Overview

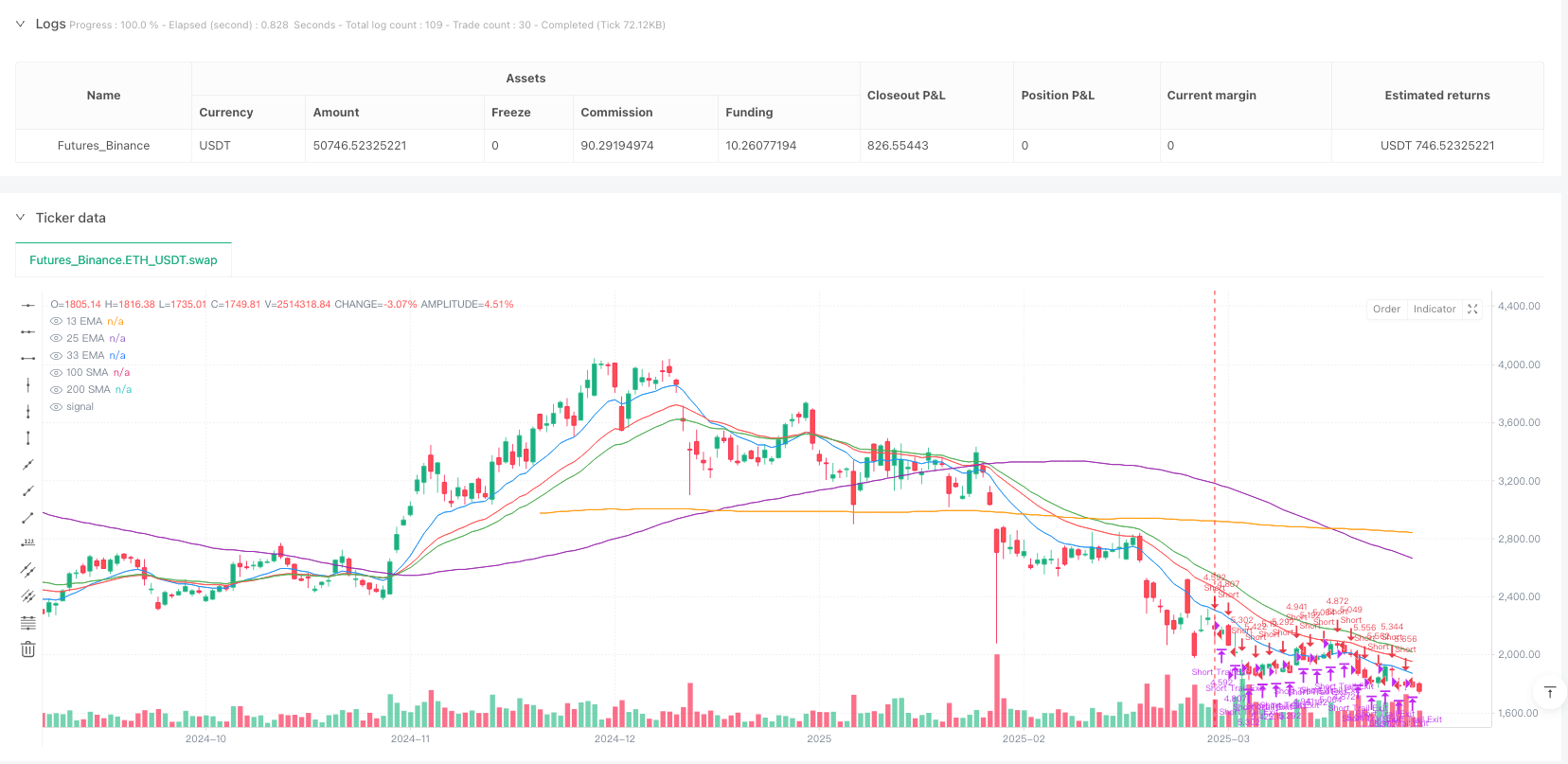

This strategy is a trend-following trading system based on Exponential Moving Average (EMA) crossover signals, combined with a dynamic trailing stop mechanism to enhance profitability and risk management. The core logic utilizes the crossover relationship between the short-term 13-period EMA and the long-term 33-period EMA to determine market trend direction, while also using the crossover between the 13-period EMA and the 25-period EMA as an exit signal for short positions. The strategy also integrates slippage simulation, prevention of duplicate exit mechanisms, and dynamic trailing stops, making trade execution more closely resemble real market conditions. This strategy is particularly suitable for 4-hour or daily timeframes, effectively capturing medium to long-term market trend transition points, avoiding short-term market noise interference, helping traders enter at the early stages of trend formation and exit promptly when trends reverse.

Strategy Principles

The core principle of this strategy is to identify market trend changes using crossover relationships between EMAs of different periods. Specifically:

Entry Signal Generation:

- Long Entry: When the 13-period EMA crosses above the 33-period EMA, indicating short-term momentum exceeds long-term momentum, suggesting the market may be entering an uptrend

- Short Entry: When the 13-period EMA crosses below the 33-period EMA, indicating short-term momentum is weaker than long-term momentum, suggesting the market may be entering a downtrend

Exit Signal Generation:

- Long Exit: When the 13-period EMA falls below the 33-period EMA

- Short Exit: When the 13-period EMA crosses above the 25-period EMA (note that short positions use a different EMA combination)

Dynamic Trailing Stop:

- Long trailing stop is set at the current bar’s high minus a fixed number of points (10)

- Short trailing stop is set at the current bar’s low plus a fixed number of points (10)

- The trailing stop offset is set at 2 points, locking in partial profits as the market moves favorably

Prevention of Overlapping Exit Mechanism:

- Uses an isExiting boolean flag to track the exit status of each bar

- Ensures only one exit operation is executed per bar, avoiding overlapping exit instructions

- Resets the exit flag after each bar is confirmed

Slippage Simulation:

- The strategy incorporates 5 points of slippage, making backtest results closer to real trading environments

Additionally, the strategy calculates and displays 100-period and 200-period Simple Moving Averages (SMA) as additional market trend reference indicators, although these indicators are not directly used for trade signal generation. The strategy’s money management adopts 20% of account equity as the default position size for each trade, implementing simple position control.

Strategy Advantages

Through in-depth analysis of the strategy’s code implementation, the following significant advantages can be summarized:

Strong Trend Capture Capability: By identifying trend turning points through EMA crossovers, the strategy can establish positions in the early stages of trends, maximizing trend-following returns. EMAs are more sensitive to price changes than SMAs, allowing earlier detection of market momentum changes.

Comprehensive Risk Management: The strategy integrates a dynamic trailing stop mechanism that automatically adjusts stop-loss prices as prices move favorably, both protecting realized profits and giving prices sufficient room to fluctuate.

Clear and Rigorous Execution Logic: Using the isExiting flag to control exit logic prevents multiple exit signals from being generated on the same bar, reducing unnecessary trading costs and system complexity.

Strong Market Adaptability: The strategy is applicable to both long and short markets, allowing flexible switching of trading directions in different market environments, fully utilizing two-way trading opportunities.

Realistic Trading Environment Simulation: By introducing slippage simulation (5 points), the strategy’s backtest results more closely resemble real trading environments, avoiding over-optimization and curve-fitting risks.

Simple and Easy to Execute: The strategy rules are clear, and the signal generation mechanism is simple and intuitive, facilitating practical operation execution and reducing the complexity of strategy implementation.

Flexible Stop-Loss Mechanism: Unlike traditional fixed stop-losses, the dynamic trailing stop mechanism can protect capital safety while giving trends sufficient development space, improving the strategy’s risk-reward ratio.

Strategy Risks

Despite the strategy’s many advantages, there are still the following risk points that need attention:

Lagging Nature of Crossover Signals: EMA crossover signals are inherently lagging indicators, which may lead to less than ideal entry and exit points, especially in rapidly fluctuating markets, potentially missing optimal entry points or exiting only after trend reversals.

Poor Performance in Oscillating Markets: In sideways or oscillating markets, EMA crossover signals appear frequently, potentially leading to frequent trading and “false breakouts,” resulting in consecutive losses.

Sensitivity of Trailing Stop Parameters: The fixed trailing stop points (10 points) and offset (2 points) may not be suitable for all market environments and instruments. In high-volatility markets, they might trigger stops too early, while in low-volatility markets, the stop may be too wide.

Reliance on a Single Technical Indicator: The strategy primarily relies on EMA crossover signals, lacking other confirmation indicators to assist judgment, increasing the risk of misjudgment.

Limitations of Fixed Position Management: The strategy uses a fixed equity percentage (20%) as position size, without dynamically adjusting positions based on market volatility or signal strength, potentially failing to achieve optimal capital management.

Potential methods to address these risks include: - Adding additional filtering conditions (such as volume confirmation, volatility filters, etc.) to reduce false signals - Dynamically adjusting trailing stop parameters according to different market environments - Introducing an adaptive position management system, adjusting position size based on signal strength and market volatility - Combining other technical indicators or price patterns as confirmation mechanisms for crossover signals

Strategy Optimization Directions

Based on in-depth analysis of the strategy code, here are several feasible optimization directions:

Introduce Market Environment Filtering Mechanism:

- Add ADX (Average Directional Index) indicator to judge market trend strength, only executing trades when ADX is above a specific threshold

- Use volatility indicators (such as ATR) to identify high and low volatility environments, adjusting strategy parameters accordingly

- Integrate price and 100⁄200-period SMA relative position judgments, only going long when price is above long-term moving averages, and short when below

Optimize Trailing Stop Parameters:

- Change the fixed trailing stop points (10) to dynamic values based on ATR, making the stop-loss adaptive to market volatility

- Set different trailing stop parameters for long and short positions, adapting to the characteristics of different market directions (rising and falling markets typically exhibit different volatility characteristics)

Enhance Signal Confirmation Mechanism:

- Add volume confirmation conditions, requiring volume to increase synchronously with EMA crossovers, improving signal reliability

- Combine momentum indicators such as RSI or MACD as auxiliary confirmation, reducing false signals

- Consider using price pattern recognition (such as support/resistance breakouts) as additional confirmation conditions

Improve Capital Management Strategy:

- Implement volatility-based position adjustment, increasing positions in low volatility environments and decreasing in high volatility environments

- Introduce position allocation based on signal strength, allocating larger positions when crossover signals are more definitive

- Implement pyramid-style position building, adding positions in batches as trends develop

Optimize Timeframe Selection:

- Develop multi-timeframe analysis functionality, combining trend directions from larger timeframes as filtering conditions

- Add trading time filters to the strategy, avoiding low liquidity or high volatility periods

Parameter Adaptive Mechanism:

- Develop an adaptive adjustment algorithm for EMA periods, dynamically adjusting short, medium, and long-term EMA periods based on market volatility characteristics

- Implement parameter switching based on market states, automatically selecting optimal parameter combinations in different market environments

The core objective of these optimization directions is to improve the strategy’s robustness and adaptability, reduce false signals, optimize capital management, and enable the strategy to maintain stable performance in different market environments. In particular, changing fixed parameters (such as EMA periods and trailing stop points) to adaptive parameters can significantly enhance the strategy’s performance under different market conditions.

Summary

The Advanced Trend Capture EMA Crossover Strategy with Dynamic Trailing Stop is a clearly structured, rigorously executed trend-following system. By identifying market trend change points through the crossover relationship between the 13-period EMA and the 33-period EMA (for longs) and 25-period EMA (for shorts), combined with a dynamic trailing stop mechanism for risk management, this strategy can capture market trends while protecting trading capital.

The main advantages of the strategy lie in its simple and intuitive signal generation mechanism, comprehensive risk management, and adaptability to two-way markets. However, as a system primarily relying on lagging technical indicators, the strategy may perform poorly in oscillating markets and faces the inherent limitations of EMA crossover signal lag.

By introducing market environment filtering mechanisms, optimizing trailing stop parameters, enhancing signal confirmation mechanisms, improving capital management strategies, and developing parameter adaptive algorithms, the strategy’s performance can be significantly improved. Particularly promising optimization directions include adjusting trailing stop parameters in combination with volatility indicators, integrating multiple technical indicators to confirm trading signals, and implementing dynamic parameter adjustments based on market states.

For traders, this strategy is best applied to medium and long-term trading with obvious trend characteristics, especially when operating on 4-hour or daily timeframes with major trading instruments. When applying in live trading, it is recommended to combine fundamental analysis and broader market scenario understanding to further enhance the strategy’s effectiveness and robustness.

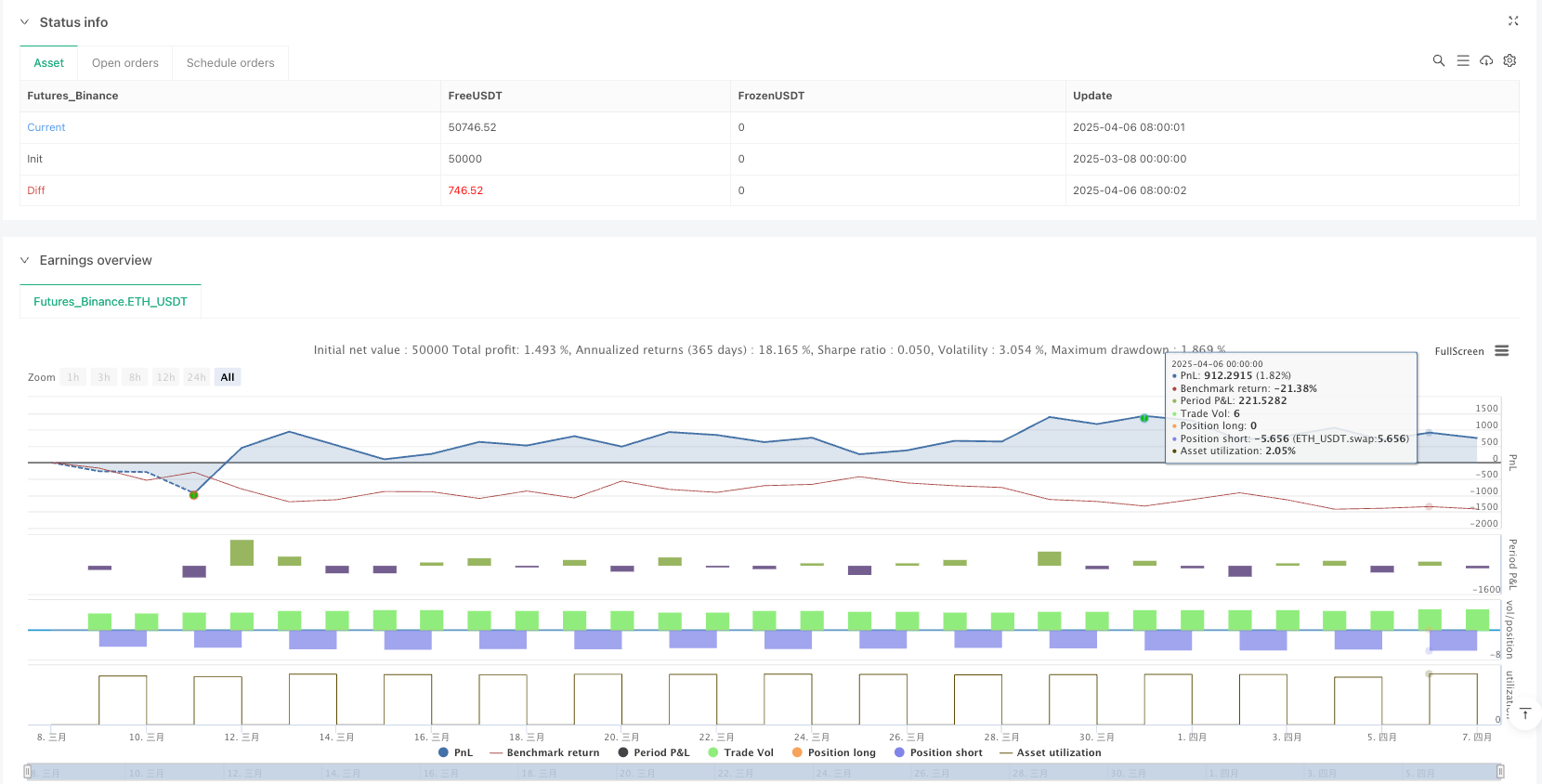

/*backtest

start: 2025-03-08 00:00:00

end: 2025-04-07 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("EMA Crossover (New Trailing Stop)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=20, slippage=5)

// Define EMA and SMA lengths

shortEMALength = 13

midEMALength = 25

longEMALength = 33

sma100Length = 100

sma200Length = 200

// Calculate EMAs

shortEMA = ta.ema(close, shortEMALength)

midEMA = ta.ema(close, midEMALength)

longEMA = ta.ema(close, longEMALength)

// Calculate SMAs

sma100 = ta.sma(close, sma100Length)

sma200 = ta.sma(close, sma200Length)

// Plot EMAs and SMAs

plot(shortEMA, title="13 EMA", color=color.blue)

plot(midEMA, title="25 EMA", color=color.red)

plot(longEMA, title="33 EMA", color=color.green)

plot(sma100, title="100 SMA", color=color.purple)

plot(sma200, title="200 SMA", color=color.orange)

// ENTRY CONDITIONS

longCondition = shortEMA >= longEMA and strategy.position_size <= 0

shortCondition = shortEMA <= longEMA and strategy.position_size >= 0

// EXIT CONDITIONS

exitLong = shortEMA < longEMA // Exit long when 13 EMA falls below 33 EMA

exitShort = shortEMA > midEMA // Exit short when 13 EMA rises above 25 EMA

// Flag to track if an exit has been processed

var bool isExiting = false

// EXECUTE LONG

if (longCondition and not isExiting)

strategy.close("Short", comment="Close Short for Long Entry")

strategy.entry("Long", strategy.long, alert_message="FAST Long Entry: 13 EMA >= 33 EMA")

// EXECUTE SHORT

if (shortCondition and not isExiting)

strategy.close("Long", comment="Close Long for Short Entry")

strategy.entry("Short", strategy.short, alert_message="FAST Short Entry: 13 EMA <= 33 EMA")

// Trailing Stop Parameters

trailOffsetPts = 2

trail = 10

// Trailing Stop for Longs

if (strategy.position_size > 0 and not isExiting)

strategy.exit("Long Trail Exit", from_entry="Long", trail_offset=trailOffsetPts, trail_price=high - trail, comment="Long Trailing Stop")

isExiting := true

// Trailing Stop for Shorts

if (strategy.position_size < 0 and not isExiting)

strategy.exit("Short Trail Exit", from_entry="Short", trail_offset=trailOffsetPts, trail_price=low + trail, comment="Short Trailing Stop")

isExiting := true

// EXIT STRATEGY

if (exitLong and not isExiting)

strategy.close("Long", comment="Exit Long: 13 EMA < 33 EMA")

isExiting := true

if (exitShort and not isExiting)

strategy.close("Short", comment="Exit Short: 13 EMA > 25 EMA")

isExiting := true

// Reset the exit flag at the end of each bar

if (barstate.isconfirmed)

isExiting := false