Strategy Overview

The Multi-Moving Average Trend Filter Crossover Quantitative Trading Strategy is a comprehensive trend-following system that cleverly combines multiple moving averages and Volume Weighted Average Price (VWAP) to capture medium to long-term market trend changes. The strategy primarily relies on Exponential Moving Average (EMA) crossover signals as the main entry trigger conditions, while utilizing VWAP and Simple Moving Average (SMA) as filters to reduce false signals and confirm the broader market trend direction. Additionally, the strategy incorporates fast EMA crossovers as a sensitive exit mechanism, allowing the system to quickly close positions during market reversals while avoiding premature exits during strong trends. The strategy also features a direct reversal mechanism, allowing switching from long to short, or from short to long when market conditions change, enhancing the strategy’s adaptability in volatile markets.

Strategy Principles

The core principle of this strategy is based on trend identification and confirmation across multiple timeframes. Specifically, the strategy operates as follows:

Trend Identification: Uses 17-period and 31-period EMA crossovers to detect medium-term momentum shifts. When the shorter-term EMA crosses above the longer-term EMA, it indicates a potential uptrend; when the shorter-term EMA crosses below the longer-term EMA, it indicates a potential downtrend.

Trend Confirmation: Employs VWAP and 69-period SMA as additional filtering conditions to confirm the trend. This requires the price to be above these indicators (for long signals) or below them (for short signals), reducing false signals in ranging or weak trend markets.

Entry Logic:

- Long Entry: When the 17-period EMA crosses above the 31-period EMA, and the price is simultaneously above both VWAP and the 69-period SMA, the system opens a long position.

- Short Entry: When the 17-period EMA crosses below the 31-period EMA, and the price is simultaneously below both VWAP and the 69-period SMA, the system opens a short position.

Exit Mechanism: The strategy uses more sensitive short-term EMAs (8-period and 9-period) crossovers as exit signals, allowing the system to respond quickly to short-term market reversals.

- Long Exit: When the 8-period EMA crosses below the 9-period EMA, and there is no short entry signal, the long position is closed.

- Short Exit: When the 8-period EMA crosses above the 9-period EMA, and there is no long entry signal, the short position is closed.

Reversal Mechanism: The strategy allows for direct position reversals. If a long position is currently held but a short entry condition is triggered, the system will first close the long position and then open a short position (and vice versa). This mechanism enhances the strategy’s flexibility in rapidly changing markets.

Code Implementation: The strategy uses boolean variables to track the current position status (

long_activeandshort_active) and executes appropriate trading operations when conditions are met. Additionally, the strategy visualizes various indicators and crossover points to help traders monitor market conditions.

Strategy Advantages

Multi-Layer Filtering System: Combines EMA crossovers, VWAP, and SMA filters to build a multi-layered confirmation system, significantly reducing false signals and improving the strategy’s stability and reliability.

Flexible Reversal Mechanism: The strategy can directly switch from long to short (or from short to long) based on market conditions, without waiting for an independent exit signal before re-entry. This design allows for faster position adjustment during trend reversals, reducing potential losses.

Separate Entry and Exit Logic: Uses different periods of EMA pairs for entry and exit signals, optimizing trade timing. Longer period EMAs (17 and 31) are used to capture medium-term trend changes for entries, while shorter period EMAs (8 and 9) provide sensitive exits, offering fast risk control response while maintaining trend-following capabilities.

Comprehensive Trend Confirmation: By combining the relative position of price to VWAP and SMA, the strategy can confirm trends across multiple dimensions, helping reduce erroneous trades during market ranging or weak trends.

Visual Assistance: The strategy provides rich visual indicators, including various EMAs, SMA, VWAP, and markers for key crossover points, allowing traders to intuitively understand and monitor market conditions and strategy signals.

Parameter Adjustability: The strategy’s parameters (such as EMA and SMA periods) can be customized through input fields, allowing traders to optimize adjustments based on different market environments and trading instruments.

Strategy Risks

Lag Risk: Due to the use of multiple moving averages and filtering conditions, entry signals may be relatively delayed, especially in rapidly changing markets. This may miss the initial phase of trends, reducing potential returns. The solution is to adjust EMA and SMA periods based on the volatility characteristics of specific markets, using shorter periods for faster markets.

Multiple Condition Restrictions: The strategy’s multiple entry conditions (EMA crossover plus price position relative to VWAP and SMA) may reduce trading frequency, causing missed potential favorable trading opportunities. Consider relaxing certain conditions in specific market environments or developing alternative rules to increase trading opportunities.

Lack of Explicit Stop-Loss Mechanism: The strategy relies solely on EMA crossovers as exit signals without setting explicit stop-loss or take-profit levels. In extreme market conditions, this may lead to larger losses. It is recommended to implement additional risk management measures, such as ATR-based dynamic stop-losses or fixed percentage stop-losses.

Parameter Sensitivity: Strategy performance is highly dependent on the selected EMA and SMA periods. Default parameters (17, 31, 8, 9, 69) may not be suitable for all assets or timeframes. The solution is to adjust parameters through backtesting optimization for specific trading instruments and market conditions, or implement adaptive parameter adjustment mechanisms.

Market Regime Change Risk: The strategy may perform poorly when markets transition from trending to ranging or vice versa. The solution is to add market environment detection mechanisms, such as volatility filters or trend strength indicators, to dynamically adjust strategy parameters or trading rules in different market environments.

Trading Cost Impact: Frequent reversal trades may increase trading costs, especially in low-volatility markets. It is advisable to consider trading costs in the strategy and potentially limit overly frequent reversal trades under certain conditions.

Strategy Optimization Directions

Adaptive Parameter Adjustment: Implement an adaptive adjustment mechanism for EMA and SMA periods, dynamically adjusting parameters based on market volatility or trend strength. For example, use shorter periods in higher volatility markets and longer periods in lower volatility markets. This allows the strategy to better adapt to different market environments, reducing lag and improving response speed.

Add Stop-Loss and Take-Profit Mechanisms: Introduce ATR (Average True Range)-based dynamic stop-losses or fixed percentage stop-losses into the strategy, along with corresponding take-profit settings. This helps control maximum risk per trade, preventing excessive losses under extreme market conditions while locking in profits during trends.

Add Volume Filters: Incorporate volume analysis into the strategy, executing trades only when volume is sufficient or displays specific patterns. This helps improve signal quality and reduce the impact of low liquidity leading to slippage and false breakouts.

Integrate Market Environment Analysis: Add market environment recognition mechanisms, such as volatility indicators, trend strength indicators, or cyclical analysis. Apply different trading rules or parameter settings in different market environments (trending, ranging, high volatility, low volatility) to improve the strategy’s adaptability.

Optimize Reversal Logic: Improve the current direct reversal mechanism, potentially introducing additional confirmation conditions or delayed reversal execution to reduce overly frequent reversal trades in ranging markets. For example, require reversal signal strength to exceed a threshold or observe additional market characteristics before reversing.

Partial Position Management: Implement more complex position management, such as phased entries/exits or adjusting position size based on signal strength. This reduces the risk of all-in trading while maintaining full exposure to strong trends.

Time Filtering: Add time filtering functionality to avoid trading during specific time periods when market volatility is particularly low or high. This is especially valuable for 24⁄7 markets like cryptocurrencies, avoiding trades during periods of insufficient liquidity or abnormal volatility.

Multi-Timeframe Analysis: Integrate multi-timeframe analysis, using trend information from longer time periods to filter or enhance signals in the current timeframe. This helps align trades with larger market trends, reducing the risk of counter-trend trading.

Summary

The Multi-Moving Average Trend Filter Crossover Quantitative Trading Strategy is a well-designed trend-following system that provides a trading framework capable of both capturing trends and managing risk by combining multiple moving averages and VWAP. The core strengths of the strategy lie in its multi-layer filtering system and flexible reversal mechanism, allowing it to effectively adapt to different market environments.

However, the strategy also faces risks such as lag, parameter sensitivity, and lack of explicit stop-loss mechanisms. By implementing the suggested optimization measures, such as adaptive parameter adjustment, adding stop-loss mechanisms, integrating market environment analysis, and improving position management, the strategy’s robustness and performance can be significantly enhanced.

Overall, this is a trading strategy with a solid foundation, particularly suitable for medium to long-term trend following. For traders seeking to capture clear trends while reducing the impact of false signals, this strategy provides a good starting point. Through appropriate parameter adjustments and optimizations targeted at specific markets and personal risk preferences, this strategy has the potential to become a valuable asset in a trader’s toolkit.

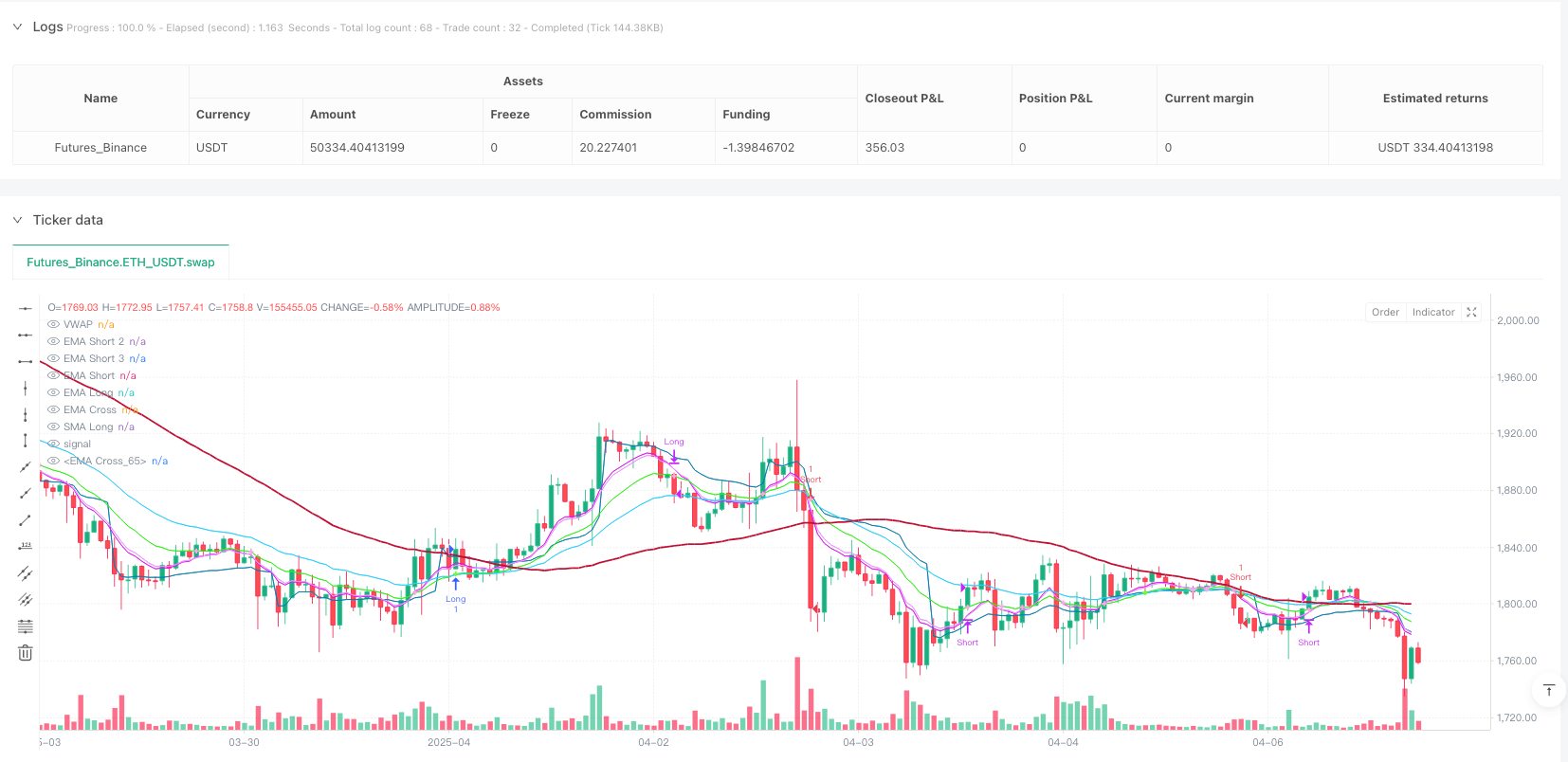

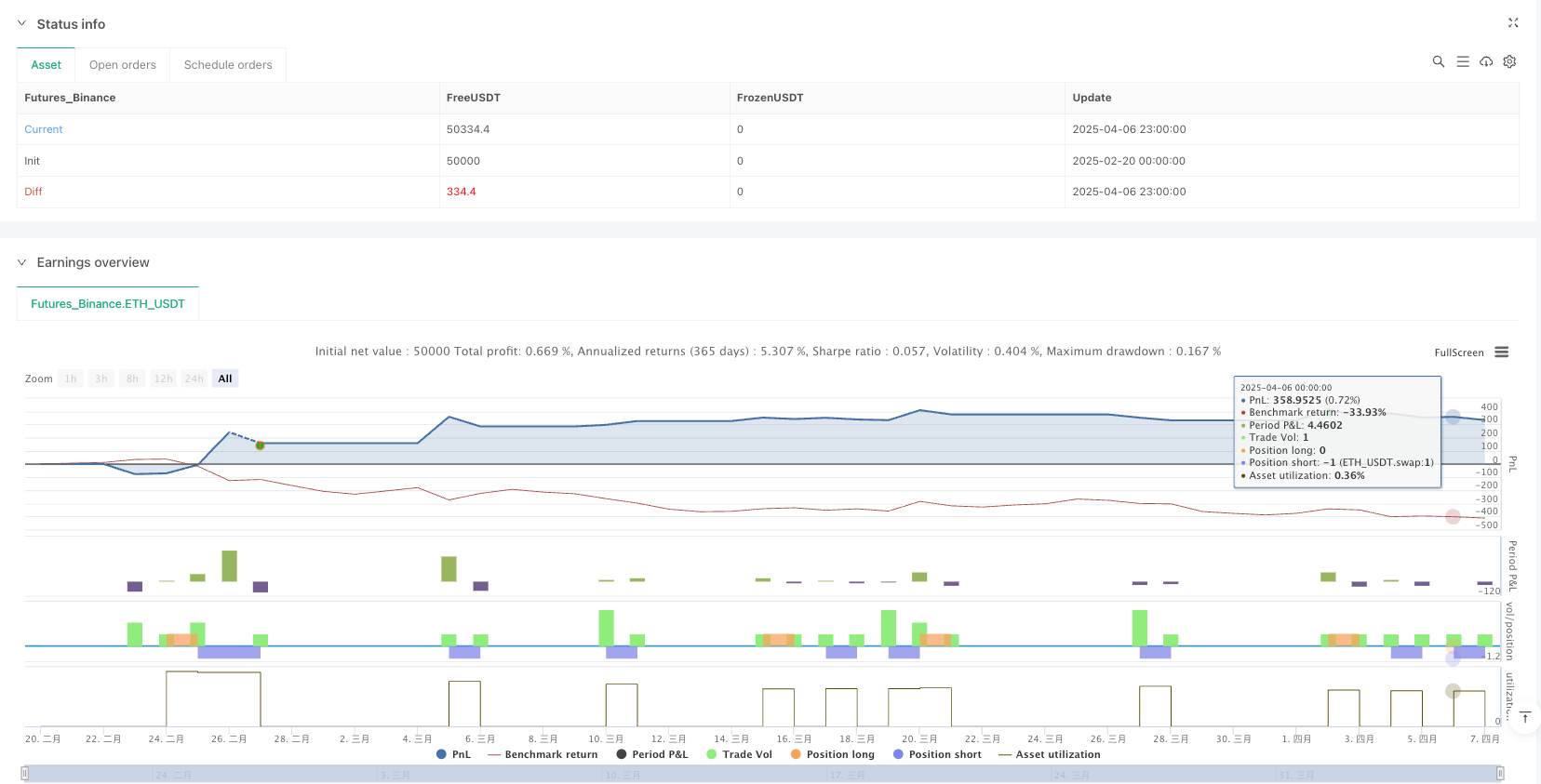

/*backtest

start: 2025-02-20 00:00:00

end: 2025-04-07 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("EMA+SMA+VWAP Trading Strategy ", overlay=true)

// Inputs

emaShortPeriod = input.int(17, title="EMA Entry Short")

emaLongPeriod = input.int(31, title="EMA Entry Long")

smaPeriod = input.int(69, title="SMA Longest")

emaShortPeriod2 = input.int(8, title="EMA Exit Small")

emaShortPeriod3 = input.int(9, title="EMA Exit Long")

// Calculate Indicators

emaShort = ta.ema(close, emaShortPeriod)

emaShort2 = ta.ema(close, emaShortPeriod2)

emaShort3 = ta.ema(close, emaShortPeriod3)

emaLong = ta.ema(close, emaLongPeriod)

vwap = ta.vwap(hlc3)

smalong = ta.sma(close, smaPeriod)

// Define Conditions

long_condition = ta.crossover(emaShort, emaLong) and close > vwap and close > smalong

short_condition = ta.crossunder(emaShort, emaLong) and close < vwap and close < smalong

long_exit_condition = ta.crossunder(emaShort2, emaShort3)

short_exit_condition = ta.crossover(emaShort2, emaShort3)

// Position Tracking

var bool long_active = false

var bool short_active = false

// Execute Trades with Reversal Logic

// Long Entry: Open long and close short if active

if long_condition

if short_active

strategy.close("Short") // Close short (buy to cover)

short_active := false

if not long_active

strategy.entry("Long", strategy.long) // Open long

long_active := true

// Short Entry: Open short and close long if active

if short_condition

if long_active

strategy.close("Long") // Close long (sell)

long_active := false

if not short_active

strategy.entry("Short", strategy.short) // Open short

short_active := true

// Normal Exits (no reversal)

if long_active and long_exit_condition and not short_condition

strategy.close("Long") // Sell to close long

long_active := false

if short_active and short_exit_condition and not long_condition

strategy.close("Short") // Buy to close short

short_active := false

// Plot Indicators

plot(emaShort, color=color.rgb(48, 240, 23), title="EMA Short")

plot(emaLong, color=color.rgb(39, 209, 252), title="EMA Long")

plot(vwap, color=color.rgb(8, 128, 175), title="VWAP")

plot(smalong, color=color.rgb(194, 12, 51), linewidth=2, title="SMA Long")

plot(ta.cross(emaShort, emaLong) ? emaShort : na, style=plot.style_cross, color=color.rgb(126, 248, 45), linewidth=3, title="EMA Cross")

plot(emaShort2, color=color.rgb(222, 23, 240), title="EMA Short 2")

plot(emaShort3, color=color.rgb(234, 148, 255), title="EMA Short 3")

plot(ta.cross(emaShort2, emaShort3) ? emaShort : na, style=plot.style_cross, color=color.rgb(250, 170, 230), linewidth=3, title="EMA Cross")