Overview

The Multi-EMA and VWAP Trend Confirmation Analysis System is an intraday trading strategy based on Exponential Moving Averages (EMA) and Volume-Weighted Average Price (VWAP). The strategy is built around two core principles: first using the position of the 50-period EMA relative to VWAP to confirm market trend direction; then generating entry signals through the crossover of the 8-period EMA and 50-period EMA in the direction of that confirmed trend. The strategy focuses on intraday trading sessions (default from 7:30 AM to 2:30 PM), aiming to capture market volatility during morning hours while avoiding choppy afternoon or overnight sessions.

Strategy Principles

The strategy operates on a clear logical framework: 1. Trend Confirmation Mechanism: The market trend is determined by comparing the 50-period EMA with VWAP. When the 50 EMA is above VWAP, it’s considered a bullish trend; when the 50 EMA is below VWAP, it’s considered a bearish trend. 2. Entry Signal Generation: Based on the confirmed trend, entry signals are generated using the crossover relationship between the fast moving average (8 EMA) and slow moving average (50 EMA). Specifically: - During bullish trends (50 EMA > VWAP), a long entry signal is triggered when the 8 EMA crosses above the 50 EMA - During bearish trends (50 EMA < VWAP), a short entry signal is triggered when the 8 EMA crosses below the 50 EMA 3. Session Filtering: The strategy only looks for trading opportunities within a specified intraday trading session (default 7:30-14:30) to focus on market environments with higher liquidity 4. Exit Logic: Positions are closed when the 8 EMA crosses the 50 EMA in the opposite direction of the entry

The core strength of the strategy lies in combining trend determination with momentum crossovers, ensuring that trading signals align with the overall market direction while avoiding interference from low-liquidity periods through session restrictions.

Strategy Advantages

Through in-depth analysis, this strategy demonstrates several significant advantages:

- Dual Confirmation Mechanism: Combining VWAP with EMA provides a more robust trend confirmation system. VWAP reflects large institutional trading preferences, while EMA captures price momentum, reducing the risk of false signals

- Adaptation to Market Structure: Through intraday session limitations, the strategy can focus on trading during periods when market liquidity is most abundant and price discovery is most active, improving signal quality

- Clear Trading Rules: Entry and exit conditions are clearly defined, requiring no subjective judgment, facilitating systematic implementation and backtest evaluation

- Parameter Simplicity: The strategy uses only two key parameters (fast and slow EMA lengths), reducing the risk of overfitting and improving strategy robustness

- Long-Short Flexibility: The strategy can automatically adjust trading direction according to market trends, maintaining adaptability in different market environments

Strategy Risks

Despite its sound design, the strategy presents several risk factors that require attention:

- Rapid Reversal Risk: In highly volatile markets, EMA crossover signals may lag, preventing timely exits during rapid market reversals. This can be mitigated by adding stop-loss mechanisms or volatility filters

- Choppy Market Performance: When the market lacks a clear trend and price oscillates around VWAP, frequent false signals may occur, leading to consecutive losses. It’s advisable to remain observant until a clear trend forms

- Parameter Sensitivity: The choice of EMA parameters significantly impacts strategy performance, and different market environments may require different parameter settings. Thorough historical backtesting validation is necessary

- Session Dependency: Strategy performance is highly dependent on the selected trading session. If market patterns change, a fixed session may no longer be effective. The optimal trading time window should be periodically evaluated

- Lack of Risk Management: The current strategy does not include stop-loss and take-profit settings, potentially facing significant drawdowns in extreme market conditions. It is recommended to supplement and improve risk control mechanisms

Optimization Directions

Based on in-depth code analysis, the strategy can be optimized in the following directions:

- Incorporate ATR Risk Management: Integrate Average True Range (ATR) indicators to set dynamic stop-loss and take-profit levels, adapting to different market volatility characteristics and improving risk-reward ratios

- Optimize Session Selection: Determine optimal trading sessions through historical data analysis, potentially establishing specific time windows for different markets to enhance strategy adaptability

- Add Filtering Conditions: Introduce additional filtering indicators such as Relative Strength Index (RSI) or Bollinger Bands to reduce false signals in choppy markets

- Dynamic Parameter Adjustment: Implement a mechanism that dynamically adjusts EMA parameters based on market volatility conditions, enabling the strategy to better adapt to different market environments

- Introduce Position Time Limits: Set maximum holding times to avoid long-term retention of inactive trades, improving capital utilization efficiency

- Quantify Signal Strength: Evaluate signal strength based on crossover magnitude, volume confirmation, or price momentum, prioritizing high-confidence trades

- Backtest Mode Optimization: Introduce more realistic slippage and commission models during the strategy evaluation phase to ensure backtest results more closely reflect actual trading environments

Conclusion

The Multi-EMA and VWAP Trend Confirmation Analysis System is a clearly structured, logically rigorous intraday trading strategy. By combining Volume-Weighted Average Price (VWAP) with Exponential Moving Averages (EMA) of different periods, the strategy effectively identifies market trends and captures momentum trading opportunities in the trend direction. The strategy’s strength lies in its dual confirmation mechanism, considering both large institutional trading behavior (reflected through VWAP) and short-term price momentum (captured through EMA crossovers).

While the strategy is quite comprehensive in its basic structure, there is still room for improvement through the introduction of appropriate risk management mechanisms, optimization of parameter selection, and addition of intelligent filtering conditions. For intraday traders, this strategy provides a data-driven, rule-clear trading framework that helps capture market trends while avoiding the interference of subjective emotions on trading decisions.

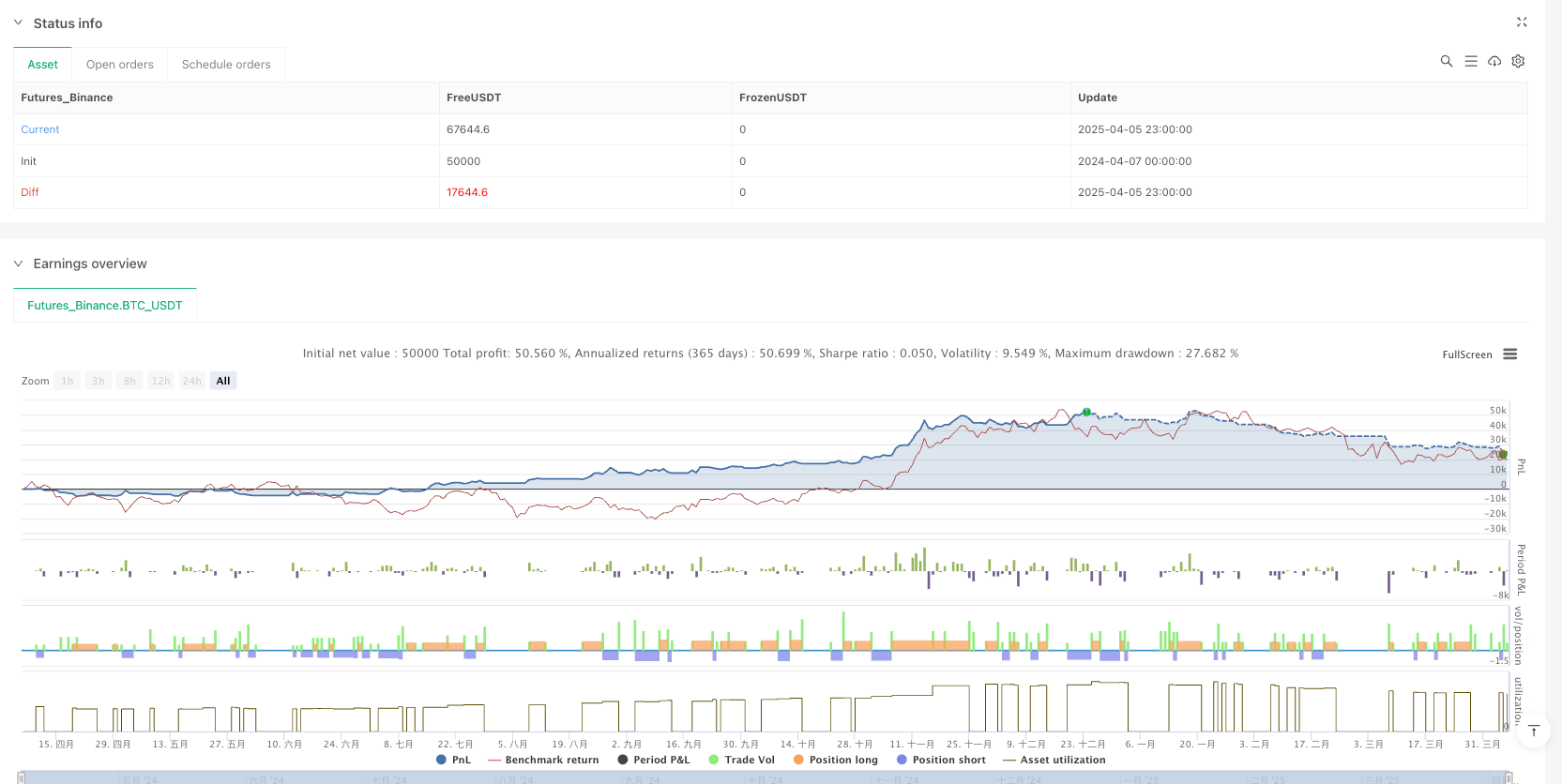

/*backtest

start: 2024-04-07 00:00:00

end: 2025-04-06 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("LUX CLARA - EMA + VWAP (No ATR Filter) - v6", overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === PARAMETERS === //

emaFastLen = input.int(8, "Fast EMA Length")

emaSlowLen = input.int(50, "Slow EMA Length")

// === CALCULATIONS === //

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

// Correct usage of ta.vwap():

// By default, it uses the chart's volume, so no second parameter is needed.

vwapLine = ta.vwap(close)

// === TREND LOGIC (50 EMA vs. VWAP) === //

isBullishTrend = emaSlow > vwapLine

isBearishTrend = emaSlow < vwapLine

// === SESSION FILTER: 7:30 AM - 11:30 AM (Exchange Time) === //

// "time(timeframe.period, '0730-1130')" returns `na` when outside that window.

isInSession = not na(time(timeframe.period, "0730-1430"))

// === ENTRY CONDITIONS === //

// Go long when 8 EMA crosses above 50 EMA during a Bullish Trend + in session

longEntry = ta.crossover(emaFast, emaSlow) and isBullishTrend and isInSession

// Go short when 8 EMA crosses below 50 EMA during a Bearish Trend + in session

shortEntry = ta.crossunder(emaFast, emaSlow) and isBearishTrend and isInSession

// === STRATEGY EXECUTION === //

if longEntry

strategy.entry("Long", strategy.long)

if shortEntry

strategy.entry("Short", strategy.short)

// === EXIT LOGIC === //

longExit = ta.crossunder(emaFast, emaSlow)

if longExit

strategy.close("Long")

shortExit = ta.crossover(emaFast, emaSlow)

if shortExit

strategy.close("Short")

// === PLOTS === //

plot(emaFast, color=color.orange, title="8 EMA")

plot(emaSlow, color=color.blue, title="50 EMA")

plot(vwapLine, color=color.fuchsia, title="VWAP")