Multi-Indicator Dynamic Reversal Trading System: RSI and VWAP Synergistic Reversal Strategy

RSI VWAP ATR 动态反转 价格行为确认 冷却期 尾随止损 Relative Strength Index Average True Range Dynamic Reversal Price Action Confirmation Cooldown Period Trailing Stop

Overview

The RSI and VWAP Synergistic Reversal Strategy is an intelligent trading system that combines the Relative Strength Index (RSI), Volume Weighted Average Price (VWAP), and price action confirmation. This strategy identifies the relationship between market overbought/oversold conditions and VWAP position, incorporating price reversal confirmation signals to execute long and short trades when market conditions meet specific criteria. The strategy also includes risk management mechanisms such as trading cooldown periods, dynamic stop-loss/take-profit levels, and trailing stops, designed to capture short-term market reversal opportunities while controlling risk.

Strategy Principles

The core principles of this strategy are based on the synergistic action of several key components:

RSI Overbought/Oversold Identification: Using the Relative Strength Index (RSI) to identify market overbought (RSI>72) and oversold (RSI<28) conditions. When RSI crosses down from the overbought zone or crosses up from the oversold zone, it may indicate an impending market reversal.

VWAP Reference Line: Volume Weighted Average Price (VWAP) serves as an important price reference line to confirm whether the price is in a reasonable zone. The relative position of price to VWAP is a key factor in determining the quality of potential reversal signals.

Price Action Confirmation:

- Short condition: Current close lower than previous close (downtrend) but still above VWAP, indicating price may be starting to fall from a high position

- Long condition: Current close higher than previous close (uptrend) but still below VWAP, indicating price may be starting to bounce from a low position

Volume Filter: Ensures trade signals occur in sufficiently active market environments (volume>500), avoiding signals in conditions of insufficient liquidity.

Cooldown Mechanism: After executing a trade, the system forces a wait of a certain number of candles (default 10) before executing another trade in the same direction, preventing excessive trading in a short period.

Dynamic Stop-Loss/Take-Profit: Sets stop-loss and take-profit levels based on ATR (Average True Range), allowing them to automatically adjust to market volatility, with a default of 1.5 times ATR.

Trailing Stop Option: Provides a trailing stop feature option that can protect profits as the price moves in a favorable direction, with a default setting of 1.5% of price.

Signal triggering logic: - Short signal: RSI crosses down through overbought level + Volume greater than minimum threshold + Price closes lower than previous close but higher than VWAP + Cooldown period has passed - Long signal: RSI crosses up through oversold level + Volume greater than minimum threshold + Price closes higher than previous close but lower than VWAP + Cooldown period has passed

Strategy Advantages

Multiple Confirmation Mechanism: Combines RSI, VWAP, and price action confirmation, requiring multiple conditions to be simultaneously satisfied to generate a signal, effectively reducing the possibility of false signals.

Adapts to Market Volatility: Dynamically adjusts stop-loss and take-profit levels through ATR, enabling the strategy to adapt to market environments with different volatility, providing looser stops in high-volatility markets and tighter stops in low-volatility markets.

Liquidity Filtering: Ensures trades occur in market conditions with sufficient liquidity through minimum volume requirements, reducing slippage risk.

Prevents Overtrading: The cooldown mechanism effectively prevents frequent trading in a short period, reducing transaction costs and avoiding re-entering the market under similar market conditions.

Flexible Risk Management: Provides two risk management options: fixed stop-loss/take-profit and trailing stops, allowing traders to choose appropriate methods based on their risk preferences and market conditions.

Price Action-Based Confirmation: Not only relies on technical indicators but also incorporates price action (closing price relative to previous close and VWAP position) as confirmation, improving signal quality.

Visualized Trading Signals: The strategy intuitively displays trading signals and key reference lines (VWAP) on the chart, facilitating real-time monitoring and analysis of market conditions.

Strategy Risks

Reversal Failure Risk: Despite using multiple conditions for confirmation, market reversal signals may still fail, especially in strong trending markets, where reversal signals might lead to counter-trend trading.

- Solution: Consider adding a trend filter to avoid generating reversal signals in obvious strong trends.

Parameter Sensitivity: Parameter settings such as RSI overbought/oversold thresholds (72⁄28) and cooldown period (10 candles) significantly impact strategy performance; inappropriate parameters may lead to decreased signal quality.

- Solution: Optimize parameters for different market conditions through historical backtesting, or consider implementing adaptive parameters.

Stop-Loss Level Setting Risk: 1.5 times ATR as a stop-loss may be too tight or too loose in certain situations.

- Solution: Adjust the ATR multiplier based on the volatility characteristics of the specific trading instrument, or consider setting stops based on support/resistance levels.

VWAP Dependency: VWAP is typically more effective in intraday trading and may lose reference value over longer time periods.

- Solution: Consider using other price reference lines, such as moving averages or support/resistance levels, over longer time periods.

Fixed Volume Threshold: A fixed volume threshold (500) may not be applicable to all market conditions and trading instruments.

- Solution: Consider using relative volume indicators (such as the ratio of current volume to average volume) instead of fixed thresholds.

Lack of Market Environment Filtering: The strategy may perform better in certain market environments (such as high volatility or range-bound oscillations) but lacks explicit identification of market environments.

- Solution: Add market environment identification indicators to adjust strategy parameters or temporarily stop trading based on different market states.

Fixed Capital Management: The strategy uses a fixed percentage of capital (10%) for trading, without dynamically adjusting position size based on signal quality or market risk.

- Solution: Implement dynamic position management, adjusting position size based on signal strength, market volatility, or risk-reward ratio.

Strategy Optimization Directions

Adaptive Parameter Settings: Currently, the strategy uses fixed RSI thresholds (72⁄28) and ATR multiplier (1.5). Consider implementing adaptive parameters that automatically adjust based on market volatility or trend strength.

- Rationale: Optimal overbought/oversold thresholds and stop-loss levels may vary significantly in different market environments; adaptive parameters can better accommodate market changes.

Add Trend Filter: Introduce trend judgment indicators (such as moving average trend or ADX) to avoid generating potentially failing reversal signals in strong trend environments.

- Rationale: Reversal strategies typically perform better in oscillating markets and are prone to false signals in strong trends; adding trend filtering can significantly improve the strategy’s win rate.

Dynamic Position Management: Dynamically adjust position size based on signal strength (such as degree of RSI deviation), market volatility, or expected risk-reward ratio.

- Rationale: Signal quality varies, and capital allocation should be adjusted accordingly; stronger signals should be allocated more capital, while weaker signals should be approached with caution.

Market Environment Classification: Implement market environment identification functionality to distinguish between trending markets, oscillating markets, and high-volatility markets, and adjust strategy parameters or trading logic for different environments.

- Rationale: Strategy performance varies significantly across different market environments; environment identification can help the strategy trade under the most favorable conditions and avoid unfavorable environments.

Optimize Volume Filtering: Replace fixed volume thresholds with relative indicators, such as the ratio of current volume to the average volume of the past N periods, to better adapt to different trading instruments and time periods.

- Rationale: Normal volume levels vary greatly across different trading instruments and time periods; relative volume indicators can more accurately measure market activity.

Add Signal Quality Scoring: Develop a signal quality scoring system based on multiple factors (such as degree of RSI deviation, distance between price and VWAP, extent of volume breakthrough, etc.) to score signals and only execute high-quality signals.

- Rationale: Not all signals that meet basic conditions are of equal quality; a scoring system can help select trading opportunities most likely to succeed.

Time Filter: Add time filtering functionality to avoid trading during market opening, closing, or important data release periods when volatility is abnormal.

- Rationale: Market fluctuations may be irregular during certain time periods, and technical indicators may fail; avoiding these periods can improve strategy stability.

Conclusion

The RSI and VWAP Synergistic Reversal Strategy is an intelligent trading system that integrates multiple indicators and confirmation mechanisms. By identifying the synergistic action between RSI overbought/oversold conditions and VWAP, combined with price action confirmation and volume filtering, it captures short-term market reversal opportunities. The strategy includes comprehensive risk management mechanisms, such as ATR dynamic stop-loss/take-profit, trailing stop options, and trading cooldown periods, which help control risk and avoid overtrading.

Although the strategy design is reasonable, challenges still exist, including reversal failure risk, parameter sensitivity, and market environment adaptability. Through implementing adaptive parameters, adding trend filtering, optimizing position management, implementing market environment classification, and developing signal quality scoring systems, the strategy’s robustness and profitability can be further enhanced. Particularly in oscillating markets, the strategy is expected to achieve good returns by capturing overbought/oversold reversal points, but should be used with caution or temporarily disabled in strong trending markets.

Overall, this strategy integrates multiple technical analysis tools and risk management techniques to provide traders with a structured market reversal trading framework, suitable for experienced traders to apply in appropriate market environments.

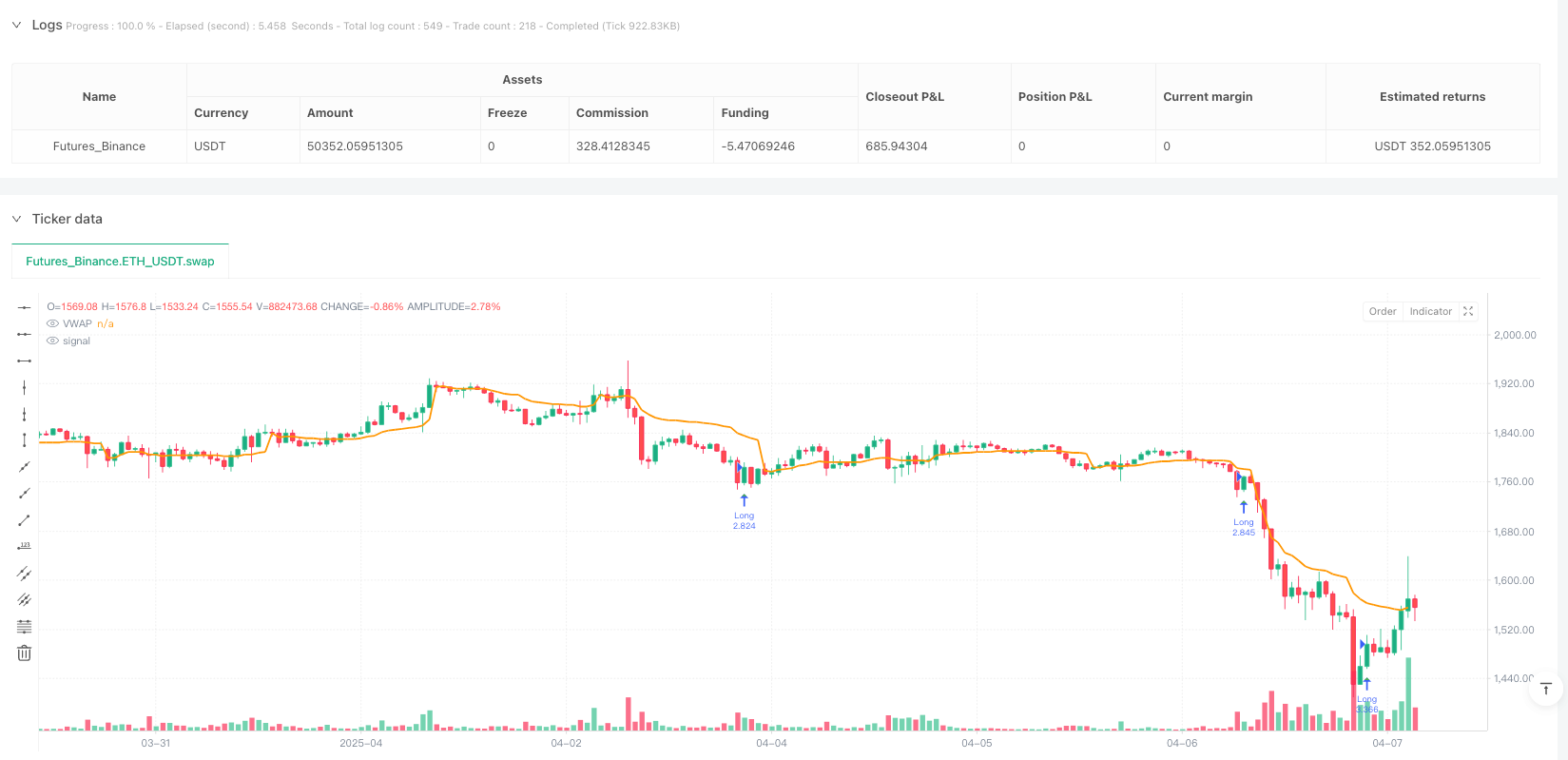

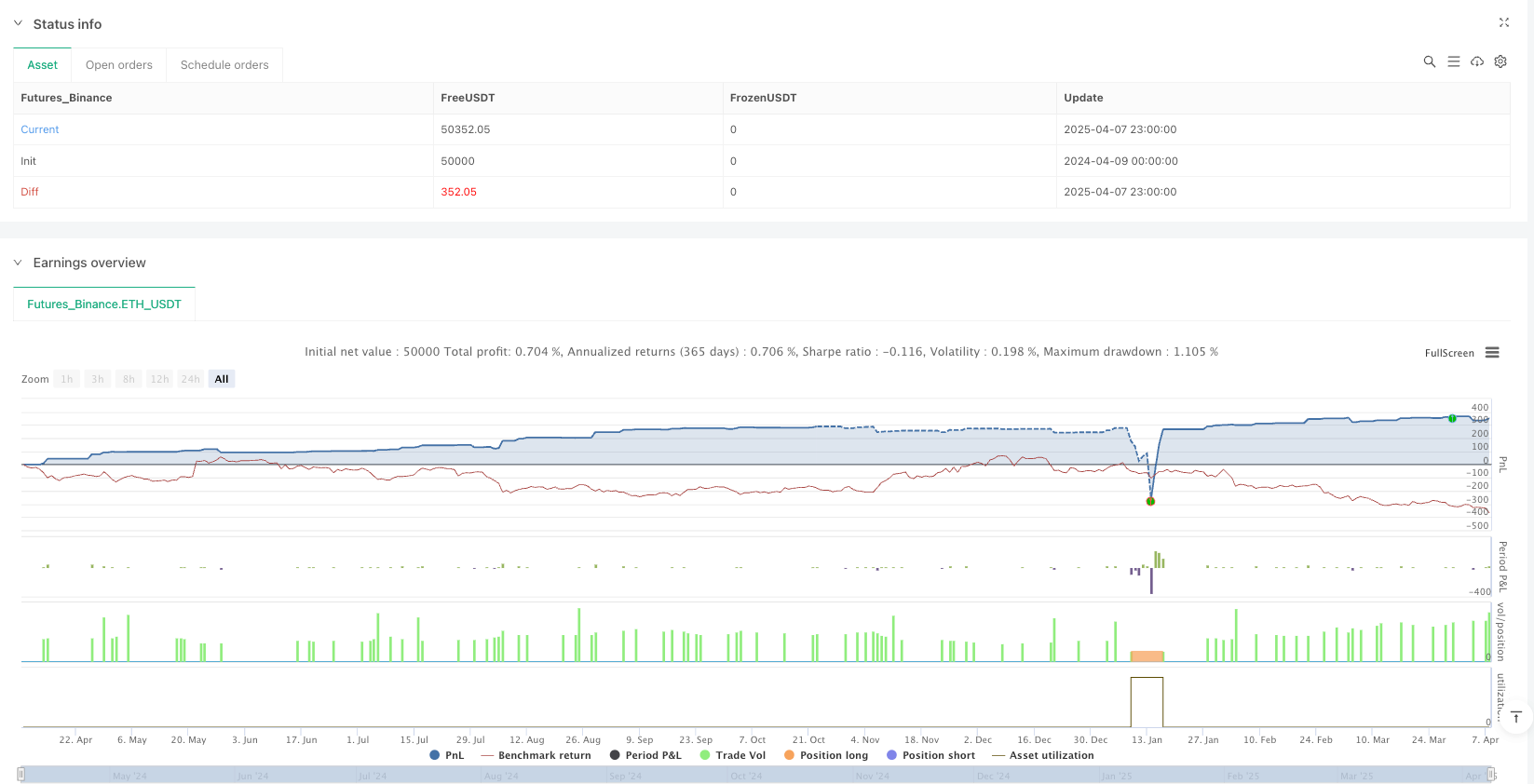

/*backtest

start: 2024-04-09 00:00:00

end: 2025-04-08 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("BTC/USDT Smart Long & Short (RSI + VWAP + Rejection)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === INPUTS ===

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(72, title="RSI Overbought Level")

rsiOversold = input.int(28, title="RSI Oversold Level")

minVol = input.float(500, title="Min Volume Filter")

cooldownBars = input.int(10, title="Cooldown Period (bars)")

atrLength = input.int(14, title="ATR Length")

atrMultiplier = input.float(1.5, title="SL/TP ATR Multiplier")

useTrailing = input.bool(true, title="Use Trailing Stop")

trailingPerc = input.float(1.5, title="Trailing %")

// === INDICATORS ===

rsi = ta.rsi(close, rsiLength)

vwap = ta.vwap(hlc3)

atr = ta.atr(atrLength)

vol = volume

// === COOLDOWN LOGIC ===

var int lastShortBar = na

var int lastLongBar = na

canShort = na(lastShortBar) or (bar_index - lastShortBar > cooldownBars)

canLong = na(lastLongBar) or (bar_index - lastLongBar > cooldownBars)

// === CANDLE REJECTION LOGIC ===

bearishRejection = close < close[1] and close > vwap // Short filter

bullishRejection = close > close[1] and close < vwap // Long filter

// === SHORT ENTRY ===

shortSignal = ta.crossunder(rsi, rsiOverbought) and vol > minVol and bearishRejection and canShort

if (shortSignal)

strategy.entry("Short", strategy.short)

if useTrailing

strategy.exit("Short Exit", from_entry="Short", trail_points=trailingPerc * close * 0.01, trail_offset=trailingPerc * close * 0.01)

else

sl = atr * atrMultiplier

tp = atr * atrMultiplier

strategy.exit("Short Exit", from_entry="Short", profit=tp, loss=sl)

lastShortBar := bar_index

// === LONG ENTRY ===

longSignal = ta.crossover(rsi, rsiOversold) and vol > minVol and bullishRejection and canLong

if (longSignal)

strategy.entry("Long", strategy.long)

if useTrailing

strategy.exit("Long Exit", from_entry="Long", trail_points=trailingPerc * close * 0.01, trail_offset=trailingPerc * close * 0.01)

else

sl = atr * atrMultiplier

tp = atr * atrMultiplier

strategy.exit("Long Exit", from_entry="Long", profit=tp, loss=sl)

lastLongBar := bar_index

// === PLOTS ===

plot(vwap, title="VWAP", color=color.orange, linewidth=2)

plotshape(shortSignal, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

plotshape(longSignal, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)