Strategy Overview

The Multi-Timeframe Opening Range Breakout Strategy with Limit Entry is a specialized intraday trading system designed to capture early market momentum. This strategy is based on the price range formed during the first 5 minutes of market open (9:30-9:35 EST) and identifies trend direction through breakouts from this range. Unlike traditional breakout strategies, this system employs limit orders at the range boundaries for entry, improving fill probability while securing more favorable entry prices. The strategy features automatic stop-loss placement, configurable take-profit multipliers, and forced position closure before market end, creating a comprehensive risk management framework.

Strategy Principles

The core logic of the strategy follows these key steps:

- Opening Range Establishment: Capturing the high and low during the first 5 minutes after market open (9:30-9:35 EST) to form the “opening range.”

- Direction Identification: Waiting for price to completely break out of the opening range (with candles fully positioned above or below the range) to confirm the trend direction.

- Limit Entry: Once direction is confirmed, rather than chasing price with market orders, limit orders are placed at the range boundary (resistance becoming support or support becoming resistance), awaiting price retracement to the range edge for entry.

- Risk Control: Stop-loss is set at the opposite boundary of the opening range, creating a clear risk boundary.

- Take-Profit Strategy: Based on the stop-loss distance multiplied by a configurable factor (default 2.0), establishing a dynamic profit target. If price has already exceeded the calculated target before order placement, the price extreme is used as the take-profit level.

- Time-Based Exit: If a trade has not triggered either take-profit or stop-loss, positions are automatically closed at 15:55 EST to avoid overnight risk.

The strategy implementation uses Pine Script’s state management mechanism, resetting all variables at the beginning of each trading day to ensure independence between different trading sessions. Through the limit order mechanism, the strategy can enter at more favorable prices after trend confirmation, reducing the impact of slippage and improving the risk-reward ratio.

Strategy Advantages

Through detailed code analysis, this strategy demonstrates the following significant advantages:

- Precise Capture of Opening Momentum: The first 5 minutes after market open typically reflect the accumulation of orders and the initial positions of major participants, and this strategy effectively utilizes this time window rich in information content.

- Cost Reduction Through Limit Entries: Compared to traditional market order breakout entries, the limit entry mechanism obtains more favorable entry prices, which is crucial for reducing spread costs and improving overall strategy performance.

- Visualization of Trading Zones: The strategy provides clear visual aids displaying the opening range and potential trading areas, helping traders intuitively understand market structure.

- Dynamic Risk Management: The take-profit multiplier can be adjusted according to market volatility, better adapting to different market environments.

- Automated Operation Process: From entry identification to exit management, the entire trading process is fully automated, reducing human intervention and emotional influence.

- Intraday Trading Avoids Overnight Risk: The forced position closure mechanism before market close effectively avoids potential gap risks associated with overnight positions.

- Clear and Extensible Logic: The strategy structure is modular with strong independence between functions, facilitating future strategy optimization and extension.

Strategy Risks

Despite the strategy’s logical design, the following potential risks exist:

Narrow Range Triggering False Signals: If the first 5 minutes show minimal volatility, resulting in a narrow range, it may lead to close stop-loss placement, increasing the risk of premature triggering. Solution: Add minimum range width restrictions or dynamically adjust the range based on historical volatility.

Slippage Risk in Highly Volatile Markets: Although limit orders are used, in extremely volatile markets, prices may rapidly cross entry levels, causing orders to remain unfilled. Solution: Consider adding backup tracking entry mechanisms.

False Breakout Traps: Prices may quickly retreat after breaking the opening range, creating false breakouts. Solution: Add confirmation filters, such as requiring sustained breakout duration or breakout strength to reach a certain threshold.

Limitations of Fixed Time Windows: Market activity may vary across different trading days, and the fixed 5-minute opening range may not always be optimal. Solution: Consider dynamically adjusting the time window length based on volatility.

Lack of Fundamental Impact Consideration: The strategy is purely technical and does not account for the impact of major news or economic data releases. Solution: Integrate economic calendar filtering functionality to adjust strategy parameters or pause trading on important data release days.

Strategy Optimization Directions

Based on code analysis, the strategy can be optimized in the following directions:

Adaptive Opening Range: The current strategy uses a fixed 5-minute time window, which could be improved to dynamically adjust the opening range duration based on market volatility. This would better adapt to different market conditions, increasing range duration on low volatility days to capture more meaningful ranges.

Multiple Confirmation Mechanisms: Additional technical indicators (such as volume, RSI, or moving averages) could be introduced as breakout confirmation conditions to reduce false breakout risk. By requiring multiple conditions to be simultaneously satisfied, entry signal reliability could be improved.

Dynamic Take-Profit Optimization: Currently, take-profit is set as a fixed multiplier, which could be improved to ATR-based (Average True Range) dynamic take-profit, or implementing trailing stop functions to lock in more profit during trend continuation.

Market State Filtering: Add assessment of overall market state, such as distinguishing between ranging and trending markets, adopting different strategy parameters or pausing trading under different market conditions.

Multi-Timeframe Analysis: Integrate higher timeframe trend direction judgment, only entering when the intraday trend aligns with higher timeframe trends, improving win rates.

Seasonality Optimization: Analyze strategy performance across different months, days of the week, or before/after specific market events, customizing parameter settings for different periods.

Capital Management Optimization: The current strategy uses a fixed capital percentage (default 100%), which could be improved to dynamically adjust position size based on historical performance and current drawdown status, implementing more refined risk control.

Conclusion

The Multi-Timeframe Opening Range Breakout Strategy with Limit Entry is a complete trading system combining technical analysis, risk management, and execution optimization. By capturing early market momentum and utilizing limit orders to optimize entry, it achieves high execution efficiency while maintaining strategic simplicity. This strategy is particularly suitable for intraday traders, especially those seeking clear rules and automated execution.

The main advantages of the strategy lie in its clear logical framework and comprehensive risk management measures, including preset stop-losses, dynamic take-profits, and time-based exit mechanisms. At the same time, by visually displaying trading zones, it improves strategy explainability and user experience.

Although the basic framework of this strategy is quite comprehensive, there remains room for further optimization, especially in terms of adaptability of range definition, reliability of entry confirmation, and flexibility of take-profit mechanisms. Through continuous parameter optimization and functional extension, this strategy has the potential to adapt to different market environments, providing more stable long-term performance.

Finally, it should be emphasized that despite the strategy’s automated features, it still needs to be used in conjunction with market experience and risk management principles, especially during high volatility periods or major market events. Thorough backtesting and forward validation are key steps to successfully implementing this strategy.

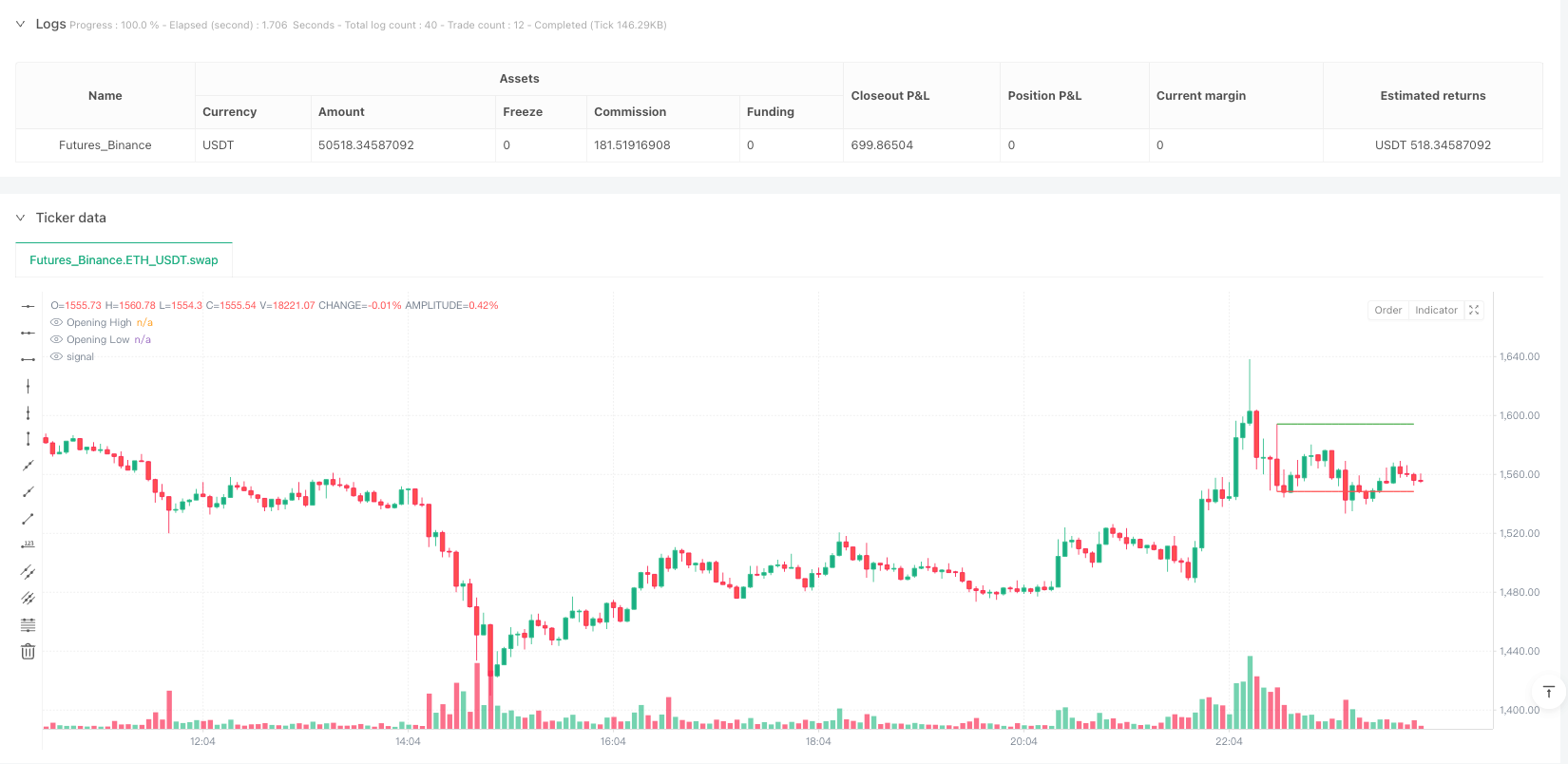

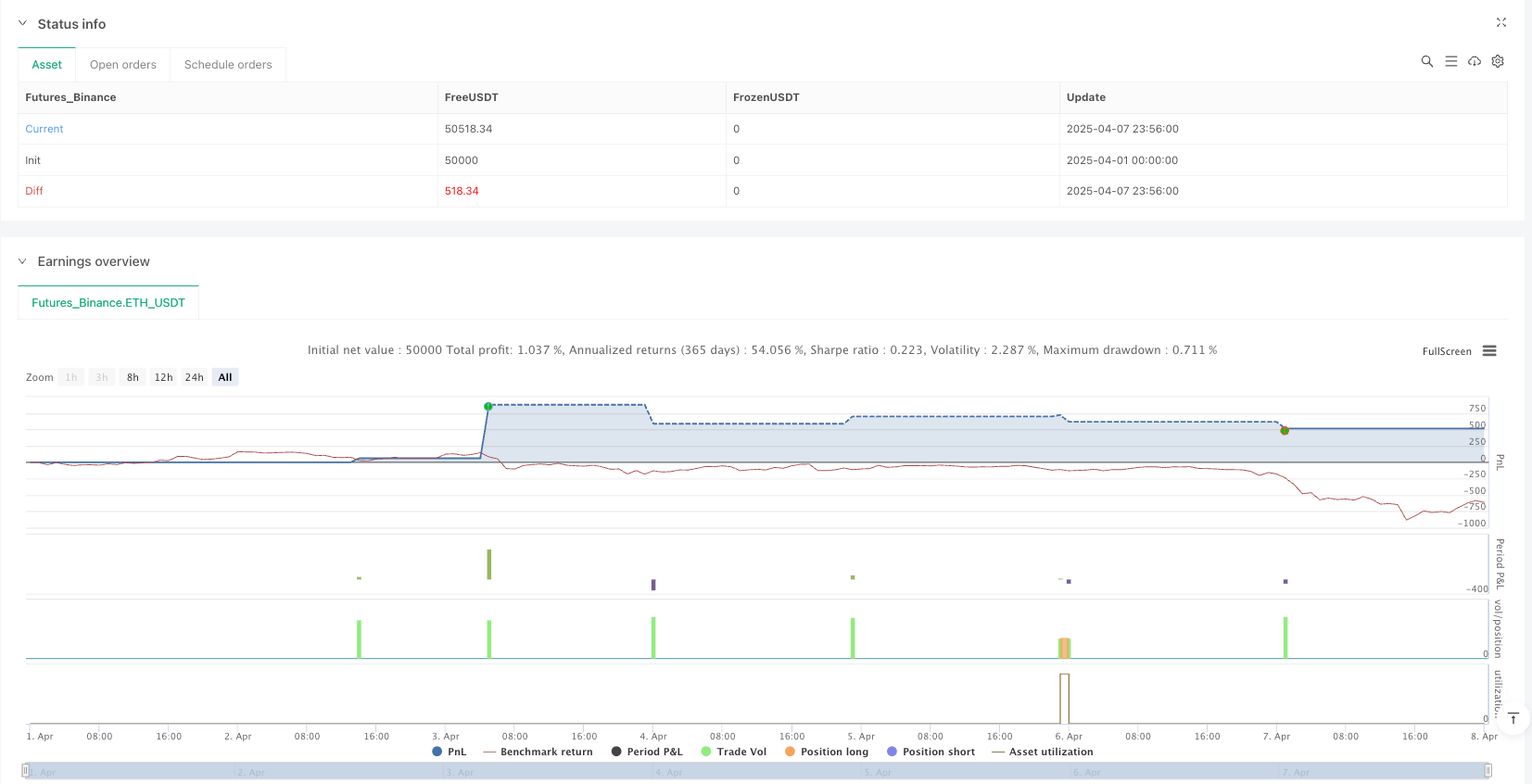

/*backtest

start: 2025-04-01 00:00:00

end: 2025-04-08 00:00:00

period: 4m

basePeriod: 4m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Opening Range Breakout (Limit Entry)", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === Parameters ===

startHour = 9

startMinute = 30

endHour = 9

endMinute = 35

closeHour = 15

closeMinute = 55

// Take Profit Multiplier

tpMultiplier = input.float(2.0, title="Take Profit Multiplier", step=0.1)

// === Time Filters ===

sessionStart = timestamp("America/New_York", year, month, dayofmonth, startHour, startMinute)

sessionEnd = timestamp("America/New_York", year, month, dayofmonth, endHour, endMinute)

closeTime = timestamp("America/New_York", year, month, dayofmonth, closeHour, closeMinute)

barTime = time

inOpeningRange = barTime >= sessionStart and barTime <= sessionEnd

rangeLockedTime = barTime > sessionEnd

exitTime = (time_close == timestamp("America/New_York", year, month, dayofmonth, closeHour, closeMinute))

// === Session Day Tracking ===

var int sessionKey = na

currentKey = year * 10000 + month * 100 + dayofmonth

newDay = na(sessionKey) or sessionKey != currentKey

if newDay

sessionKey := currentKey

// === Opening Range and State Variables ===

var float openingHigh = na

var float openingLow = na

var bool directionSet = false

var bool directionUp = false

var float entryPrice = na

var float stop = na

var float target = na

var float interimMax = na

var float interimMin = na

var bool orderPlaced = false

var bool rangeLocked = false

var int rangeStartIndex = na

// === Daily Reset & Opening Range Update ===

if newDay

openingHigh := na

openingLow := na

directionSet := false

directionUp := false

entryPrice := na

stop := na

target := na

interimMax := na

interimMin := na

orderPlaced := false

rangeLocked := false

rangeStartIndex := na

if inOpeningRange and not rangeLocked

openingHigh := na(openingHigh) ? high : openingHigh

openingLow := na(openingLow) ? low : openingLow

rangeStartIndex := na(rangeStartIndex) ? bar_index : rangeStartIndex

// === Lock the range after the window ===

if rangeLockedTime and not rangeLocked and not na(openingHigh) and not na(openingLow)

rangeLocked := true

// === Detect first candle fully outside the opening range ===

outOfRange = rangeLocked and not directionSet and ((low > openingHigh and high > openingHigh) or (high < openingLow and low < openingLow))

if outOfRange

directionUp := low > openingHigh

directionSet := true

// === Entry Setup ===

var box tradeBox = na

if directionSet and not orderPlaced

interimMax := high

interimMin := low

if directionUp

entryPrice := openingHigh

stop := openingLow

target := entryPrice + tpMultiplier * (entryPrice - stop)

if interimMax > target

target := interimMax

strategy.entry("Long", strategy.long, limit=entryPrice)

strategy.exit("TP/SL", from_entry="Long", limit=target, stop=stop)

orderPlaced := true

else

entryPrice := openingLow

stop := openingHigh

target := entryPrice - tpMultiplier * (stop - entryPrice)

if interimMin < target

target := interimMin

strategy.entry("Short", strategy.short, limit=entryPrice)

strategy.exit("TP/SL", from_entry="Short", limit=target, stop=stop)

orderPlaced := true

// === Exit near end of day ===

if exitTime and orderPlaced

strategy.close_all(comment="EOD Close")

// === Plotting ===

plot(openingHigh, color=color.green, title="Opening High")

plot(openingLow, color=color.red, title="Opening Low")