Overview

The Alpha Beast Advanced Quantitative Trading Strategy is a comprehensive trading system that combines multiple technical indicators, designed to capture strong trends in the market. The core of this strategy lies in integrating the Supertrend indicator, Relative Strength Index (RSI), and volume breakthrough confirmation to form a multi-dimensional entry signal confirmation mechanism. Additionally, the strategy employs dynamic stop-loss based on Average True Range (ATR) and target profit setting based on risk-reward ratio (RR), ensuring that each trade is executed within a strict risk management framework. The strategy defaults to using 20% of the account equity as trading capital, balancing profit potential with risk exposure.

Strategy Principles

The Alpha Beast Advanced Quantitative Trading Strategy operates based on the following key components and logical flow:

Indicator Calculations:

- RSI(14): Measures the relative strength of price movements

- ATR(14): Measures market volatility

- Supertrend(3.0, 10): Determines market trend direction

- Volume Analysis: Compares current volume with 20-day moving average to identify volume-driven moves

Entry Conditions:

- Long Condition: Upward Supertrend (direction indicator below closing price) + RSI > 60 + Volume Breakthrough (current volume > 20-day average volume * 1.5)

- Short Condition: Downward Supertrend (direction indicator above closing price) + RSI < 40 + Volume Breakthrough (current volume > 20-day average volume * 1.5)

Risk Management:

- Stop-Loss Setting: Calculated based on ATR value, for long positions it’s current price minus ATR*1.2, for short positions it’s current price plus ATR*1.2

- Take-Profit Setting: Calculated based on risk-reward ratio, default is 2.5 times the stop-loss distance

- Capital Management: Each trade uses 20% of account equity

The core logic of the strategy requires multiple conditions to be simultaneously satisfied to trigger a trading signal. This “confirmation mechanism” effectively reduces false signals, while dynamically calculated stop-loss and take-profit levels adapt to changes in market volatility.

Strategy Advantages

Multiple Confirmation Mechanism: Combines indicators from three dimensions: trend, momentum, and volume, significantly reducing the risk of false signals. Trades are only executed when the market simultaneously satisfies trend, strength, and volume conditions.

Dynamic Risk Management: Stop-loss and take-profit levels are dynamically adjusted according to actual market volatility (ATR), rather than using fixed levels. This allows the strategy to adapt to different market environments and volatility cycles.

Effective Capture of Trending Markets: Through the combination of the Supertrend indicator and RSI threshold, the strategy is particularly suitable for capturing strong market movements with clear direction.

Volume Confirmation: Incorporates volume analysis as trade confirmation, ensuring entry points have sufficient market participation and momentum support, reducing unnecessary trades in low liquidity environments.

Risk-Reward Ratio Optimization: Uses a default 2.5:1 risk-reward ratio setting, enabling the strategy to maintain profitability in the long term even with a moderate win rate.

Built-in Capital Management Mechanism: Controls the amount of capital for each trade through percentage allocation, avoiding excessive risk exposure and contributing to long-term stable account growth.

Strategy Risks

RSI Threshold Sensitivity: Fixed RSI thresholds (60⁄40) may perform differently in various market environments. They might generate too many false signals in long-term range-bound markets, while potentially missing sustained opportunities in strong trending markets.

Volume Dependency Risk: The strategy has a strong dependence on volume breakouts. In certain trading instruments or time periods, volume data may not be accurate enough or may have latency, affecting signal quality.

Fixed Supertrend Parameter Issue: Using fixed Supertrend parameters (3.0, 10) may not be suitable for all market environments, and parameter optimization lacks an adaptive mechanism.

Potentially Tight Stop-Loss Setting: In highly volatile markets, an ATR multiplier of 1.2 may cause stop-losses to be too close to the current price, increasing the risk of being triggered by market noise.

Fixed Capital Allocation: Using a fixed percentage (20%) of account equity for each trade may not be flexible enough, unable to dynamically adjust position sizes based on signal strength and market conditions.

Solutions: - Introduce adaptive RSI thresholds that adjust dynamically based on market volatility - Add volume data quality verification mechanisms, or use multi-period volume confirmation - Implement adaptive optimization of Supertrend parameters - Dynamically adjust ATR multipliers during high volatility periods - Introduce dynamic position sizing algorithms based on signal strength

Strategy Optimization Directions

Indicator Parameter Adaptive Optimization:

- Implement adaptive adjustment of RSI thresholds, Supertrend factors, and volume multipliers, dynamically optimizing parameters based on market volatility cycles and historical performance

- Rationale: Fixed parameters struggle to adapt to all market environments; adaptive parameters can enhance strategy universality and robustness

Time Filter Introduction:

- Add intraday trading time filters or market session analysis functionality to avoid inefficient trading periods

- Rationale: Different time periods show significant differences in market efficiency and signal reliability; time filtering can improve overall signal quality

Multi-Timeframe Confirmation System:

- Add trend confirmation across multiple timeframes to ensure trade direction aligns with larger timeframe trends

- Rationale: Single timeframe analysis is easily affected by short-term market noise; multi-timeframe analysis provides a more comprehensive market perspective

Machine Learning Signal Optimization:

- Introduce machine learning algorithms to filter existing signals, identifying trading opportunities with higher win rates

- Rationale: Traditional technical indicator combinations struggle to capture complex non-linear relationships in markets; machine learning can significantly improve pattern recognition capabilities

Dynamic Risk Management Adjustment:

- Dynamically adjust risk-reward ratios and capital allocation percentages based on historical volatility and current market states

- Rationale: Optimal risk parameters vary greatly across different market environments; dynamic risk management can better adapt to market changes

Market Sentiment Indicator Integration:

- Integrate VIX or other market sentiment indicators to adjust strategy behavior in extreme market environments

- Rationale: In periods of market panic or extreme greed, conventional technical analysis effectiveness decreases; market sentiment indicators can provide additional decision support dimensions

Conclusion

The Alpha Beast Advanced Quantitative Trading Strategy represents a modern trading system that fuses multiple indicators’ synergistic effects, achieving multi-dimensional identification of market opportunities through the combination of trend analysis, momentum indicators, and volume confirmation. Its core advantages lie in strict signal screening mechanisms and dynamic risk management systems, allowing the strategy to maintain stable performance even in volatile markets.

Despite limitations such as fixed RSI thresholds and parameter optimization, through the proposed optimization directions—especially introducing adaptive parameter systems, multi-timeframe confirmation, and machine learning-assisted decision making—this strategy has the potential to develop into a more comprehensive and robust trading system. Most importantly, its risk management framework design concept—combining ATR dynamic stop-loss with fixed risk-reward ratios—provides a template worth referencing for quantitative trading strategy development.

For traders seeking to build systematic trading methods based on technical analysis, the Alpha Beast strategy offers a practical framework that balances signal quality and risk control. Through further optimization and personalized adjustments, it can adapt to various market environments and trading styles.

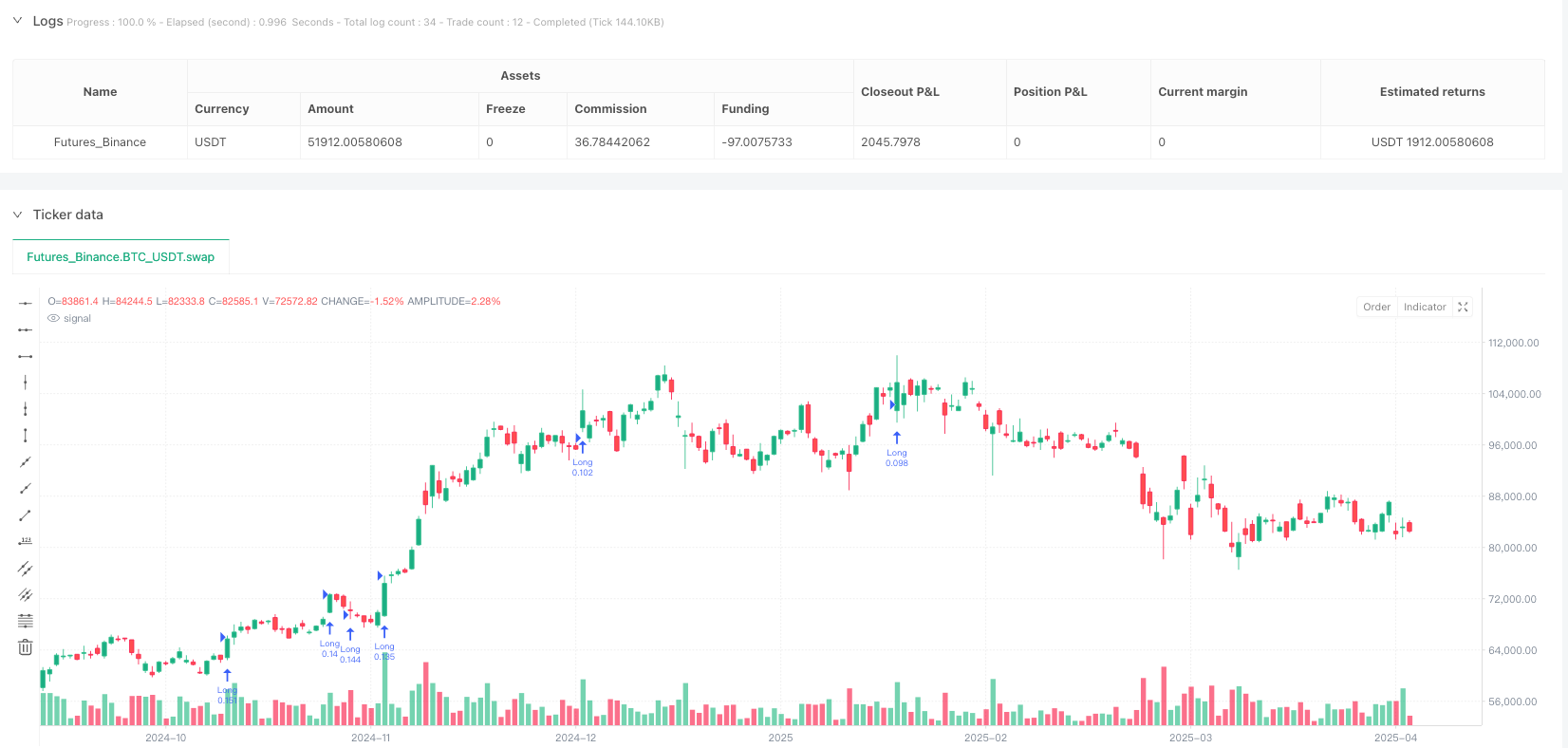

/*backtest

start: 2024-04-07 00:00:00

end: 2025-04-06 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ErayPala

//@version=6

strategy("Alpha Beast – Max Performance Mode", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=20)

// === Inputs

rsiLen = input.int(14, title="RSI Length")

rsiThreshold = input.int(60, title="RSI Entry Threshold")

atrLen = input.int(14, title="ATR Length")

atrMultSL = input.float(1.2, title="ATR SL Multiplier")

rr = input.float(2.5, title="Risk-Reward Ratio")

supertrendFactor = input.float(3.0, title="Supertrend Factor")

supertrendLen = input.int(10, title="Supertrend Length")

volMult = input.float(1.5, title="Volumen-Multiplikator")

// === Indicators

rsi = ta.rsi(close, rsiLen)

atr = ta.atr(atrLen)

vol = volume

volSMA = ta.sma(volume, 20)

// === Supertrend Calc

[_, direction] = ta.supertrend(supertrendFactor, supertrendLen)

isUpTrend = direction < close

isDownTrend = direction > close

// === Volumen-Push

volBoost = vol > volSMA * volMult

// === Entry Conditions

longCond = isUpTrend and rsi > rsiThreshold and volBoost

shortCond = isDownTrend and rsi < (100 - rsiThreshold) and volBoost

// === SL & TP

longSL = close - atr * atrMultSL

longTP = close + atr * atrMultSL * rr

shortSL = close + atr * atrMultSL

shortTP = close - atr * atrMultSL * rr

// === Strategy Entries/Exits

if (longCond)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longSL, limit=longTP)

if (shortCond)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortSL, limit=shortTP)