trend conditions

atrMultStrong = 0.3

atrMultWeak = 0.1

// ——— CALCULATIONS ———

// Calculate EMAs and their difference

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

emaDiff = emaFast - emaSlow

// --- Custom ADX Calculation ---

up = ta.change(high)

down = -ta.change(low)

plusDM = (up > down and up > 0) ? up : 0.0

minusDM = (down > up and down > 0) ? down : 0.0

trur = ta.rma(ta.tr, adxLen)

plusDI = 100 * ta.rma(plusDM, adxLen) / trur

minusDI = 100 * ta.rma(minusDM, adxLen) / trur

dx = 100 * math.abs(plusDI - minusDI) / (plusDI + minusDI)

adxVal = ta.rma(dx, adxLen)

// Determine the dynamic ATR multiplier based solely on ADX

dynamicAtrMult = adxVal > adxThreshold ? atrMultStrong : atrMultWeak

// Define bull (blue) and bear (pink) zones using the dynamic multiplier

emaBull = emaDiff > dynamicAtrMult * ta.atr(atrLen)

emaBear = emaDiff < -dynamicAtrMult * ta.atr(atrLen)

// ——— PLOTTING ———

clrBull = color.rgb(70, 163, 255) // Blue for bull

clrBear = color.rgb(255, 102, 170) // Pink for bear

clrNeutral = color.rgb(128, 128, 128) // Gray for neutral

fastPlot = plot(emaFast, linewidth=2, color=emaBull ? clrBull : emaBear ? clrBear : clrNeutral, title="Fast EMA")

slowPlot = plot(emaSlow, linewidth=2, color=emaBull ? clrBull : emaBear ? clrBear : clrNeutral, title="Slow EMA")

fill(fastPlot, slowPlot, color=emaBull ? color.new(clrBull, 70) : emaBear ? color.new(clrBear, 70) : color.new(clrNeutral, 70))

// ——— STRATEGY LOGIC ———

// Enter long immediately when the zone turns blue, and exit when it turns pink.

if emaBull

strategy.entry("Long", strategy.long, comment="Long Entry")

if emaBear

strategy.close("Long", comment="Close Long")