Overview

This is an automated trading strategy that combines moving averages, MACD indicators, and volume filtering, aimed at determining trend direction and managing trading risks through multiple technical indicators. The strategy judges market trends through short-term and long-term moving averages, confirms trend signals using MACD, and incorporates volume filtering and dynamic risk management mechanisms to enhance trading accuracy and stability.

Strategy Principle

The strategy primarily includes four core technical components: 1. Moving Average Trend Determination: Using short-term (20-period) and long-term (100-period) moving average crossovers to judge market trend direction. 2. MACD Signal Confirmation: Verifying the validity of trend signals through the relative position of MACD line and signal line. 3. Volume Filtering: Ensuring trades occur under active market conditions by comparing current volume with historical average volume. 4. Dynamic Risk Management: Calculating take-profit and stop-loss points using ATR indicators and setting daily maximum loss and maximum drawdown limits.

Strategy Advantages

- Multiple Indicator Verification: Significantly improving signal accuracy by combining moving averages, MACD, and volume.

- Dynamic Risk Control: Flexible position size calculation and risk management mechanisms effectively control per-trade and overall risks.

- Trend Tracking Capability: Ability to capture medium-term market trends, reducing ineffective trades in oscillating markets.

- Parameter Adjustability: Providing multiple customizable parameters for optimization across different market environments.

Strategy Risks

- Lagging Risk: Moving averages and MACD have inherent lagging characteristics, potentially delaying trend reversal point capture.

- Parameter Sensitivity: Strategy performance highly depends on chosen parameters, requiring continuous adjustment in different market environments.

- Oscillating Market Challenges: In markets lacking clear trends, the strategy may generate frequent and ineffective trading signals.

- Extreme Market Conditions: Risk control mechanisms might fail to completely avoid significant losses during violent fluctuations or black swan events.

Strategy Optimization Directions

- Incorporate Machine Learning Algorithms: Introduce dynamic parameter adjustment mechanisms that adaptively optimize strategy parameters based on real-time market changes.

- Multi-Period Verification: Introduce more technical indicators from different periods to improve signal reliability.

- Correlation Analysis: Add market correlation analysis to reduce systematic risks between different assets.

- Comprehensive Risk Assessment: Enhance risk models by incorporating more complex risk assessment indicators and scenario simulations.

Summary

This is an automated trading strategy comprehensively utilizing multiple technical analysis tools, aiming to provide a relatively stable and reliable trading method through strict risk management and multiple indicator verification. The strategy’s core lies in balancing trend capture capabilities and risk control, providing a flexible and optimizable framework for quantitative trading.

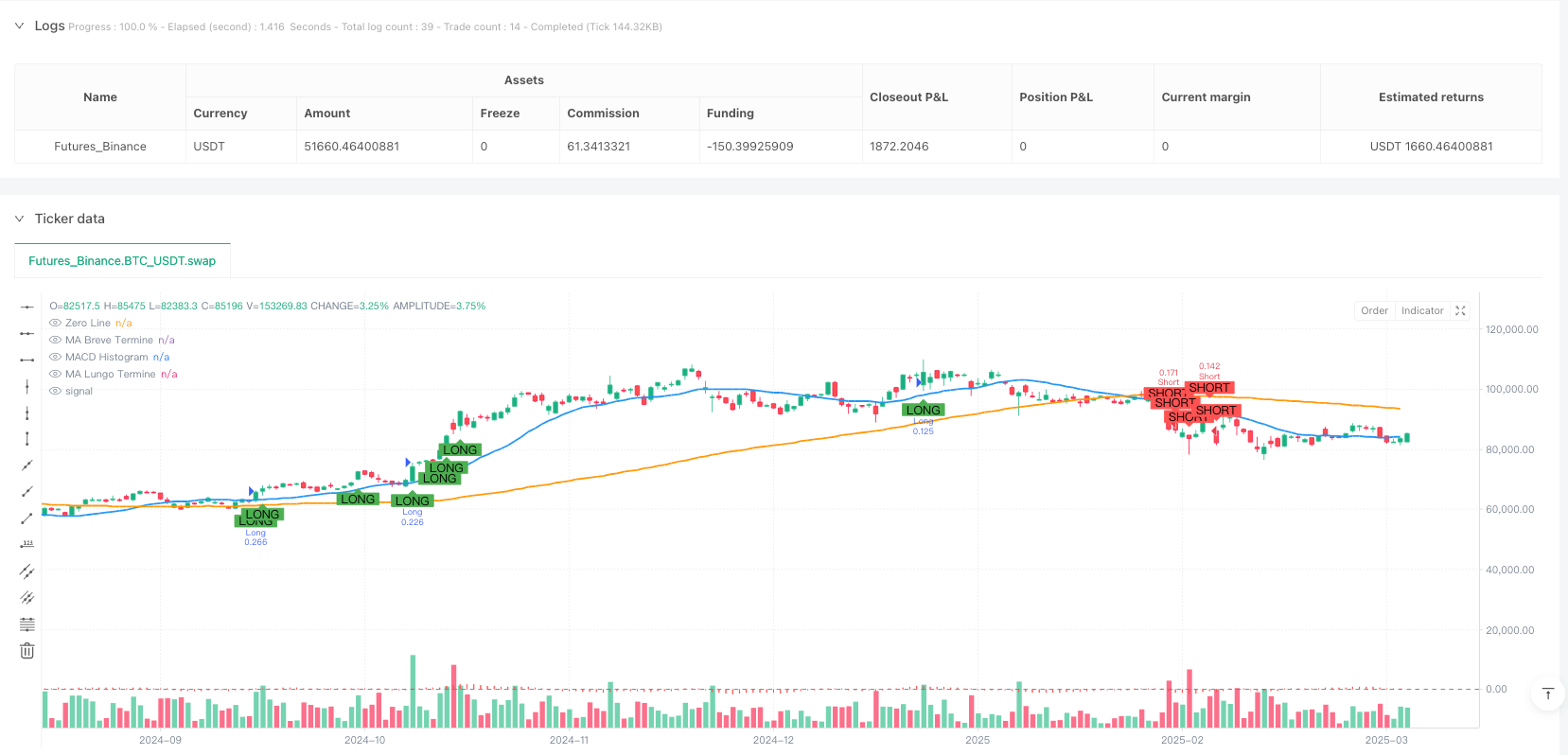

/*backtest

start: 2024-04-02 00:00:00

end: 2025-04-02 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Strategia Semmoncino", shorttitle="semmoncino", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10, commission_type=strategy.commission.percent, commission_value=0.05)

// Inputs

useVolumeFilter = input.bool(true, title="Usa Filtro di Volume")

volumeThreshold = input.float(1.5, title="Soglia Volume (x Media)", minval=1)

atrPeriod = input.int(14, title="ATR Period", minval=1)

atrMultiplier = input.float(2.0, title="ATR Multiplier", minval=0.1)

takeProfitMultiplier = input.float(6.0, title="Take Profit Multiplier", minval=1.0) // Aumentato per ottimizzare

riskPerTrade = input.float(2.0, title="Rischio per Trade (%)", minval=0.1) / 100

maxDailyLoss = input.float(2.0, title="Perdita Massima Giornaliera (%)", minval=0.1) / 100

maxDrawdown = input.float(10.0, title="Drawdown Massimo (%)", minval=0.1) / 100

shortMAPeriod = input.int(20, title="MA Breve Termine", minval=1)

longMAPeriod = input.int(100, title="MA Lungo Termine", minval=1)

// MACD Inputs

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalLength = input.int(9, title="MACD Signal Length")

showSignals = input.bool(true, title="Mostra Segnali di Entrata")

// Prezzi di Apertura e Chiusura delle Candele Precedenti (senza repainting)

prevOpen = ta.valuewhen(1, open, 0)

prevClose = ta.valuewhen(1, close, 0)

// Calculate ATR

atr = ta.atr(atrPeriod)

// Calculate Volume Filter

volumeAvg = ta.sma(volume, 20)

volumeFilter = useVolumeFilter ? volume > (volumeAvg * volumeThreshold) : true

// Calculate Moving Averages

shortMA = ta.sma(close, shortMAPeriod)

longMA = ta.sma(close, longMAPeriod)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

macdConditionLong = macdLine > signalLine

macdConditionShort = macdLine < signalLine

// Determine Trend Direction

uptrend = shortMA > longMA

downtrend = shortMA < longMA

// Determine Order Conditions

longCondition = prevClose > prevOpen and volumeFilter and uptrend and macdConditionLong

shortCondition = prevClose < prevOpen and volumeFilter and downtrend and macdConditionShort

// Calcola la dimensione della posizione basata sul capitale iniziale

initialCapital = strategy.initial_capital

positionSize = (initialCapital * riskPerTrade) / (atr * atrMultiplier)

// Calculate Take Profit and Stop Loss Levels dynamically using ATR

takeProfitLong = close + (atr * takeProfitMultiplier)

stopLossLong = close - (atr * 1.5) // Ridotto per ottimizzare

takeProfitShort = close - (atr * takeProfitMultiplier)

stopLossShort = close + (atr * 1.5) // Ridotto per ottimizzare

// Limite di Perdita Giornaliera

var float dailyLossLimit = na

if na(dailyLossLimit) or (time - time) > 86400000 // Se è un nuovo giorno

dailyLossLimit := strategy.equity * (1 - maxDailyLoss)

// Drawdown Massimo

var float drawdownLimit = na

if na(drawdownLimit)

drawdownLimit := strategy.equity * (1 - maxDrawdown)

// Controllo delle Perdite

if strategy.equity < dailyLossLimit

strategy.cancel_all()

strategy.close_all()

label.new(bar_index, high, text="Perdita Giornaliera Massima Raggiunta", color=color.red)

if strategy.equity < drawdownLimit

strategy.cancel_all()

strategy.close_all()

label.new(bar_index, high, text="Drawdown Massimo Raggiunto", color=color.red)

// Strategy Entries

if (longCondition)

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("Take Profit/Stop Loss Long", from_entry="Long", limit=takeProfitLong, stop=stopLossLong)

if (shortCondition)

strategy.entry("Short", strategy.short, qty=positionSize)

strategy.exit("Take Profit/Stop Loss Short", from_entry="Short", limit=takeProfitShort, stop=stopLossShort)

// Plot Entry Signals

plotshape(series=longCondition and showSignals ? close : na, location=location.belowbar, color=color.green, style=shape.labelup, text="LONG")

plotshape(series=shortCondition and showSignals ? close : na, location=location.abovebar, color=color.red, style=shape.labeldown, text="SHORT")

// Plot Moving Averages

plot(shortMA, color=color.blue, title="MA Breve Termine", linewidth=2)

plot(longMA, color=color.orange, title="MA Lungo Termine", linewidth=2)

// Plot MACD

hline(0, "Zero Line", color=color.gray)

plot(macdLine - signalLine, title="MACD Histogram", color=color.red, style=plot.style_histogram)