Overview

The “Multi-Confirmation EMA Trend and Stochastic RSI Momentum Trading Strategy” is a quantitative trading system that combines trend following and momentum indicators. The core of the strategy utilizes the crossover between a fast Exponential Moving Average (EMA) and a slow EMA as a signal for trend direction, while simultaneously using the relationship between the %K and %D lines of the Stochastic RSI indicator as momentum confirmation. This dual-confirmation mechanism effectively reduces false signals and improves trading quality. The strategy is primarily designed for short-term trading and generates signals using precisely defined parameters: 11⁄50 period EMAs and 15/7/10 parameters for the Stochastic RSI indicator.

Strategy Principles

The core principles of this strategy are based on the synergistic action of two key technical indicators:

Exponential Moving Average (EMA) Crossover System:

- Uses an 11-period fast EMA and a 50-period slow EMA

- When the fast EMA crosses above the slow EMA, it is viewed as a potential uptrend establishment

- When the fast EMA crosses below the slow EMA, it is viewed as a potential downtrend establishment

Stochastic RSI Momentum Confirmation:

- First calculates a 10-period RSI value

- Computes the stochastic indicator based on the RSI, generating the raw stochastic values

- Smooths the raw stochastic value with a 15-period average to obtain the %K line

- Further smooths the %K line with a 7-period average to obtain the %D line

- When the %K line is above the %D line, it indicates positive momentum

- When the %K line is below the %D line, it indicates negative momentum

Buy signal generation logic: Both conditions must be met: (1) fast EMA crosses above slow EMA and (2) %K line is above the %D line. Sell signal generation logic: Both conditions must be met: (1) fast EMA crosses below slow EMA and (2) %K line is below the %D line.

Through this dual-confirmation mechanism, the strategy can enter at the early stages of trend changes while reducing the risk of false breakouts through momentum confirmation.

Strategy Advantages

Multiple Confirmation Mechanism: Combines trend and momentum indicators, two different types of technical indicators that validate each other, effectively filtering out false signals and improving trading accuracy.

Flexible Parameter Settings: The EMA periods (11⁄50) and Stochastic RSI parameters (15/7/10) have been optimized, but users can adjust them according to different market characteristics or personal risk preferences.

Early Trend Capture: The 11-period fast EMA is sensitive to price changes and can capture trend changes early, while the 50-period slow EMA provides trend filtering functionality.

Clear Entry and Exit Rules: The strategy defines explicit entry and exit conditions, reducing subjective judgment and facilitating systematic execution.

Fully Quantitative: The strategy is completely based on technical indicator calculations, enabling fully automated trading and avoiding emotional interference.

Simple Risk Control: Through percentage position management (default 100%), it’s easy to adjust risk exposure according to capital size.

Strategy Risks

Frequent Trading in Ranging Markets: In sideways or trendless market environments, EMAs may cross frequently. Even with Stochastic RSI filtering, this could still generate excessive trading signals, increasing transaction costs.

Parameter Sensitivity: The choice of EMA periods and Stochastic RSI parameters significantly affects strategy performance. The current parameters (11⁄50 EMA and 15/7/10 Stochastic RSI) may not be suitable for all market conditions.

Lag Risk: Although a fast EMA (11-period) is used, any strategy based on moving averages inherently has some lag, which may lead to untimely entries and exits in volatile markets.

Lack of Stop-Loss Mechanism: The current strategy relies only on signal reversal for exits and doesn’t set explicit stop-loss mechanisms, potentially facing significant drawdowns in extreme market conditions.

Simplified Capital Management: The strategy defaults to using 100% of the capital proportion for trading, lacking more sophisticated capital management mechanisms, which may face capital risks in the case of consecutive losses.

Risk mitigation methods include: adding additional filtering conditions (such as volatility filters), introducing adaptive parameters, setting hard stop-losses, optimizing capital management strategies, and adding longer-term trend indicators as supplementary confirmation.

Strategy Optimization Directions

Add Trend Strength Filtering: The Average Directional Index (ADX) could be added as a trend strength filter, only considering trading signals when the ADX value exceeds a certain threshold (typically 20 or 25), avoiding frequent trading in weak trends or ranging markets.

Introduce Adaptive Parameters: Parameters for EMA and Stochastic RSI could be dynamically adjusted based on market volatility. For example, using longer periods in high volatility to reduce noise, and shorter periods in low volatility to increase sensitivity.

Add Stop-Loss Mechanisms: Implement stop-loss settings based on Average True Range (ATR) or set fixed percentage stop-losses to protect capital from abnormal market fluctuations.

Optimize Capital Management: Improve position management strategy, such as adjusting risk exposure based on volatility, or implementing gradual position building/reduction strategies, rather than simple 100% position trading.

Signal Confirmation Layer Optimization: A third confirmation layer could be added, such as volume breakout or price pattern confirmation, to further improve signal quality.

Expand Timeframe Analysis: Add trend direction confirmation from longer timeframes to avoid counter-trend trading when the main trend is in the opposite direction.

Backtest Optimization: Conduct extensive parameter optimization and historical backtesting to determine optimal parameter combinations for different market environments.

These optimization directions aim to improve the strategy’s robustness and adaptability, especially consistency of performance across different market environments.

Summary

The “Multi-Confirmation EMA Trend and Stochastic RSI Momentum Trading Strategy” is a short-term trading system that combines trend following and momentum confirmation. By judging trend direction through crossovers between a fast EMA (11-period) and a slow EMA (50-period), and using the relationship between the %K and %D lines of the Stochastic RSI (parameters 15/7/10) for momentum confirmation, it achieves a dual-verification mechanism for generating trading signals.

The strategy’s greatest advantage lies in reducing the possibility of false signals through multiple indicator confirmations, thereby improving trading quality. At the same time, clear parameter settings and execution rules make it easy to automate. However, the strategy may face overtrading risks in ranging markets and lacks a comprehensive stop-loss mechanism.

There is considerable room for optimization through the introduction of trend strength filtering, adaptive parameter adjustment, stop-loss mechanisms, and better capital management. Particularly, adding multi-timeframe analysis and improving signal confirmation mechanisms can significantly enhance the strategy’s robustness and long-term stability.

Overall, this strategy provides a clear structure and logical framework for short-term trend trading, suitable for application in markets with defined trends, and can serve as a foundational component for more complex trading systems.

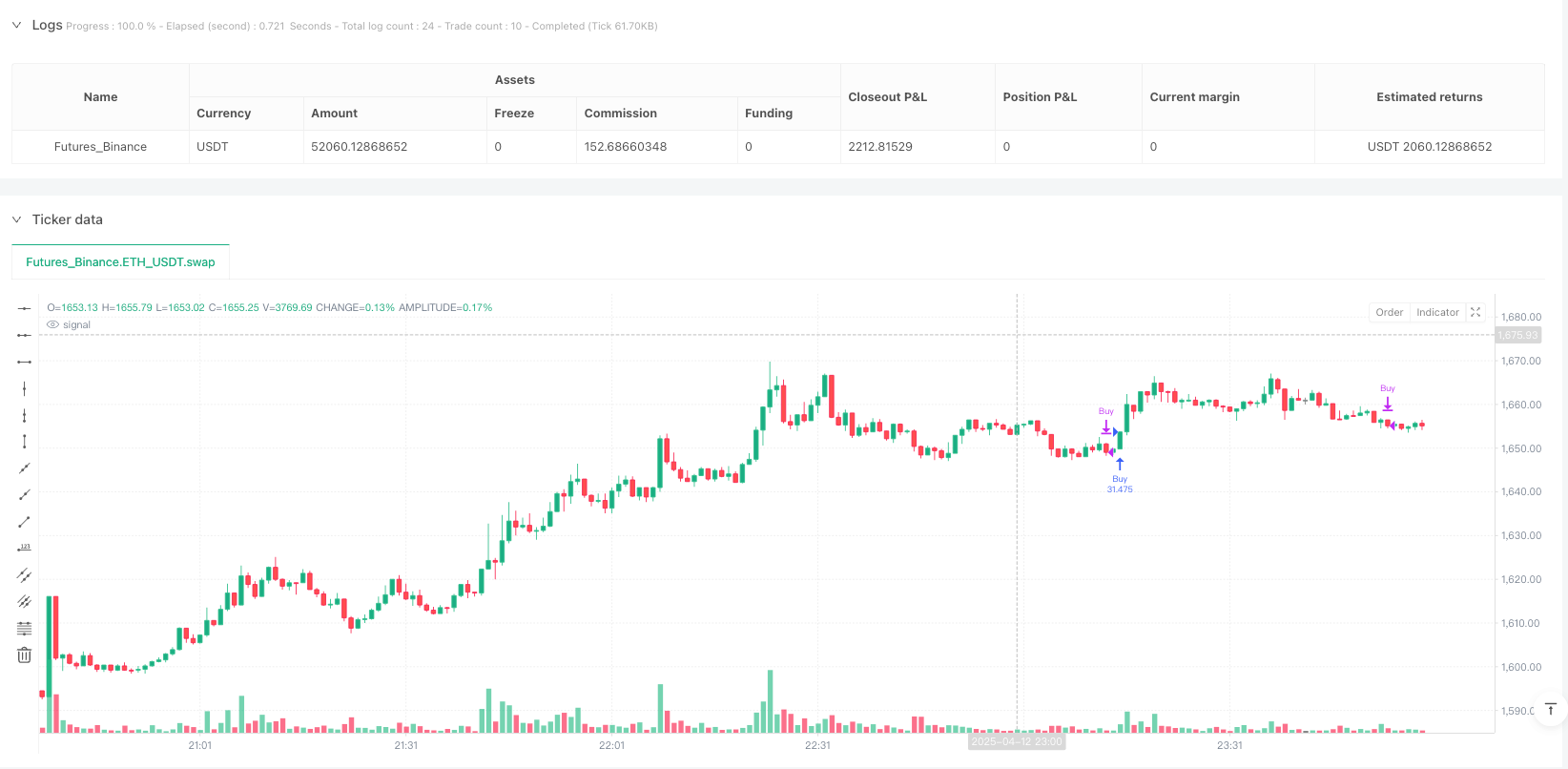

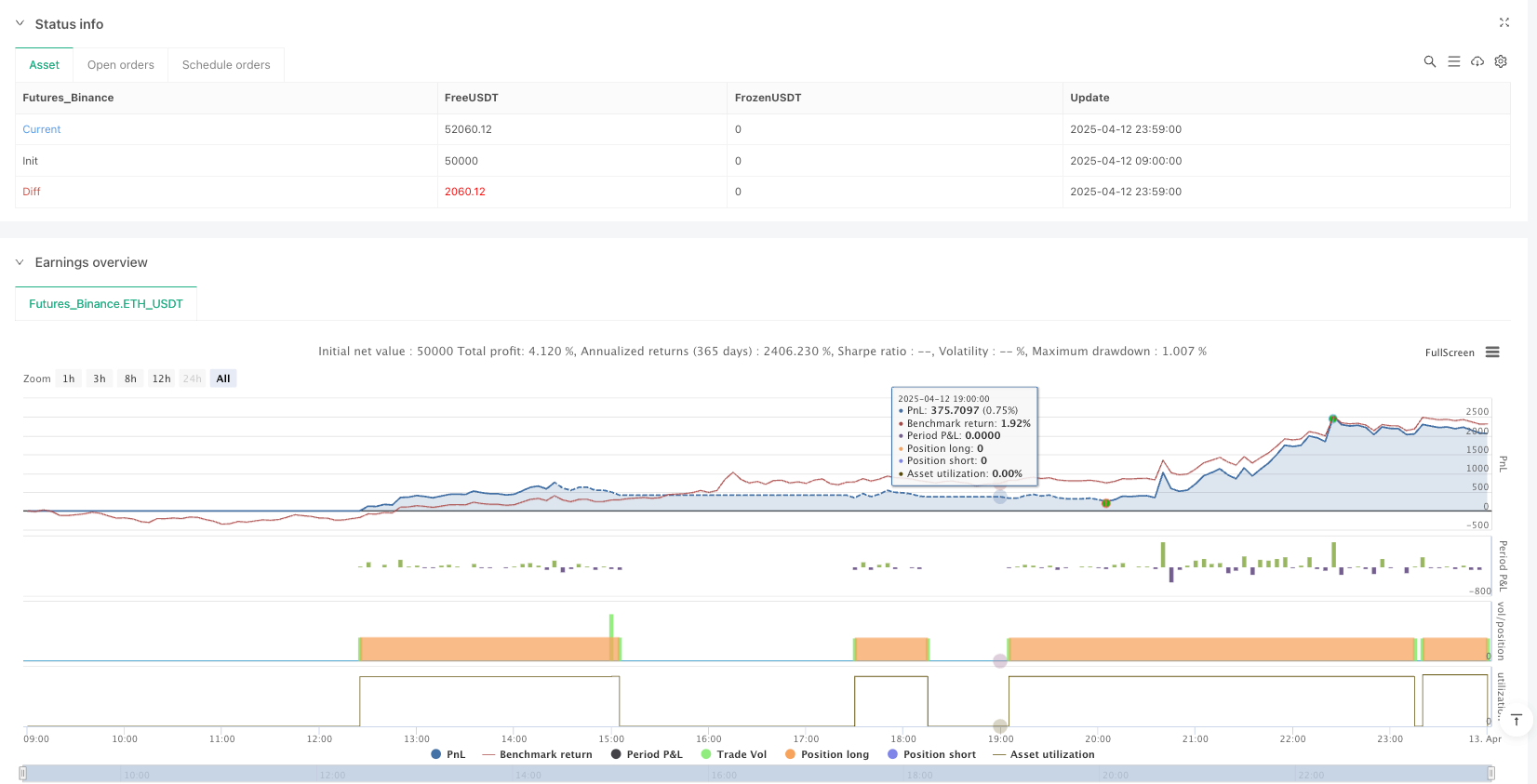

/*backtest

start: 2025-04-12 09:00:00

end: 2025-04-13 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Haze EMA Signal", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === Inputs ===

fastLength = input.int(11, title="Fast EMA")

slowLength = input.int(50, title="Slow EMA")

stochLength = input.int(10, title="Stoch RSI Length")

kLength = input.int(15, title="%K Smoothing")

dLength = input.int(7, title="%D Smoothing")

// === EMA Calculations ===

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

// === Stochastic RSI Calculations ===

rsi = ta.rsi(close, stochLength)

stoch = ta.stoch(rsi, rsi, rsi, stochLength)

k = ta.sma(stoch, kLength)

d = ta.sma(k, dLength)

// === Conditions ===

emaCrossUp = ta.crossover(fastEMA, slowEMA)

emaCrossDown = ta.crossunder(fastEMA, slowEMA)

stochRising = k > d

stochFalling = k < d

// === Final Buy/Sell Logic ===

buyCondition = emaCrossUp and stochRising

sellCondition = emaCrossDown and stochFalling

// === Strategy Execution ===

if buyCondition

strategy.entry("Buy", strategy.long)

if sellCondition

strategy.close("Buy")

// No plots to keep chart clean