Overview

The Dual EMA Crossover Strategy with Dynamic Trailing Stop Mechanism is a comprehensive trading system that employs both Exponential Moving Averages (EMA) and Simple Moving Averages (SMA) for bidirectional trading. The core mechanism relies on crossovers between different period EMAs to capture market trend reversals and momentum shifts. Specifically, the strategy uses the crossover between the 13-period EMA (short-term) and the 33-period EMA (long-term) for long entries, while the relationship between the 13-period EMA and the 25-period EMA (medium-term) determines short entry opportunities. Additionally, the strategy incorporates 100-period and 200-period SMAs as supplementary trend indicators to provide a more comprehensive context for market conditions. The most distinctive feature is the implementation of a dynamic trailing stop mechanism that both secures profits and effectively controls risk.

Strategy Principles

The core logic of the strategy is built on multiple moving average crossovers, monitoring the relative positions of these averages in real-time to determine market trend direction:

Long Entry Condition: When the 13-period EMA crosses above the 33-period EMA, indicating a potential uptrend formation, the system generates a long signal.

Short Entry Condition: When the 13-period EMA crosses below the 33-period EMA, suggesting a potential downtrend development, the system generates a short signal.

Long Exit Condition: When the 13-period EMA falls back below the 33-period EMA, signaling a possible end to the uptrend, the system closes the long position.

Short Exit Condition: When the 13-period EMA crosses above the 25-period EMA, indicating a potential weakening of the downtrend, the system closes the short position.

The strategy implements a fast execution mechanism in the code, ensuring positions are established promptly when market conditions are met. Crucially, the strategy emphasizes the application of trailing stops:

- Long trailing stops are set at the current bar’s high price minus a specified trailing distance

- Short trailing stops are set at the current bar’s low price plus a specified trailing distance

This dynamic stop-loss method automatically adjusts the stop level as the market moves favorably, both securing profits and reducing risk. Additionally, the strategy incorporates 100-period and 200-period SMAs to evaluate longer-term market trends, helping to filter out potential false breakouts.

Strategy Advantages

Balance Between Trend Following and Reversal Capture: By utilizing EMAs of different periods, the strategy can both capture medium to long-term trends and promptly identify short-term reversals, achieving a balance between trend following and reversal trading.

Distinct Long and Short Signal Logic: The strategy employs different entry and exit logic (different EMA combinations) for long and short positions, reflecting an understanding of market asymmetry, as markets often exhibit different characteristics and speeds during uptrends versus downtrends.

Dynamic Risk Management: The trailing stop mechanism adjusts stop-loss positions dynamically according to market movements, offering more flexibility than fixed stops and maximizing trend profit capture while protecting capital.

Multiple Timeframe Confirmation: By combining short-term EMAs, medium-term EMAs, and long-term SMAs, the strategy can confirm market movements across multiple timeframes, reducing false signals.

Real-Time Execution Optimization: The code design prioritizes real-time execution, ensuring rapid market entry when conditions are met, which is particularly important in highly volatile environments.

Integrated Capital Management: The strategy defaults to using a percentage of account equity for position sizing rather than fixed quantities, aiding in proportional risk control.

Strategy Risks

Frequent Trading Risk: In oscillating markets, EMAs may cross frequently, leading to excessive trading signals and unnecessary transaction costs. A solution is to add filtering conditions, such as requiring prices to be on a specific side of the 100 or 200-period SMA.

Reversal Breakout Risk: Markets may exhibit false breakouts followed by quick reversals, triggering short-term stop-losses. Consider introducing additional confirmation indicators, such as volume or volatility filters.

Parameter Sensitivity: Strategy performance is highly sensitive to the choice of EMA and trailing stop parameters. To address this risk, comprehensive backtesting is recommended to identify parameter combinations that perform robustly under varying market conditions.

Inadequate Response to Trend Mutations: During dramatic market shifts, such as after major news releases, EMAs may not respond quickly enough. Consider adding price breakout detection mechanisms or volatility filters to address such situations.

Fixed Parameter Adaptability Issues: Market conditions change over time, and fixed EMA parameters may not always be optimal. One possible solution is to implement adaptive parameter adjustment mechanisms that dynamically adjust EMA periods based on market volatility.

Strategy Optimization Directions

Adaptive EMA Parameters: Develop volatility-based adaptive EMA period calculation methods, allowing the strategy to automatically adjust parameters in different volatility environments, enhancing adaptability.

Additional Filtering Conditions: Introduce supplementary market state filters such as Relative Strength Index (RSI), Average True Range (ATR), or volume indicators, executing trades only when market conditions are ideal.

Optimize Trailing Stop Mechanism: The current trailing stop uses fixed points; consider implementing ATR-based dynamic trailing stops, which would be more accommodating in highly volatile markets and tighter in less volatile ones.

Time-Based Filtering: Certain markets may experience greater volatility or lower liquidity during specific time periods; adding time filters can help avoid these unfavorable trading windows.

Partial Profit-Taking Mechanism: Implement a scaled exit strategy, taking partial profits when prices reach specific targets, thus securing some gains while allowing remaining positions to continue capturing trends.

Sentiment Indicator Integration: Consider integrating market sentiment indicators such as MACD, stochastic oscillators, etc., as additional confirmation signals, which can improve entry precision.

Summary

The Dual EMA Crossover Strategy with Dynamic Trailing Stop Mechanism is a comprehensive trading system that combines multiple EMAs and SMAs to capture market trend changes by monitoring relationships between moving averages of different periods. The key advantages of this strategy lie in its flexible long-short trading logic and dynamic trailing stop mechanism, enabling it to maximize trend capture while protecting capital.

The strategy applies subtly different signal logic for long and short positions, demonstrating a profound understanding of market asymmetry. Through the use of trailing stops, the strategy can lock in profits as the market moves favorably while providing protection during market reversals. Furthermore, the strategy integrates longer-period SMAs to provide additional market context, helping to filter out some false signals.

However, the strategy also faces challenges such as overtrading in oscillating markets and parameter sensitivity. By incorporating adaptive parameters, market state filters, and optimized risk management methods, there is significant room to enhance the strategy’s robustness and performance. Ultimately, successful application of this strategy requires a deep understanding of its principles and limitations, with appropriate adjustments based on specific market environments.

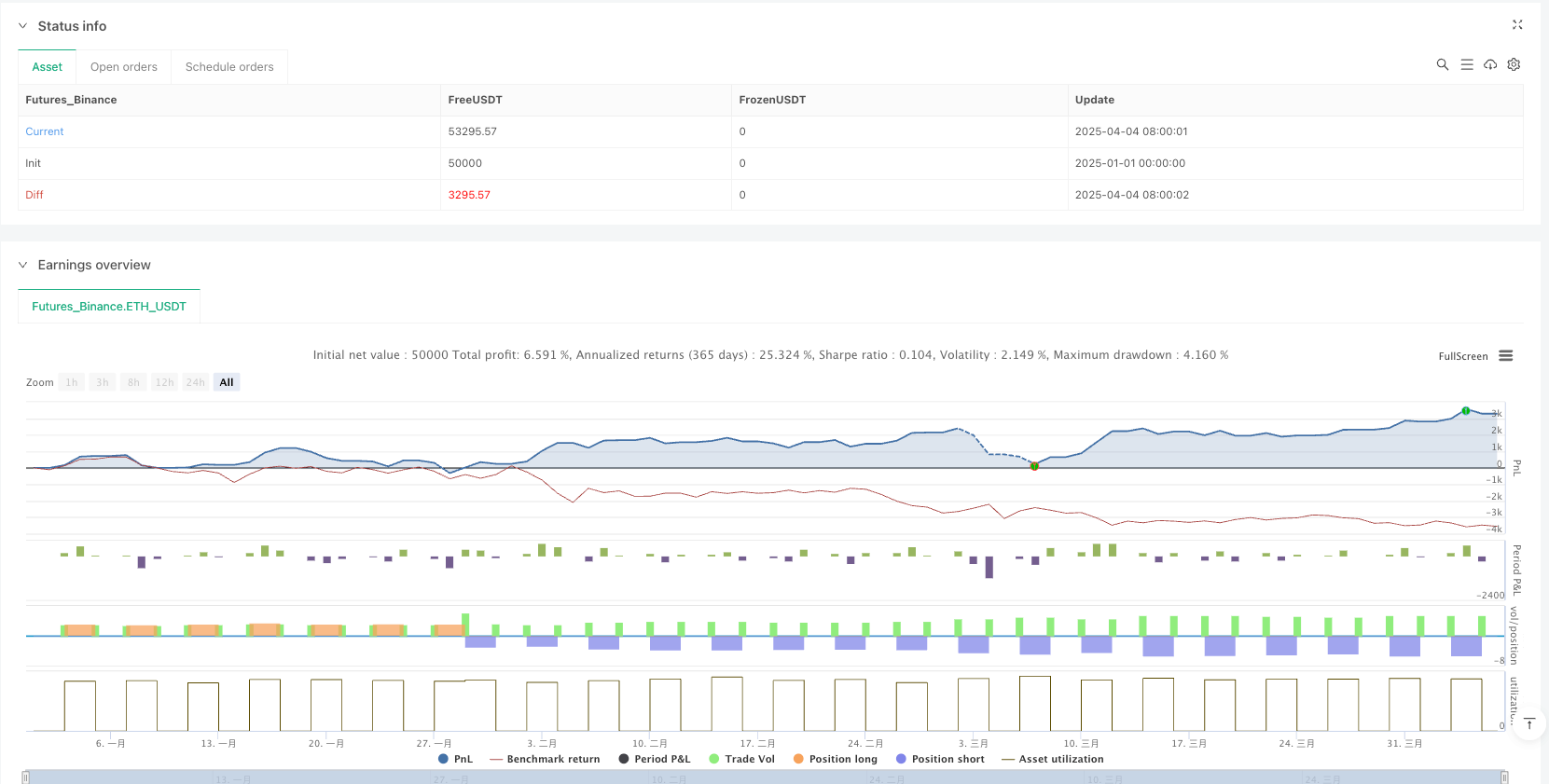

/*backtest

start: 2025-01-01 00:00:00

end: 2025-04-06 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("EMA Crossover (Short Focus with Trailing Stop)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=20)

// Define EMA and SMA lengths

shortEMALength = 13

midEMALength = 25

longEMALength = 33

sma100Length = 100

sma200Length = 200

// Calculate EMAs

shortEMA = ta.ema(close, shortEMALength)

midEMA = ta.ema(close, midEMALength)

longEMA = ta.ema(close, longEMALength)

// Calculate SMAs

sma100 = ta.sma(close, sma100Length)

sma200 = ta.sma(close, sma200Length)

// Plot EMAs and SMAs

plot(shortEMA, title="13 EMA", color=color.blue)

plot(midEMA, title="25 EMA", color=color.red)

plot(longEMA, title="33 EMA", color=color.green)

plot(sma100, title="100 SMA", color=color.purple)

plot(sma200, title="200 SMA", color=color.orange)

// ENTRY CONDITIONS (Fast & Real-Time Execution)

longCondition = shortEMA >= longEMA and strategy.position_size <= 0

shortCondition = shortEMA <= longEMA and strategy.position_size >= 0

// EXIT CONDITIONS

exitLong = shortEMA < longEMA // Exit long when 13 EMA falls below 33 EMA

exitShort = shortEMA > midEMA // Exit short when 13 EMA rises above 25 EMA

// EXECUTE LONG

if (longCondition)

strategy.close("Short", comment="Close Short for Long Entry")

strategy.entry("Long", strategy.long, alert_message="FAST Long Entry: 13 EMA >= 33 EMA")

// EXECUTE SHORT

if (shortCondition)

strategy.close("Long", comment="Close Long for Short Entry")

strategy.entry("Short", strategy.short, alert_message="FAST Short Entry: 13 EMA <= 33 EMA")

// Trailing Stop Parameters

trailOffsetPts = 2

trail = 10

// Trailing Stop for Longs

if (strategy.position_size > 0)

strategy.exit("Long Trail Exit", from_entry="Long", trail_offset=trailOffsetPts, trail_price=high - trail, comment="Long Trailing Stop")

// Trailing Stop for Shorts

if (strategy.position_size < 0)

strategy.exit("Short Trail Exit", from_entry="Short", trail_offset=trailOffsetPts, trail_price=low + trail, comment="Short Trailing Stop")

// EXIT STRATEGY

if (exitLong)

strategy.close("Long", comment="Exit Long: 13 EMA < 33 EMA")

if (exitShort)

strategy.close("Short", comment="Exit Short: 13 EMA > 25 EMA")