Strategy Overview

The Bollinger Bands and ATR Dynamic Trend Following Strategy is an advanced quantitative trading system that combines Bollinger Bands breakout signals with Average True Range (ATR) dynamic adjustment through a “Follow Line” mechanism to identify and track market trends. The strategy notably introduces a Higher Timeframe (HTF) confirmation mechanism that filters trading signals based on the trend direction of a higher timeframe, significantly improving strategy stability and profitability. The system also includes multiple advanced features such as optional trading session filtering, ATR volatility-adaptive adjustment, and real-time reaction to HTF trend changes, forming a comprehensive and flexible quantitative trading solution.

Strategy Principles

The core of this strategy is the “Follow Line” mechanism, which dynamically identifies and adapts to market trends through the following steps:

Bollinger Bands Signal Generation: The system first calculates standard Bollinger Bands, generating a bullish signal (1) when price breaks above the upper band, a bearish signal (-1) when it breaks below the lower band, and a neutral signal (0) when within the bands.

Follow Line Calculation: Based on the Bollinger Bands signal and current price position, the system calculates a temporary Follow Line value. In bullish signal cases, the Follow Line is set to the current bar’s low minus the ATR value (if ATR filter is enabled) or just the low point; in bearish signal cases, it’s set to the current bar’s high plus the ATR value or just the high point.

Follow Line Locking Mechanism: The strategy employs a “ratchet” logic to maintain the Follow Line—in uptrends, the new Follow Line value takes the maximum of the temporary value and the previous value; in downtrends, it takes the minimum. This ensures the Follow Line only moves in the trend direction, forming a dynamic support/resistance level.

Trend Determination: By comparing the current Follow Line with the previous Follow Line value, the system determines trend direction—rising indicates a bullish trend (1), falling indicates a bearish trend (-1), and flat maintains the previous trend.

Multi-Timeframe Analysis: The strategy uses similar logic to calculate Follow Line and trend status on a higher timeframe, which can be selected automatically or manually (e.g., 1min automatically corresponds to 15min HTF).

Entry Conditions: When the trade timeframe trend changes from neutral or bearish to bullish, and the HTF confirms an uptrend, a buy signal is generated; conversely for sell signals.

Exit Conditions: When the trade timeframe trend changes to the opposite direction, or the HTF trend changes to the opposite direction (new in v2.5), the strategy closes existing positions.

Time Filtering: Optionally, trades can be executed only during specific trading sessions (such as regular US stock market hours 0930-1600).

Strategy Advantages

Strong Adaptability: The Follow Line mechanism automatically adjusts according to market volatility, especially when the ATR filter is enabled, providing dynamic adaptation to different volatility environments.

Trend Confirmation Mechanism: The multi-timeframe confirmation feature effectively filters out “noise” trades, only trading when the HTF trend direction is aligned, significantly improving signal quality.

Flexible Configuration Options: The strategy provides rich parameter settings, including Bollinger Bands period and deviation, ATR period, time filtering, and HTF selection methods, which can be optimized for different markets and trading instruments.

High Responsiveness: The HTF trend change reaction mechanism added in v2.5 enables the strategy to respond more quickly to major trend changes, stopping losses promptly and avoiding severe drawdowns.

Visual Assistance: The strategy plots the Follow Line for both trade timeframe and HTF on charts, and can optionally display buy/sell signal labels, making the trading logic intuitive and clear.

Position Management: The pyramiding=0 setting prevents multiple entries in the same direction, avoiding unnecessary risk accumulation.

Strategy Risks

False Breakout Risk: Despite using Bollinger Bands and HTF confirmation, the market may still produce false breakouts, especially in high volatility environments. Solution: Increase Bollinger Bands deviation value or extend confirmation periods, even add additional breakout confirmation mechanisms.

Parameter Sensitivity: Strategy performance is quite sensitive to parameters such as ATR period and Bollinger Bands settings. Solution: Find the most suitable parameter combinations for specific trading instruments through backtesting, avoiding overfitting issues from excessive optimization.

Trend Change Lag: The Follow Line mechanism may respond relatively slowly in the initial stages of a trend, leading to slightly delayed entries. Solution: Consider using smaller ATR multipliers or Bollinger Bands periods to improve response speed, but balance signal quality and responsiveness.

Timeframe Dependency: Improper selection of HTF may result in excessive filtering or signal conflicts. Solution: Recommend using the automatic HTF selection feature, which automatically selects an appropriate higher timeframe based on the current chart timeframe.

Lack of Money Management: The strategy itself does not include a complete money management mechanism. Solution: In practical applications, it should be combined with appropriate stop-loss strategies and position management rules, such as fixed percentage risk or ATR multiple stops.

Strategy Optimization Directions

Enhanced Signal Filtering: Consider introducing other technical indicators, such as Relative Strength Index (RSI) or Stochastic, to confirm entry signals, executing trades only when indicators show overbought/oversold conditions. This will further reduce false breakout signals and improve win rates.

Dynamic Parameter Adjustment: Develop an adaptive parameter adjustment mechanism based on market states, for example, automatically increasing Bollinger Bands deviation in high volatility environments and decreasing it in low volatility environments, allowing the strategy to better adapt to different market conditions.

Optimized HTF Trend Judgment: Improve the HTF trend confirmation algorithm, such as introducing exponential moving average crossovers or other trend indicators rather than relying solely on Follow Line direction, to obtain more stable trend judgments.

Refined Money Management: Integrate a comprehensive money management system that dynamically adjusts position size based on market volatility and account size, setting ATR-based stop-loss levels and profit targets to maximize risk-adjusted returns.

Market State Analysis: Introduce market environment classification to distinguish between trending and ranging markets, and automatically adjust strategy parameters or trading rules based on market state, or even pause trading in market environments unsuitable for this strategy.

Multi-Strategy Integration: Use this strategy as a component, combined with other complementary strategies (such as reversal strategies or breakout confirmation strategies) to form a complete strategy portfolio, balancing performance across different market environments.

Summary

The Bollinger Bands and ATR Dynamic Trend Following Strategy is an elegantly designed quantitative trading system that effectively identifies and tracks market trends by combining Bollinger Bands, ATR, and multi-timeframe analysis. The core advantages of this strategy lie in its adaptability and flexibility, allowing it to dynamically adjust according to market conditions while improving signal quality and win rates through the HTF confirmation mechanism.

Despite some inherent risks, such as parameter sensitivity and false breakout issues, these can be mitigated through appropriate parameter optimization and additional filtering mechanisms. Strategic optimization directions, such as enhanced signal filtering, dynamic parameter adjustment, and refined money management, provide clear paths for further improving strategy performance.

Overall, this strategy is particularly suitable for medium to long-term trend traders, providing a robust framework for identifying trend changes and executing trades under favorable market conditions. With reasonable parameter settings and appropriate risk management, this strategy has the potential to generate stable returns across various market environments.

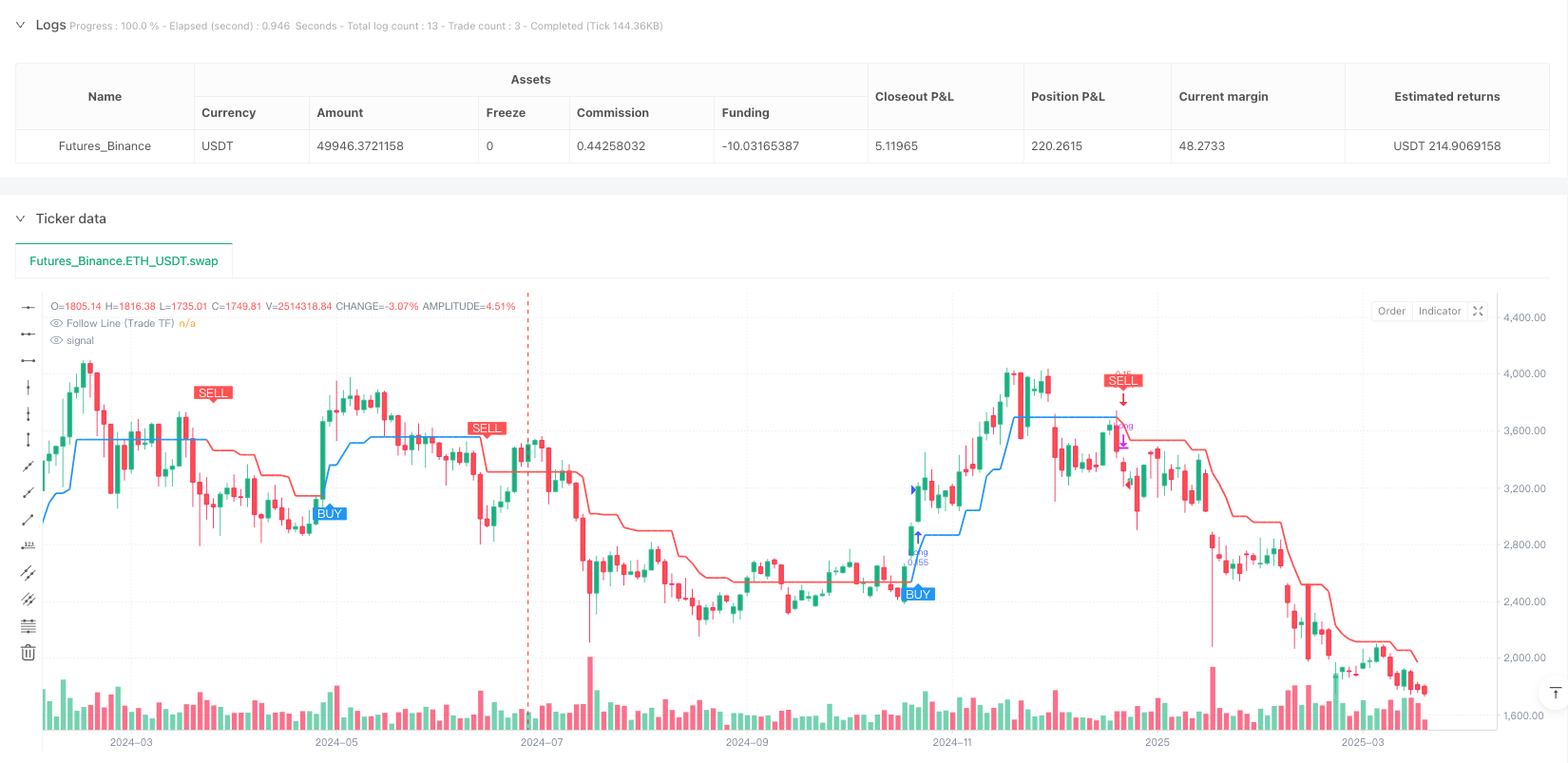

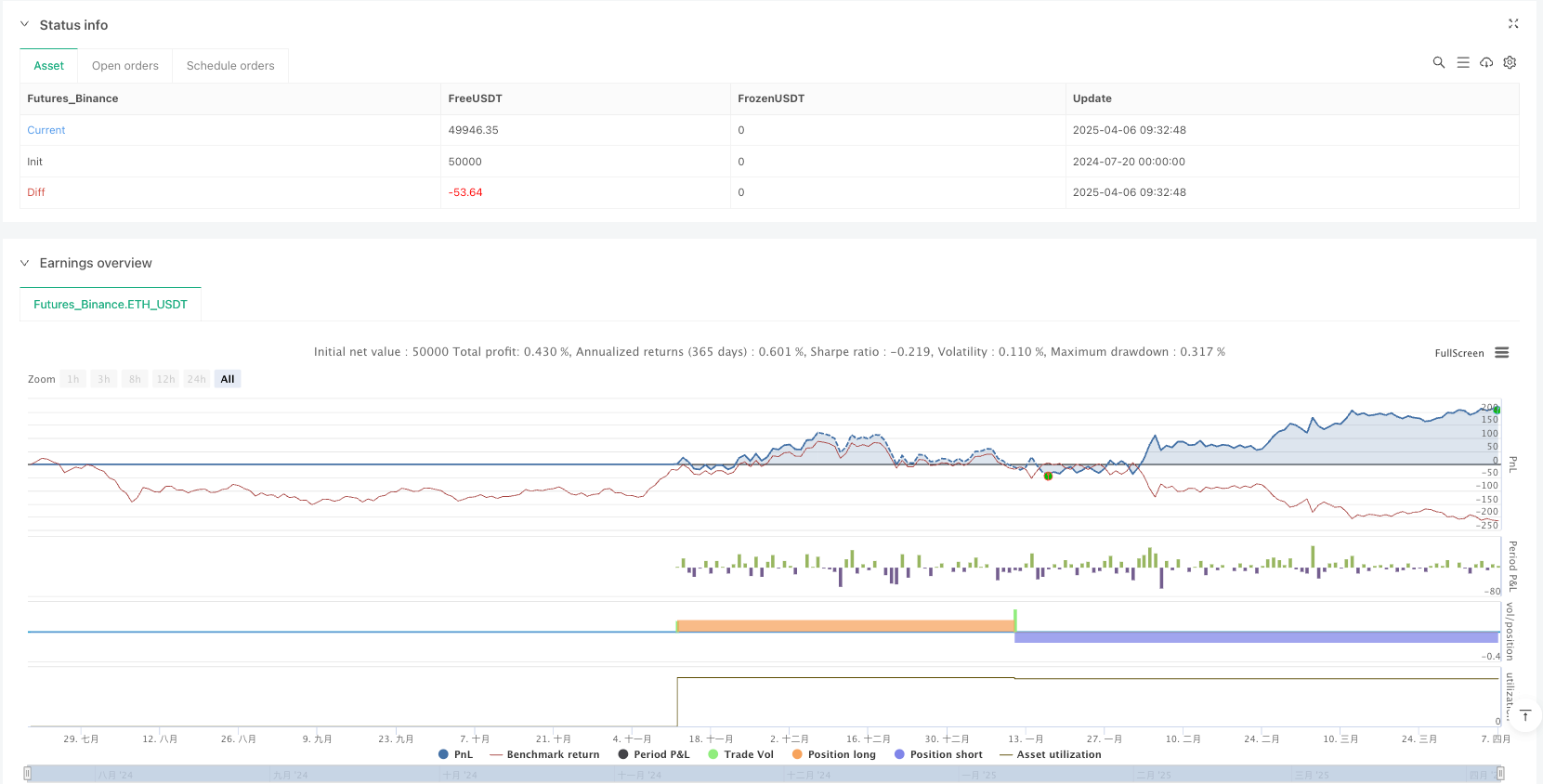

/*backtest

start: 2024-07-20 00:00:00

end: 2025-04-07 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

//@fenyesk

//Optional Working Hours and ATR based TP/SL removed

// Added Optional Higher Timeframe Confirmation with Auto/Manual Selection

// Revised for improved profitability: Trend-following Entries/Exits

// v2.5: React to HTF trend changes as well

strategy('Follow Line Strategy Version 2.5 (React HTF)', overlay = true, process_orders_on_close = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 1, pyramiding = 0) // Version bump overlay=true, process_orders_on_close=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1, pyramiding=0) // Prevent multiple entries in the same direction )

// --- Settings ---

// Indicator Parameters

atrPeriodInput = input.int(defval = 5, title = 'ATR Period', minval = 1, group = 'Indicator Settings')

bbPeriodInput = input.int(defval = 21, title = 'Bollinger Bands Period', minval = 1, group = 'Indicator Settings')

bbDeviationInput = input.float(defval = 1.00, title = 'Bollinger Bands Deviation', minval = 0.1, step = 0.1, group = 'Indicator Settings')

useAtrFilterInput = input.bool(defval = true, title = 'Use ATR for Follow Line Offset?', group = 'Indicator Settings')

showSignalsInput = input.bool(title = 'Show Trade Signals on Chart?', defval = true, group = 'Indicator Settings')

// --- Higher Timeframe Confirmation ---

htf_group = 'Higher Timeframe Confirmation'

useHTFConfirmationInput = input.bool(false, title = 'Enable HTF Confirmation?', group = htf_group)

htfSelectionMethodInput = input.string('Auto', title = 'HTF Selection Method', options = ['Auto', 'Manual'], group = htf_group)

manualHTFInput = input.timeframe('240', title = 'Manual Higher Timeframe', group = htf_group) // Default to 4h if Manual

showHTFLineInput = input.bool(false, title = 'Show HTF Follow Line?', group = htf_group)

// --- Determine Higher Timeframe ---

// Revised function with explicit return variable

f_getAutoHTF() =>

string htfResult = 'D' // Initialize with a default value (e.g., Daily)

if timeframe.isintraday

if timeframe.multiplier <= 1 and timeframe.isminutes

htfResult := '15' // 1min -> 15min

htfResult

else if timeframe.multiplier <= 5 and timeframe.isminutes

htfResult := '240' // 5min -> 4h (240min)

htfResult

else if timeframe.multiplier <= 30 and timeframe.isminutes

htfResult := '240' // 15-30min -> 4h (240min)

htfResult

else if timeframe.multiplier == 60 and timeframe.isminutes // 1 hour

htfResult := 'D' // 1h -> 1 Day

htfResult

else if timeframe.multiplier <= 240 and timeframe.isminutes // Up to 4 hours

htfResult := 'W' // 4h -> 1 Week

htfResult

// else // The default "D" is already set if none of the above match

// htfResult := "D" // Default for other intraday -> 1 Day (already default)

else if timeframe.isdaily // Daily

htfResult := 'M' // 1 Day -> 1 Month

htfResult

else if timeframe.isweekly // Weekly

htfResult := 'M' // 1 Week -> 1 Month

htfResult

else // Monthly or higher (or unknown)

htfResult := '3M' // Default to 3 Months

htfResult

htfResult // Explicitly return the variable value

autoHTF = f_getAutoHTF()

selectedHTF = htfSelectionMethodInput == 'Auto' ? autoHTF : manualHTFInput

// --- Trade Timeframe Calculations ---

// Bollinger Bands calculation

bbMiddle_trade = ta.sma(close, bbPeriodInput)

bbStdDev_trade = ta.stdev(close, bbPeriodInput)

BBUpper_trade = bbMiddle_trade + bbStdDev_trade * bbDeviationInput

BBLower_trade = bbMiddle_trade - bbStdDev_trade * bbDeviationInput

// ATR calculation

atrValue_trade = ta.atr(atrPeriodInput)

// Signal initialization for Trade TF

var float followLine_trade = na

var int bbSignal_trade = 0

var int trend_trade = 0 // Renamed from iTrend

// Determine BB signal based on current close (Trade TF)

if close > BBUpper_trade

bbSignal_trade := 1

bbSignal_trade

else if close < BBLower_trade

bbSignal_trade := -1

bbSignal_trade

else

bbSignal_trade := 0 // Reset signal if price is within bands

bbSignal_trade

// Calculate potential new FollowLine value for the current bar (Trade TF)

float tempFollowLine_trade = na // Explicit type

if bbSignal_trade == 1

tempFollowLine_trade := useAtrFilterInput ? low - atrValue_trade : low

tempFollowLine_trade

else if bbSignal_trade == -1

tempFollowLine_trade := useAtrFilterInput ? high + atrValue_trade : high

tempFollowLine_trade

// Determine the final FollowLine for the current bar, applying the "ratchet" logic (Trade TF)

if bbSignal_trade == 1 // Price closed above upper BB

followLine_trade := na(followLine_trade[1]) ? tempFollowLine_trade : math.max(tempFollowLine_trade, nz(followLine_trade[1], tempFollowLine_trade))

followLine_trade

else if bbSignal_trade == -1 // Price closed below lower BB

followLine_trade := na(followLine_trade[1]) ? tempFollowLine_trade : math.min(tempFollowLine_trade, nz(followLine_trade[1], tempFollowLine_trade))

followLine_trade

else // Price closed within bands, FollowLine continues from previous bar

if not na(followLine_trade[1])

followLine_trade := followLine_trade[1]

followLine_trade

// else followLine_trade remains na if followLine_trade[1] was na

// Trend direction determination (Based on current FollowLine vs previous FollowLine - Trade TF)

if not na(followLine_trade) and not na(followLine_trade[1])

if followLine_trade > followLine_trade[1]

trend_trade := 1

trend_trade

else if followLine_trade < followLine_trade[1]

trend_trade := -1

trend_trade

else

trend_trade := nz(trend_trade[1], 0) // Maintain previous trend if line is flat but valid

trend_trade

else if not na(followLine_trade) and na(followLine_trade[1])

trend_trade := bbSignal_trade == 1 ? 1 : bbSignal_trade == -1 ? -1 : 0 // Use ternary for initial trend

trend_trade

else if na(followLine_trade)

trend_trade := 0 // Reset trend if FollowLine becomes invalid

trend_trade

// --- Higher Timeframe Calculations ---

// Function revised to return only one value (as float) based on parameter

f_calculateHTFData(htf_close, htf_high, htf_low, return_type) =>

// Explicitly type potentially 'na' indicator results

float htf_atrValue = ta.atr(atrPeriodInput)

float htf_bbMiddle = ta.sma(htf_close, bbPeriodInput)

float htf_bbStdDev = ta.stdev(htf_close, bbPeriodInput)

float htf_BBUpper = na

float htf_BBLower = na

// Calculate BBands only if middle/stdev are valid

if not na(htf_bbMiddle) and not na(htf_bbStdDev)

htf_BBUpper := htf_bbMiddle + htf_bbStdDev * bbDeviationInput

htf_BBLower := htf_bbMiddle - htf_bbStdDev * bbDeviationInput

htf_BBLower

// Determine BB signal (HTF) - Default to 0

int htf_bbSignal = 0

// Check if bands are valid before comparing

if not na(htf_BBUpper) and not na(htf_BBLower)

if htf_close > htf_BBUpper

htf_bbSignal := 1

htf_bbSignal

else if htf_close < htf_BBLower

htf_bbSignal := -1

htf_bbSignal

// Calculate potential new FollowLine (HTF)

float htf_tempFollowLine = na // Explicitly typed float

if htf_bbSignal == 1

htf_tempFollowLine := useAtrFilterInput and not na(htf_atrValue) ? htf_low - htf_atrValue : htf_low

htf_tempFollowLine

else if htf_bbSignal == -1

htf_tempFollowLine := useAtrFilterInput and not na(htf_atrValue) ? htf_high + htf_atrValue : htf_high

htf_tempFollowLine

// Maintain FollowLine state using 'var'

var float htf_followLine = na

var int htf_trend = 0

// Determine the final FollowLine (HTF)

if htf_bbSignal == 1

htf_followLine := na(htf_followLine[1]) ? htf_tempFollowLine : math.max(htf_tempFollowLine, nz(htf_followLine[1], htf_tempFollowLine))

htf_followLine

else if htf_bbSignal == -1

htf_followLine := na(htf_followLine[1]) ? htf_tempFollowLine : math.min(htf_tempFollowLine, nz(htf_followLine[1], htf_tempFollowLine))

htf_followLine

else

if not na(htf_followLine[1])

htf_followLine := htf_followLine[1]

htf_followLine

// else htf_followLine remains na if htf_followLine[1] was na (unless reset below)

// Reset FollowLine if it's based on invalid temp line

if na(htf_tempFollowLine) and htf_bbSignal != 0 // If the signal existed but calc failed (e.g., na ATR)

htf_followLine := na // Reset line

htf_followLine

// Determine Trend (HTF)

if not na(htf_followLine) and not na(htf_followLine[1])

if htf_followLine > htf_followLine[1]

htf_trend := 1

htf_trend

else if htf_followLine < htf_followLine[1]

htf_trend := -1

htf_trend

else

htf_trend := nz(htf_trend[1], 0)

htf_trend

else if not na(htf_followLine) and na(htf_followLine[1])

htf_trend := htf_bbSignal == 1 ? 1 : htf_bbSignal == -1 ? -1 : 0

htf_trend

else if na(htf_followLine) // Trend is 0 if line becomes (or is) na

htf_trend := 0

htf_trend

// Return the requested value as float type (or na)

float return_value = na

if return_type == 'line'

return_value := htf_followLine

return_value

else if return_type == 'trend'

return_value := float(htf_trend) // Convert int trend to float for consistent return type

return_value

return_value // Return the single calculated value

// Explicitly declare variables that will receive the security call result

float followLine_htf = na

int trend_htf = 0 // Initialize with a default value (0 for neutral)

// Request HTF data UNCONDITIONALLY

followLine_htf_result = request.security(syminfo.tickerid, selectedHTF, f_calculateHTFData(close, high, low, 'line'), lookahead = barmerge.lookahead_off)

trend_htf_result_float = request.security(syminfo.tickerid, selectedHTF, f_calculateHTFData(close, high, low, 'trend'), lookahead = barmerge.lookahead_off)

// Conditionally assign the results based on whether the HTF feature is enabled

if useHTFConfirmationInput or showHTFLineInput

// Assign results, handling potential 'na' values safely

followLine_htf := followLine_htf_result // Assign float/na directly

trend_htf := na(trend_htf_result_float) ? 0 : int(nz(trend_htf_result_float)) // Convert float result back to int, default to 0 if na

trend_htf

else // If HTF features are disabled, set variables to 'na'

followLine_htf := na

trend_htf := 0 // or na if preferred

trend_htf

// HTF Filter

// Use the potentially 'na' followLine_htf and the guaranteed non-'na' trend_htf

htfConfirmsLong = not useHTFConfirmationInput or useHTFConfirmationInput and trend_htf == 1

htfConfirmsShort = not useHTFConfirmationInput or useHTFConfirmationInput and trend_htf == -1

// --- Entry/Exit Conditions ---

// Buy & Sell Conditions (Based on Trade TF trend crossover)

longCondition_trade = nz(trend_trade[1]) <= 0 and trend_trade == 1

shortCondition_trade = nz(trend_trade[1]) >= 0 and trend_trade == -1

// Combined Entry Conditions with Filters

goLong = htfConfirmsLong and longCondition_trade and strategy.position_size <= 0 // Only enter long if flat or short & HTF confirms

goShort = htfConfirmsShort and shortCondition_trade and strategy.position_size >= 0 // Only enter short if flat or long & HTF confirms

// Exit conditions based on *either* TTF or HTF changing trend against the position

exitLong = trend_trade == -1 or trend_htf == -1 // TTF to short OR HTF to short

exitShort = trend_trade == 1 or trend_htf == 1 // TTF to long OR HTF to long

// --- Strategy Execution ---

if goLong

strategy.close('Short', comment = 'Close Short for Long')

strategy.entry('Long', strategy.long, comment = 'Enter Long')

if goShort

strategy.close('Long', comment = 'Close Long for Short')

strategy.entry('Short', strategy.short, comment = 'Enter Short')

if exitLong

strategy.close('Long', comment = 'Exit Long')

if exitShort

strategy.close('Short', comment = 'Exit Short')

// --- Alerts ---

// Alerts trigger on the same bar as the entry condition, respecting all filters

// NOTE: Removed dynamic HTF from message as alertcondition requires const string

alertcondition(goLong, title = 'FL Buy Signal', message = 'Follow Line Buy Signal - {{ticker}} {{interval}}')

alertcondition(goShort, title = 'FL Sell Signal', message = 'Follow Line Sell Signal - {{ticker}} {{interval}}')

alertcondition(goLong or goShort, title = 'FL Signal', message = 'Follow Line Signal - {{ticker}} {{interval}}')

// --- Plotting ---

// Plot the Trade Timeframe Follow Line

lineColor_trade = trend_trade > 0 ? color.new(color.blue, 0) : trend_trade < 0 ? color.new(color.red, 0) : color.new(color.gray, 0)

plot(followLine_trade, color = lineColor_trade, linewidth = 2, title = 'Follow Line (Trade TF)')

// Plot the Higher Timeframe Follow Line (optional)

// Use the potentially 'na' followLine_htf and the guaranteed non-'na' trend_htf for coloring

lineColor_htf = trend_htf > 0 ? color.new(color.aqua, 0) : trend_htf < 0 ? color.new(color.orange, 0) : color.new(color.gray, 70)

plot(showHTFLineInput and useHTFConfirmationInput ? followLine_htf : na, color = lineColor_htf, linewidth = 2, style = plot.style_circles, title = 'Follow Line (HTF)', offset = 0)

// Plot shapes on the bar the trade signal occurs (based on trade TF condition), placing them AT the calculated Trade TF price level.

// Use the original trade long/short conditions for plotting shapes for clarity, before plots

plotshape(longCondition_trade and showSignalsInput and not na(followLine_trade) and not na(atrValue_trade) ? followLine_trade - atrValue_trade : na, text = 'BUY', style = shape.labelup, location = location.absolute, color = color.new(color.blue, 0), textcolor = color.new(color.white, 0), offset = 0, size = size.auto)

plotshape(shortCondition_trade and showSignalsInput and not na(followLine_trade) and not na(atrValue_trade) ? followLine_trade + atrValue_trade : na, text = 'SELL', style = shape.labeldown, location = location.absolute, color = color.new(color.red, 0), textcolor = color.new(color.white, 0), offset = 0, size = size.auto)

// Plot BBands for reference if desired

// plot(BBUpper_trade, "Upper BB", color=color.gray)

// plot(BBLower_trade, "Lower BB", color=color.gray)