Overview

The Dual EMA Retest Reversal Strategy is a trend following system based on Exponential Moving Averages (EMA), with the core philosophy of “not chasing every EMA cross, but waiting for the market to retest the fast EMA for confirmation before entering.” This strategy combines technical analysis concepts of EMA crossovers with price retest confirmation mechanisms. By setting reasonable retest tolerances, risk-reward ratios, and daily trade limits, it executes high-probability trades at retracement points after trend changes. The strategy uses 200-period and 800-period EMAs as benchmarks. When the fast EMA (200-period) crosses above the slow EMA (800-period) forming a bullish signal, it waits for price to pull back to near the fast EMA (default tolerance 0.2%) before buying; conversely, it waits for pullbacks to short after bearish signals. Each trade is equipped with percentage-based stop-loss and take-profit levels, with a default risk-reward ratio of 4:1, ensuring sound money management.

Strategy Principles

The core principles of this strategy are built upon several technical analysis concepts:

EMA Crossover Signal Identification: The strategy uses 200-period and 800-period EMAs to determine the overall market trend direction. When the fast EMA (200) crosses above the slow EMA (800), the system identifies this as the beginning of a bullish trend; when the fast EMA crosses below the slow EMA, the system identifies this as the beginning of a bearish trend. This stage only determines the trend and does not trigger trades.

Trend State Tracking: The strategy continuously tracks the current trend state through boolean variables (in_bullish_trend and in_bearish_trend), ensuring trades are only executed in the confirmed trend direction.

Retest Confirmation Mechanism: Unlike traditional EMA crossover strategies, this strategy does not enter directly at the crossover point but waits for the price to pull back to near the fast EMA. Specifically, when the percentage deviation between price and fast EMA is less than the preset retest tolerance (default 0.2%), the system considers the retest confirmation complete and triggers a trading signal.

Risk Control Mechanism: The strategy sets a fixed percentage stop-loss (default 0.5%) and a risk-reward ratio-based take-profit level (default 4:1) for each trade. At the same time, it limits the maximum number of trades per day (default 2) to avoid overtrading.

Daily Reset: The strategy resets the trade counter at the beginning of each trading day, ensuring the trade frequency limit is calculated on a daily basis.

Strategy Advantages

Through in-depth code analysis, this strategy has the following significant advantages:

Trading After Trend Confirmation: The strategy only considers entry after EMA crossovers confirm the trend direction, avoiding losses from frequent trading in consolidating markets.

Retest Entry Improves Win Rate: By waiting for price to pull back to key support/resistance levels (fast EMA) before entering, it improves the probability of successful trades and avoids the risk of entering when price is overextended.

Clear Risk Management: Each trade has predefined stop-loss and take-profit levels with a risk-reward ratio set at 4:1, ensuring the possibility of long-term profitability even with a moderate win rate.

Overtrading Protection: Through daily maximum trade limits, it prevents excessive trading in volatile markets, which helps reduce trading costs and enhance overall strategy stability.

Visualization of Trading Signals: The strategy uses labels and background color changes to intuitively display trading signals and position status, facilitating backtest analysis and real-time monitoring.

Parameter Adjustability: All key parameters such as EMA periods, retest tolerance, risk-reward ratio, stop-loss percentage, and maximum daily trades are adjustable through input fields, giving the strategy strong adaptability.

Strategy Risks

Despite its reasonable design, the strategy still has the following potential risks:

Delayed Trend Reversal Recognition: Due to the use of longer-period EMAs (200 and 800), the strategy may experience significant lag in identifying trend reversals, causing missed opportunities in the early stages of trends. Solution: Consider incorporating shorter-period indicators for auxiliary judgment, or adjust EMA periods according to market characteristics.

False Breakout Risk: In oscillating markets, EMA crossovers may frequently produce false breakouts, leading to erroneous signals. Solution: Add crossover confirmation mechanisms, such as requiring price to maintain a certain trend direction after crossing, or add volume confirmation.

Frequent Triggers in Narrow Range Fluctuations: In low-volatility environments, price may frequently fluctuate near the EMA, meeting retest conditions but quickly departing, forming invalid signals. Solution: Consider adding volatility filters, or increase retest tolerance requirements in low-volatility environments.

Fixed Stop-Loss Risk: The strategy uses fixed percentage stop-losses without considering market volatility differences, potentially leading to too-small stops that trigger frequently in high-volatility markets. Solution: Consider using ATR (Average True Range) to dynamically adjust stop-loss levels.

Single Technical Indicator Dependency: The strategy primarily relies on EMA indicators, lacking multi-dimensional market analysis. Solution: Consider combining other types of indicators (such as momentum indicators, volatility indicators) for signal confirmation.

Strategy Optimization Directions

Based on the above analysis, the strategy can be optimized in the following directions:

Dynamic Parameter Adjustment: Change fixed retest tolerance and stop-loss percentages to be dynamically adjusted based on market volatility (such as ATR) to adapt to different market environments. This is done because market volatility characteristics change over time, and fixed parameters may not be suitable for all market conditions.

Multi-Timeframe Analysis: Add assessment of higher timeframe trends, only trading in the direction of the overall trend to avoid counter-trend trading in consolidating major trends. This optimization can improve signal quality and reduce the risk of counter-trend trading.

Volume Confirmation: Add volume confirmation conditions when generating entry signals, such as requiring volume support/resistance breakouts at retest points. Volume is the source of price movement dynamics, and incorporating volume analysis can improve signal effectiveness.

Dynamic Profit-Loss Ratio Adjustment: Dynamically adjust the risk-reward ratio based on market volatility characteristics and historical price structure, rather than using a fixed 4:1 ratio. This allows the strategy to better adapt to different market phases and characteristics.

Add Filtering Conditions: Incorporate market trend strength indicators (such as ADX) as filters, only activating the strategy in strong trend markets. This can avoid generating too many false signals in weak trend or oscillating markets.

Partial Profit Locking Mechanism: Add partial profit-taking functionality, locking in some profits when price reaches certain profit levels while continuing to hold the remainder to track the trend. This mechanism can balance short-term profit-taking and long-term trend-following needs.

Backtest Time Period Optimization: Add trading session filters to avoid high-volatility periods around market open and close, or focus on specific high-efficiency trading sessions. Different sessions have significant differences in market efficiency and characteristics; selecting the most suitable periods for the strategy logic can improve overall performance.

Summary

The Dual EMA Retest Reversal Strategy creates a complete trend-following trading system by combining EMA crossover signals with price retest confirmation mechanisms. The strategy not only includes clear entry and exit logic but also features sound money management and risk control mechanisms. Its core advantage lies in the “wait for confirmation” philosophy, improving the probability of successful trades by avoiding direct pursuit of EMA crossover signals and instead waiting for price to pull back to key technical levels before entering.

However, the strategy still has limitations such as dependence on long-period EMAs, single technical indicator judgment, and fixed parameter settings. By introducing dynamic parameter adjustments, multi-timeframe analysis, volume confirmation, and trend strength filtering, the strategy’s adaptability and robustness can be further enhanced. These optimization measures will be particularly effective in highly volatile or trend-unclear market environments.

Ultimately, this strategy represents a trading approach that balances aggression with stability, suitable for traders with certain risk tolerance who pursue medium to long-term stable returns. Through reasonable parameter settings and continuous strategy optimization, it can maintain relatively stable performance in various market environments.

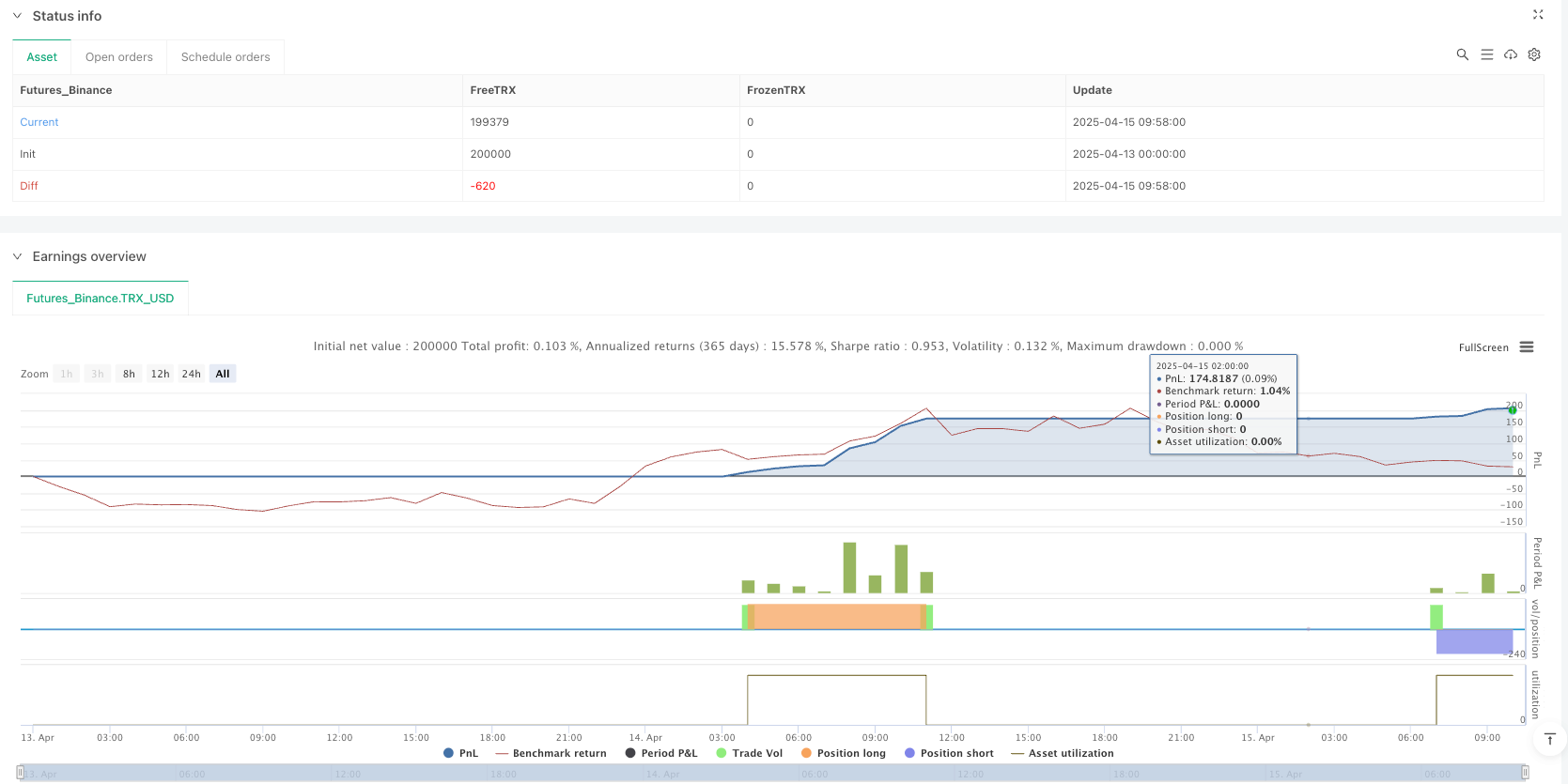

/*backtest

start: 2025-04-13 00:00:00

end: 2025-04-15 10:00:00

period: 2m

basePeriod: 2m

exchanges: [{"eid":"Futures_Binance","currency":"TRX_USD"}]

*/

//@version=6

strategy("200/500 EMA Retest Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=1)

// INPUTS

ema_fast_length = input.int(200, title="Fast EMA Length")

ema_slow_length = input.int(500, title="Slow EMA Length")

retest_tolerance = input.float(0.002, title="Retest Tolerance (%)") // 0.2% by default

risk_reward_ratio = input.float(4.0, title="Risk-Reward Ratio (TP:SL)")

stop_loss_perc = input.float(0.005, title="Stop Loss % (e.g., 0.5%)") // 0.5% default

max_trades_per_day = input.int(2, title="Max Trades Per Day")

// EMA CALCULATIONS

ema_fast = ta.ema(close, ema_fast_length)

ema_slow = ta.ema(close, ema_slow_length)

// PLOT EMAs

plot(ema_fast, color=color.blue)

plot(ema_slow, color=color.orange)

// CROSS DETECTION

bullish_cross = ta.crossover(ema_fast, ema_slow)

bearish_cross = ta.crossunder(ema_fast, ema_slow)

// STATE TRACKING

var bool in_bullish_trend = false

var bool in_bearish_trend = false

var int trades_today = 0

if ta.change(time("D")) != 0

trades_today := 0

if bullish_cross

in_bullish_trend := true

in_bearish_trend := false

if bearish_cross

in_bullish_trend := false

in_bearish_trend := true

// RETEST CONDITION

bullish_retest = in_bullish_trend and (math.abs(close - ema_fast) / ema_fast <= retest_tolerance)

bearish_retest = in_bearish_trend and (math.abs(close - ema_fast) / ema_fast <= retest_tolerance)

// ENTRIES WITH SL/TP AND TRADE LIMIT

if bullish_retest and trades_today < max_trades_per_day

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", from_entry="Long", stop=close * (1 - stop_loss_perc), limit=close * (1 + stop_loss_perc * risk_reward_ratio))

label.new(bar_index, low, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.small)

trades_today += 1

if bearish_retest and trades_today < max_trades_per_day

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", from_entry="Short", stop=close * (1 + stop_loss_perc), limit=close * (1 - stop_loss_perc * risk_reward_ratio))

label.new(bar_index, high, "SELL", color=color.red, style=label.style_label_down, textcolor=color.white, size=size.small)

trades_today += 1

// BACKGROUND COLOR WHEN IN POSITION

bgcolor(strategy.position_size > 0 ? color.new(color.green, 90) : na)

bgcolor(strategy.position_size < 0 ? color.new(color.red, 90) : na)

// ALERTS

if bullish_retest

alert("BUY Retest Triggered!", alert.freq_once_per_bar)

if bearish_retest

alert("SELL Retest Triggered!", alert.freq_once_per_bar)