Overview

This is an innovative multi-timeframe adaptive KDJ oscillator strategy designed to provide more precise and flexible trading signals by dynamically adjusting indicator parameters and analyzing market trends across multiple timeframes. The strategy combines volatility-based length calculation, multi-timeframe weight allocation, and adaptive trend determination, offering traders a sophisticated and powerful analysis tool.

Strategy Principles

The core principles of the strategy include the following key technologies:

- Multi-timeframe analysis: Simultaneously using 1-minute, 5-minute, and 15-minute timeframes

- Adaptive swing length calculation: Dynamically adjusting indicator parameters based on market volatility

- Dynamic weight allocation: Assigning different weight coefficients to different timeframes

- Trend determination mechanism: Determining market trend direction by calculating the average of smoothAvgTotal

- Intelligent signal generation: Combining primary signals and anticipated signals to improve signal accuracy

Strategy Advantages

- High flexibility: Customizable timeframe and weight configuration

- Dynamic adaptability: Adjusting indicator parameters based on market volatility

- Multi-dimensional analysis: Integrating information from multiple timeframes

- Low-latency signals: Including primary and anticipated signals

- Built-in trend filtering: Reducing false signals in unfavorable market conditions

Strategy Risks

- Parameter overfitting risk

- Increased signal complexity with multiple timeframes

- Potential signal reliability reduction in extreme market conditions

- Requires additional confirmation indicators to validate signals

Strategy Optimization Directions

- Introduce machine learning algorithms for dynamic weight adjustment

- Add additional filtering conditions

- Optimize stop-loss mechanisms

- Develop cross-instrument adaptability

Summary

The multi-timeframe adaptive KDJ oscillator strategy provides traders with a flexible, dynamic, and multi-dimensional market analysis tool through innovative design, offering significant technical advantages and potential performance improvement space.

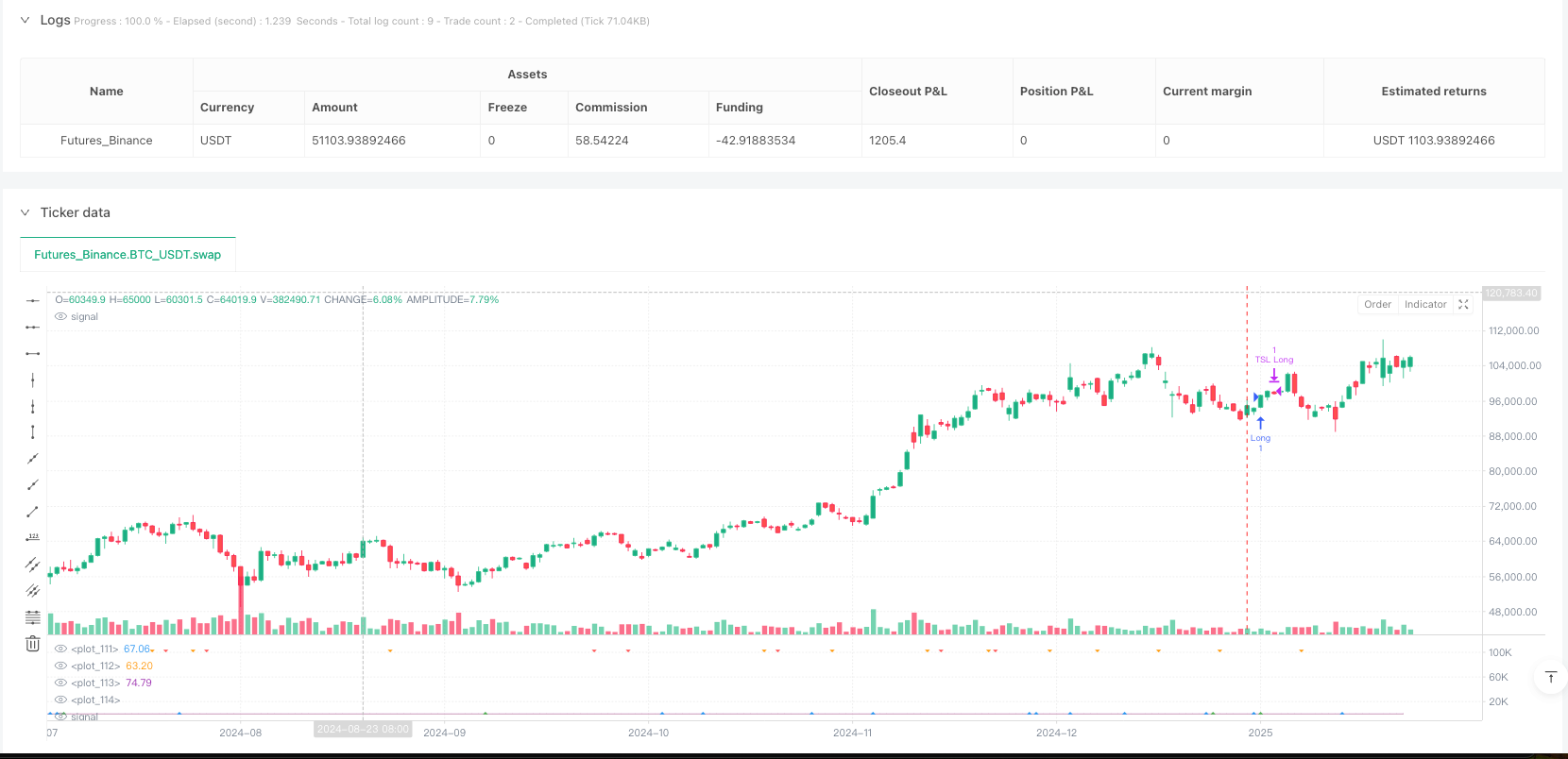

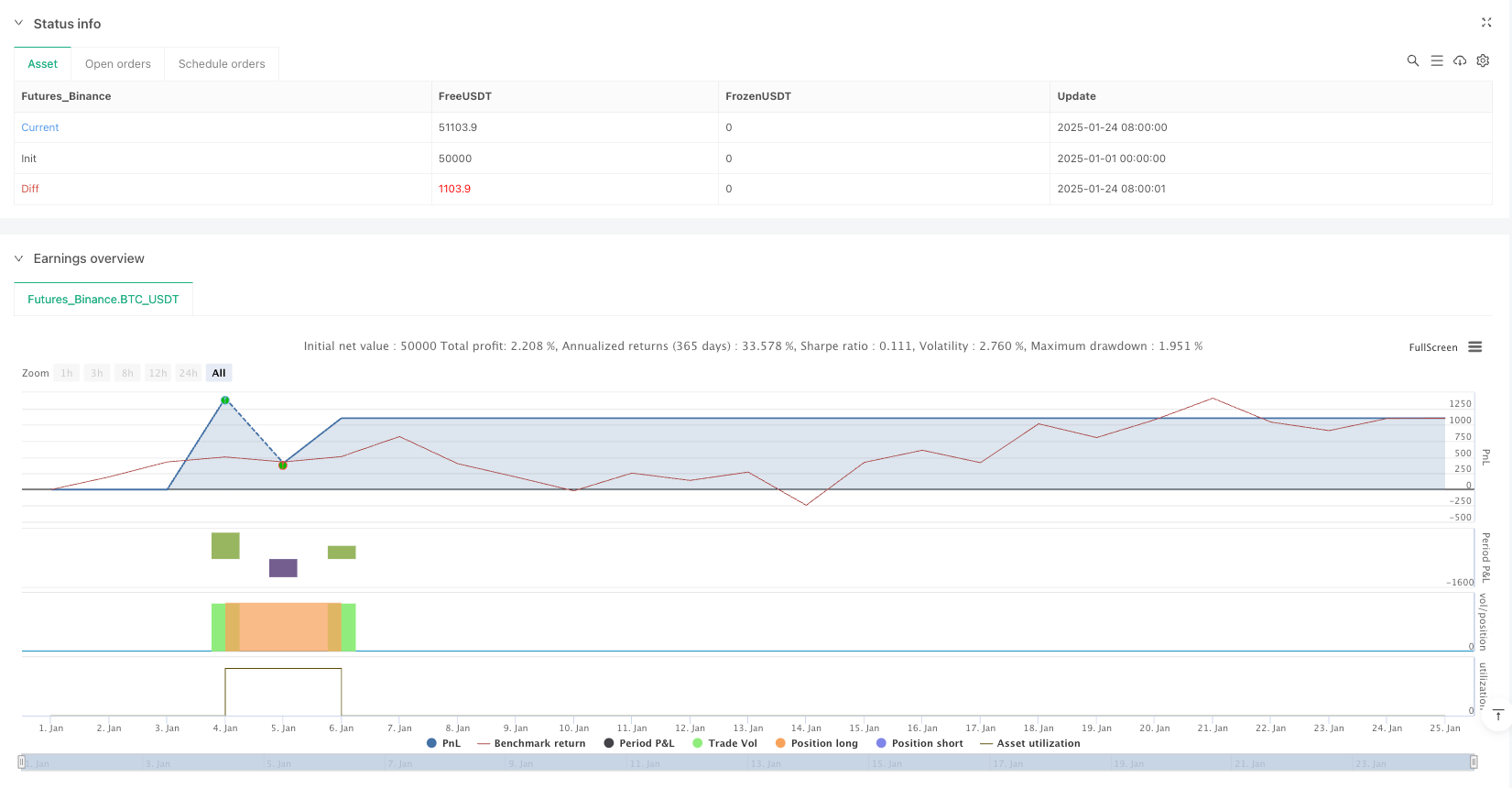

/*backtest

start: 2025-01-01 00:00:00

end: 2025-01-25 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ is subject to the Mozilla Public License 2.0 (https://mozilla.org/MPL/2.0/)

// © Lausekopf

//@version=5

strategy("Adaptive KDJ (MTF)", overlay=false)

// Dropdown for the swing length calculation method

method = input.int(1, title="Calculation Method", options=[1, 2, 3], tooltip="1: Volatility Based\n2: Inverse Volatility\n3: Fixed Length")

// Fixed length for method 3

fixedLength = input.int(9, title="Fixed KDJ Length", minval=3, maxval=15)

// Timeframes

tf1 = input.timeframe("1", title="Timeframe 1")

tf2 = input.timeframe("5", title="Timeframe 2")

tf3 = input.timeframe("15", title="Timeframe 3")

// Timeframe weighting

weightOption = input.int(1, title="Timeframe Weighting", options=[1, 2, 3, 4, 5])

weightTF1 = weightOption == 1 ? 0.5 : weightOption == 2 ? 0.4 : weightOption == 3 ? 0.33 : weightOption == 4 ? 0.2 : 0.1

weightTF2 = 0.33

weightTF3 = 1.0 - (weightTF1 + weightTF2)

// EMA smoothing length

smoothingLength = input.int(5, title="EMA Smoothing Length", minval=1, maxval=50)

// Trend calculation period

trendLength = input.int(40, title="Trend Calculation Period", minval=5, maxval=50)

// KDJ function

f_kdj(len, srcHigh, srcLow, srcClose) =>

roundedLen = int(math.round(len))

high_max = ta.highest(srcHigh, roundedLen)

low_min = ta.lowest(srcLow, roundedLen)

rsv = 100 * (srcClose - low_min) / (high_max - low_min)

k = ta.sma(rsv, 3)

d = ta.sma(k, 3)

j = 3 * k - 2 * d

[k, d, j]

// Swing length function

f_swingLength(tf) =>

atrLen = 14

volatility = request.security(syminfo.tickerid, tf, ta.atr(atrLen) / close)

var float length = na

if method == 1

length := volatility > 0.03 ? 3 : volatility > 0.002 ? 14 : 15

if method == 2

length := 18

if method == 3

length := fixedLength

length

// Calculate swing lengths for each timeframe

swingLength1 = f_swingLength(tf1)

swingLength2 = f_swingLength(tf2)

swingLength3 = f_swingLength(tf3)

// Calculate KDJ values

[k1, d1, j1] = f_kdj(swingLength1, request.security(syminfo.tickerid, tf1, high), request.security(syminfo.tickerid, tf1, low), request.security(syminfo.tickerid, tf1, close))

[k2, d2, j2] = f_kdj(swingLength2, request.security(syminfo.tickerid, tf2, high), request.security(syminfo.tickerid, tf2, low), request.security(syminfo.tickerid, tf2, close))

[k3, d3, j3] = f_kdj(swingLength3, request.security(syminfo.tickerid, tf3, high), request.security(syminfo.tickerid, tf3, low), request.security(syminfo.tickerid, tf3, close))

// Weighted averages

avgK = (k1 * weightTF1 + k2 * weightTF2 + k3 * weightTF3)

avgD = (d1 * weightTF1 + d2 * weightTF2 + d3 * weightTF3)

avgJ = (j1 * weightTF1 + j2 * weightTF2 + j3 * weightTF3)

smoothAvgK = ta.ema(avgK, smoothingLength)

smoothAvgD = ta.ema(avgD, smoothingLength)

smoothAvgJ = ta.ema(avgJ, smoothingLength)

smoothAvgTotal = ta.ema((avgK + avgD + avgJ) / 3, smoothingLength)

// Trend determination

trendAvg = ta.sma(smoothAvgTotal, trendLength)

isUptrend = trendAvg > 60

isDowntrend = trendAvg < 40

// Dynamic signal thresholds

buyLevel = isUptrend ? 40 : isDowntrend ? 15 : 25

sellLevel = isUptrend ? 85 : isDowntrend ? 60 : 75

// Buy/Sell signals

buySignal = smoothAvgJ < buyLevel and ta.crossover(smoothAvgK, smoothAvgD)

sellSignal = smoothAvgJ > sellLevel and ta.crossunder(smoothAvgK, smoothAvgD)

// Anticipated signals

anticipateBuy = (smoothAvgK - smoothAvgK[1]) > 0 and (smoothAvgD - smoothAvgD[1]) < 0 and math.abs(smoothAvgK - smoothAvgD) < 5

anticipateSell = (smoothAvgK - smoothAvgK[1]) < 0 and (smoothAvgD - smoothAvgD[1]) > 0 and math.abs(smoothAvgK - smoothAvgD) < 5

// Entry conditions

longEntryCondition = (buySignal or anticipateBuy) and smoothAvgTotal < 22

shortEntryCondition = (sellSignal or anticipateSell) and smoothAvgTotal > 78

// Entry orders

strategy.entry("Long", strategy.long, when=longEntryCondition)

strategy.entry("Short", strategy.short, when=shortEntryCondition)

// Trailing Stop-Loss

atrMultiplierTSL = 2.5

atrValueTSL = ta.atr(12) * atrMultiplierTSL

strategy.exit("TSL Long", from_entry="Long", trail_points=atrValueTSL / syminfo.mintick, stop=open * 0.9972)

strategy.exit("TSL Short", from_entry="Short", trail_points=atrValueTSL / syminfo.mintick, stop=open * 1.0028)

// Plot signals

plotshape(series=buySignal, location=location.bottom, style=shape.triangleup, color=color.green, size=size.small)

plotshape(series=sellSignal, location=location.top, style=shape.triangledown, color=color.red, size=size.small)

plotshape(series=anticipateBuy, location=location.bottom, style=shape.triangleup, color=color.blue, size=size.tiny, offset=-1)

plotshape(series=anticipateSell, location=location.top, style=shape.triangledown, color=color.orange, size=size.tiny, offset=-1)

// Plot KDJ lines

plot(smoothAvgK, color=color.blue, linewidth=1)

plot(smoothAvgD, color=color.orange, linewidth=1)

plot(smoothAvgJ, color=color.purple, linewidth=1)

plot(smoothAvgTotal, color=color.white, linewidth=1)

// Alert for impending signals

alertcondition(anticipateBuy or anticipateSell, title='Impending KDJ Crossover', message='Possible KDJ crossover detected!')

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Lausekopf