Overview

The Adaptive Volatility Multi-Indicator Trend Following Trading System is a quantitative trading strategy designed for high-volatility markets, combining dynamically adjusted technical indicators with advanced risk management mechanisms. The core of this strategy lies in using ATR (Average True Range) to dynamically adjust moving average parameters, achieving adaptability to market volatility, while integrating RSI overbought/oversold filtering, candlestick pattern recognition, multi-timeframe trend confirmation, and dollar-cost averaging (DCA) functions to form a comprehensive trading framework. This strategy is particularly suitable for high-volatility environments such as futures markets, providing flexible operational modes for intraday trading and swing trading.

Strategy Principles

The core principles of the strategy are based on the following key modules:

Adaptive Moving Average System: The strategy uses fast and slow Simple Moving Averages (SMA), with lengths dynamically adjusted through ATR. In high-volatility environments, moving average lengths shorten to quickly react to market changes; in low-volatility environments, lengths extend to reduce noise. Long signals are generated when the fast MA crosses above the slow MA with price confirmation; short signals work in reverse.

RSI Momentum Filter: Validates entry signals through RSI (Relative Strength Index), ensuring trade direction aligns with market momentum. This feature can be optionally enabled or disabled, and supports customized RSI parameters (such as length 14, overbought 60, oversold 40).

Candlestick Pattern Recognition: The system identifies strong bullish or bearish engulfing patterns, validated by volume and range strength. To avoid false signals, the system skips trades when both opposing patterns appear simultaneously.

Multi-Timeframe Trend Confirmation: Optionally aligns trading signals with the 15-minute timeframe SMA trend, adding an additional confirmation layer to improve trade quality.

Dollar-Cost Averaging (DCA) Mechanism: Allows multiple entries in the trend direction, supporting up to a preset number of entries (e.g., 4), with entry intervals based on ATR multiples. This mechanism helps optimize average cost in trending markets.

Advanced Risk Management:

- Initial Stop: Based on ATR settings (typically 2-3.5x), with a wider fixed stop multiplier (e.g., 1.3) applied on the entry bar.

- Trailing Stop: Uses ATR-based offset and multiplier, dynamically adjusted as profit increases (e.g., multiplier reduces from 0.5 to 0.3 when profit exceeds ATR).

- Profit Target: Set at entry price ±ATR by a specific multiplier (e.g., 1.2).

- Cooldown Period: Pause after exit (0-5 minutes) to prevent overtrading.

- Minimum Hold Time: Ensures trades last a certain number of bars (e.g., 2-10).

Trade Execution Logic: The system prioritizes moving average or candlestick pattern signals (based on user preference), and applies volume, volatility, and time filters. To ensure entry quality, a volume spike condition is also added (volume > 1.2 * 10-period SMA).

Strategy Advantages

Strong Market Adaptability: By dynamically adjusting technical indicator parameters through ATR, the strategy can automatically adapt to different market conditions, maintaining effectiveness in both high and low volatility environments.

Signal Quality Filtering: Multi-layer filtering mechanisms (RSI, multi-timeframe trend, volume, and volatility) effectively reduce false signals, improving trade quality.

Flexible Entry Mechanism: Supports prioritizing moving average or candlestick pattern signals based on user preference, and optimizes entry points in the trend direction through DCA functionality.

Dynamic Risk Management: Stop-loss points and trailing stops adjust dynamically with market volatility and trade profits, protecting capital while giving trends sufficient room to develop.

Visualization and Debugging Tools: The strategy provides rich chart overlays, real-time dashboards, and debugging tables to help users optimize parameters and understand trading logic.

Modular Design: Users can enable or disable various features (such as RSI filtering, candlestick pattern recognition, multi-timeframe trend, etc.) according to preferences, offering high customization.

Fine-tuned Entry Control: Volume spike filters ensure entries only occur during significant market activity, while cooldown mechanisms prevent overtrading.

Strategy Risks

- Parameter Sensitivity: The strategy uses multiple parameters (such as moving average lengths, ATR periods, RSI thresholds, etc.), and these settings significantly impact performance. Inappropriate parameter combinations may lead to overfitting historical data.

Solution: Conduct extensive parameter optimization tests while avoiding over-optimization; use walk-forward testing and out-of-sample testing to verify strategy robustness.

- Market Transition Risk: During rapid market mode transitions (e.g., from trending to ranging), the strategy may generate consecutive losses before adapting to the new environment.

Solution: Consider adding market state recognition mechanisms, using different parameter sets for different market environments; implement overall risk limits, such as maximum daily loss or pausing after consecutive losses.

- Slippage and Liquidity Issues: High-frequency trading and highly volatile markets may face increased slippage and reduced liquidity risks.

Solution: Include realistic slippage and commission estimates in backtesting; avoid trading during low liquidity periods; consider using limit orders instead of market orders.

- System Complexity: Multiple layers of logic and condition combinations increase strategy complexity, potentially making it difficult to understand and maintain.

Solution: Use the strategy’s debugging tools to closely monitor component performance; maintain good code comments; consider modular testing of each component’s independent effect.

- Overtrading Risk: DCA mechanisms and frequent signal generation may lead to overtrading, increasing transaction costs.

Solution: Set appropriate cooldown periods and minimum holding times; strictly consider trading costs in backtesting; regularly review and optimize entry criteria.

Optimization Directions

Machine Learning Enhancement: Introduce adaptive parameter optimization algorithms, such as Bayesian optimization or genetic algorithms, to automatically find optimal parameter combinations for different market environments. This will reduce the need for manual optimization and improve strategy adaptability to market changes.

Market Environment Classification: Develop a market state classification system (trending, ranging, high volatility, low volatility, etc.), with preset optimal parameter configurations for each state. This approach can adjust strategy behavior more quickly during market transitions, reducing adaptation lag.

Enhanced Position Management: Introduce more sophisticated position management algorithms, such as dynamic position adjustment based on the Kelly criterion or momentum strength. This can optimize capital utilization, increasing exposure on strong signals and reducing risk on weak signals.

Alternative Indicator Integration: Test the effectiveness of other technical indicators, such as Bollinger Bands, MACD, or Ichimoku Cloud, as supplements or alternatives to the existing system. Different indicators may provide more accurate signals under specific market conditions.

Sentiment Data Integration: Consider incorporating market sentiment indicators, such as the VIX volatility index or options market data, to identify potential market transitions in advance. These external data sources can provide information that traditional technical indicators cannot capture.

Multi-Asset Correlation Analysis: Develop cross-asset class correlation analysis, using signals from one market to validate or strengthen trading decisions in another related market. For example, using commodity price movements to confirm trends in related stock sectors.

Computational Efficiency Optimization: Refactor code to improve computational efficiency, especially for high-frequency strategies. This includes optimizing ATR calculations, condition evaluation order, and reducing unnecessary repetitive calculations.

Summary

The Adaptive Volatility Multi-Indicator Trend Following Trading System represents a comprehensive and flexible quantitative trading approach, effectively addressing different market environments through dynamic parameter adjustments and multi-layer filtering mechanisms. The core advantages of the strategy lie in its adaptability and comprehensive risk management framework, making it particularly suitable for high-volatility futures markets.

The strategy integrates multiple classic technical analysis tools (moving averages, RSI, candlestick patterns) while incorporating modern quantitative trading elements (adaptive parameters, multi-timeframe analysis, DCA) to form a balanced system. Through fine control of entry timing, optimization of multiple entry strategies, and dynamic adjustment of stop-loss levels, the strategy can fully capitalize on market trend opportunities while protecting capital.

However, the complexity of the strategy also brings challenges in parameter sensitivity and system maintenance. Investors should conduct thorough backtesting and forward testing before implementing this strategy, and be prepared to adjust parameters according to market changes. Future optimization directions include introducing machine learning techniques for automatic parameter optimization, adding market environment classification systems, and improving position management algorithms, which will further enhance the strategy’s robustness and adaptability.

Overall, this strategy provides a solid quantitative trading framework, suitable for experienced traders to customize according to specific needs and risk preferences, seeking consistent trading advantages in today’s rapidly changing financial markets.

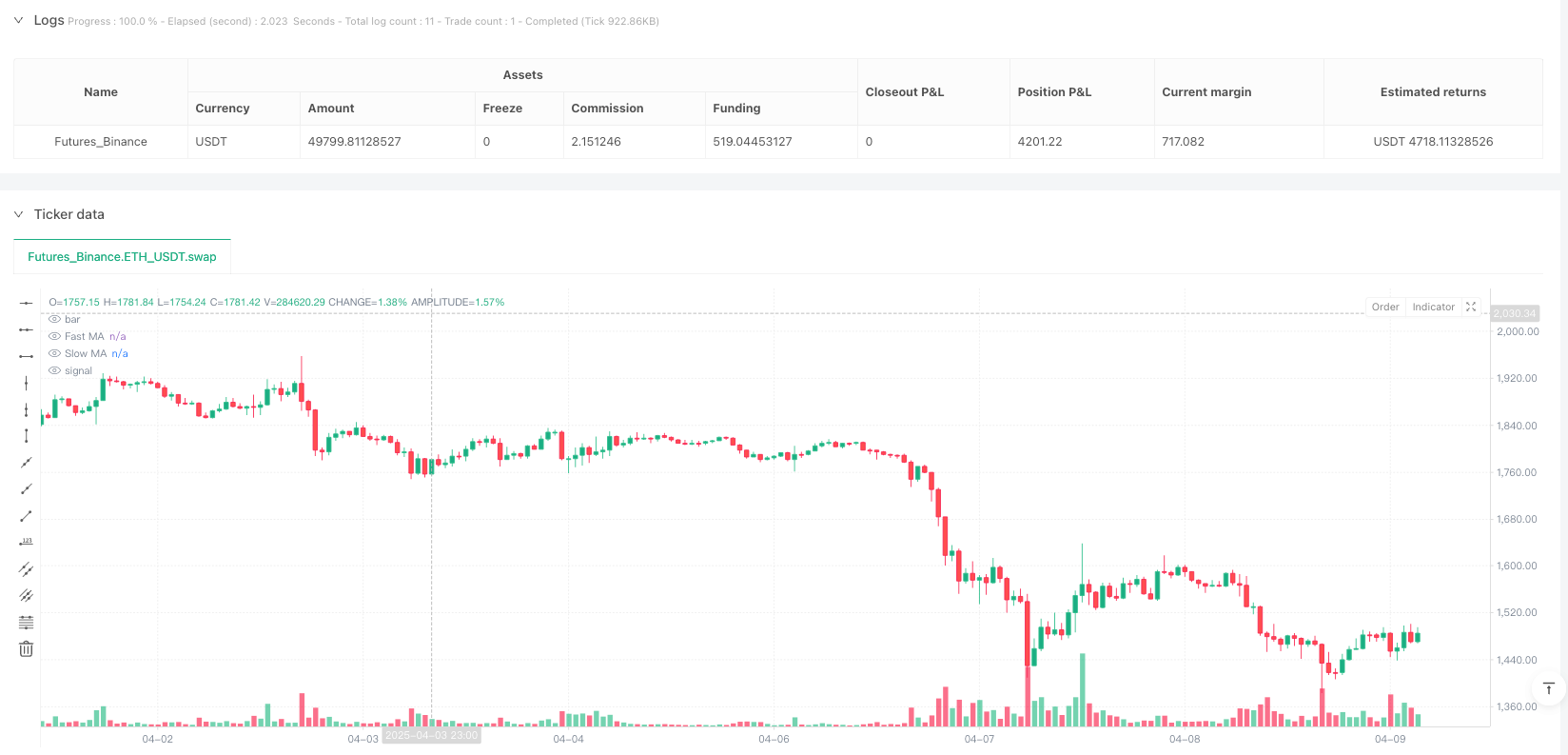

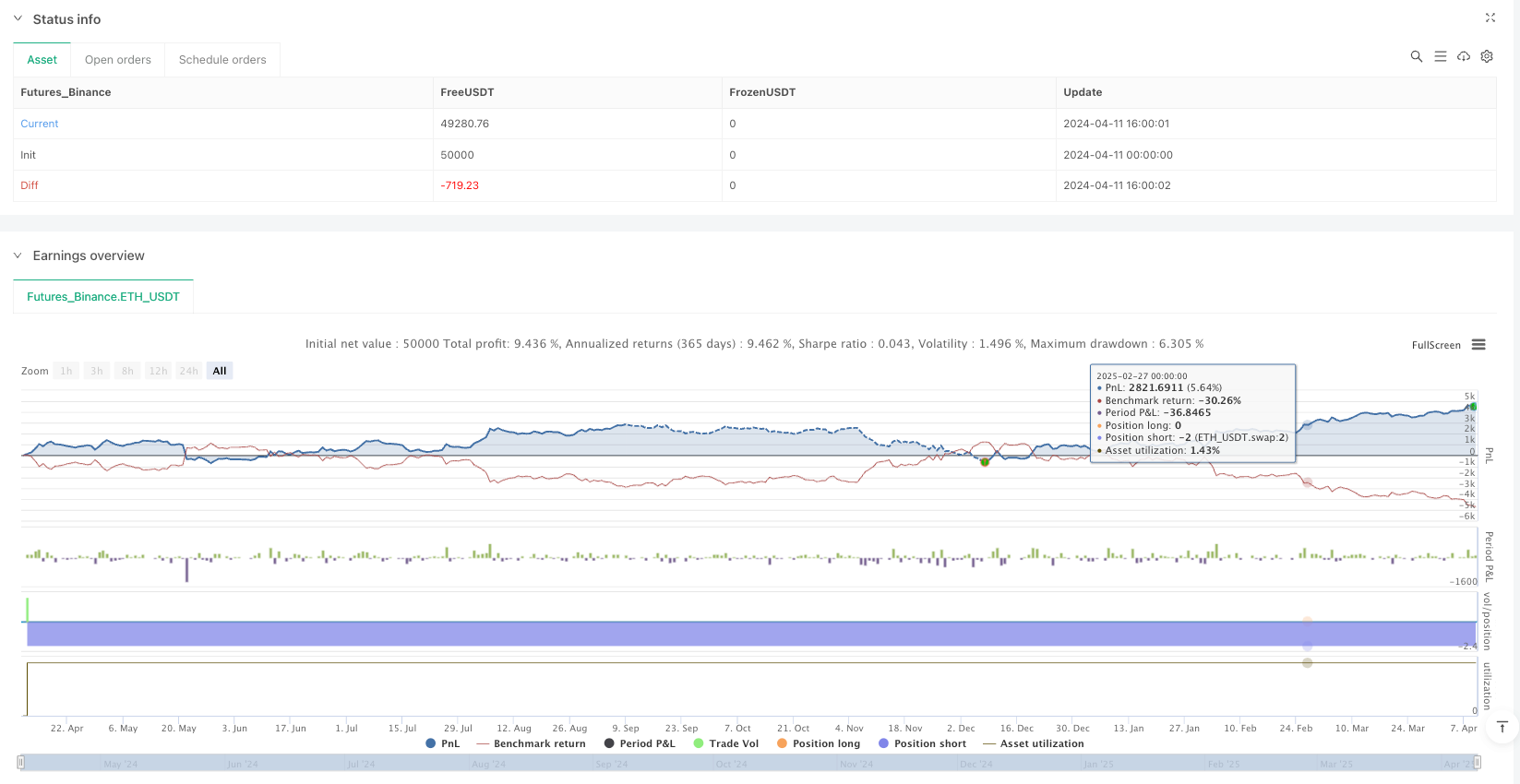

/*backtest

start: 2024-04-11 00:00:00

end: 2025-04-10 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy('Dskyz Adaptive Futures Elite (DAFE) - Updated',

overlay=true,

default_qty_type=strategy.fixed,

initial_capital=1000000,

commission_value=0,

slippage=1,

pyramiding=10)

// === INPUTS ===

// Moving Average Settings

fastLength = input.int(9, '[MA] Fast MA Length', minval=1)

slowLength = input.int(19, '[MA] Slow MA Length', minval=1)

// RSI Settings

useRSI = input.bool(false, '[RSI Settings] Use RSI Filter')

rsiLength = input.int(14, 'RSI Length', minval=1)

rsiOverbought = input.int(60, 'RSI Overbought', minval=50, maxval=100)

rsiOversold = input.int(40, 'RSI Oversold', minval=0, maxval=50)

rsiLookback = input.int(1, 'RSI Lookback', minval=1)

// Pattern Settings

usePatterns = input.bool(true, '[Pattern Settings] Use Candlestick Patterns')

patternLookback = input.int(19, 'Pattern Lookback Bars', minval=1)

// Filter Settings

useTrendFilter = input.bool(true, '[Filter Settings] Use 15m Trend Filter')

minVolume = input.int(10, 'Minimum Volume', minval=1)

volatilityThreshold = input.float(1.0, 'Volatility Threshold (%)', minval=0.1, step=0.1) / 100

tradingStartHour = input.int(9, 'Trading Start Hour (24h)', minval=0, maxval=23)

tradingEndHour = input.int(16, 'Trading End Hour (24h)', minval=0, maxval=23)

// DCA Settings

useDCA = input.bool(false, '[DCA Settings] Use DCA')

maxTotalEntries = input.int(4, 'Max Total Entries per Direction', minval=1)

dcaMultiplier = input.float(1.0, 'DCA ATR Multiplier', minval=0.1, step=0.1)

// Signal Settings

signalPriority = input.string('MA', '[Signal Settings] Signal Priority', options=['Pattern', 'MA'])

minBarsBetweenSignals = input.int(5, 'Min Bars Between Signals', minval=1)

plotMode = input.string('Potential Signals', 'Plot Mode', options=['Potential Signals', 'Actual Entries'])

// Exit Settings

trailOffset = input.float(0.5, '[Exit Settings] Trailing Stop Offset ATR Multiplier', minval=0.01, step=0.01)

trailPointsMult = input.float(0.5, 'Trailing Stop Points ATR Multiplier', minval=0.01, step=0.01)

profitTargetATRMult = input.float(1.2, 'Profit Target ATR Multiplier', minval=0.1, step=0.1) // Profit target factor

fixedStopMultiplier = input.float(1.3, 'Fixed Stop Multiplier', minval=0.5, step=0.1) // Fixed stop multiplier

// General Settings

debugLogging = input.bool(true, '[General Settings] Enable Debug Logging')

fixedQuantity = input.int(2, 'Trade Quantity', minval=1)

cooldownMinutes = input.int(0, 'Cooldown Minutes', minval=0)

// ATR Settings – Use Dynamic ATR or fixed value

useDynamicATR = input.bool(true, title="Use Dynamic ATR")

userATRPeriod = input.int(7, title="ATR Period (if not using dynamic)", minval=1)

defaultATR = timeframe.isminutes and timeframe.multiplier <= 2 ? 5 :

timeframe.isminutes and timeframe.multiplier <= 5 ? 7 : 10

atrPeriod = useDynamicATR ? defaultATR : userATRPeriod

// === TRADE TRACKING VARIABLES ===

var int lastSignalBar = 0

var int lastSignalType = 0 // 1 for long, -1 for short

var int entryBarIndex = 0

var bool inLongTrade = false

var bool inShortTrade = false

// DCA Tracking Variables

var int longEntryCount = 0

var int shortEntryCount = 0

var float longInitialEntryPrice = na

var float shortInitialEntryPrice = na

var float longEntryATR = na

var float shortEntryATR = na

var float long_stop_price = na

var float short_stop_price = na

// Signal Plotting Variables

var int lastLongPlotBar = 0

var int lastShortPlotBar = 0

// === CALCULATIONS ===

// Volume and Time Filters

volumeOk = volume >= minVolume

currentHour = hour(time)

timeWindow = currentHour >= tradingStartHour and currentHour <= tradingEndHour

// Additional Entry Filter: Volume Spike Condition

volumeSpike = volume > 1.2 * ta.sma(volume, 10)

// ATR & Volatility Calculations

atr = ta.atr(atrPeriod)

volatility = nz(atr / close, 0)

volatilityOk= volatility <= volatilityThreshold

// Adaptive MA Lengths

fastLengthAdaptive = math.round(fastLength / (1 + volatility))

slowLengthAdaptive = math.round(slowLength / (1 + volatility))

fastLengthSafe = math.max(1, not na(atr) ? fastLengthAdaptive : fastLength)

slowLengthSafe = math.max(1, not na(atr) ? slowLengthAdaptive : slowLength)

fastMA = ta.sma(close, fastLengthSafe)

slowMA = ta.sma(close, slowLengthSafe)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

rsiCrossover = ta.crossover(rsi, rsiOversold)

rsiCrossunder = ta.crossunder(rsi, rsiOverbought)

rsiLongOk = not useRSI or (rsiCrossover and rsi[rsiLookback] < 70)

rsiShortOk = not useRSI or (rsiCrossunder and rsi[rsiLookback] > 30)

// 15m Trend Filter

[fastMA15m, slowMA15m] = request.security(syminfo.tickerid, '15', [ta.sma(close, fastLength), ta.sma(close, slowLength)])

trend15m = fastMA15m > slowMA15m ? 1 : fastMA15m < slowMA15m ? -1 : 0

// Candlestick Patterns

isBullishEngulfing() =>

close[1] < open[1] and close > open and open < close[1] and close > open[1] and (close - open) > (open[1] - close[1]) * 0.8

isBearishEngulfing() =>

close[1] > open[1] and close < open and open > close[1] and close < open[1] and (open - close) > (close[1] - open[1]) * 0.8

// Pattern Strength Calculation

patternStrength(isBull) =>

bull = isBull ? 1 : 0

bear = isBull ? 0 : 1

volumeStrength = volume > ta.sma(volume, 10) ? 1 : 0

rangeStrength = (high - low) > ta.sma(high - low, 10) ? 1 : 0

strength = bull * (volumeStrength + rangeStrength) - bear * (volumeStrength + rangeStrength)

strength

bullStrength = patternStrength(true)

bearStrength = patternStrength(false)

// Detect Patterns

bullishEngulfingOccurred = ta.barssince(isBullishEngulfing()) <= patternLookback and bullStrength >= 1

bearishEngulfingOccurred = ta.barssince(isBearishEngulfing()) <= patternLookback and bearStrength <= -1

patternConflict = bullishEngulfingOccurred and bearishEngulfingOccurred

// MA Conditions with Trend & RSI Filters

maAbove = close > fastMA and fastMA > slowMA and close > close[1]

maBelow = close < fastMA and fastMA < slowMA and close < close[1]

trendLongOk = not useTrendFilter or trend15m >= 0

trendShortOk = not useTrendFilter or trend15m <= 0

// Signal Priority Logic

bullPattern = usePatterns and bullishEngulfingOccurred

bearPattern = usePatterns and bearishEngulfingOccurred

bullMA = maAbove and trendLongOk and rsiLongOk

bearMA = maBelow and trendShortOk and rsiShortOk

longCondition = false

shortCondition = false

if signalPriority == 'Pattern'

longCondition := bullPattern or (not bearPattern and bullMA)

shortCondition := bearPattern or (not bullPattern and bearMA)

else

longCondition := bullMA or (not bearMA and bullPattern)

shortCondition := bearMA or (not bullMA and bearPattern)

// Apply Filters and require volume spike for quality entries

longCondition := longCondition and volumeOk and volumeSpike and timeWindow and volatilityOk and not patternConflict

shortCondition := shortCondition and volumeOk and volumeSpike and timeWindow and volatilityOk and not patternConflict

// Update Trade Status

if strategy.position_size > 0

inLongTrade := true

inShortTrade := false

else if strategy.position_size < 0

inShortTrade := true

inLongTrade := false

else

inLongTrade := false

inShortTrade := false

// Entry Checks

canTrade = strategy.position_size == 0

validQuantity = fixedQuantity > 0

quantity = fixedQuantity

// Prevent Multiple Alerts Per Bar

var bool alertSent = false

if barstate.isnew

alertSent := false

// Cooldown Logic

var float lastExitTime = na

if strategy.position_size == 0 and strategy.position_size[1] != 0

lastExitTime := time

canEnter = na(lastExitTime) or ((time - lastExitTime) / 60000 >= cooldownMinutes)

// === ENTRY LOGIC ===

if canTrade and validQuantity and not alertSent and canEnter and barstate.isconfirmed

if longCondition and not shortCondition and (lastSignalBar != bar_index or lastSignalType != 1)

strategy.entry('Long', strategy.long, qty=quantity)

longInitialEntryPrice := close

longEntryATR := atr

longEntryCount := 1

alert('Enter Long', alert.freq_once_per_bar)

alertSent := true

lastSignalBar := bar_index

lastSignalType := 1

entryBarIndex := bar_index

else if shortCondition and not longCondition and (lastSignalBar != bar_index or lastSignalType != -1)

strategy.entry('Short', strategy.short, qty=quantity)

shortInitialEntryPrice := close

shortEntryATR := atr

shortEntryCount := 1

alert('Enter Short', alert.freq_once_per_bar)

alertSent := true

lastSignalBar := bar_index

lastSignalType := -1

entryBarIndex := bar_index

// === DCA LOGIC (IF ENABLED) ===

if useDCA

if strategy.position_size > 0 and longEntryCount < maxTotalEntries and bullMA and rsi < 70

nextDCALevel = longInitialEntryPrice - longEntryCount * longEntryATR * dcaMultiplier

if close <= nextDCALevel

strategy.entry('Long DCA ' + str.tostring(longEntryCount), strategy.long, qty=quantity)

longEntryCount := longEntryCount + 1

if strategy.position_size < 0 and shortEntryCount < maxTotalEntries and bearMA and rsi > 30

nextDCALevel = shortInitialEntryPrice + shortEntryATR * shortEntryCount * dcaMultiplier

if close >= nextDCALevel

strategy.entry('Short DCA ' + str.tostring(shortEntryCount), strategy.short, qty=quantity)

shortEntryCount := shortEntryCount + 1

// === RESET DCA VARIABLES ON EXIT ===

if strategy.position_size == 0 and strategy.position_size[1] != 0

longEntryCount := 0

shortEntryCount := 0

longInitialEntryPrice := na

shortInitialEntryPrice := na

longEntryATR := na

shortEntryATR := na

// === FIXED STOP-LOSS CALCULATION (WIDER INITIAL STOP) ===

long_stop_price := strategy.position_avg_price - atr * fixedStopMultiplier

short_stop_price := strategy.position_avg_price + atr * fixedStopMultiplier

// === ADJUST TRAILING POINTS BASED ON PROFIT ===

profitLong = strategy.position_size > 0 ? close - strategy.position_avg_price : 0

profitShort = strategy.position_size < 0 ? strategy.position_avg_price - close : 0

trailPointsMultAdjusted = profitLong > atr ? 0.3 : profitLong > atr * 0.66 ? 0.4 : trailPointsMult // For long positions

trailPointsMultAdjustedShort = profitShort > atr ? 0.3 : profitShort > atr * 0.66 ? 0.4 : trailPointsMult // For short positions

trailPointsLong = atr * trailPointsMultAdjusted

trailPointsShort = atr * trailPointsMultAdjustedShort

// === EXIT LOGIC ===

// On the entry bar, always use the fixed stop; thereafter, use a combination of fixed stop, trailing stop, and a profit target.

// Profit Target: For longs, exit at avg_entry + atr * profitTargetATRMult; for shorts, exit at avg_entry - atr * profitTargetATRMult.

if strategy.position_size > 0

if bar_index == entryBarIndex

if debugLogging

log.info("Long exit on entry bar: fixed stop applied. Price=" + str.tostring(close))

strategy.exit('Long Exit', 'Long', stop=long_stop_price)

else

if debugLogging

log.info("Long Trade: profit=" + str.tostring(profitLong) + ", ATR=" + str.tostring(atr))

strategy.exit('Long Exit', 'Long',

stop=long_stop_price,

limit = strategy.position_avg_price + atr * profitTargetATRMult,

trail_points=trailPointsLong,

trail_offset=atr * trailOffset)

if strategy.position_size < 0

if bar_index == entryBarIndex

if debugLogging

log.info("Short exit on entry bar: fixed stop applied. Price=" + str.tostring(close))

strategy.exit('Short Exit', 'Short', stop=short_stop_price)

else

if debugLogging

log.info("Short Trade: profit=" + str.tostring(profitShort) + ", ATR=" + str.tostring(atr))

strategy.exit('Short Exit', 'Short',

stop=short_stop_price,

limit = strategy.position_avg_price - atr * profitTargetATRMult,

trail_points=trailPointsShort,

trail_offset=atr * trailOffset)

// === FORCE CLOSE ON LAST BAR (OPTIONAL) ===

if barstate.islast

if strategy.position_size > 0

strategy.close('Long', comment='Forced Exit')

if strategy.position_size < 0

strategy.close('Short', comment='Forced Exit')

// === SIGNAL PLOTTING LOGIC ===

plotLongSignal = longCondition and canTrade and (bar_index - lastLongPlotBar >= minBarsBetweenSignals or lastLongPlotBar == 0)

plotShortSignal = shortCondition and canTrade and (bar_index - lastShortPlotBar >= minBarsBetweenSignals or lastShortPlotBar == 0)

if plotLongSignal

lastLongPlotBar := bar_index

if plotShortSignal

lastShortPlotBar := bar_index

// Define plotting conditions based on plotMode

plotLongShape = plotMode == 'Potential Signals' ? plotLongSignal : strategy.position_size > 0 and strategy.position_size[1] <= 0

plotShortShape = plotMode == 'Potential Signals' ? plotShortSignal : strategy.position_size < 0 and strategy.position_size[1] >= 0

// === VISUALIZATION ===

plot(fastMA, color=color.blue, linewidth=2, title='Fast MA')

plot(slowMA, color=color.red, linewidth=2, title='Slow MA')

var float longSL = na

var float shortSL = na

if strategy.position_size > 0

longSL := math.max(longSL, high - trailPointsLong)

else

longSL := na

plot(longSL, color=color.green, style=plot.style_stepline, title='Long SL')

if strategy.position_size < 0

shortSL := math.min(shortSL, low + trailPointsShort)

else

shortSL := na

plot(shortSL, color=color.red, style=plot.style_stepline, title='Short SL')

bgcolor(timeWindow ? color.new(color.blue, 95) : na, title="Trading Hours Highlight")

if plotLongShape

label.new(bar_index, low, "Buy", yloc=yloc.belowbar, color=color.green, textcolor=color.white, style=label.style_label_up)

if plotShortShape

label.new(bar_index, high, "Sell", yloc=yloc.abovebar, color=color.red, textcolor=color.white, style=label.style_label_down)

// === DEBUG TABLE ===

var table debugTable = table.new(position.top_right, 3, 10, bgcolor=color.rgb(0, 0, 0, 80), border_color=color.white, border_width=1)

if barstate.islast

table.cell(debugTable, 0, 0, 'Signal', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(debugTable, 1, 0, 'Status', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(debugTable, 2, 0, 'Priority', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(debugTable, 0, 1, 'MA Long', text_color=color.blue)

table.cell(debugTable, 1, 1, bullMA ? 'Yes' : 'No', text_color=bullMA ? color.green : color.red)

table.cell(debugTable, 2, 1, signalPriority == 'MA' ? 'High' : 'Low', text_color=color.white)

table.cell(debugTable, 0, 2, 'MA Short', text_color=color.blue)

table.cell(debugTable, 1, 2, bearMA ? 'Yes' : 'No', text_color=bearMA ? color.green : color.red)

table.cell(debugTable, 2, 2, signalPriority == 'MA' ? 'High' : 'Low', text_color=color.white)

table.cell(debugTable, 0, 3, 'Bull Pattern', text_color=color.blue)

table.cell(debugTable, 1, 3, bullPattern ? 'Yes' : 'No', text_color=bullPattern ? color.green : color.red)

table.cell(debugTable, 2, 3, signalPriority == 'Pattern' ? 'High' : 'Low', text_color=color.white)

table.cell(debugTable, 0, 4, 'Bear Pattern', text_color=color.blue)

table.cell(debugTable, 1, 4, bearPattern ? 'Yes' : 'No', text_color=bearPattern ? color.green : color.red)

table.cell(debugTable, 2, 4, signalPriority == 'Pattern' ? 'High' : 'Low', text_color=color.white)

table.cell(debugTable, 0, 5, 'Filters', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(debugTable, 1, 5, 'Status', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(debugTable, 2, 5, '', text_color=color.white, bgcolor=color.rgb(50, 50, 50))

table.cell(debugTable, 0, 6, 'Time Window', text_color=color.blue)

table.cell(debugTable, 1, 6, timeWindow ? 'OK' : 'Closed', text_color=timeWindow ? color.green : color.red)

table.cell(debugTable, 2, 6, str.tostring(currentHour) + 'h', text_color=color.white)

table.cell(debugTable, 0, 7, 'Volume', text_color=color.blue)

table.cell(debugTable, 1, 7, volumeOk ? 'OK' : 'Low', text_color=volumeOk ? color.green : color.red)

table.cell(debugTable, 2, 7, str.tostring(volume, '#'), text_color=color.white)

table.cell(debugTable, 0, 8, 'Volatility', text_color=color.blue)

table.cell(debugTable, 1, 8, volatilityOk ? 'OK' : 'High', text_color=volatilityOk ? color.green : color.red)

table.cell(debugTable, 2, 8, str.tostring(volatility * 100, '#.##') + '%', text_color=color.white)

table.cell(debugTable, 0, 9, 'Signals', text_color=color.blue)

table.cell(debugTable, 1, 9, longCondition and not shortCondition ? 'LONG' : shortCondition and not longCondition ? 'SHORT' : longCondition and shortCondition ? 'CONFLICT' : 'NONE', text_color=longCondition and not shortCondition ? color.green : shortCondition and not longCondition ? color.red : color.yellow)

table.cell(debugTable, 2, 9, canEnter ? alertSent ? 'Sent' : 'Ready' : 'Cooldown', text_color=canEnter ? alertSent ? color.yellow : color.green : color.gray)

// === PERFORMANCE DASHBOARD ===

var table dashboard = table.new(position.bottom_left, 3, 3, bgcolor=color.rgb(0, 0, 0, 80), border_color=color.white, border_width=1)

if barstate.islast

table.cell(dashboard, 0, 0, 'Position', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(dashboard, 1, 0, 'P/L', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(dashboard, 2, 0, 'Statistics', text_color=color.rgb(168, 168, 168), bgcolor=color.rgb(50, 50, 50))

table.cell(dashboard, 0, 1, strategy.position_size > 0 ? 'Long' : strategy.position_size < 0 ? 'Short' : 'Flat', text_color=strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : color.blue)

table.cell(dashboard, 1, 1, str.tostring(strategy.netprofit, '#.##'), text_color=strategy.netprofit >= 0 ? color.green : color.red)

table.cell(dashboard, 2, 1, 'Win Rate', text_color=color.white)

table.cell(dashboard, 0, 2, strategy.position_size != 0 ? 'Bars: ' + str.tostring(bar_index - entryBarIndex) : '', text_color=color.white)

table.cell(dashboard, 1, 2, strategy.position_size != 0 ? 'Cooldown: ' + str.tostring(cooldownMinutes) + 'm' : '', text_color=color.white)

table.cell(dashboard, 2, 2, strategy.closedtrades > 0 ? str.tostring(strategy.wintrades / strategy.closedtrades * 100, '#.##') + '%' : 'N/A', text_color=color.white)

// === CHART TITLE ===

var table titleTable = table.new(position.bottom_right, 1, 1, bgcolor=color.rgb(0, 0, 0, 80), border_color=color.rgb(0, 50, 137), border_width=1)

table.cell(titleTable, 0, 0, "Dskyz - DAFE Trading Systems", text_color=color.rgb(159, 127, 255, 80), text_size=size.large)